“Those who know it best love it least for they have been disappointed the most.” -Don Coxe 1 One of the more...

“Those who know it best love it least for they have been disappointed the most.” -Don Coxe 1 One of the more...

Read More

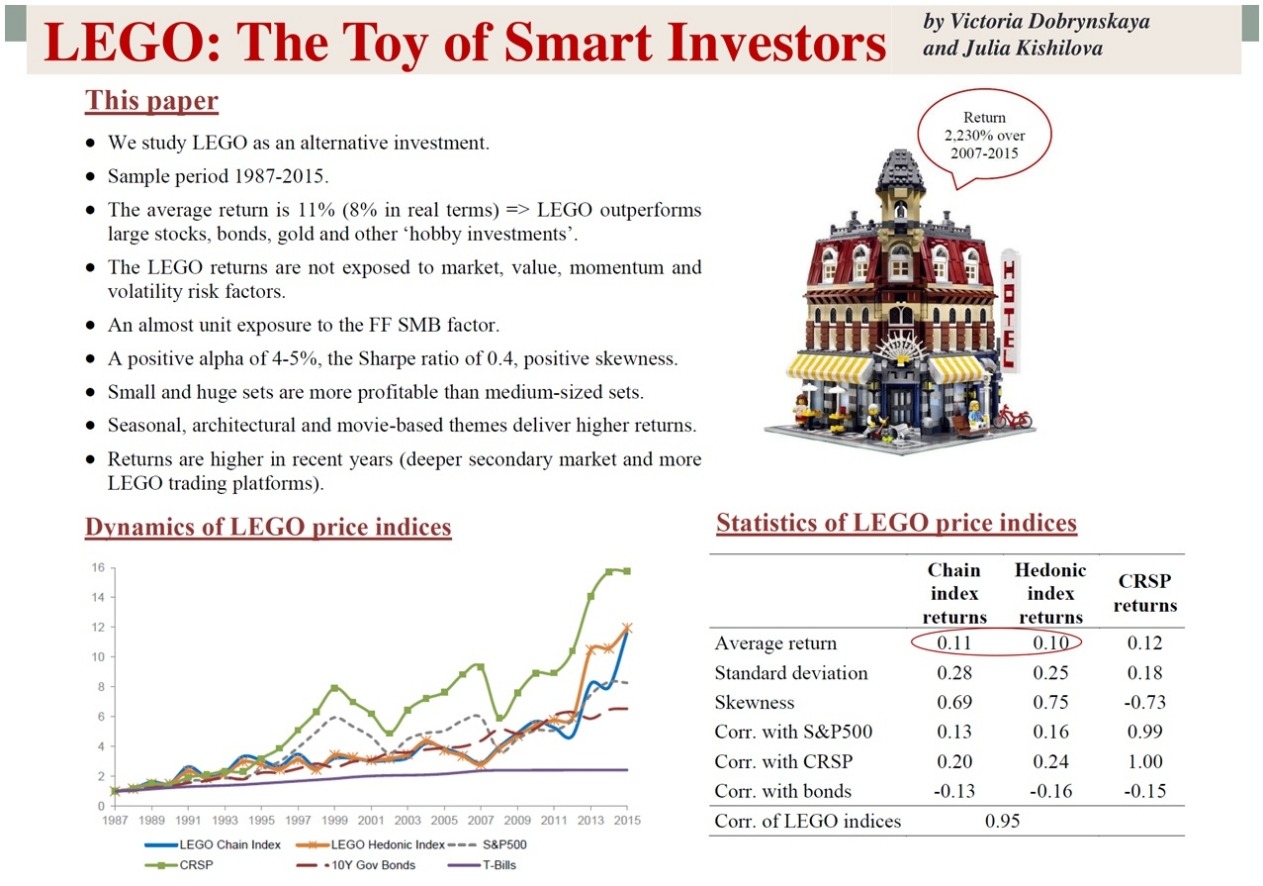

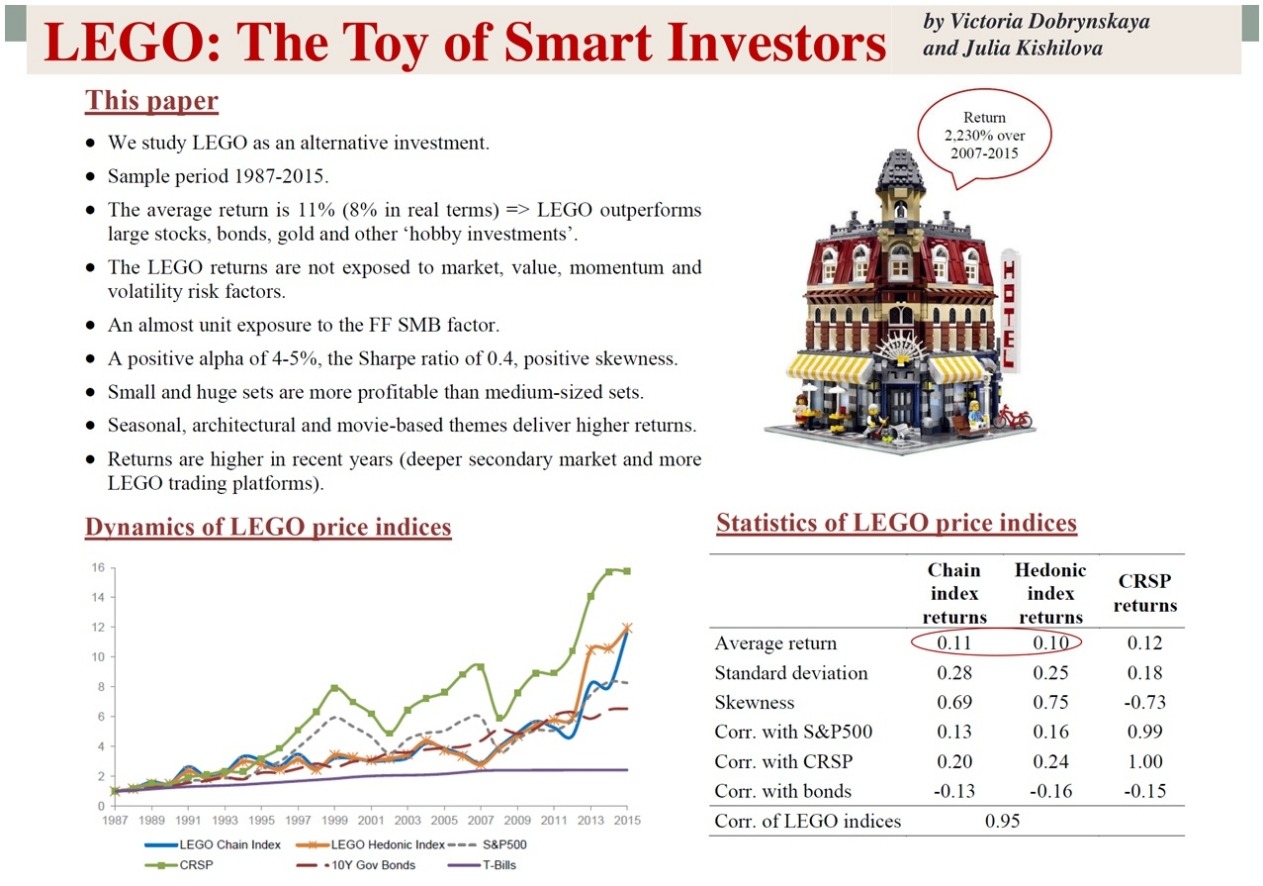

To hear an audio spoken word version of this post, click here. “Study: Toys Prove to Be Better Investment Than Gold,...

To hear an audio spoken word version of this post, click here. “Study: Toys Prove to Be Better Investment Than Gold,...

Read More

A friend accidentally sent me an invite to a metals and mining conference. She knows I was bullish on Gold in the mid-2000s...

A friend accidentally sent me an invite to a metals and mining conference. She knows I was bullish on Gold in the mid-2000s...

Read More

The pandemic has changed the state of the economy, and with it, the most attractive risk assets. David Rosenberg expects rates to remain...

Read More

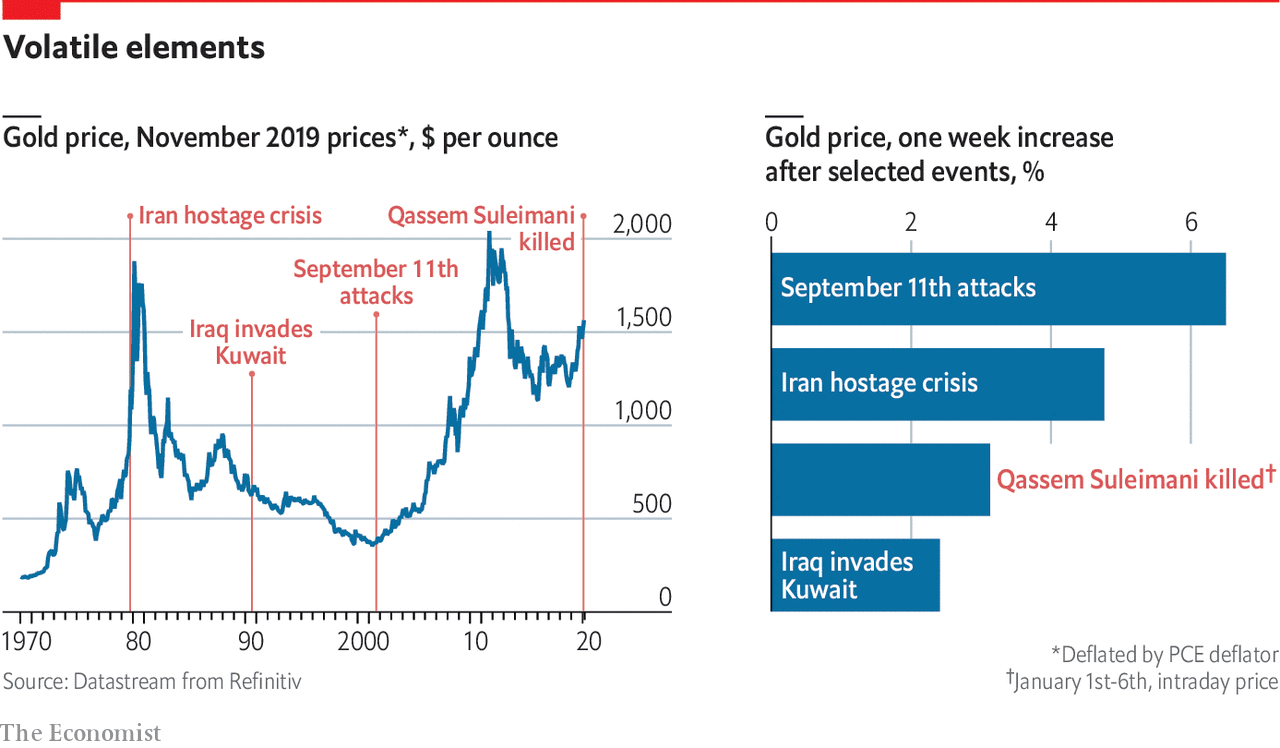

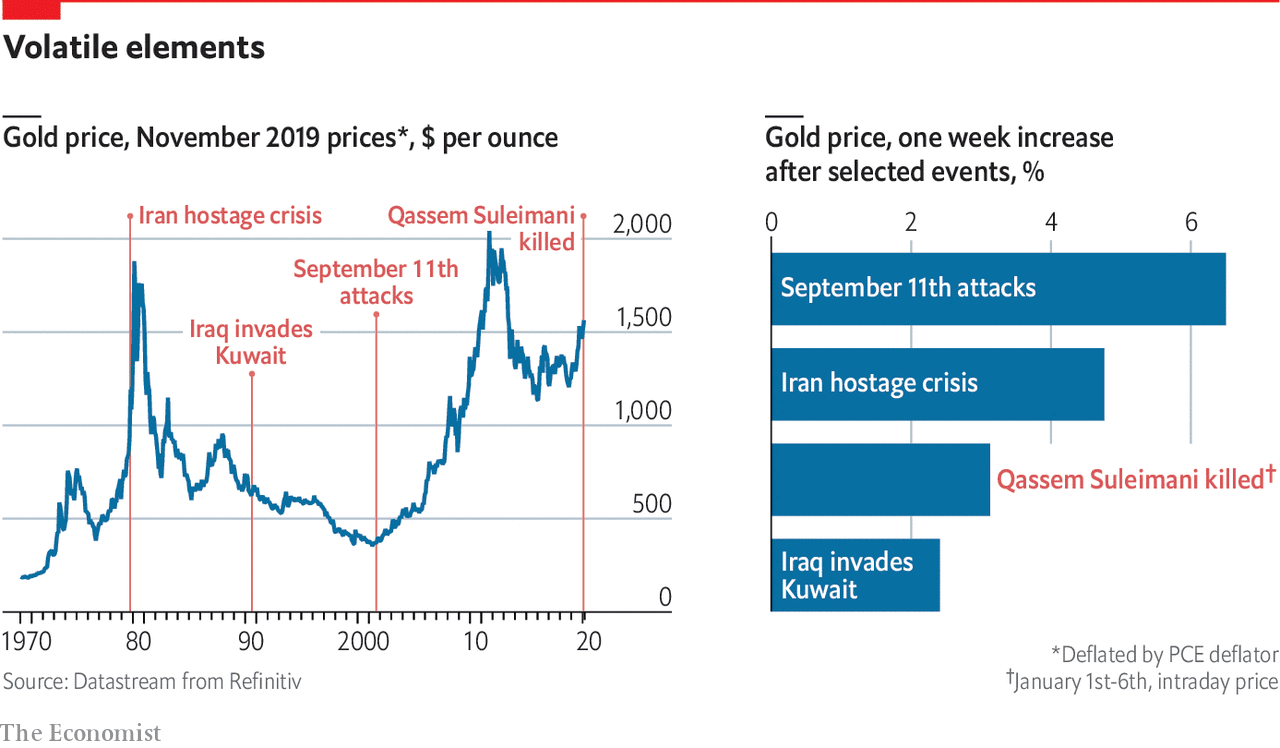

Source: The Economist Gold has been on a tear all of 2019, but the surprise assassination of Iran’s Military leader...

Source: The Economist Gold has been on a tear all of 2019, but the surprise assassination of Iran’s Military leader...

Read More

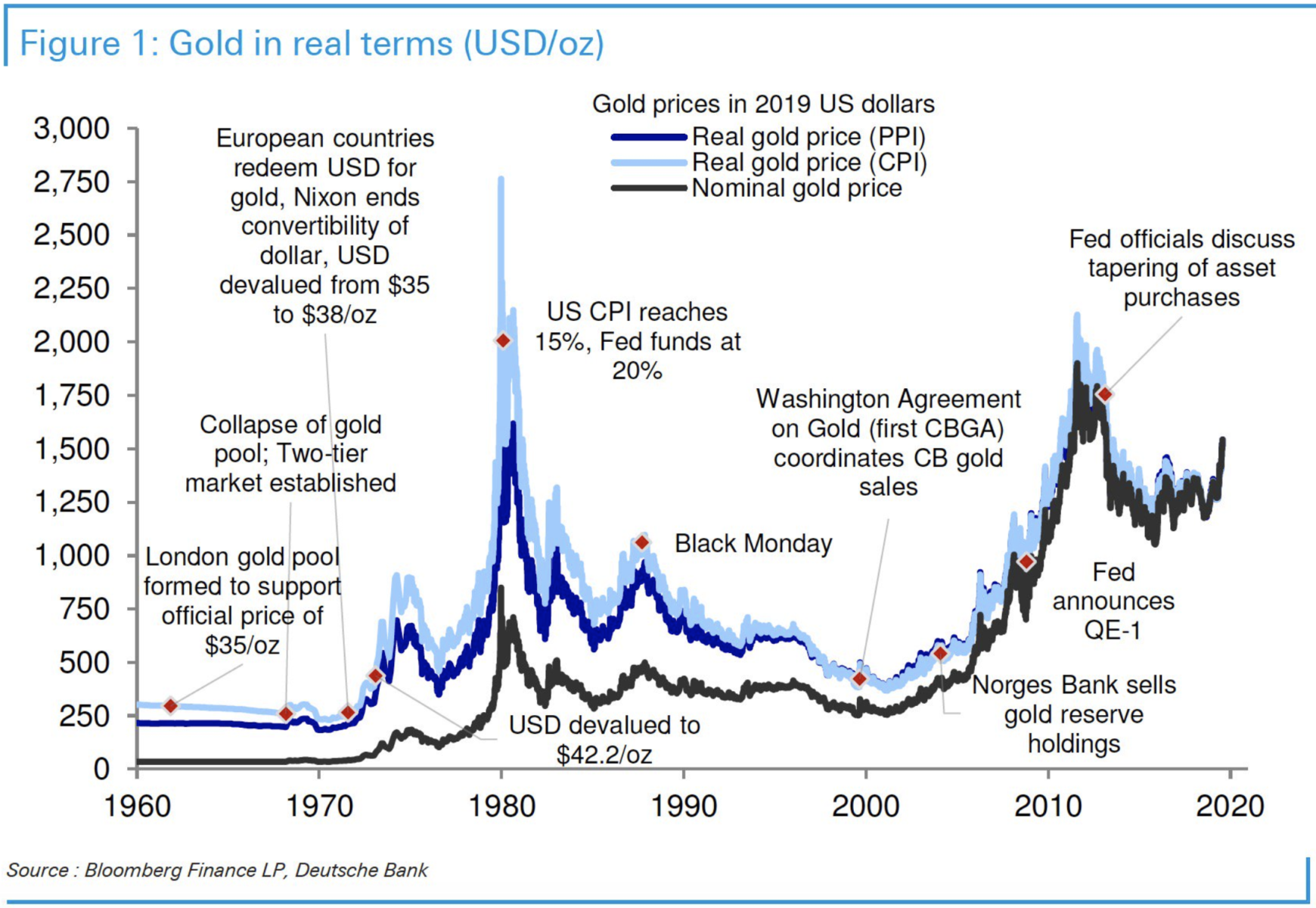

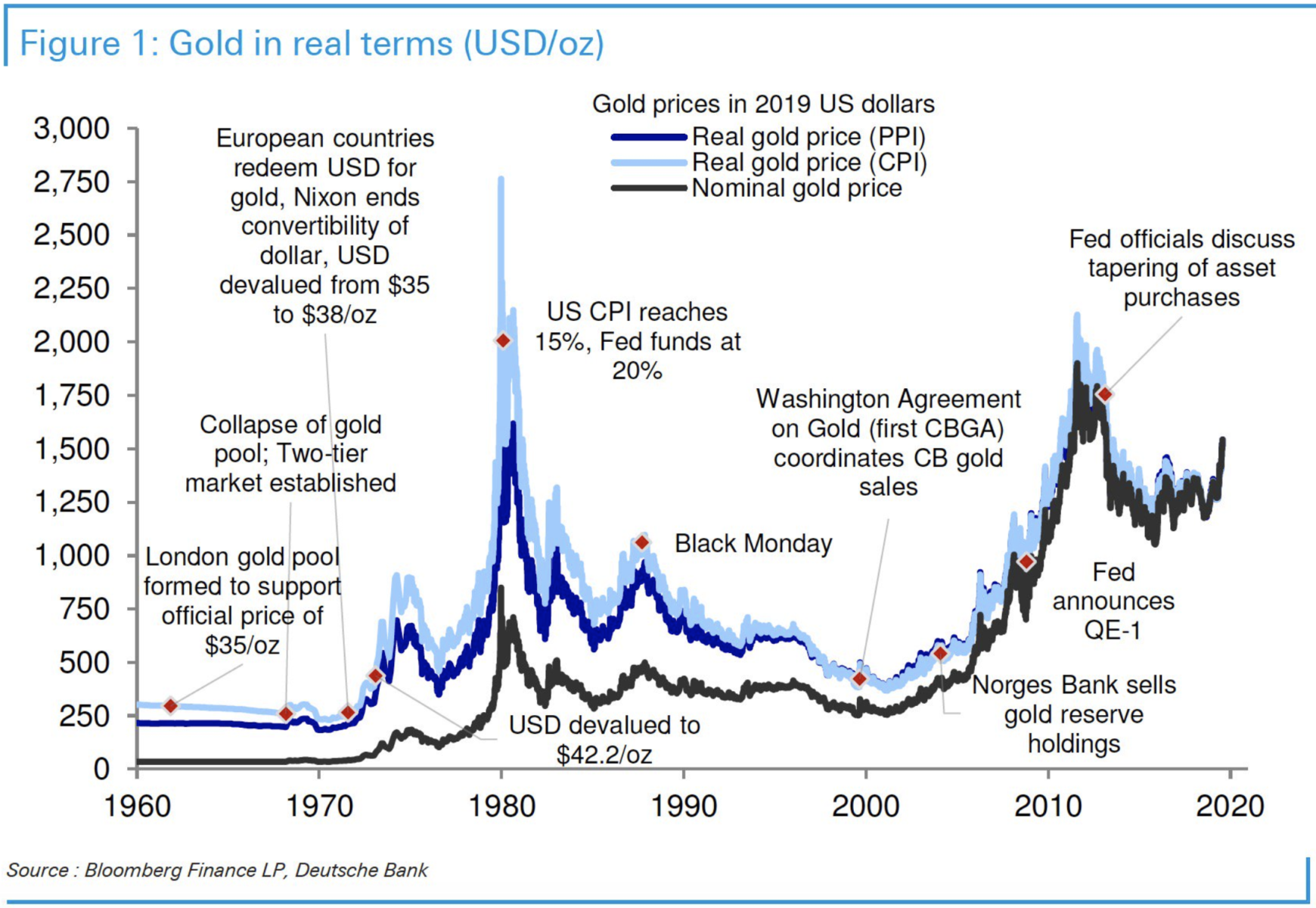

Chart of the Day Gold in Real Terms As Gold rallied past $1500, I wanted to find some historical context. The fascinating...

Chart of the Day Gold in Real Terms As Gold rallied past $1500, I wanted to find some historical context. The fascinating...

Read More

A Billionaire Makes a Classic Investing Error Concentrating in a single asset class can be an invitation to trouble. Bloomberg, May 3,...

Read More

This is fascinating: >> Source: Bloomberg More on the topic later today . . .

Read More

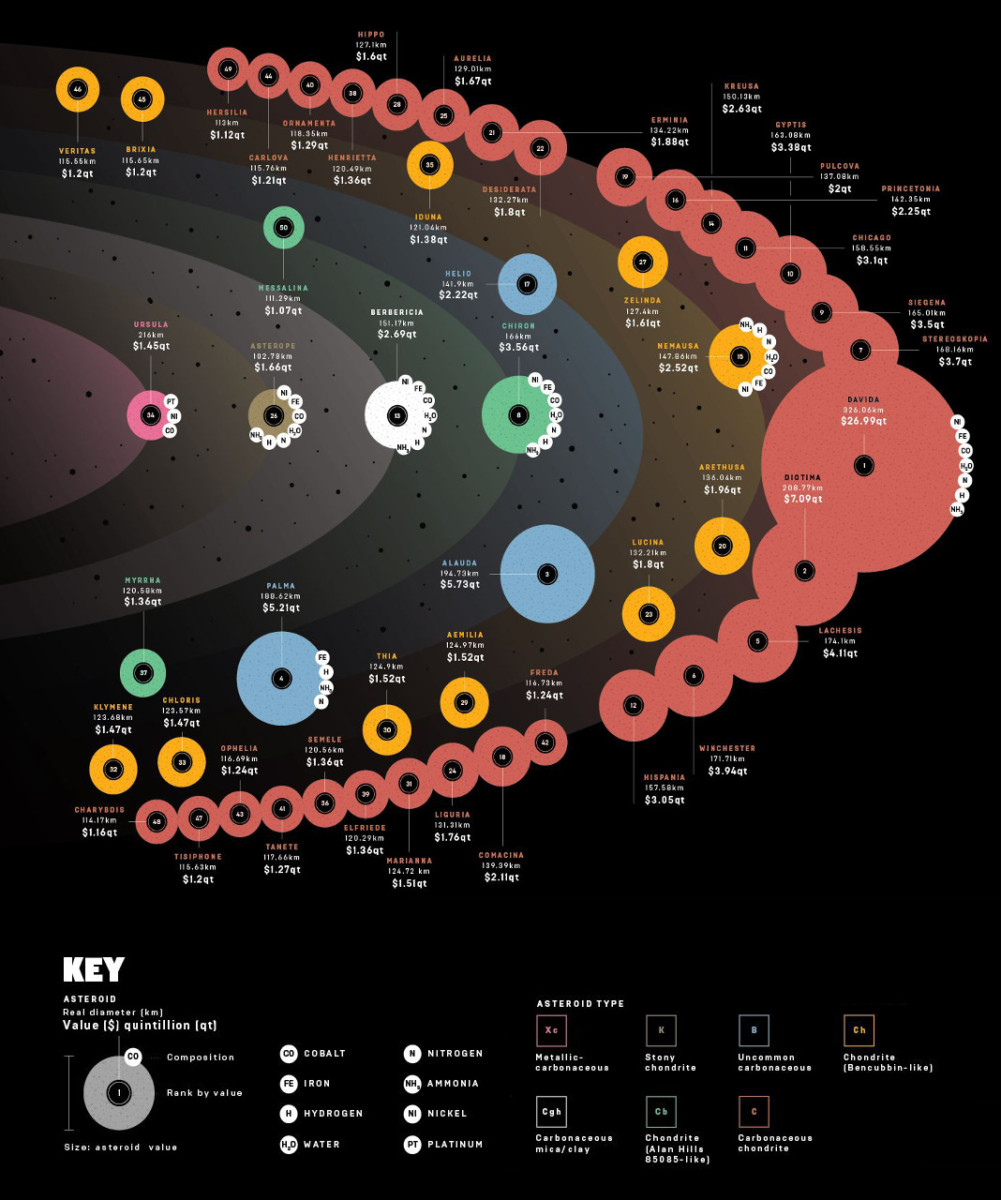

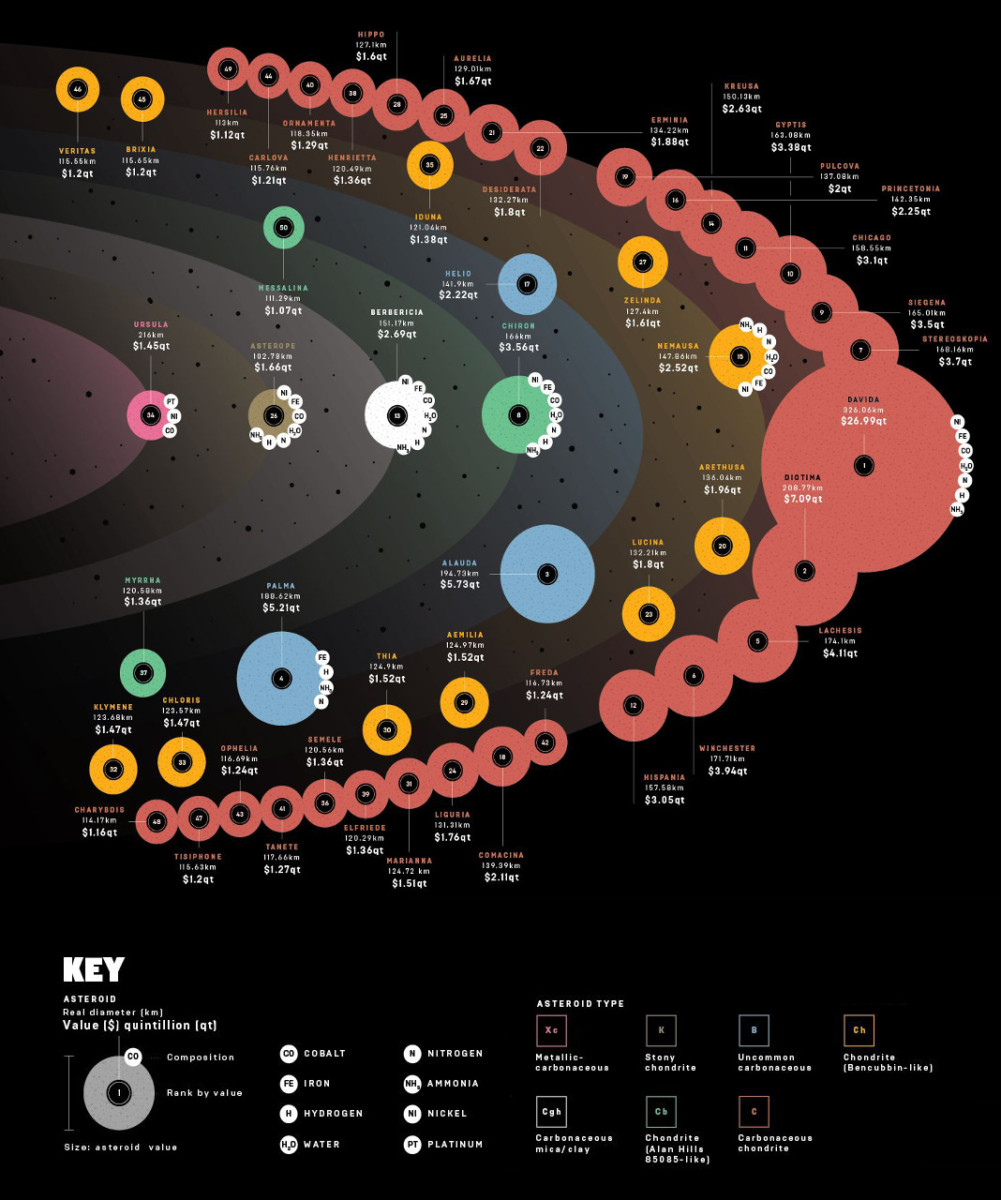

Very cool: click for ginormous graphic Source: Visual Capitalist

Very cool: click for ginormous graphic Source: Visual Capitalist

Read More

I had some fun doing the BBC podcast Elements — a series on all of the elements in the periodical table; my segment...

I had some fun doing the BBC podcast Elements — a series on all of the elements in the periodical table; my segment...

Read More

“Those who know it best love it least for they have been disappointed the most.” -Don Coxe 1 One of the more...

“Those who know it best love it least for they have been disappointed the most.” -Don Coxe 1 One of the more...

“Those who know it best love it least for they have been disappointed the most.” -Don Coxe 1 One of the more...

“Those who know it best love it least for they have been disappointed the most.” -Don Coxe 1 One of the more...