Sorting Through Online Investment Noise

Hey, investment cranks: The Internet never forgets By Barry Ritholtz Washington Post, August 1, 2015 As Theodore Sturgeon...

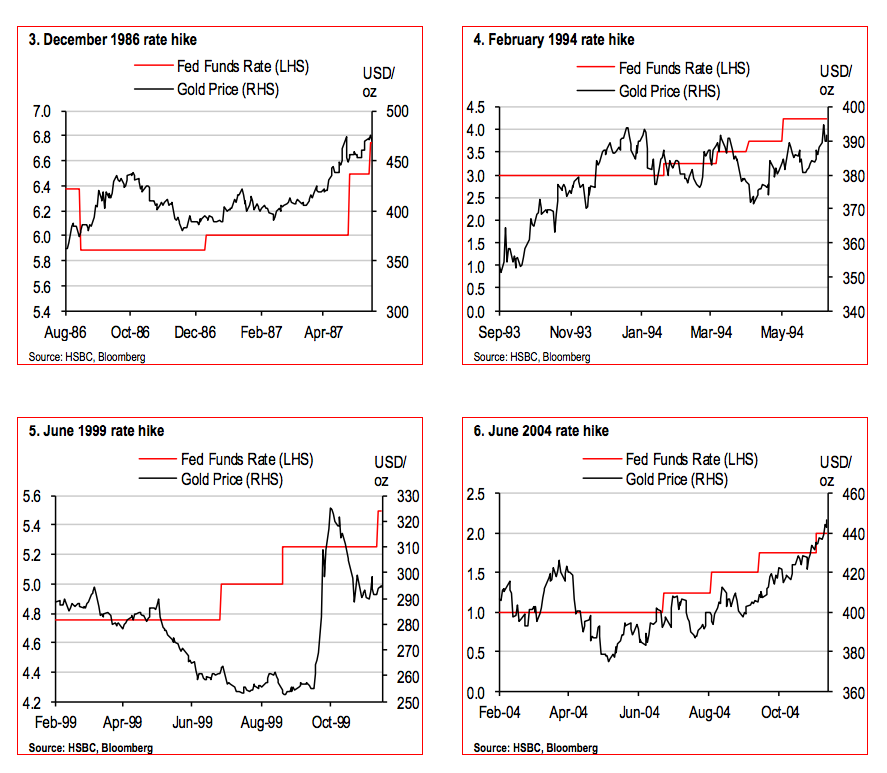

Interesting few examples from the past showing Gold benefitting from rate increases, as per a report by HSBC’s FX strategist, David...

Interesting few examples from the past showing Gold benefitting from rate increases, as per a report by HSBC’s FX strategist, David...

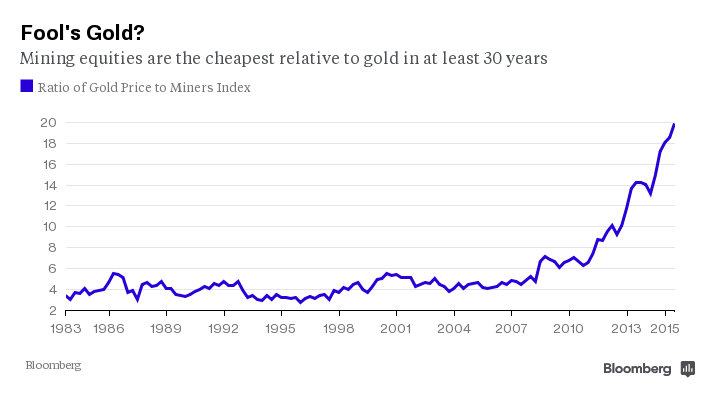

Let’s say this right up front: The SPDR Gold Shares Trust exchange-traded fund has killed the shares of the gold miners. For a few...

Let’s say this right up front: The SPDR Gold Shares Trust exchange-traded fund has killed the shares of the gold miners. For a few...

“A gold mine is a hole in the ground with a liar standing on top of it.” — unverified quote attributed to Mark Twain...

“A gold mine is a hole in the ground with a liar standing on top of it.” — unverified quote attributed to Mark Twain...

Equity markets started off this year by falling. They rallied in February, working their way back into the green. The Standard &...

Equity markets started off this year by falling. They rallied in February, working their way back into the green. The Standard &...

Get subscriber-only insights and news delivered by Barry every two weeks.