The Fed held its benchmark Federal-Funds rate steady yesterday at 5.25% – 5.5%, leaving the possibility of cuts in...

The Fed held its benchmark Federal-Funds rate steady yesterday at 5.25% – 5.5%, leaving the possibility of cuts in...

Read More

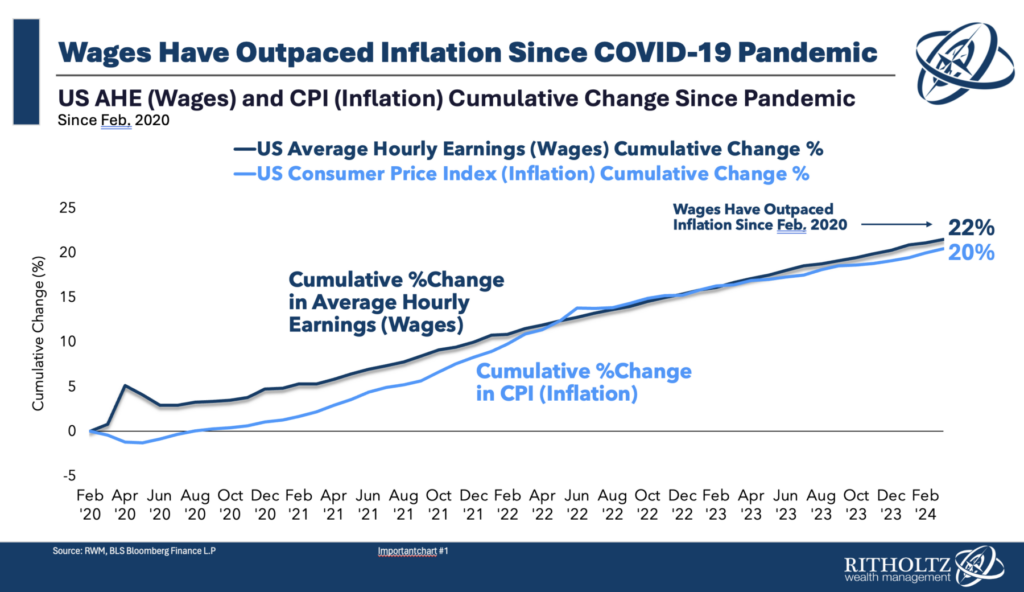

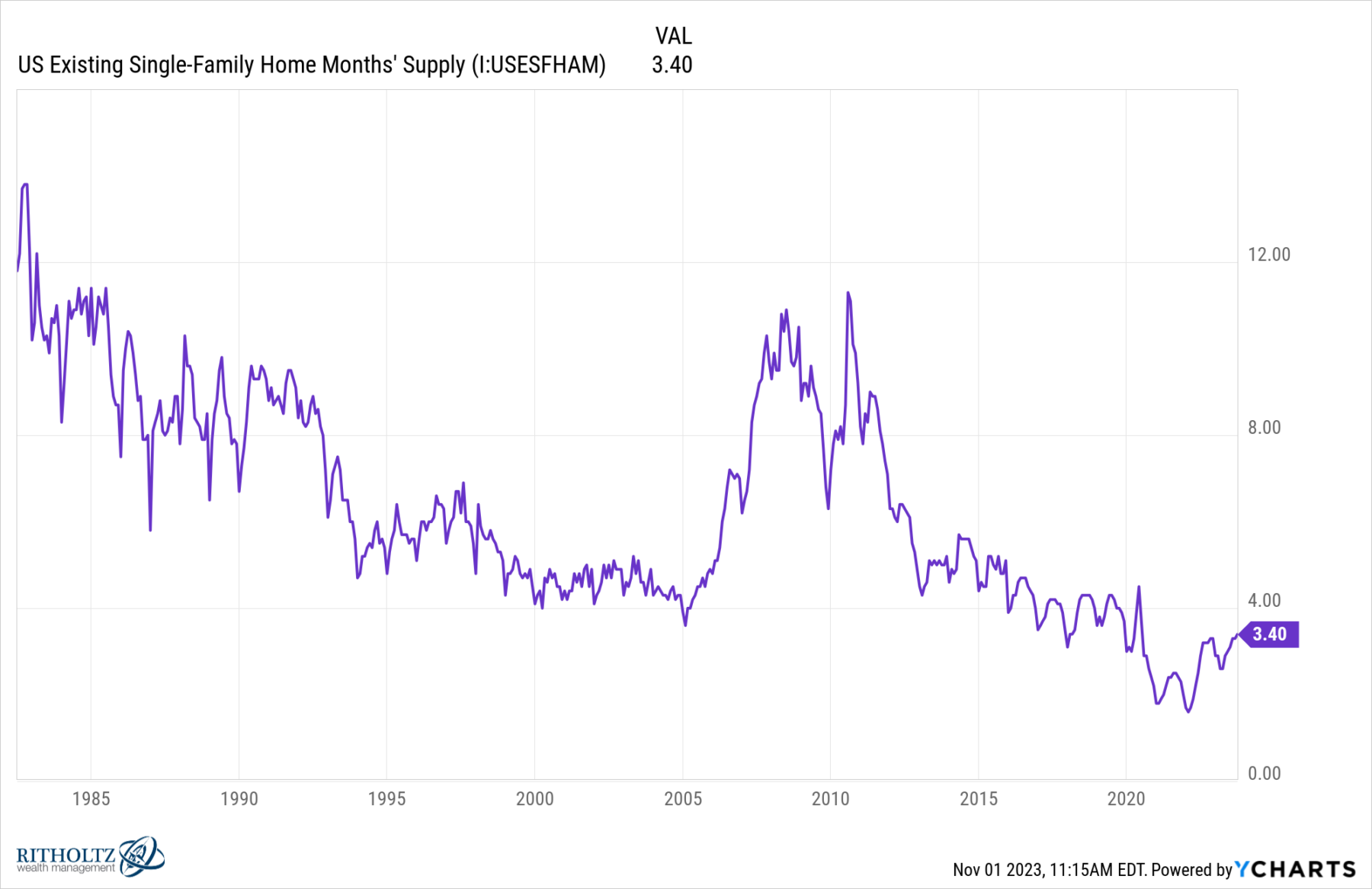

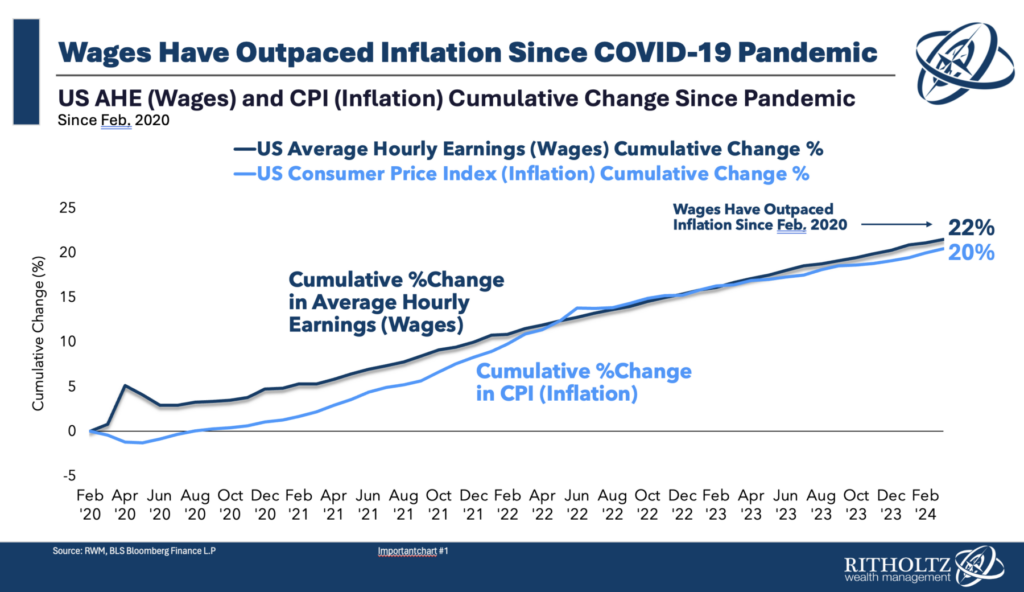

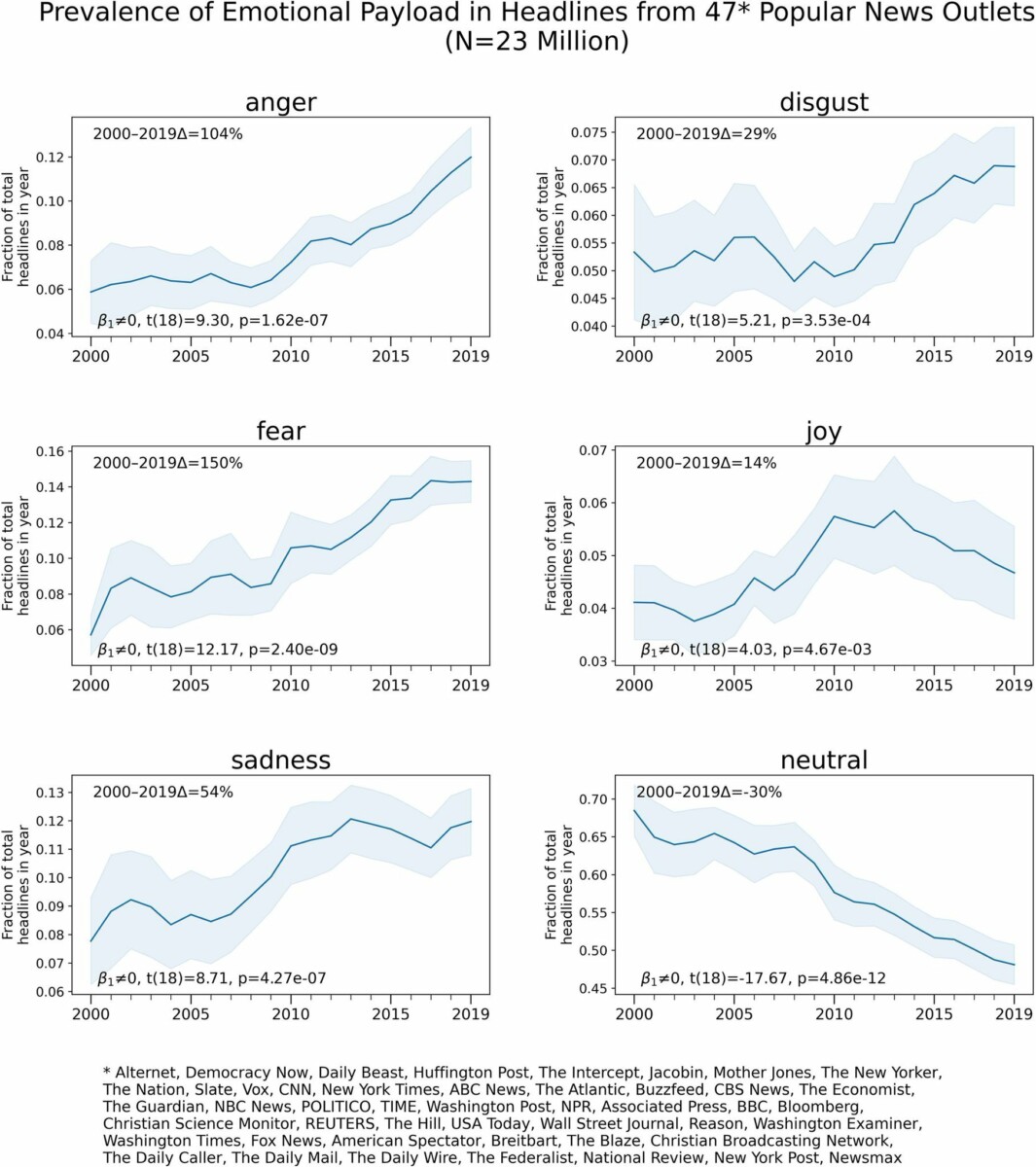

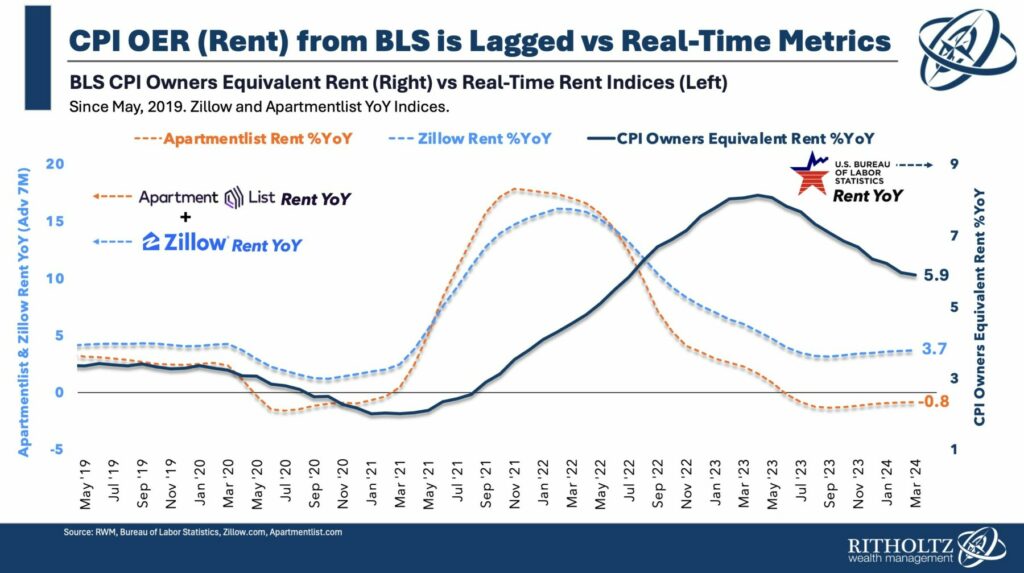

Putting the final touches on my quarterly RWM client call, I wanted to share a chart that is surprising to many people. The...

Putting the final touches on my quarterly RWM client call, I wanted to share a chart that is surprising to many people. The...

Read More

At the Money: Knowing When You’ve Whipped Inflation. (March 6, 2024) Investors hate inflation. How can they evaluate...

Read More

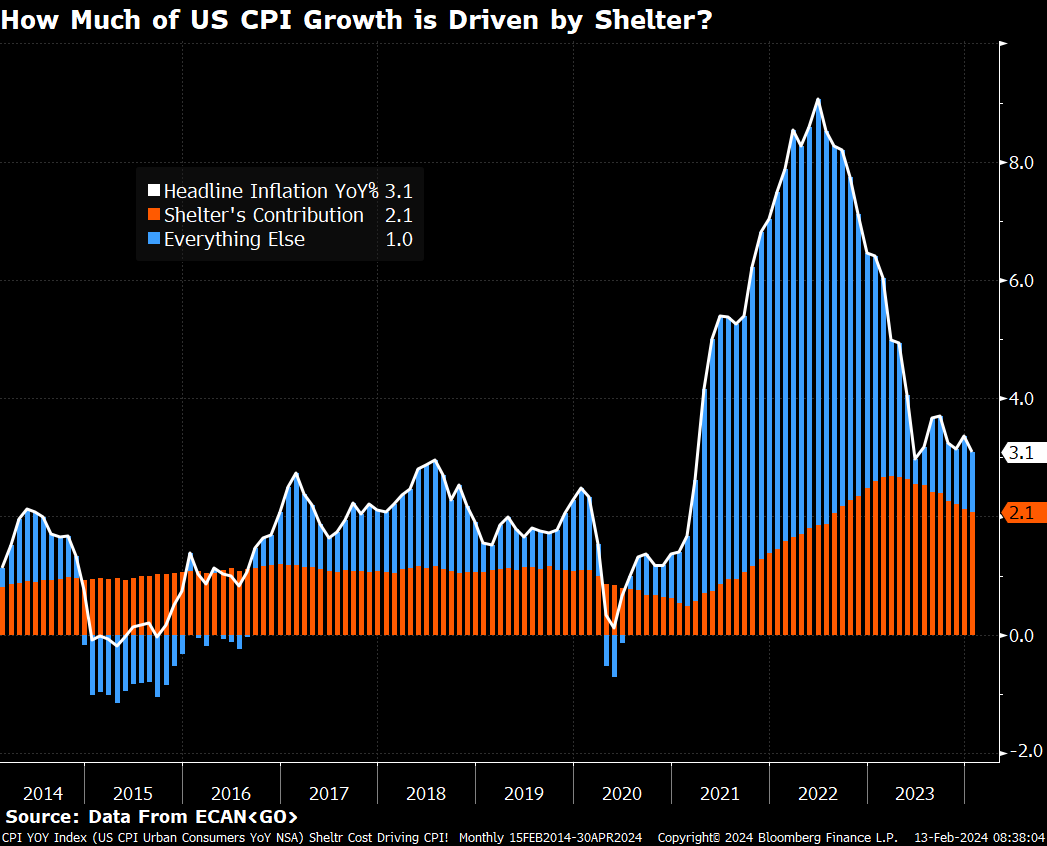

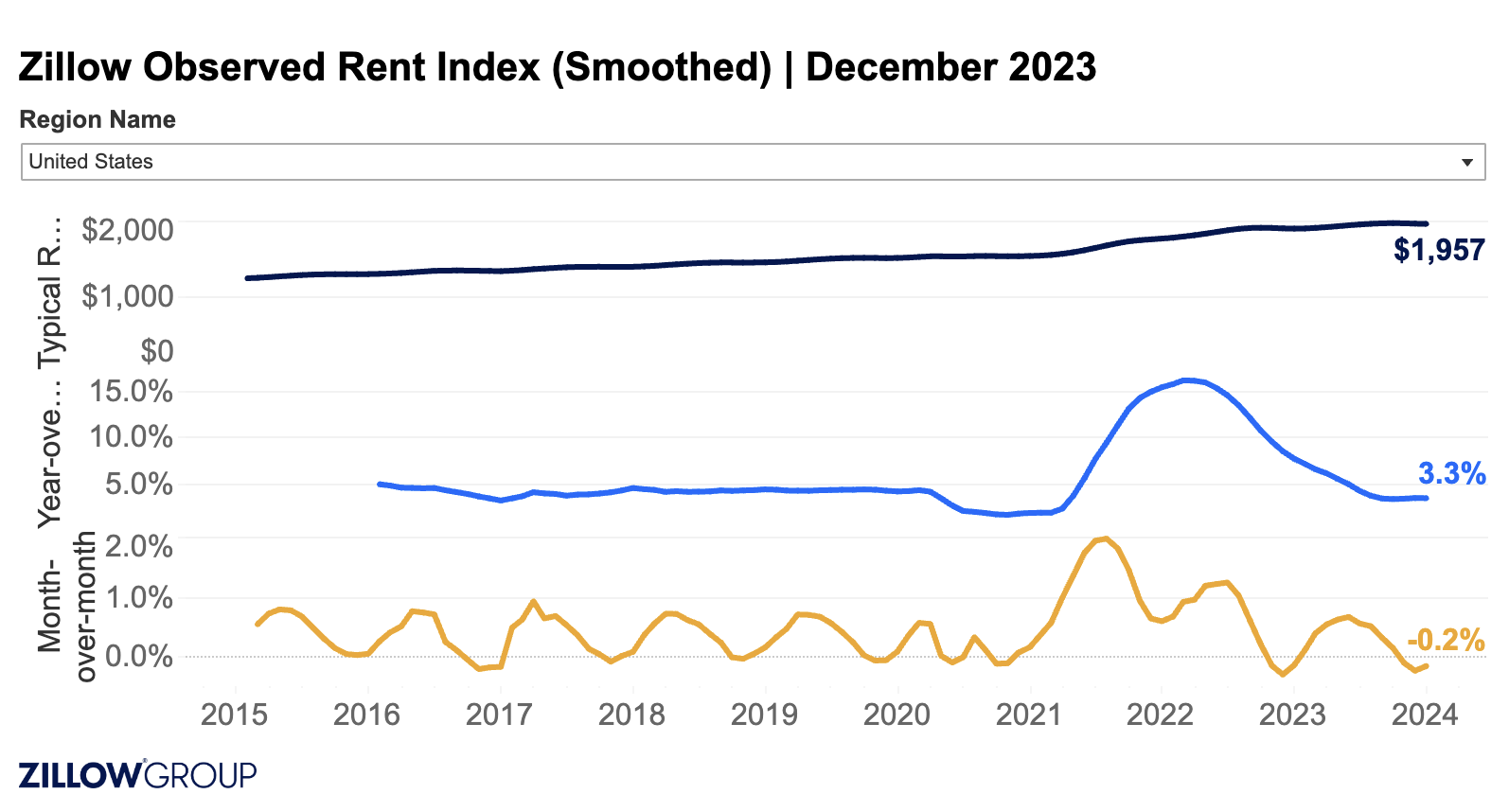

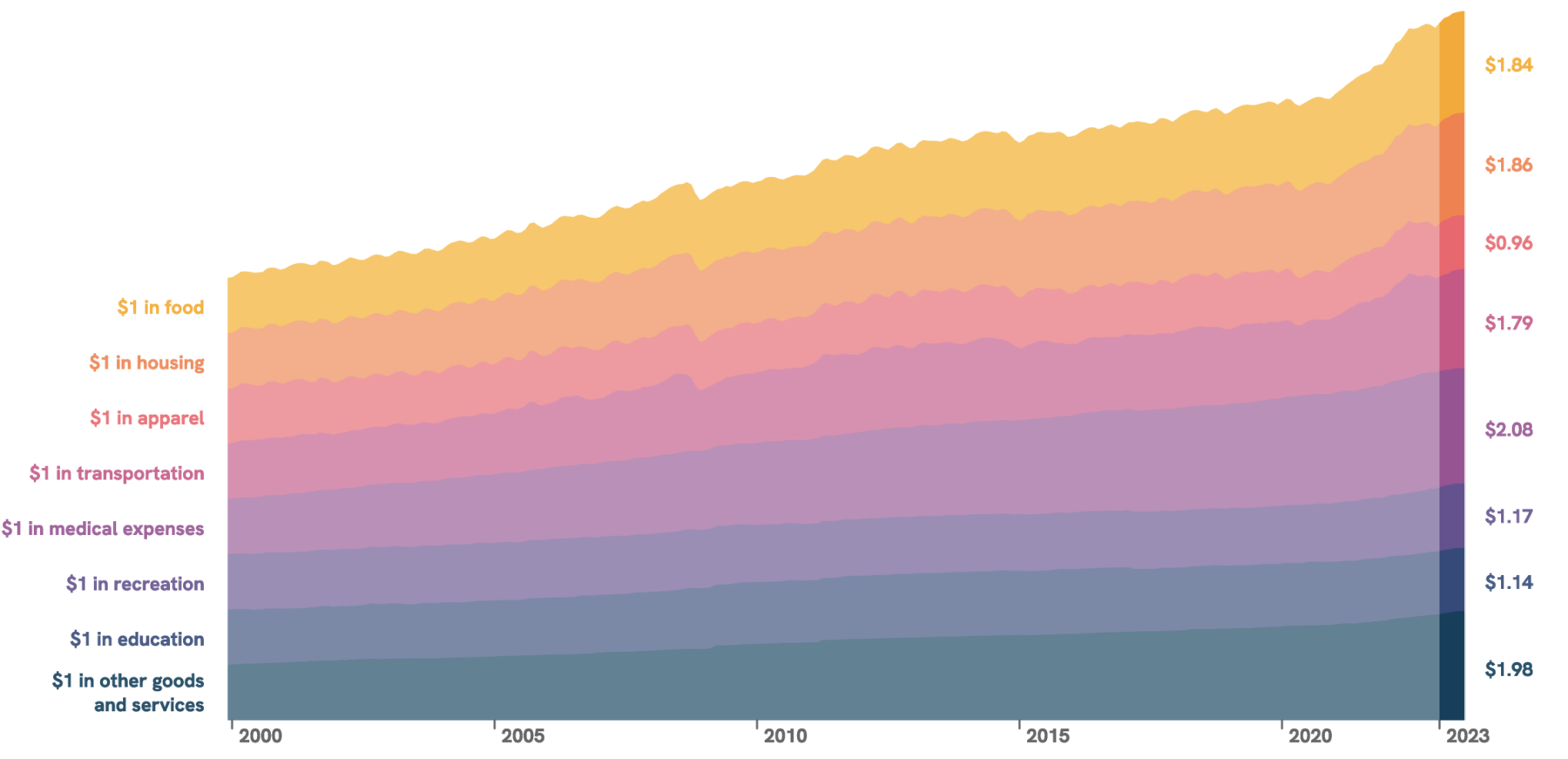

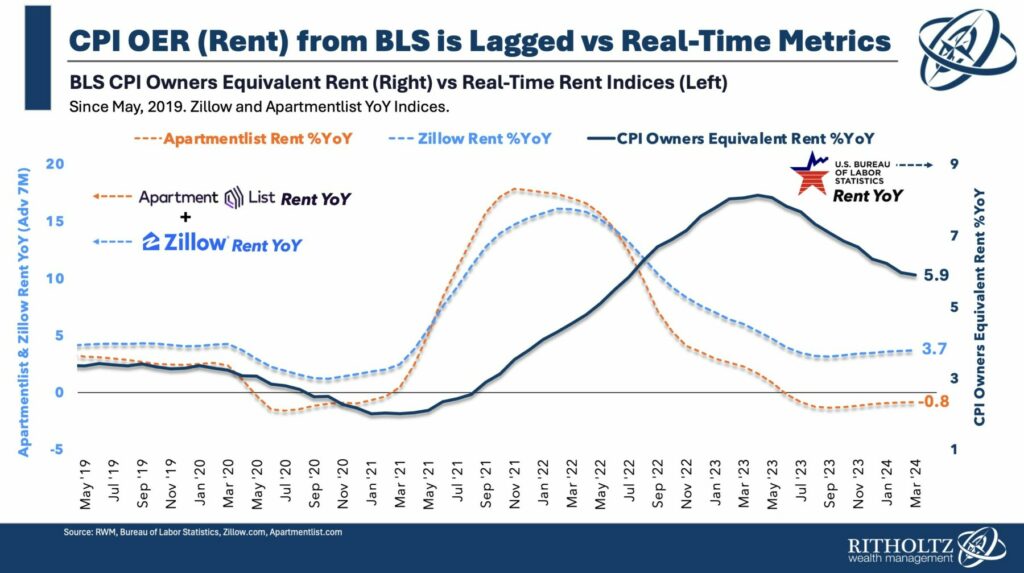

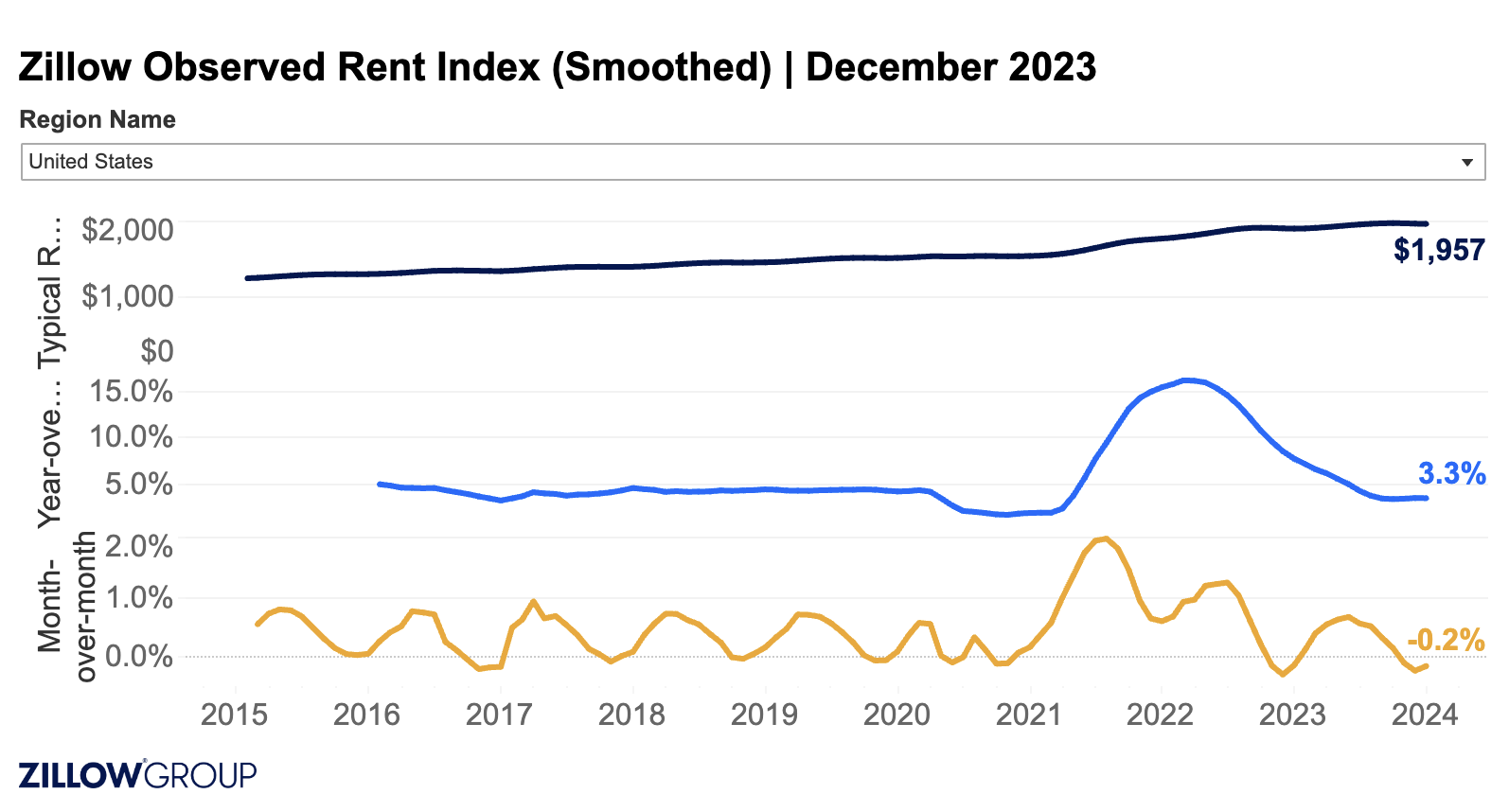

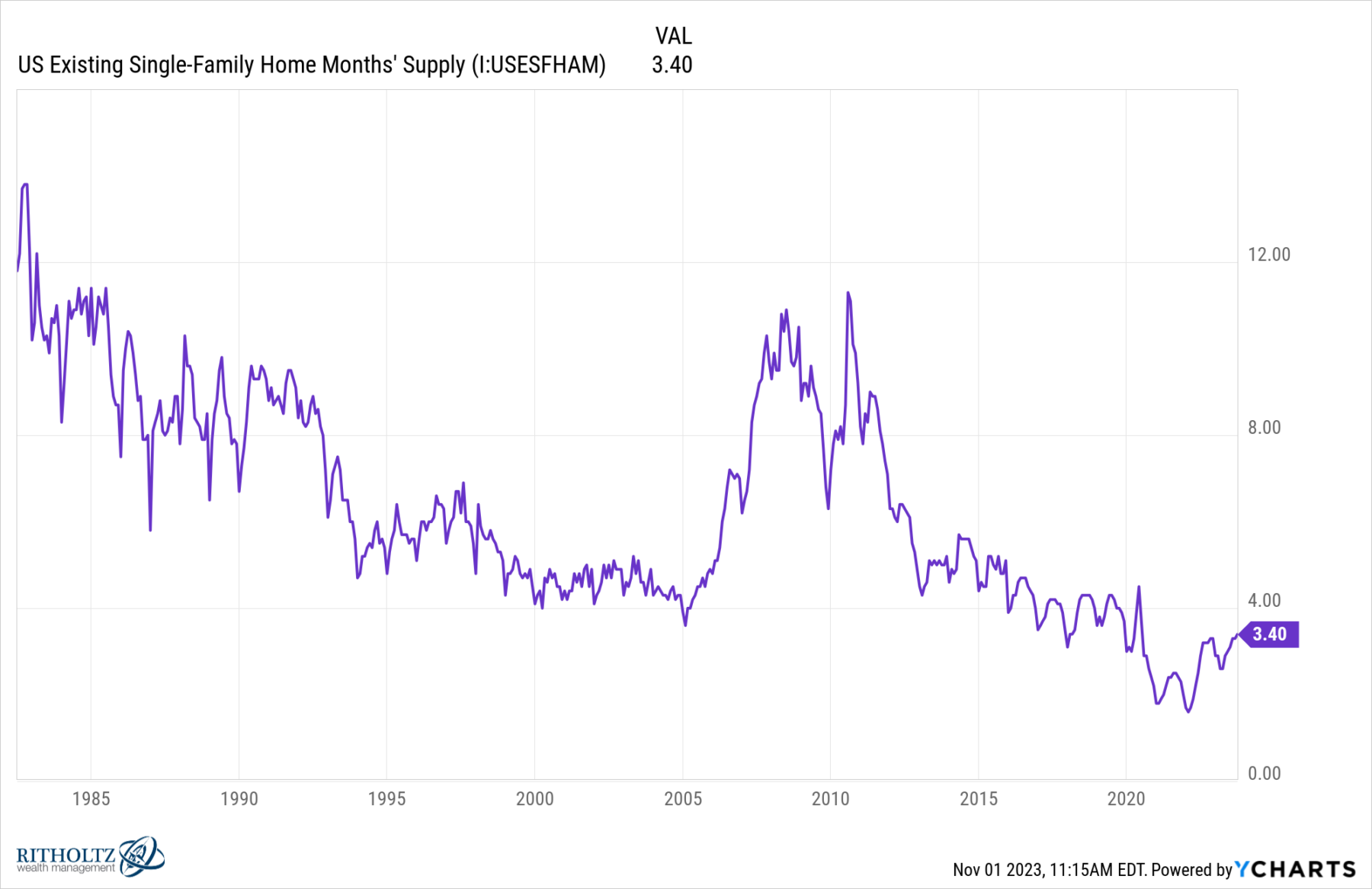

Last month, I mentioned that CPI inflation measures were based on lagging BLS measures of Owners’ Equivalent Rent...

Last month, I mentioned that CPI inflation measures were based on lagging BLS measures of Owners’ Equivalent Rent...

Read More

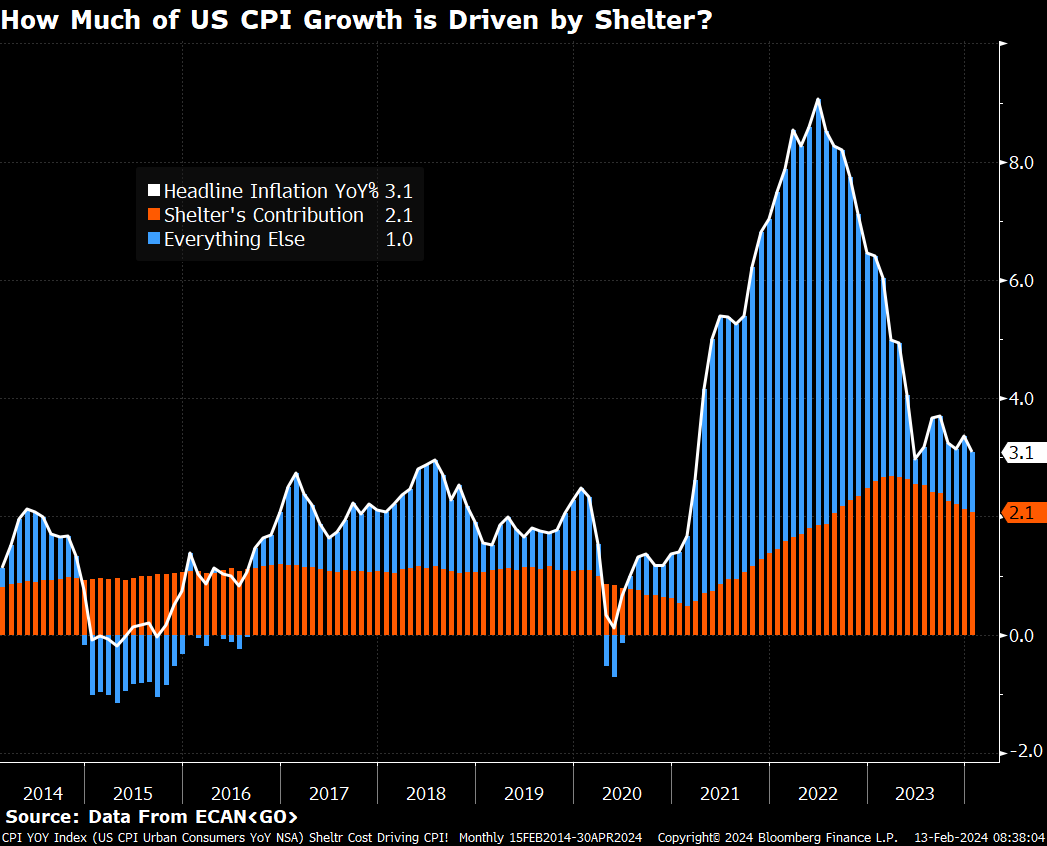

I am popping out of book leave to just throw a few charts at you regarding the Inflation data for December. CPI came in a 0.3%...

I am popping out of book leave to just throw a few charts at you regarding the Inflation data for December. CPI came in a 0.3%...

Read More

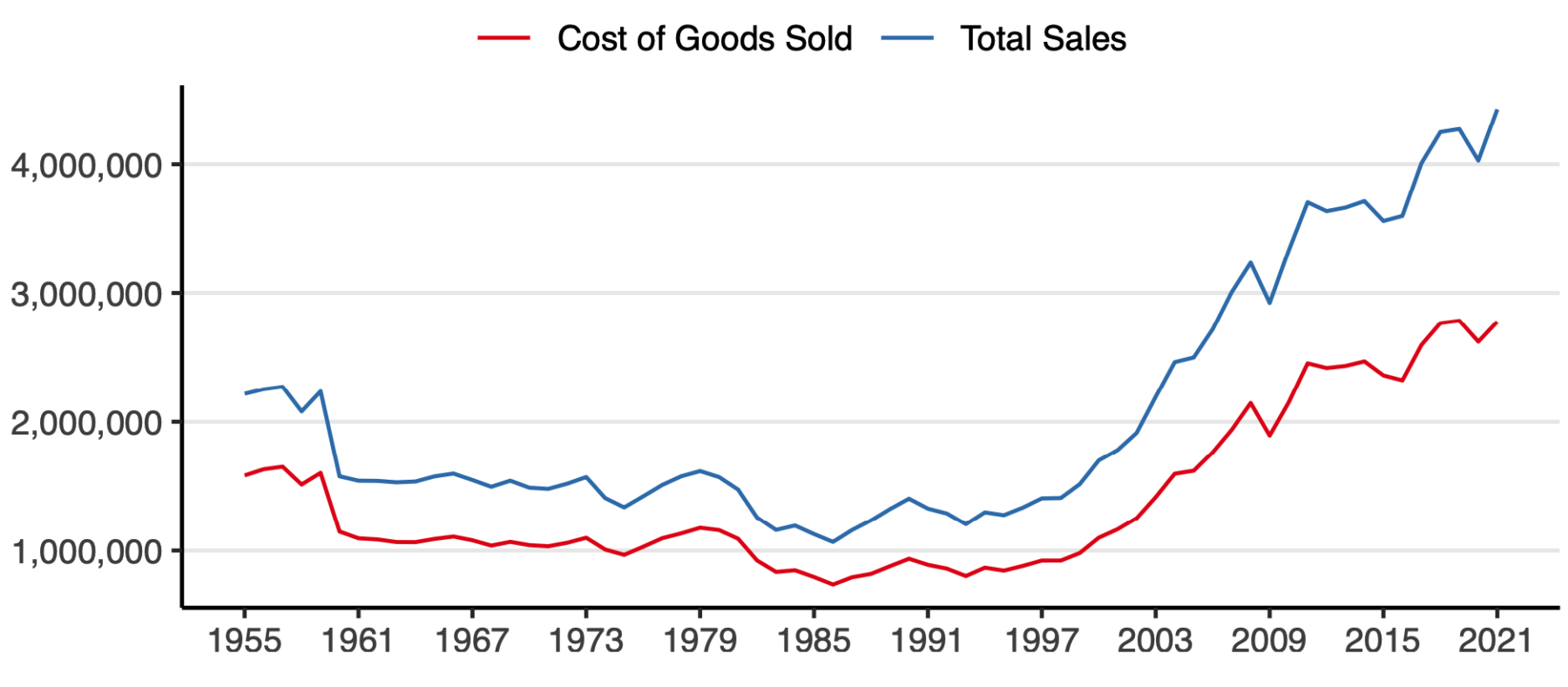

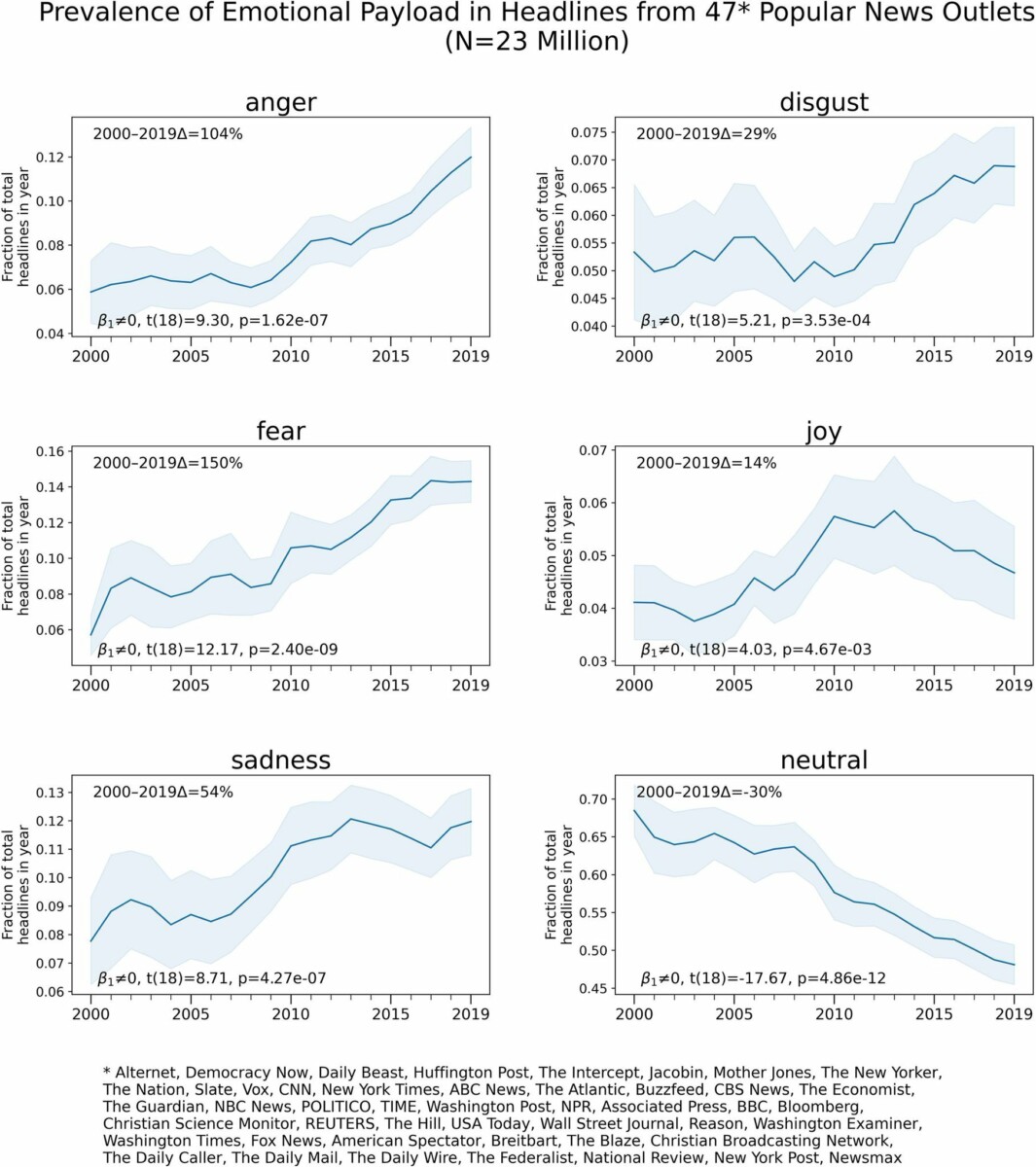

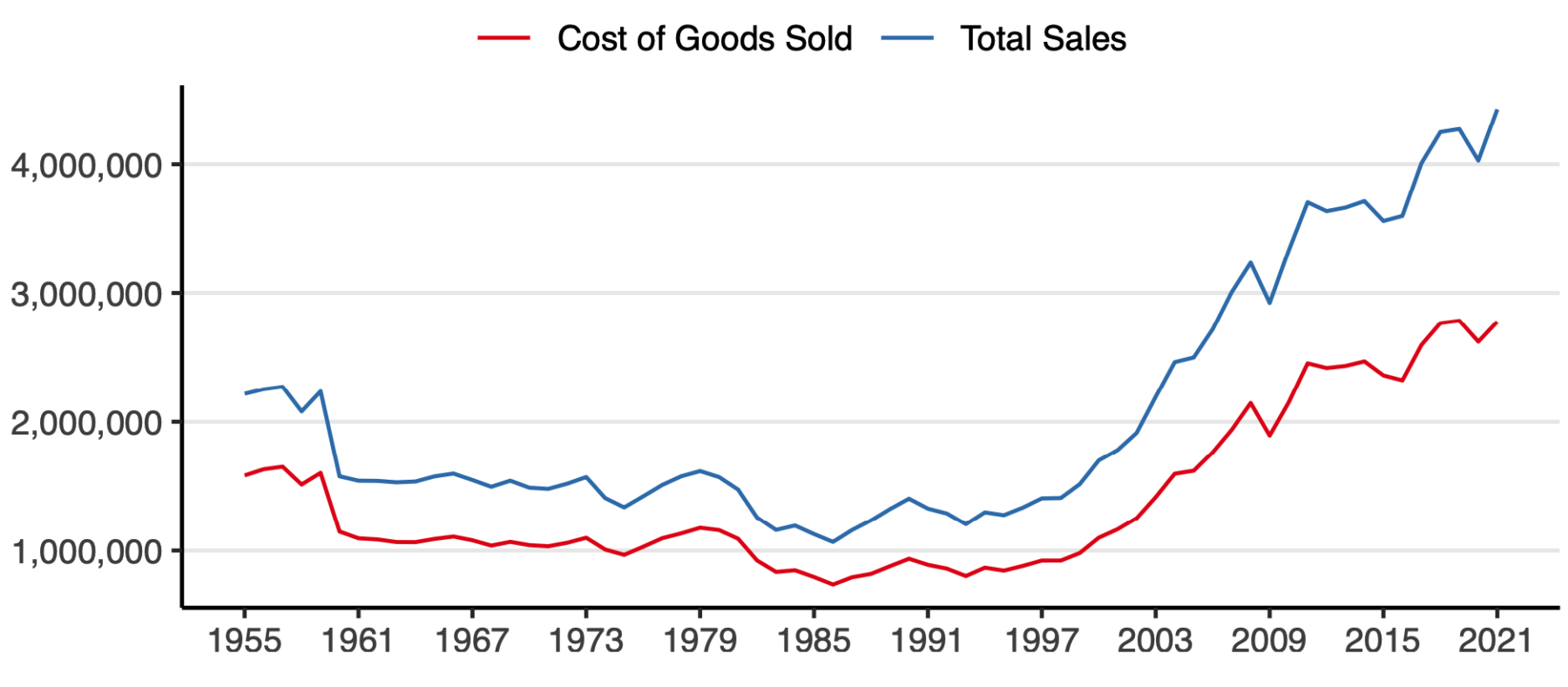

Over at Alphaville, Robin Wigglesworth looks at whether ‘Greedflation’ (aka price-gouging) meaningfully contributed to...

Over at Alphaville, Robin Wigglesworth looks at whether ‘Greedflation’ (aka price-gouging) meaningfully contributed to...

Read More

Everybody is waiting with bated breath for today’s 2:00 announcement about the rates, but let me spare you the suspense:...

Everybody is waiting with bated breath for today’s 2:00 announcement about the rates, but let me spare you the suspense:...

Read More

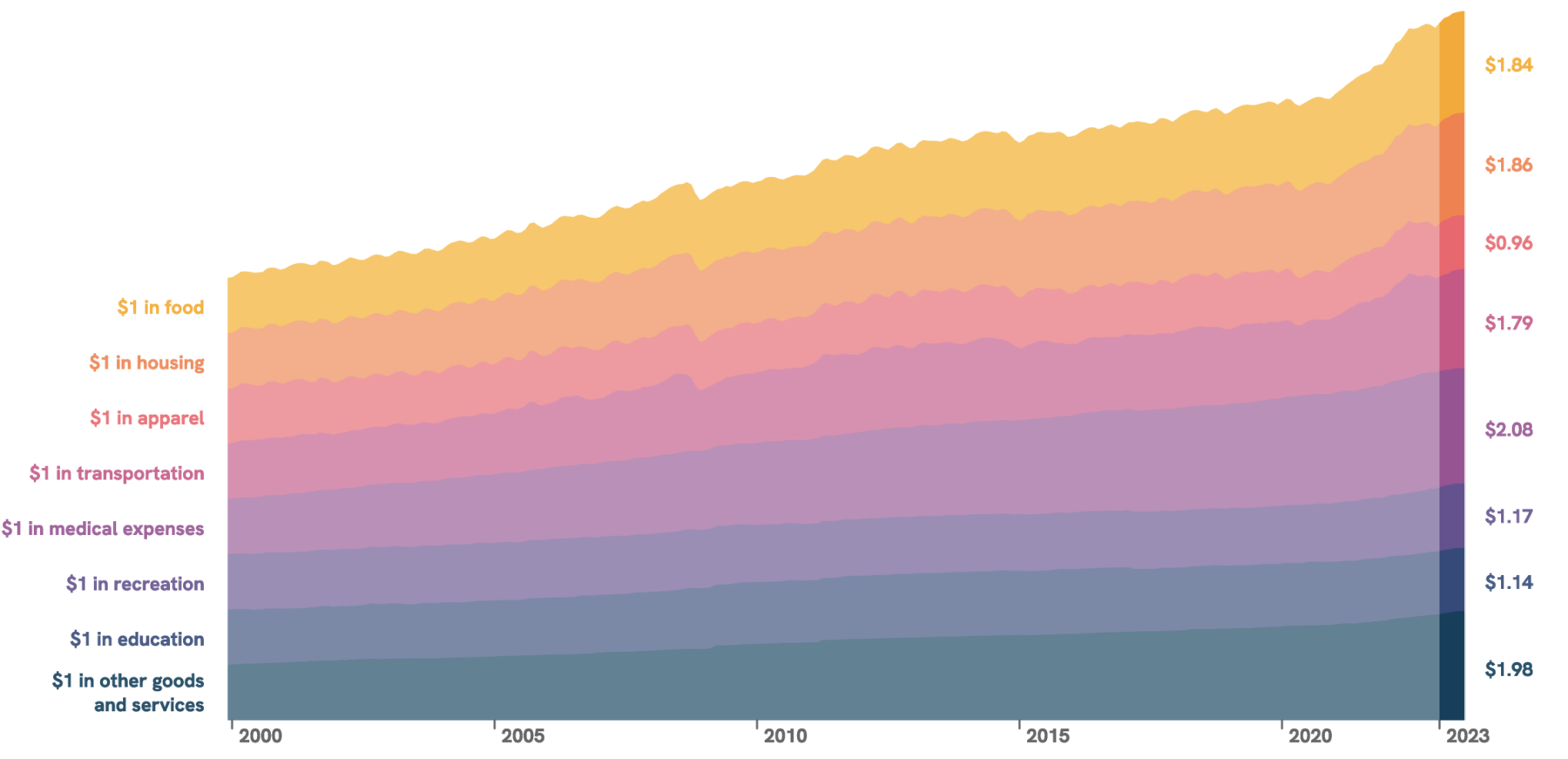

“I need the US Dollar to be a store of value between the time I make it until I spend it, invest it, pay my...

“I need the US Dollar to be a store of value between the time I make it until I spend it, invest it, pay my...

Read More

One of my favorite responsibilities as chief investment officer at Ritholtz Wealth Management is the quarterly conference call I do for...

One of my favorite responsibilities as chief investment officer at Ritholtz Wealth Management is the quarterly conference call I do for...

Read More

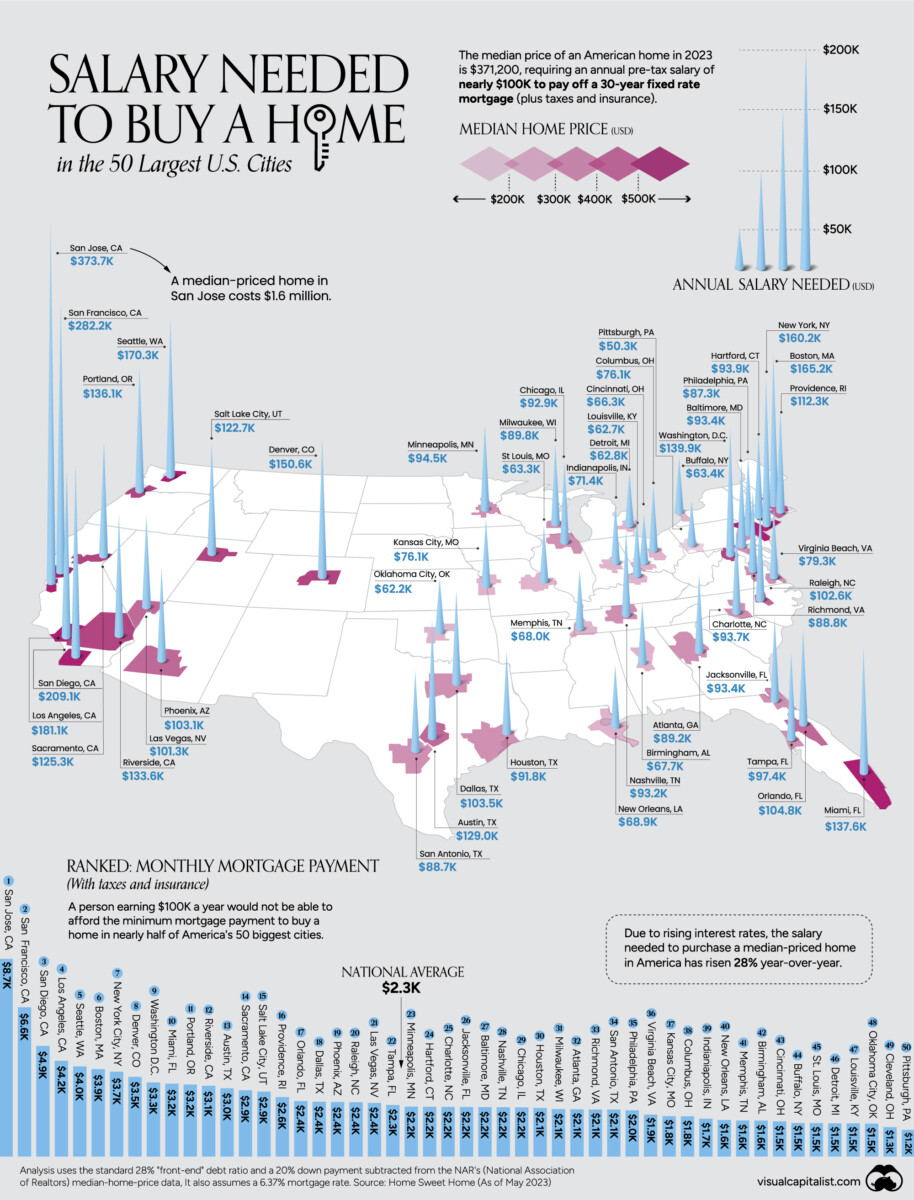

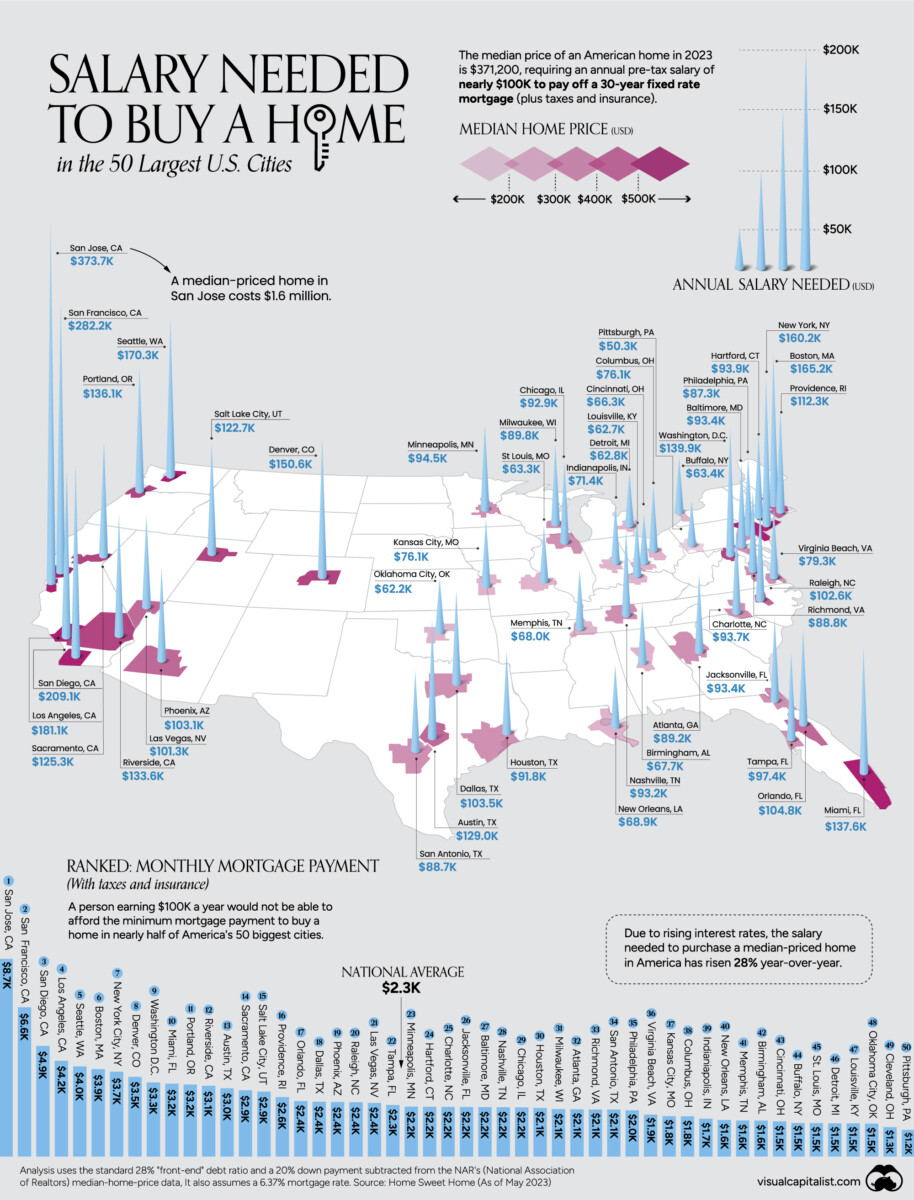

click for ginormous chart While I am wrapped up working on a few projects today, I wanted to share this map/chart/table showing US...

click for ginormous chart While I am wrapped up working on a few projects today, I wanted to share this map/chart/table showing US...

Read More

The Fed held its benchmark Federal-Funds rate steady yesterday at 5.25% – 5.5%, leaving the possibility of cuts in...

The Fed held its benchmark Federal-Funds rate steady yesterday at 5.25% – 5.5%, leaving the possibility of cuts in...

The Fed held its benchmark Federal-Funds rate steady yesterday at 5.25% – 5.5%, leaving the possibility of cuts in...

The Fed held its benchmark Federal-Funds rate steady yesterday at 5.25% – 5.5%, leaving the possibility of cuts in...