MiB: Samara Cohen, BlackRock CIO for ETF and Index Investments

This week, we speak with Samara Cohen, who is chief investment officer of ETF and Index investments at BlackRock....

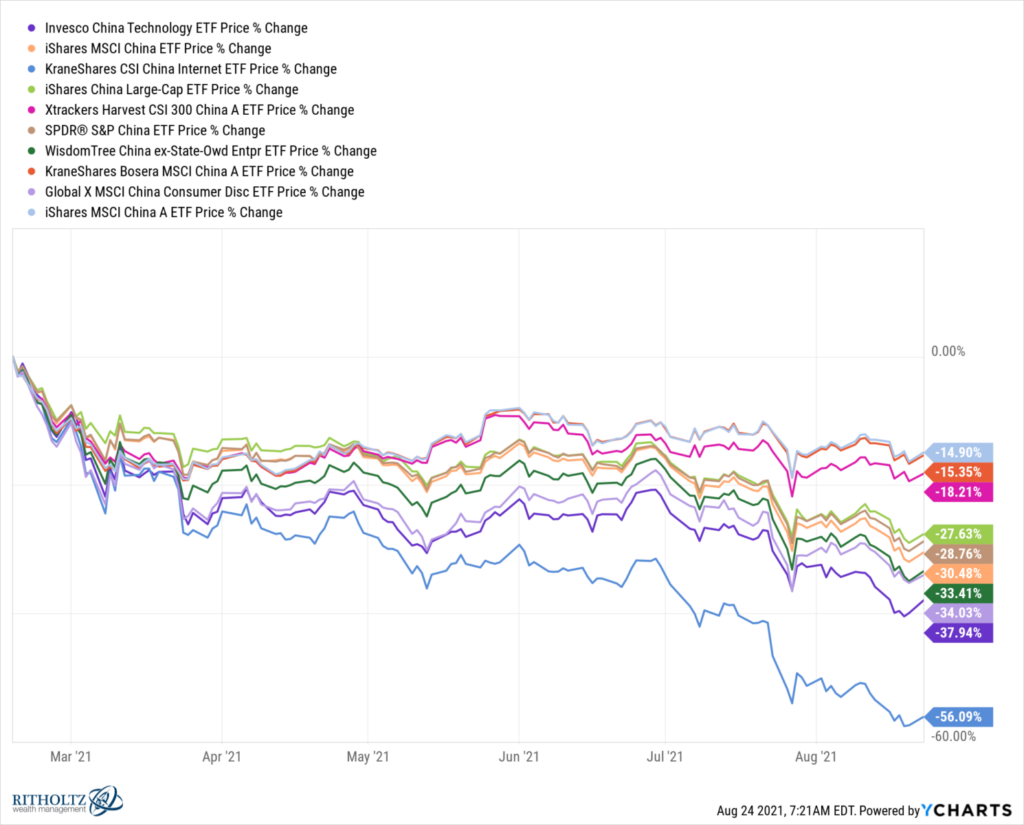

In less than a month, Russia has moved from an emerging market country to a pariah nation. They have been cut off from western...

In less than a month, Russia has moved from an emerging market country to a pariah nation. They have been cut off from western...

Earlier this month, I asked How Much is the Rule of Law Worth to Markets? It’s a challenge to quantify that query...

Earlier this month, I asked How Much is the Rule of Law Worth to Markets? It’s a challenge to quantify that query...

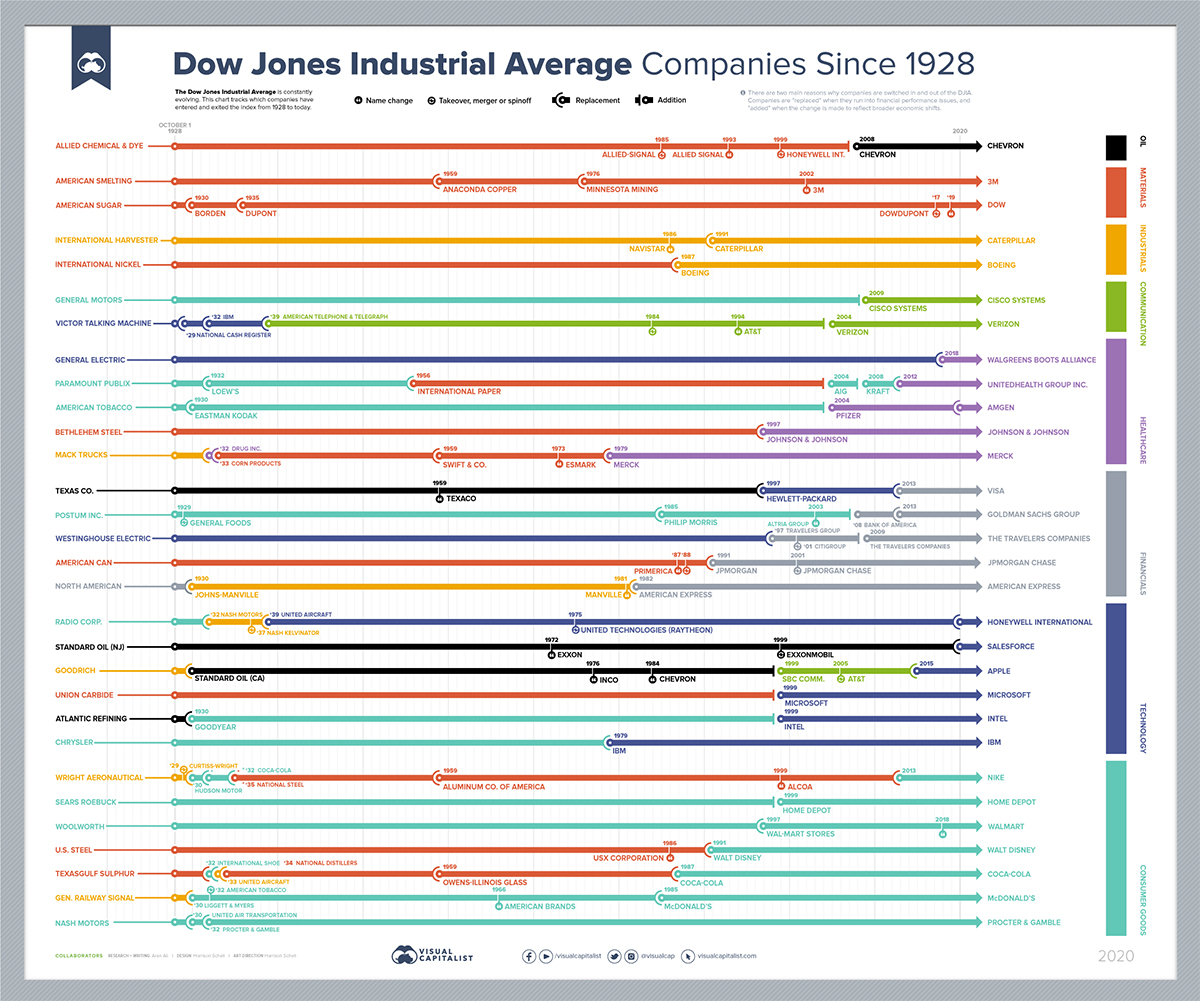

Every Company In and Out of the Dow Jones Industrial Average Since 1928 Source: Visual Capitalist I hope you did not...

Every Company In and Out of the Dow Jones Industrial Average Since 1928 Source: Visual Capitalist I hope you did not...

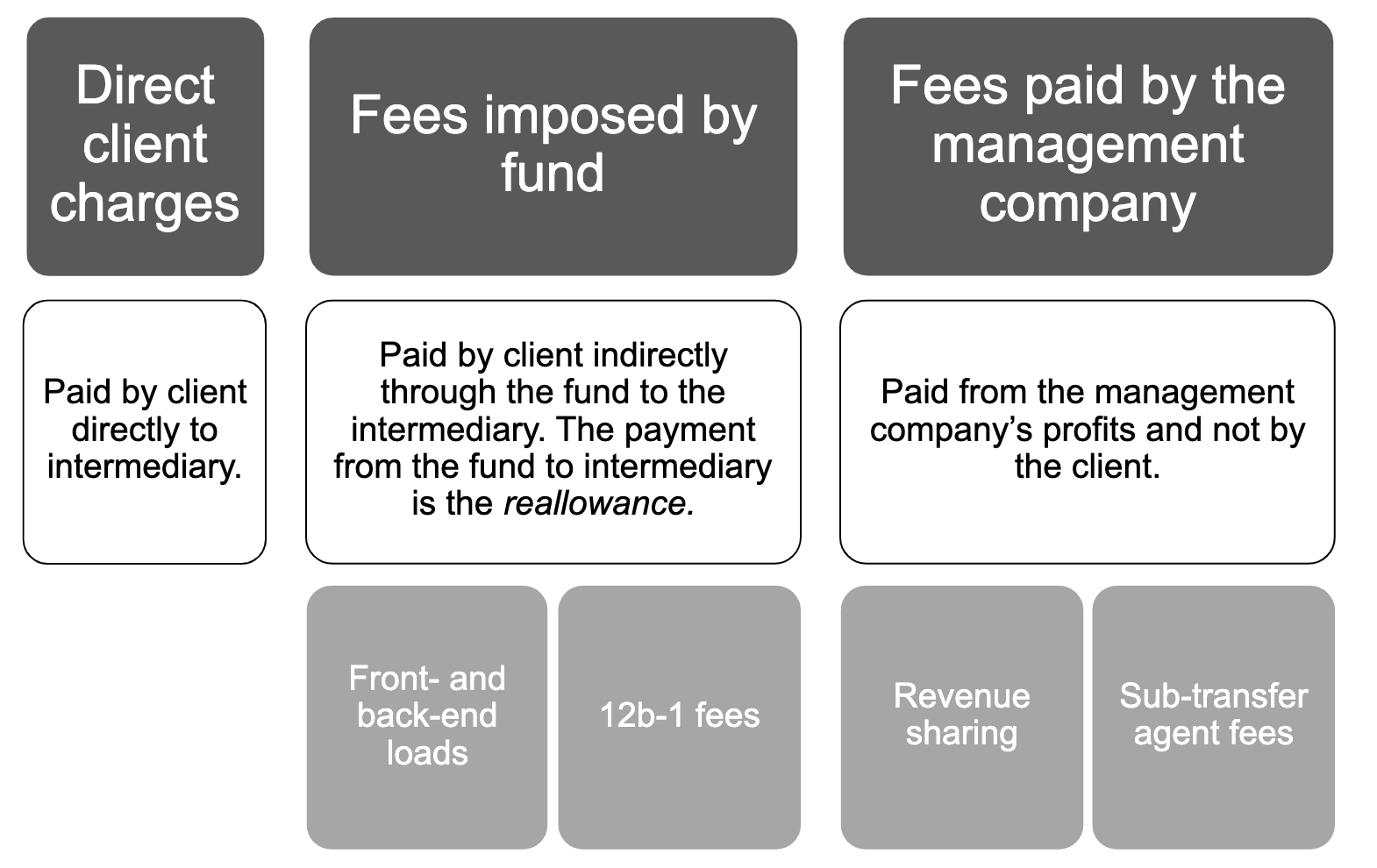

Source: Distribution Channels for Mutual Funds Retail Sales Today’s discussion is a little “inside...

Source: Distribution Channels for Mutual Funds Retail Sales Today’s discussion is a little “inside...

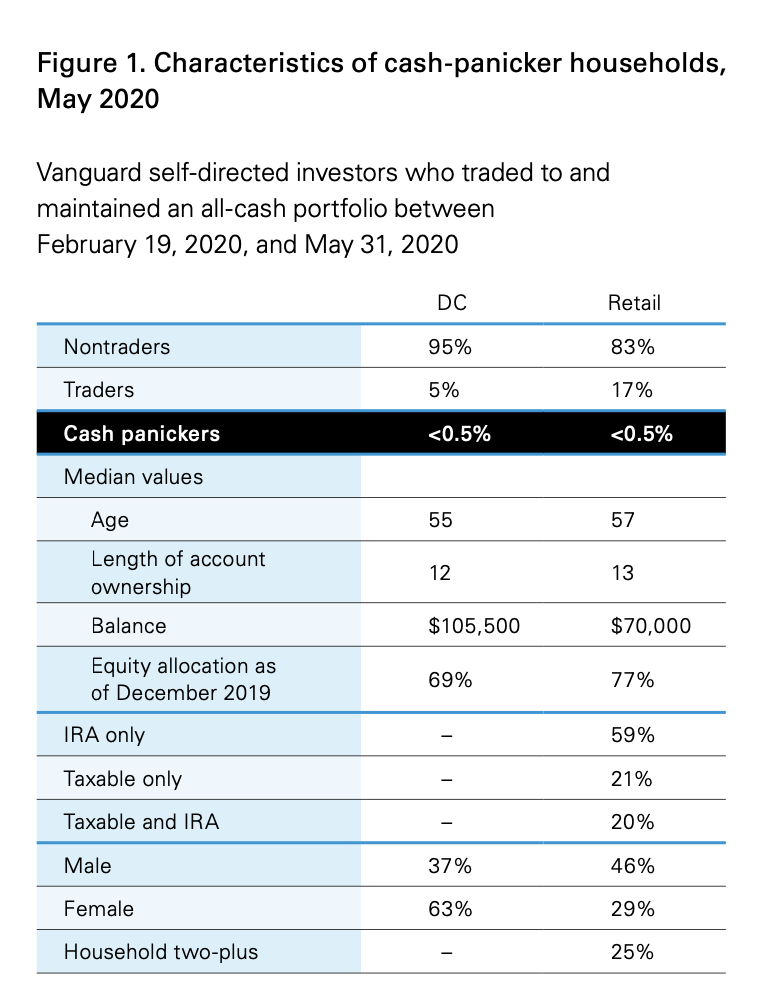

Cash panickers: Coronavirus market volatility Source: Vanguard Of all the silly criticisms of passive index-based investing...

Cash panickers: Coronavirus market volatility Source: Vanguard Of all the silly criticisms of passive index-based investing...

Get subscriber-only insights and news delivered by Barry every two weeks.