MiB: BlackRock’s Salim Ramji

This week, we speak with BlackRock Senior Managing Director Salim Ramji, Head of iShares Index and ETFs. Ramji’s division manages...

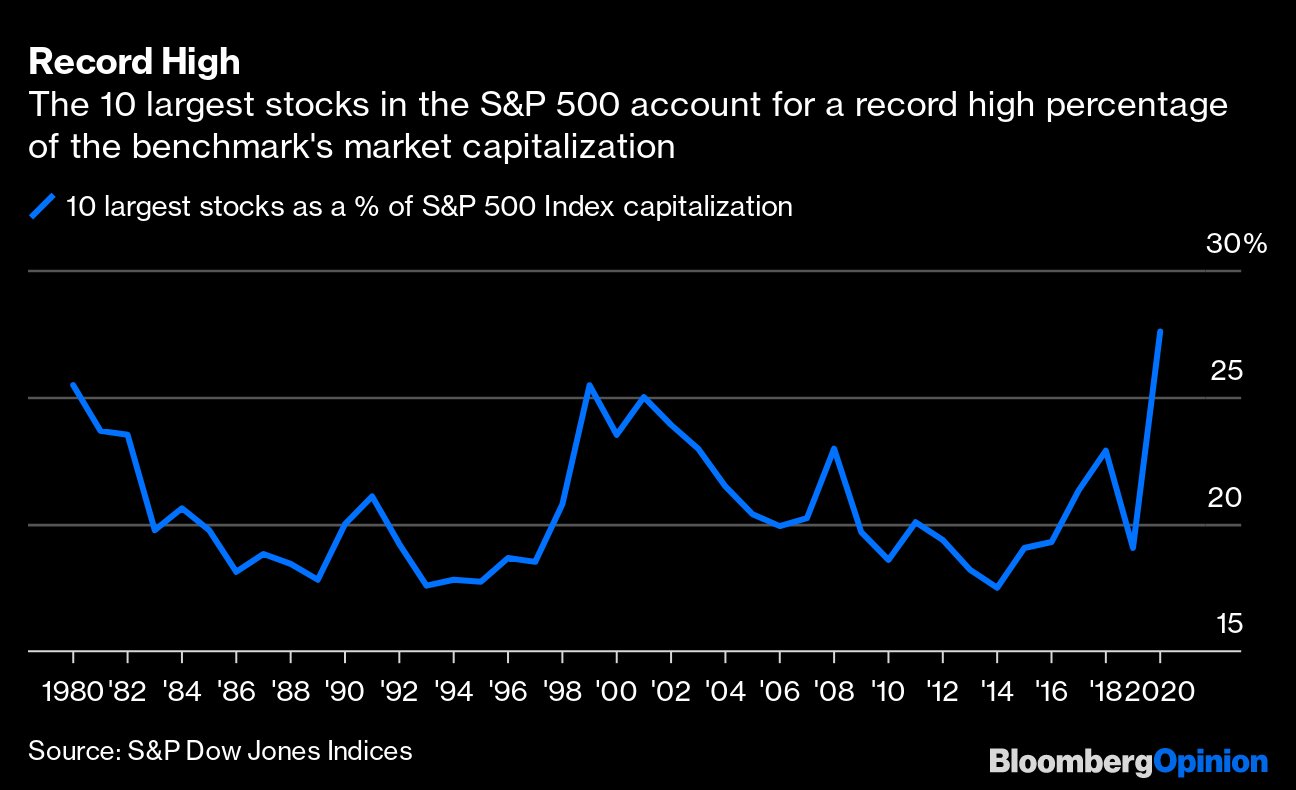

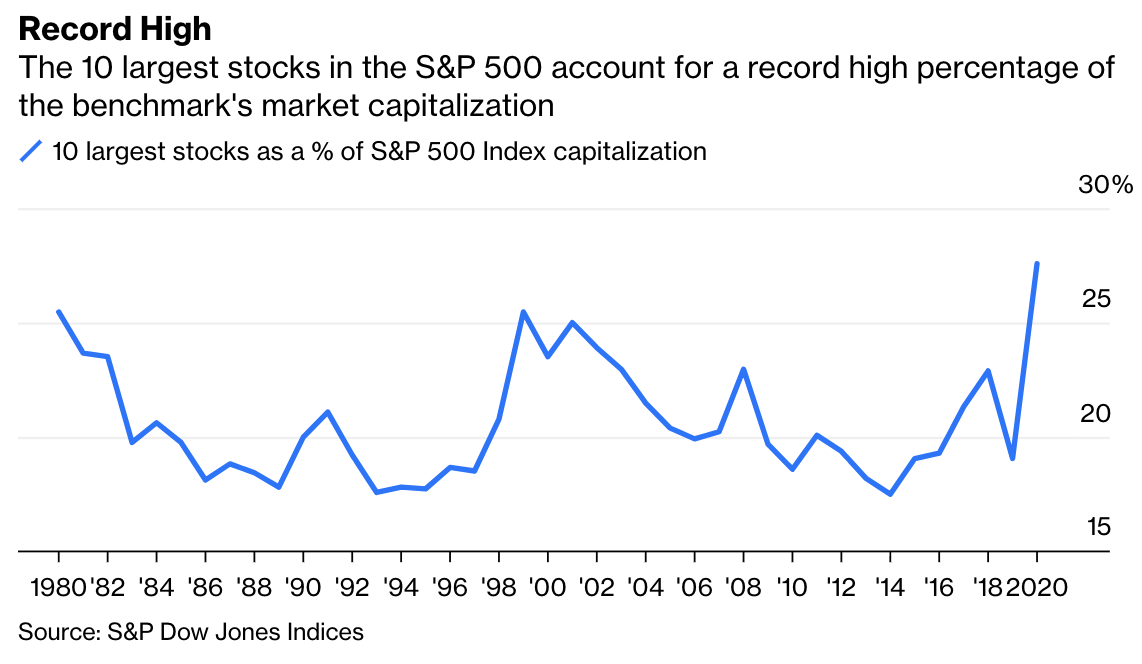

Top-Heavy Stock Indexes Are Nothing to Fear It’s not rare for a small group of equities such as Apple, Microsoft and Amazon.com to...

Top-Heavy Stock Indexes Are Nothing to Fear It’s not rare for a small group of equities such as Apple, Microsoft and Amazon.com to...

Source: JPM Chase “Stop trying to put 10 pounds of shit in a 5 pound bag.” I had an editor who was very fond of...

Source: JPM Chase “Stop trying to put 10 pounds of shit in a 5 pound bag.” I had an editor who was very fond of...

Top-Heavy Stock Indexes Are Nothing to Fear It’s not rare for a small group of equities such as Apple, Microsoft and Amazon.com to...

Top-Heavy Stock Indexes Are Nothing to Fear It’s not rare for a small group of equities such as Apple, Microsoft and Amazon.com to...

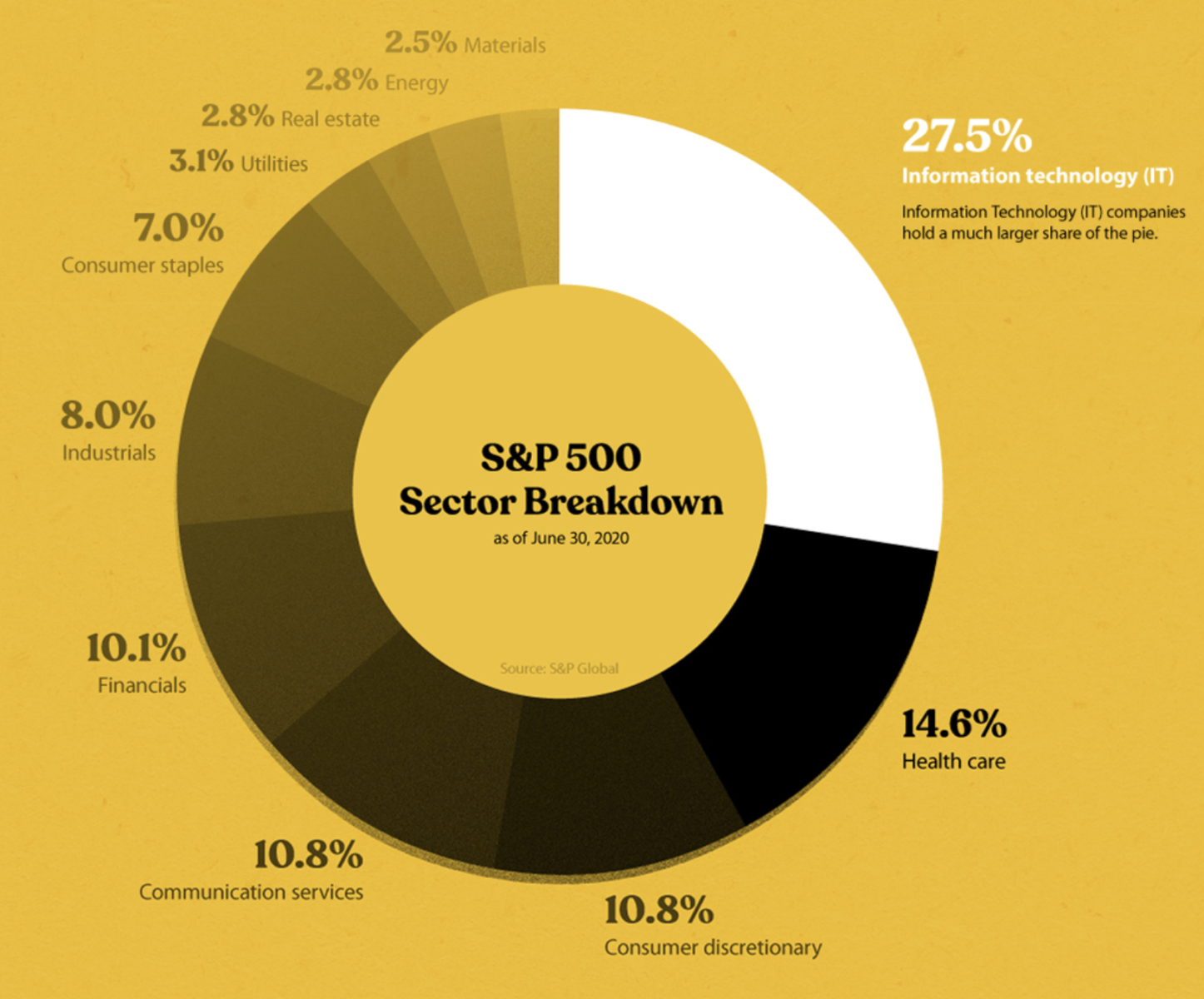

The core of the argument in last week’s discussion on Why Markets Don’t Seem to Care If the Economy Stinks surprised a few...

The core of the argument in last week’s discussion on Why Markets Don’t Seem to Care If the Economy Stinks surprised a few...

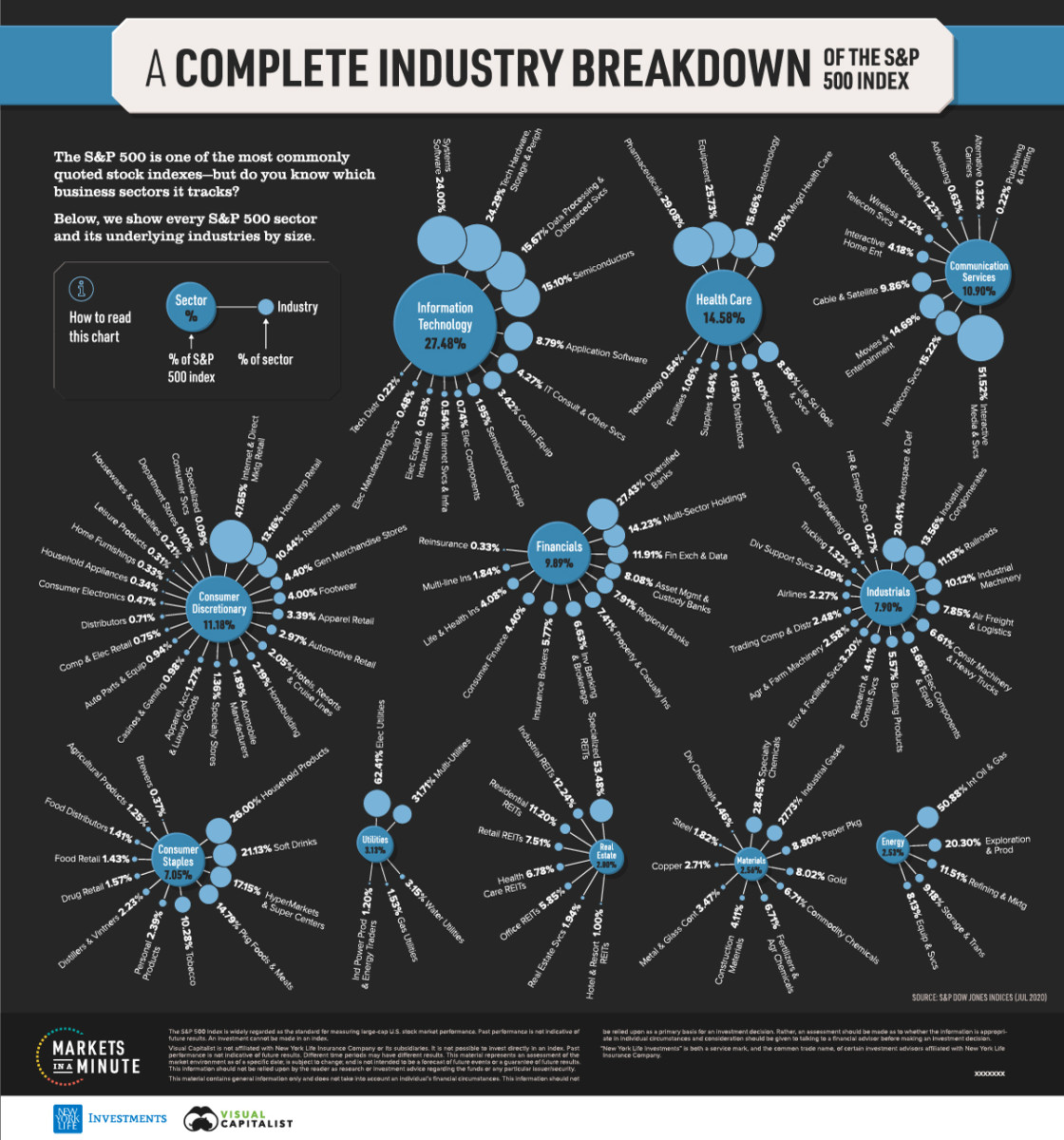

Why Markets Don’t Seem to Care If the Economy Stinks So many of the most battered industries don’t matter much because of the way...

Why Markets Don’t Seem to Care If the Economy Stinks So many of the most battered industries don’t matter much because of the way...

They’re All Friends in the Index Matt Levine Bloomberg, July 20, 2020 Matt Levine is a Bloomberg Opinion columnist covering...

They’re All Friends in the Index Matt Levine Bloomberg, July 20, 2020 Matt Levine is a Bloomberg Opinion columnist covering...

Get subscriber-only insights and news delivered by Barry every two weeks.