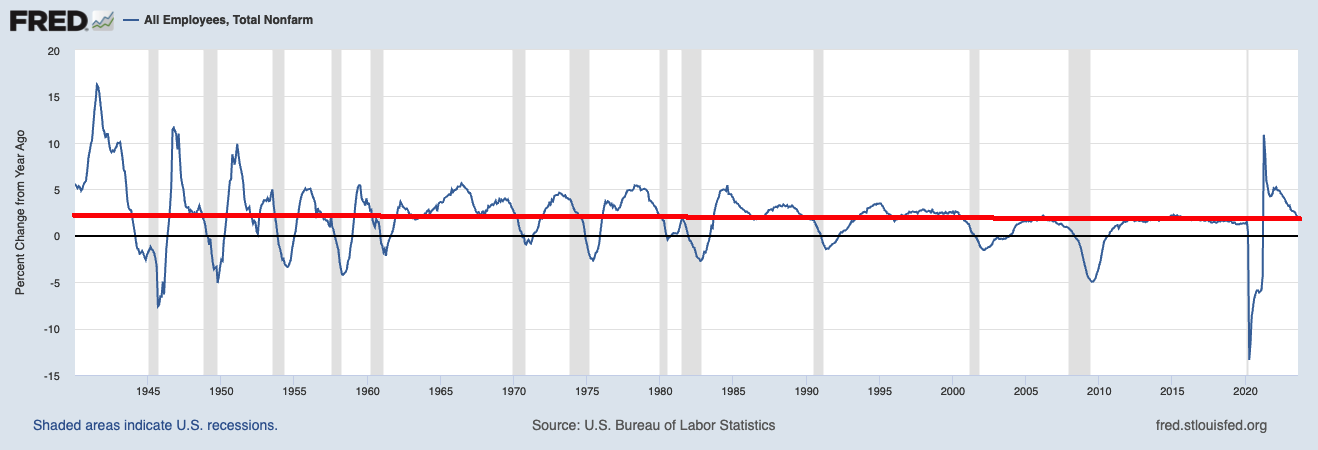

The Fed is done. It’s unimaginable that they will do anything at the September FOMC meeting, and barring any radical change...

The Fed is done. It’s unimaginable that they will do anything at the September FOMC meeting, and barring any radical change...

Read More

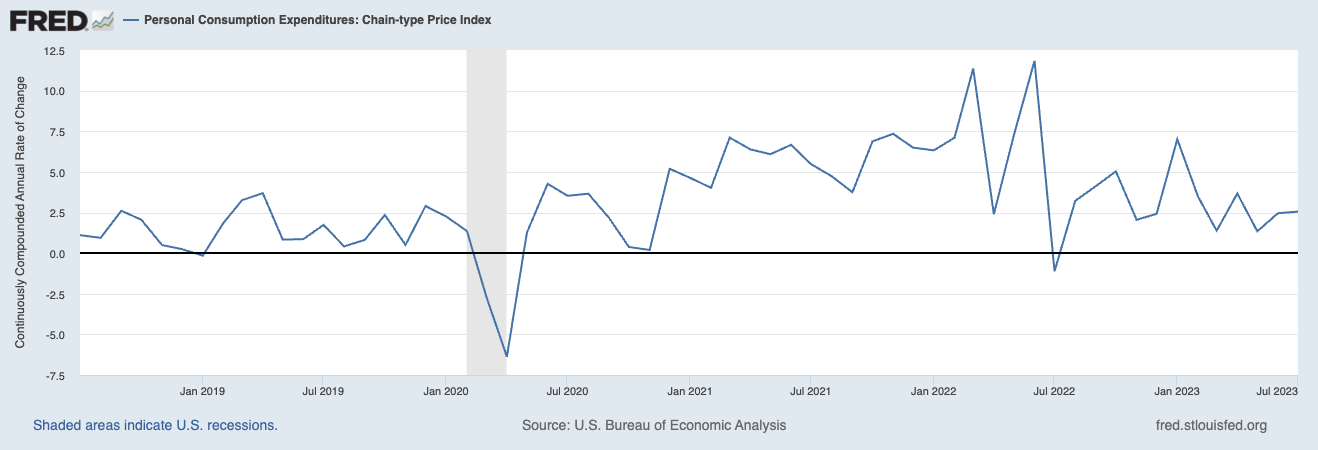

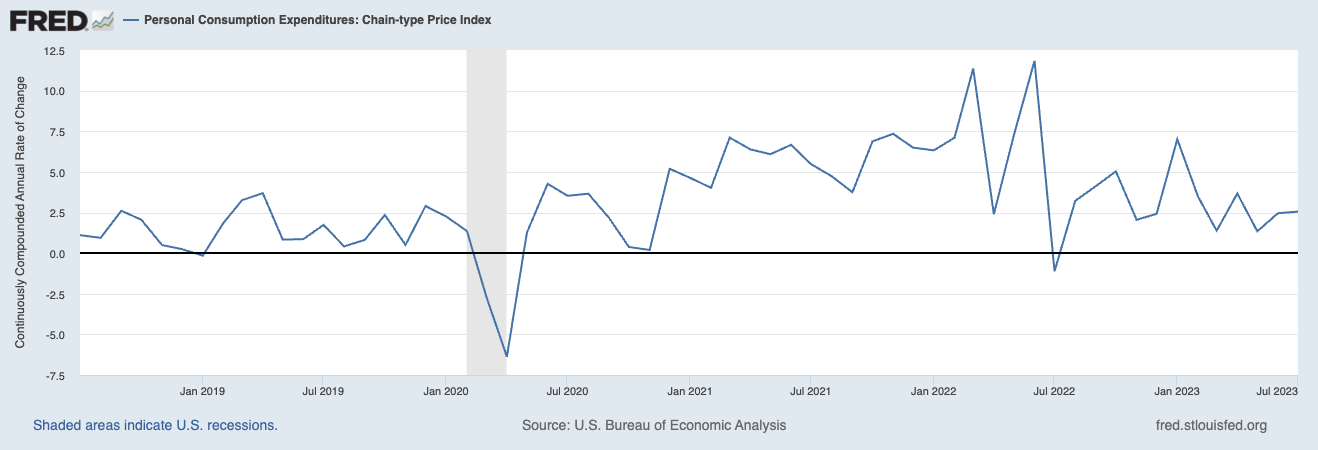

The Fed’s favored inflation report was a 2.1% annualized (3 months through July) and 3.3% year-over-year. Here is BEA:...

The Fed’s favored inflation report was a 2.1% annualized (3 months through July) and 3.3% year-over-year. Here is BEA:...

Read More

I have a new column out in Businessweek, just in time for the Federal Reserve meeting in Jackson Hole. It is a...

I have a new column out in Businessweek, just in time for the Federal Reserve meeting in Jackson Hole. It is a...

Read More

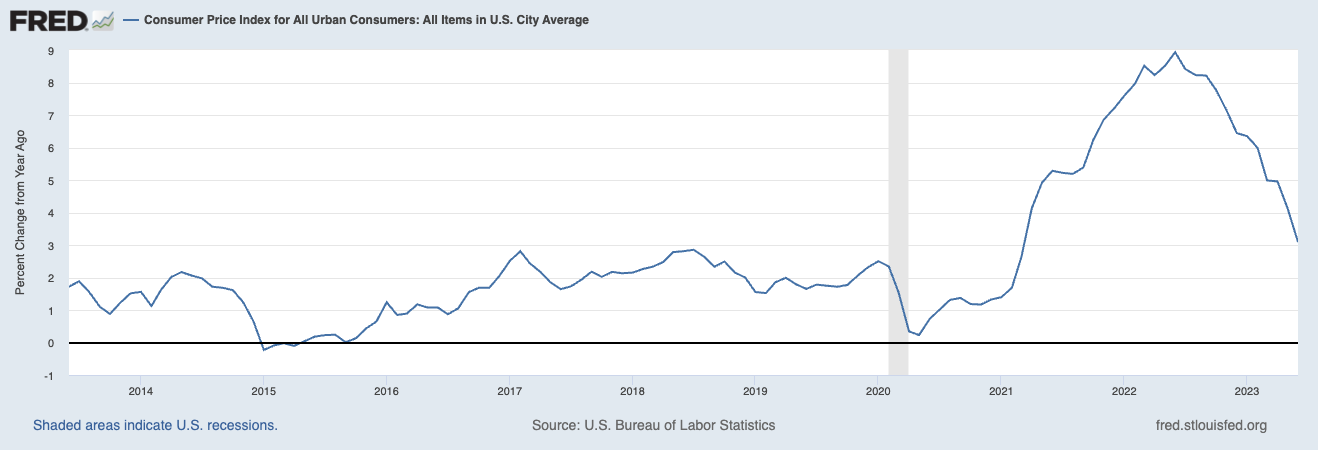

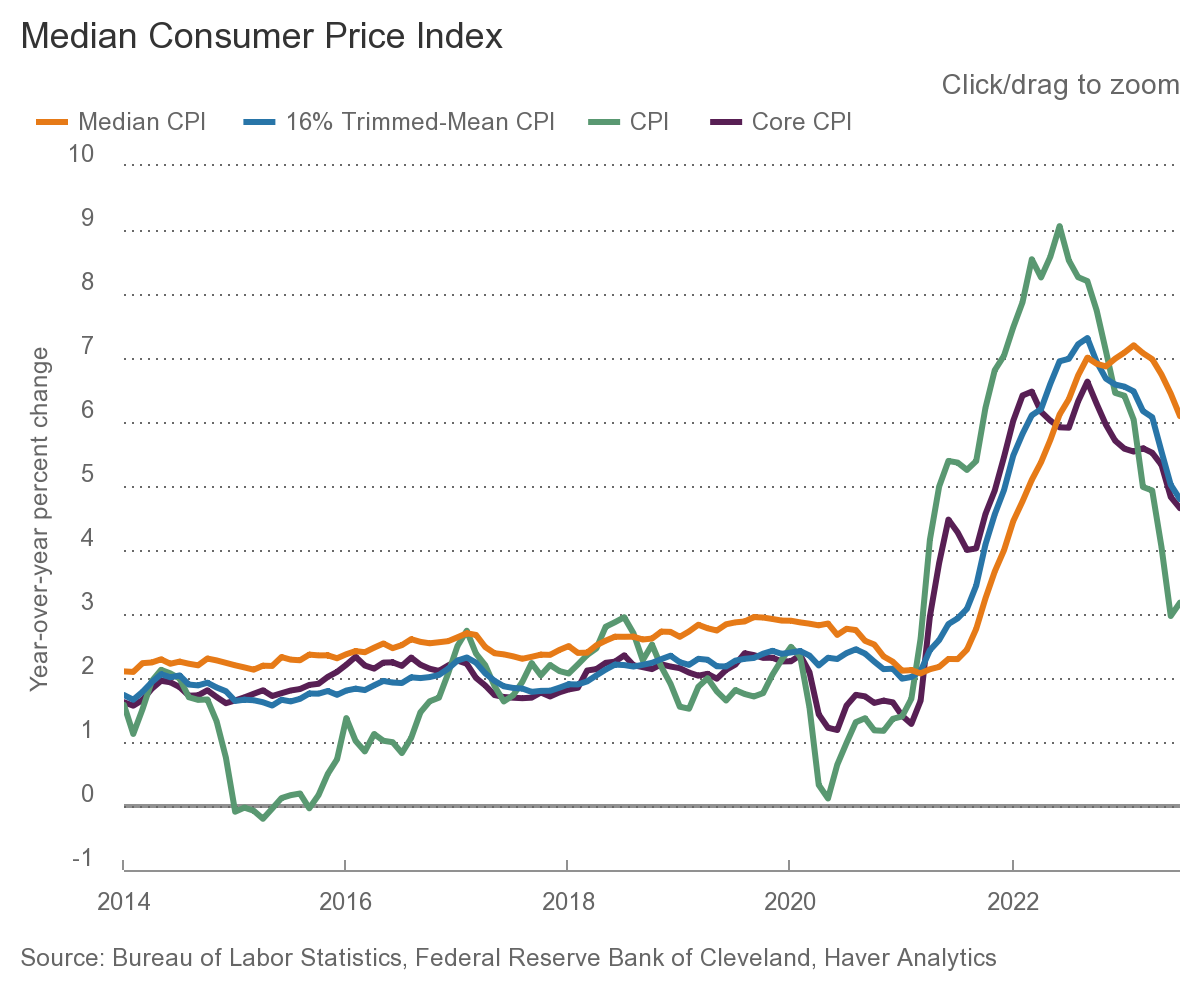

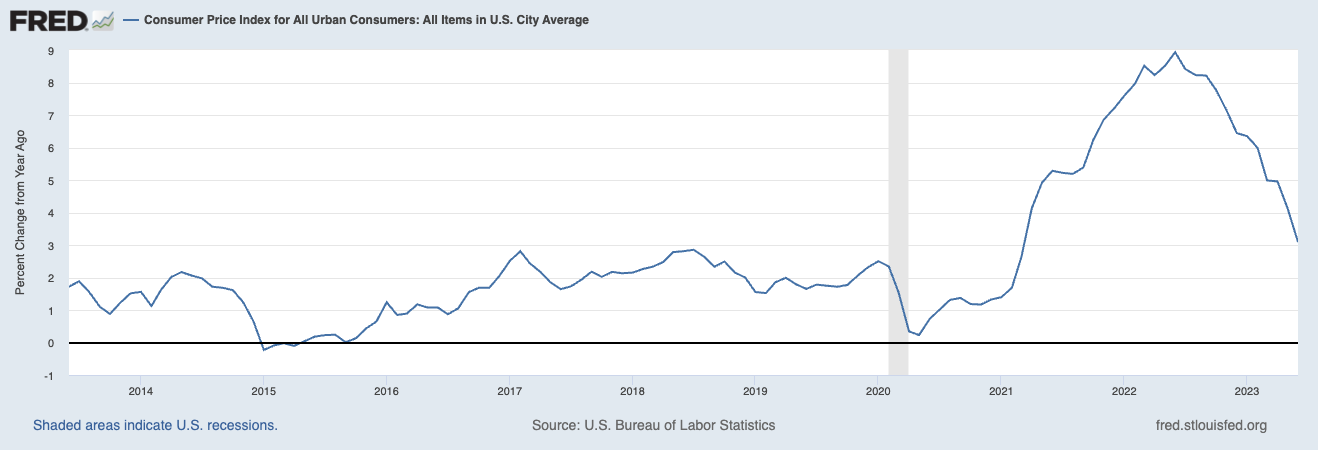

A quick note on today’s BLS report on the Consumer Price Index (CPI), which rose 0.2% in July on a seasonally adjusted...

A quick note on today’s BLS report on the Consumer Price Index (CPI), which rose 0.2% in July on a seasonally adjusted...

Read More

Last week, in anticipation of the FOMC meeting, I hopped into the shed with Pete Dominick, and as always, we BS...

Read More

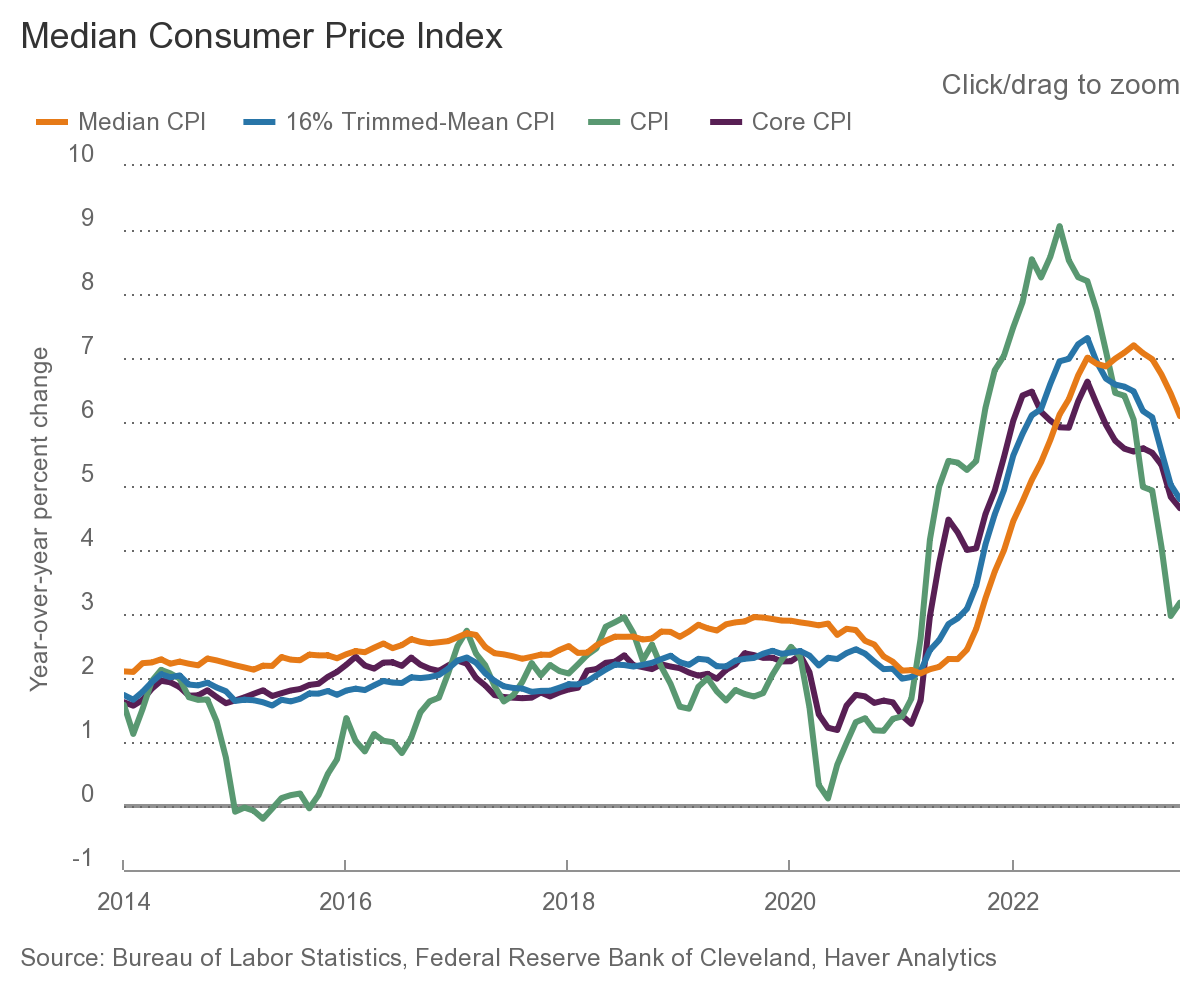

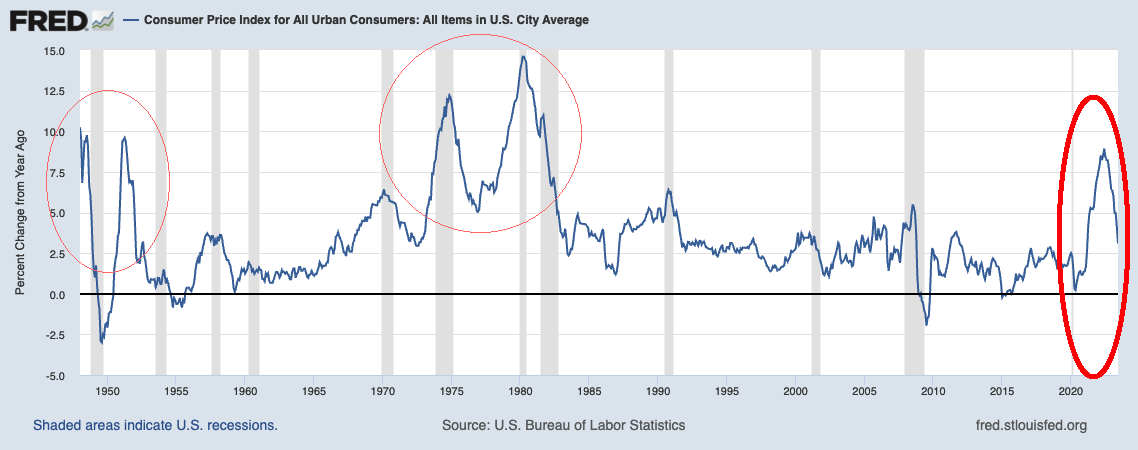

One of the more foolish arguments1 that seem to be emanating from the Fed about their intention to raise rates another quarter...

One of the more foolish arguments1 that seem to be emanating from the Fed about their intention to raise rates another quarter...

Read More

On today’s show I join Downtown Josh Brown to discuss my recent piece “A Dozen Contrarian Thoughts About Inflation.”...

Read More

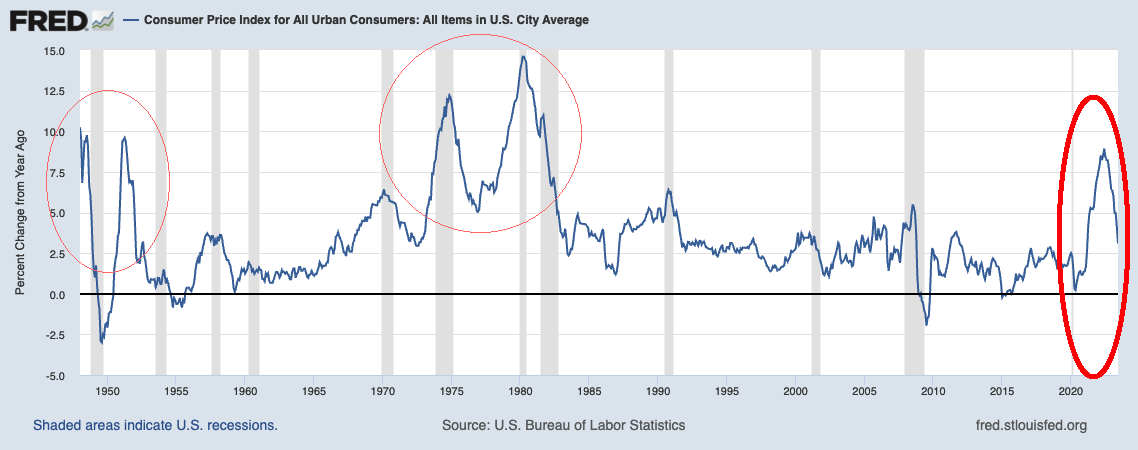

BLS reported the Consumer Price Index was up 3% year over year in June. It has been a near round trip from the prior...

BLS reported the Consumer Price Index was up 3% year over year in June. It has been a near round trip from the prior...

Read More

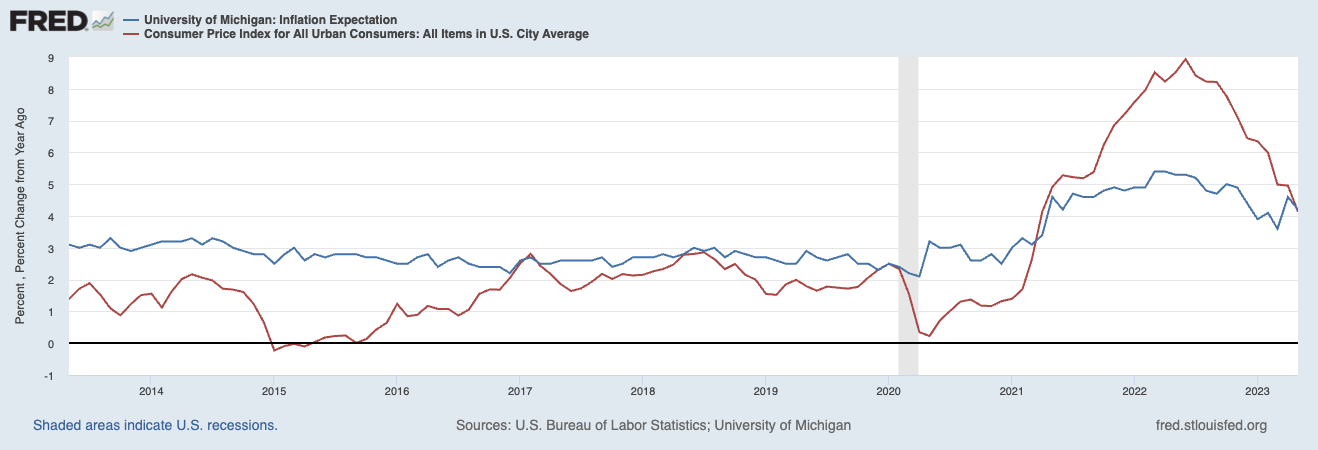

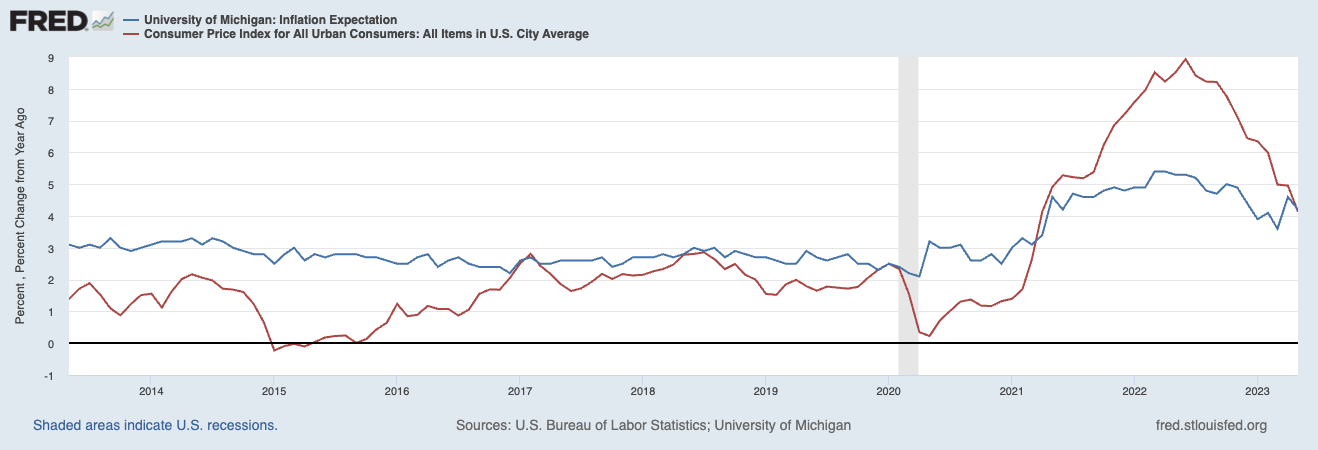

This morning, the WSJ reported that “Consumers expect to see 4.1% inflation a year from now, the lowest such reading in two...

This morning, the WSJ reported that “Consumers expect to see 4.1% inflation a year from now, the lowest such reading in two...

Read More

Pete & I discuss Inflation, the Fed, and even get into Swiss Banking Secrecy laws. Its a fun romp through current news...

Read More

The Fed is done. It’s unimaginable that they will do anything at the September FOMC meeting, and barring any radical change...

The Fed is done. It’s unimaginable that they will do anything at the September FOMC meeting, and barring any radical change...

The Fed is done. It’s unimaginable that they will do anything at the September FOMC meeting, and barring any radical change...

The Fed is done. It’s unimaginable that they will do anything at the September FOMC meeting, and barring any radical change...