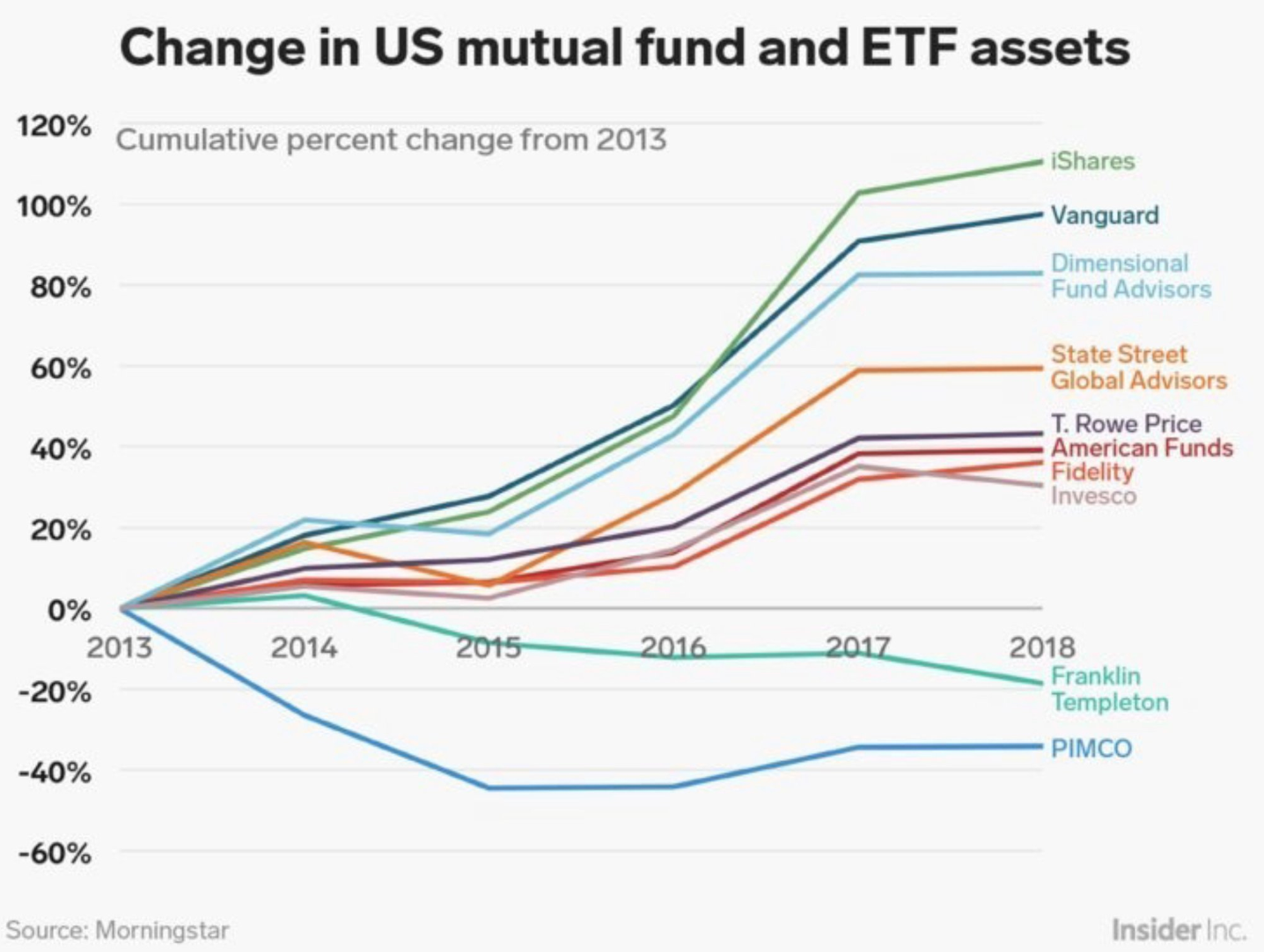

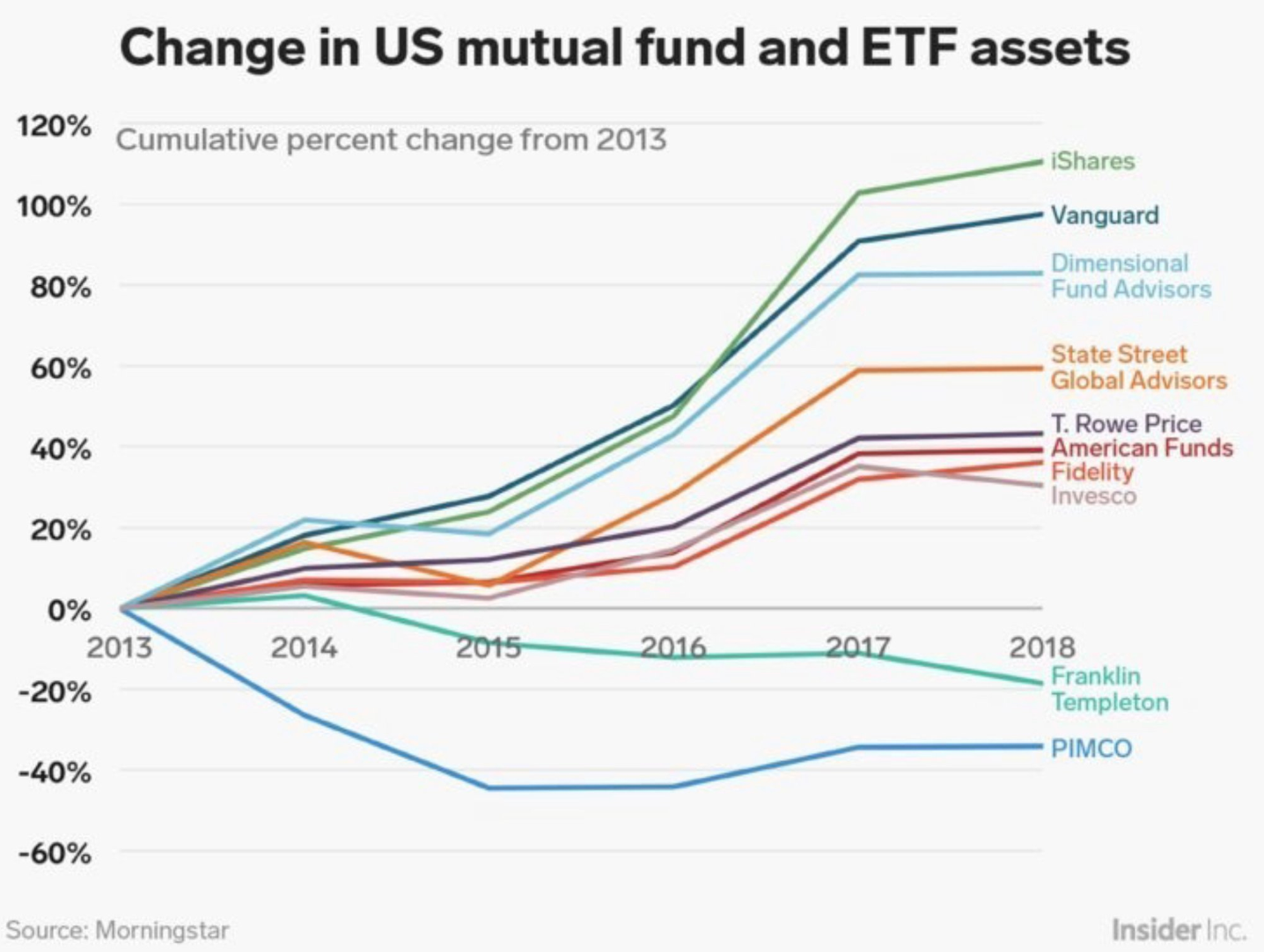

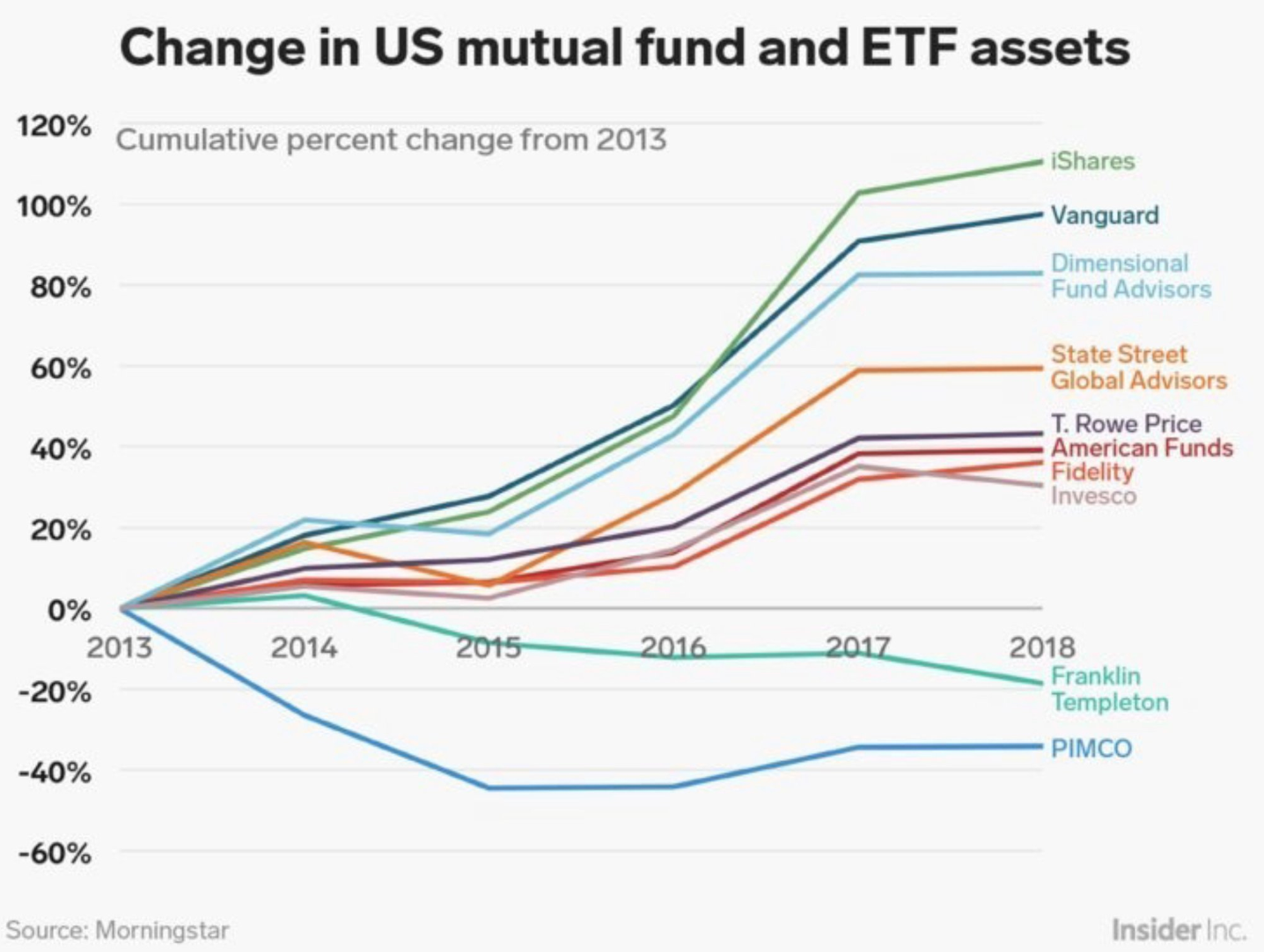

Via our man Brian in Chicago comes this fascinating pair of charts. As much as the active crowd slag on indexing — recall its...

Via our man Brian in Chicago comes this fascinating pair of charts. As much as the active crowd slag on indexing — recall its...

Read More

The transcript from this week’s MIB: Jason Schwarz, Wilshire Funds Management, is below. You can stream/download...

Read More

This week, we speak with Jason Schwarz, who is president of Wilshire Funds Management and Wilshire Analytics. The firm manages more than...

Read More

Index-Investing Critic Takes Aim, Fires, Misses New arguments against low-cost, passive investing are no better than the old ones....

Read More

Index-Investing Critic Takes Aim, Fires, Misses New arguments against low-cost, passive investing are no better than the old ones....

Read More

Small Is Better and So Is Passive in Money Management S&P’s latest report on fund managers portrays persistent contrasts in...

Read More

Small Is Better and So Is Passive in Money Management S&P’s latest report on fund managers portrays persistent contrasts in...

Read More

Index Funds Will Be Fine Confronting Cruel Markets The claim that passive investors will suffer more in an equity slump doesn’t hold...

Read More

Active Money Management Isn’t Dead Yet There are five niches that should survive Bloomberg, August 13, 2018 ...

Read More

Index Funds Will Be Fine Confronting Cruel Markets The claim that passive investors will suffer more in an equity slump doesn’t hold...

Read More

Via our man Brian in Chicago comes this fascinating pair of charts. As much as the active crowd slag on indexing — recall its...

Via our man Brian in Chicago comes this fascinating pair of charts. As much as the active crowd slag on indexing — recall its...

Via our man Brian in Chicago comes this fascinating pair of charts. As much as the active crowd slag on indexing — recall its...

Via our man Brian in Chicago comes this fascinating pair of charts. As much as the active crowd slag on indexing — recall its...