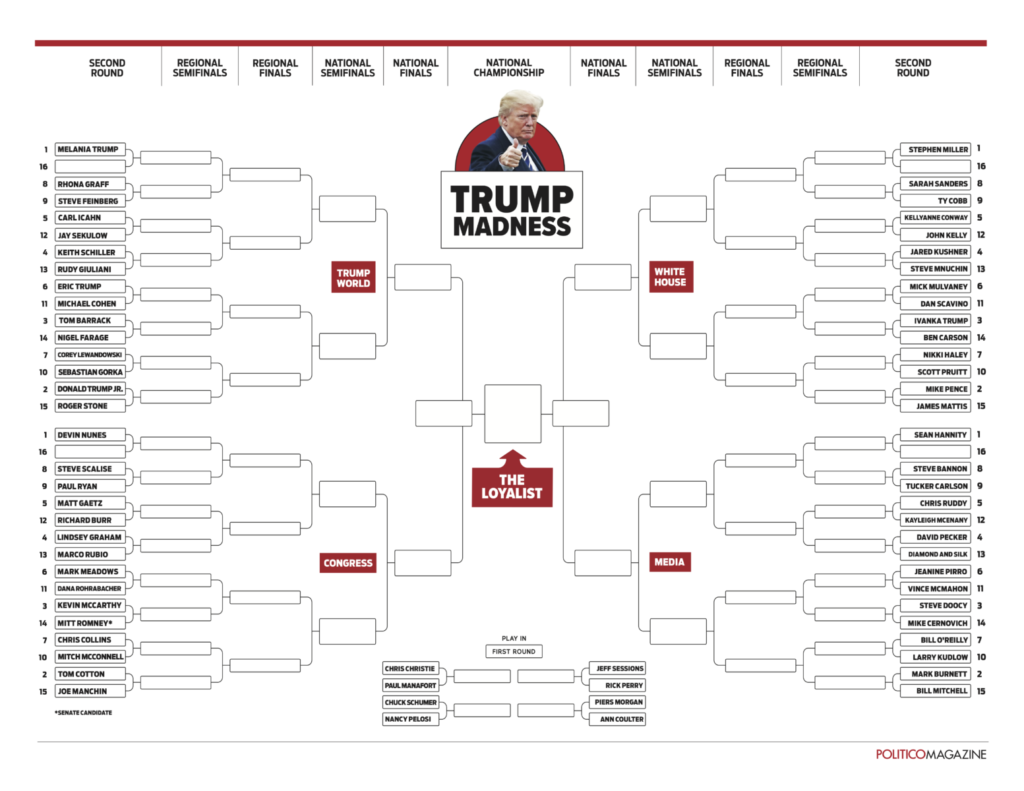

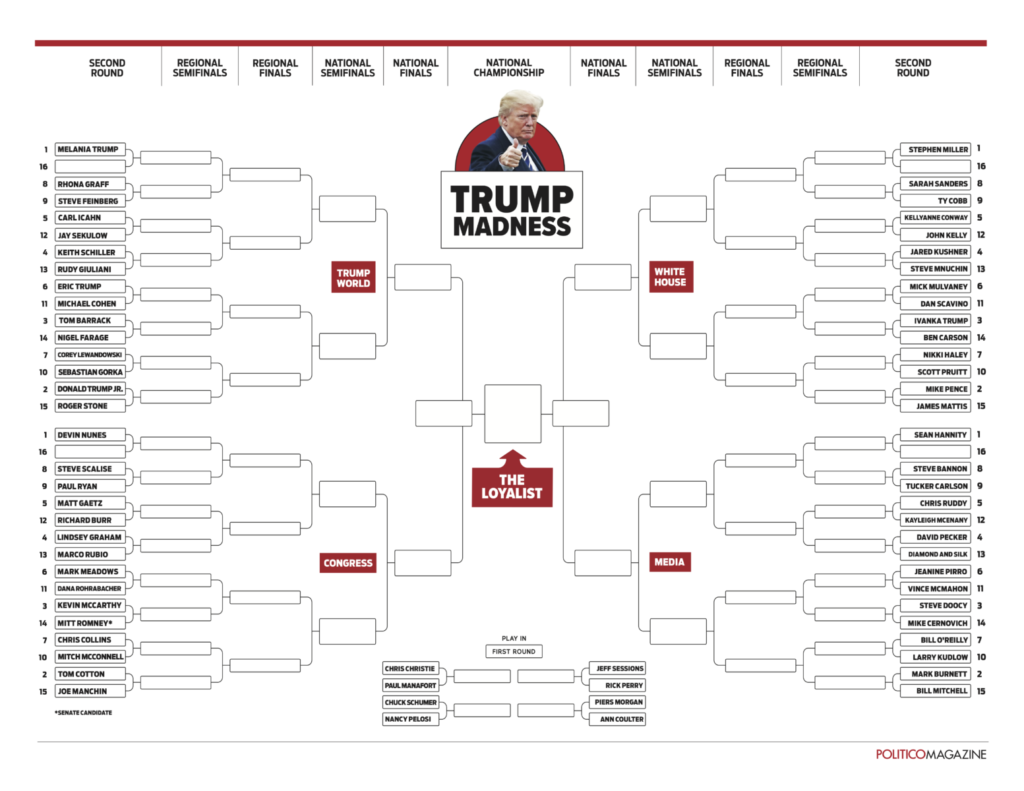

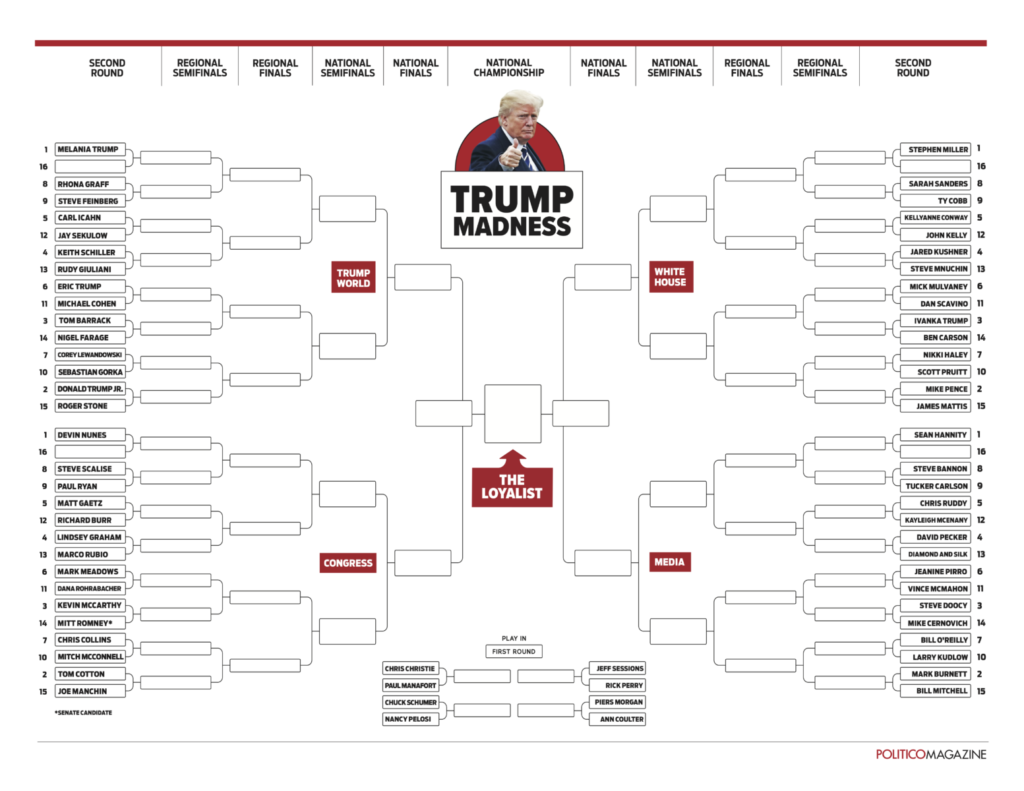

click for ginormous bracket Source: Politico Very amusing: “Who is most likely to stay in Trump’s good graces until the...

click for ginormous bracket Source: Politico Very amusing: “Who is most likely to stay in Trump’s good graces until the...

Read More

Digital currencies are generating a lot of excitement. John Oliver enlists Keegan-Michael Key to get potential investors equally excited...

Read More

While the Russia investigation has become clouded by the confusion surrounding dueling memos, Stephen heads to to Congress to get the...

Read More

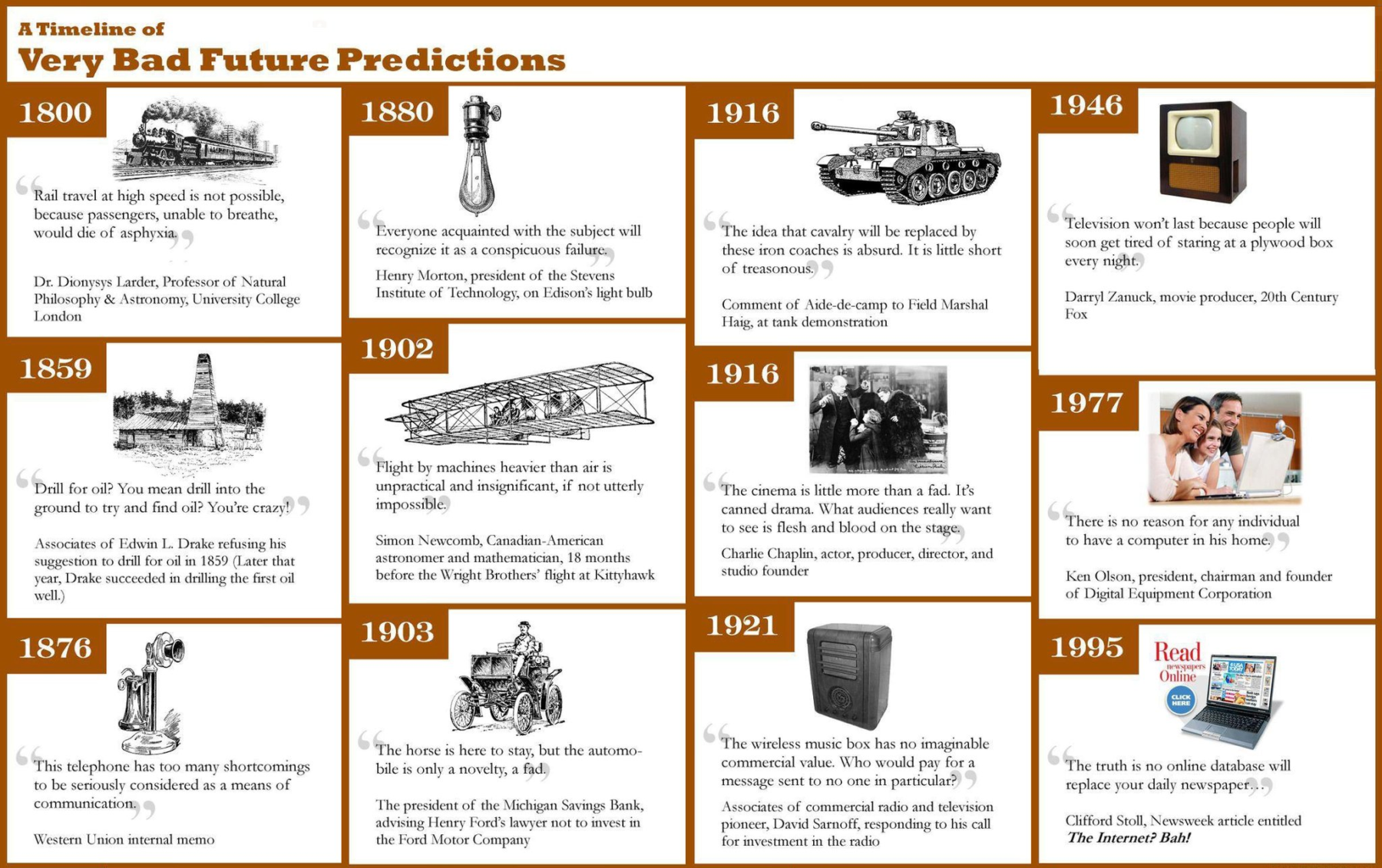

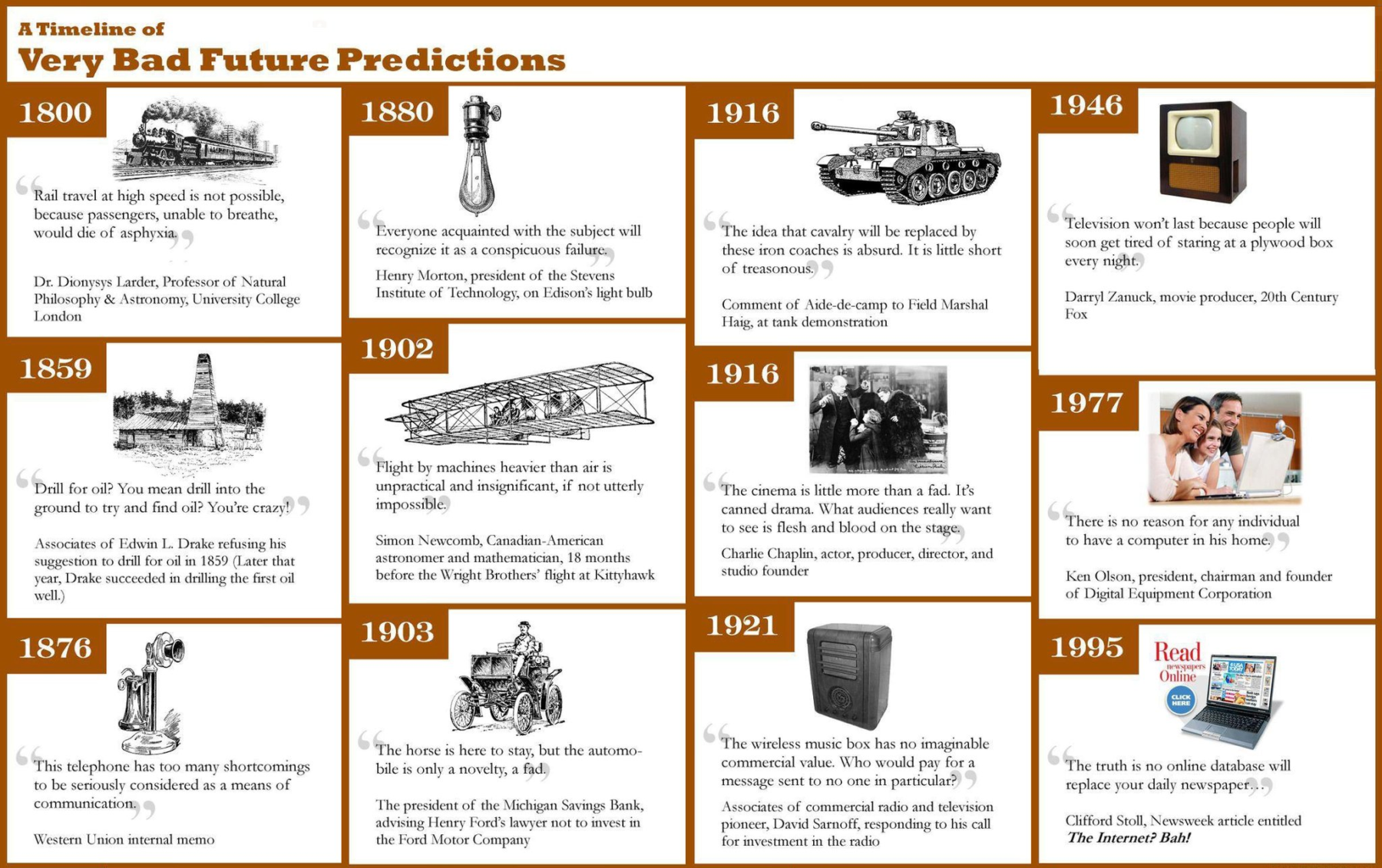

click for complete graphic Source: Infographic City Presented without comment . . . Previously: Apprenticed...

click for complete graphic Source: Infographic City Presented without comment . . . Previously: Apprenticed...

Read More

Lenny Henry on Richard Pryor: The Making of a Satirist Seriously… click for audio Source: BBC Source: BBC Lenny Henry...

Read More

A full ten minutes of Rodney Dangerfield doing stand-up and having some laughs with Johnny Carson. Originally aired August 1, 1979 on the...

Read More

In honor of the classic Bill Murray film “Groundhog Day,” Reason releases this horrifyingly relevant parody about a cycle...

Read More

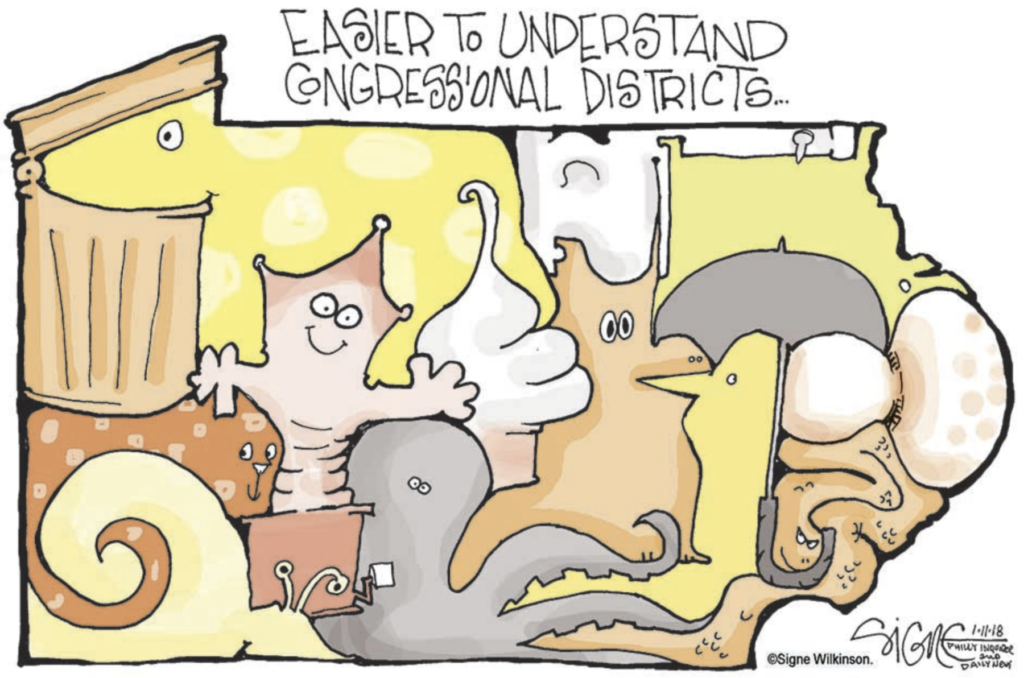

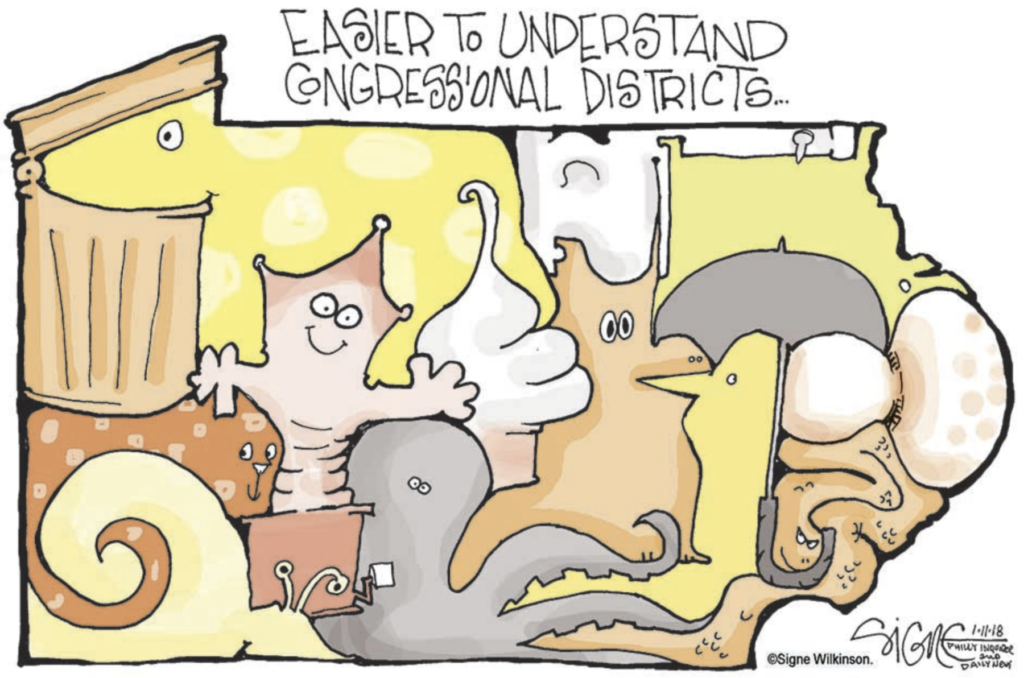

I don’t know why I find this so amusing; I guess its turning such a serious issue into a children’s game. . .

I don’t know why I find this so amusing; I guess its turning such a serious issue into a children’s game. . .

Read More

click for ginormous bracket Source: Politico Very amusing: “Who is most likely to stay in Trump’s good graces until the...

click for ginormous bracket Source: Politico Very amusing: “Who is most likely to stay in Trump’s good graces until the...

click for ginormous bracket Source: Politico Very amusing: “Who is most likely to stay in Trump’s good graces until the...

click for ginormous bracket Source: Politico Very amusing: “Who is most likely to stay in Trump’s good graces until the...