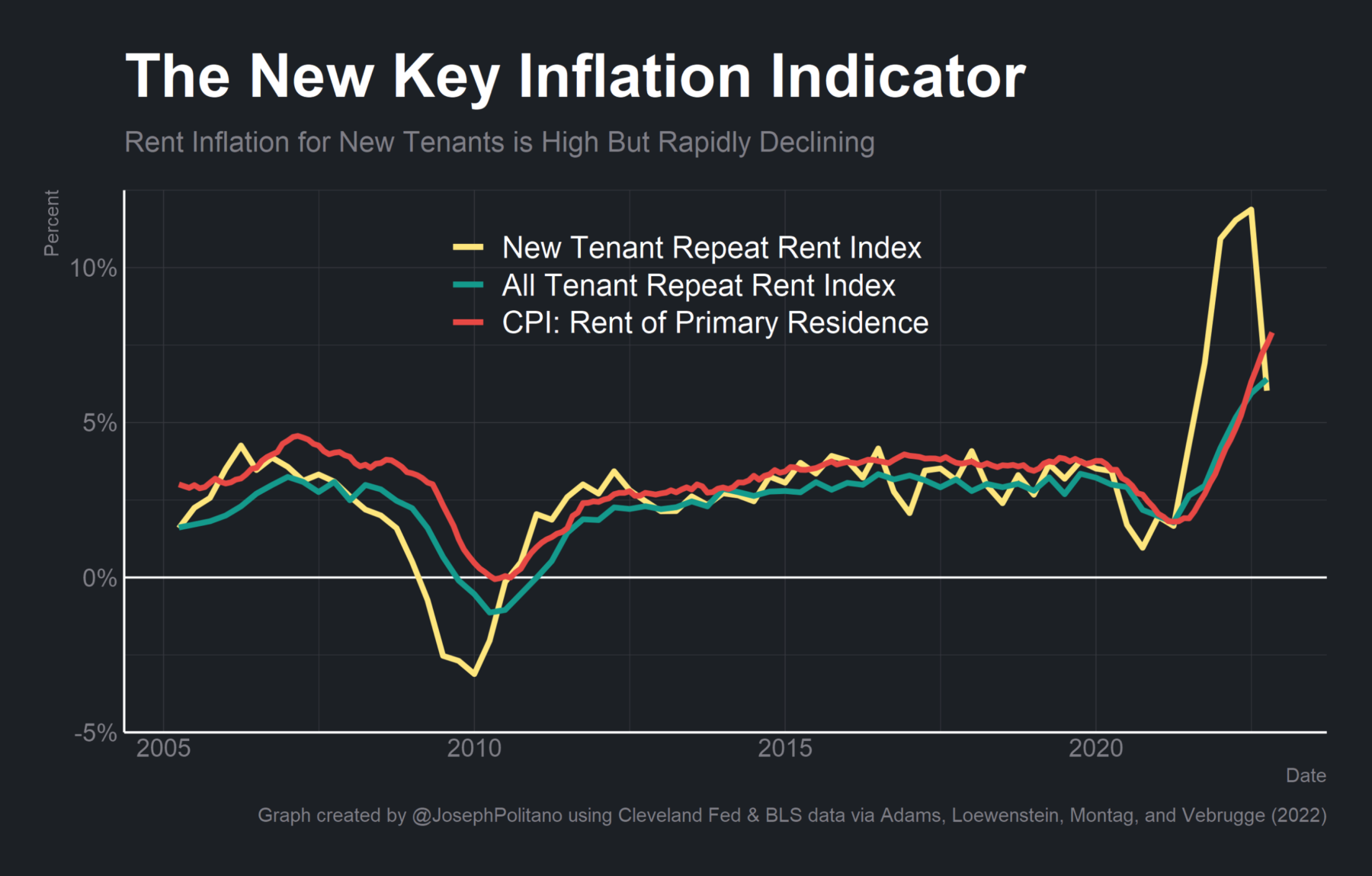

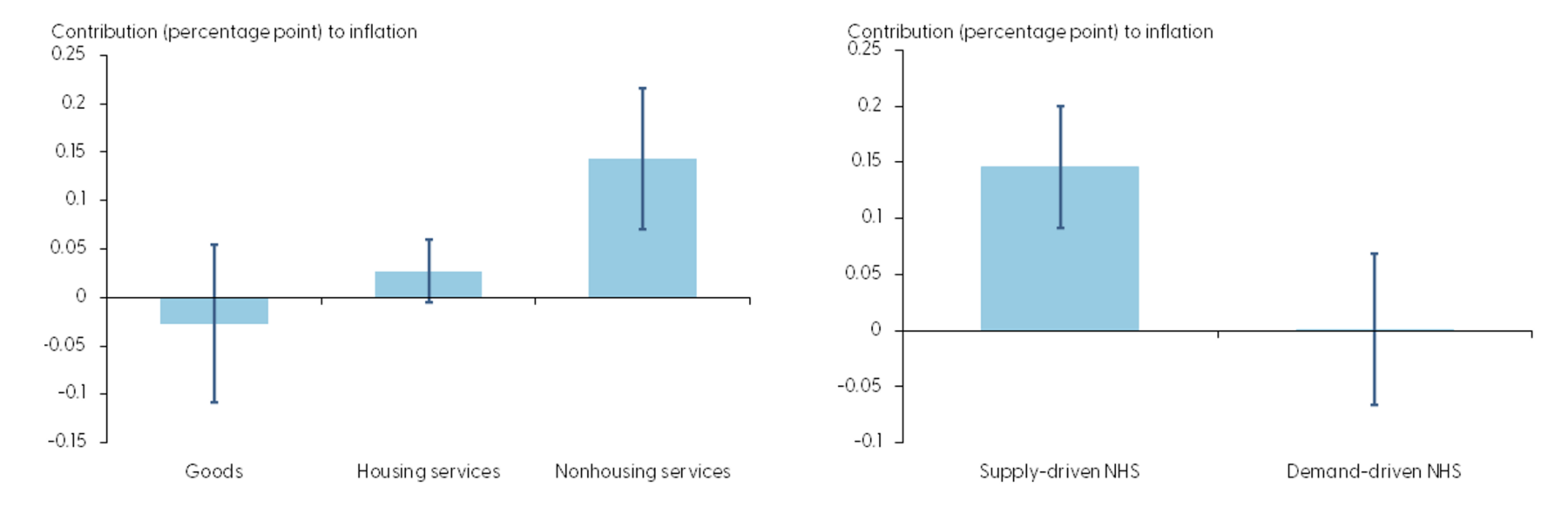

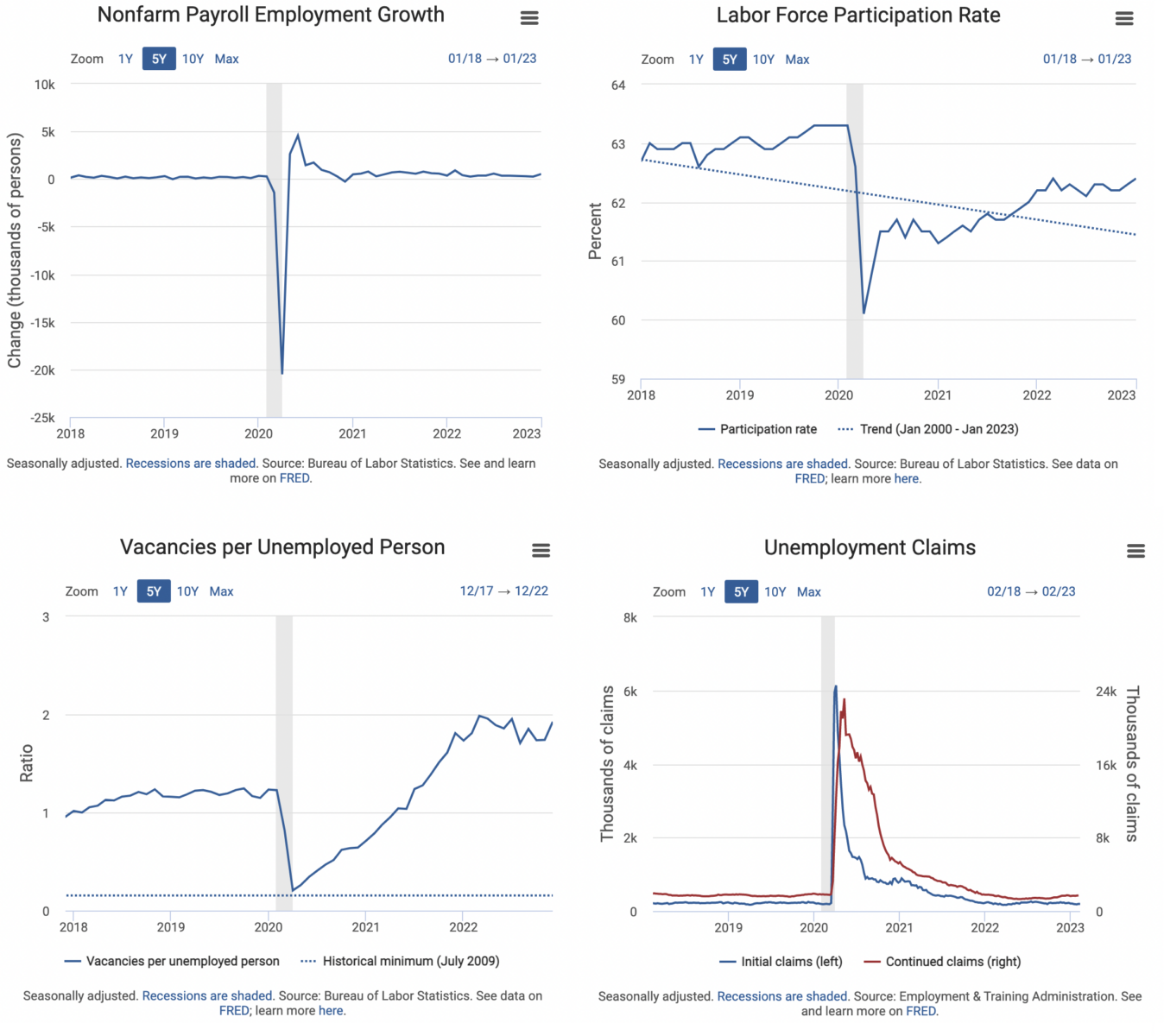

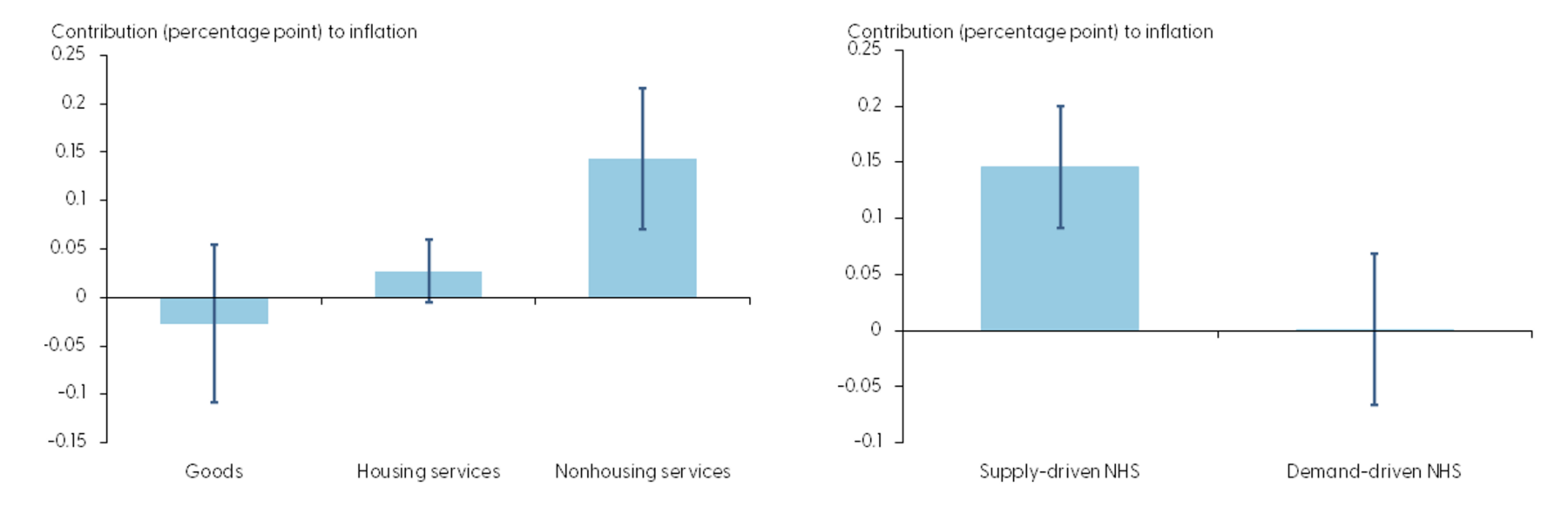

“Tight labor markets have raised concerns about the role of labor costs in persistently high inflation readings....

“Tight labor markets have raised concerns about the role of labor costs in persistently high inflation readings....

Read More

I have a new thesis I have been noodling around with: All of those Square credit card processing machines you use to pay for...

I have a new thesis I have been noodling around with: All of those Square credit card processing machines you use to pay for...

Read More

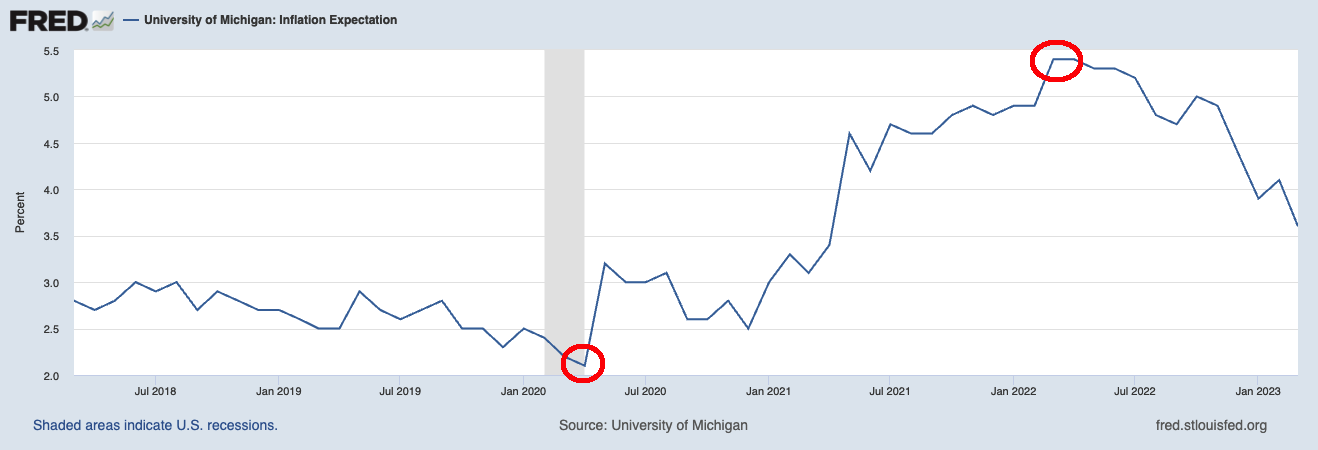

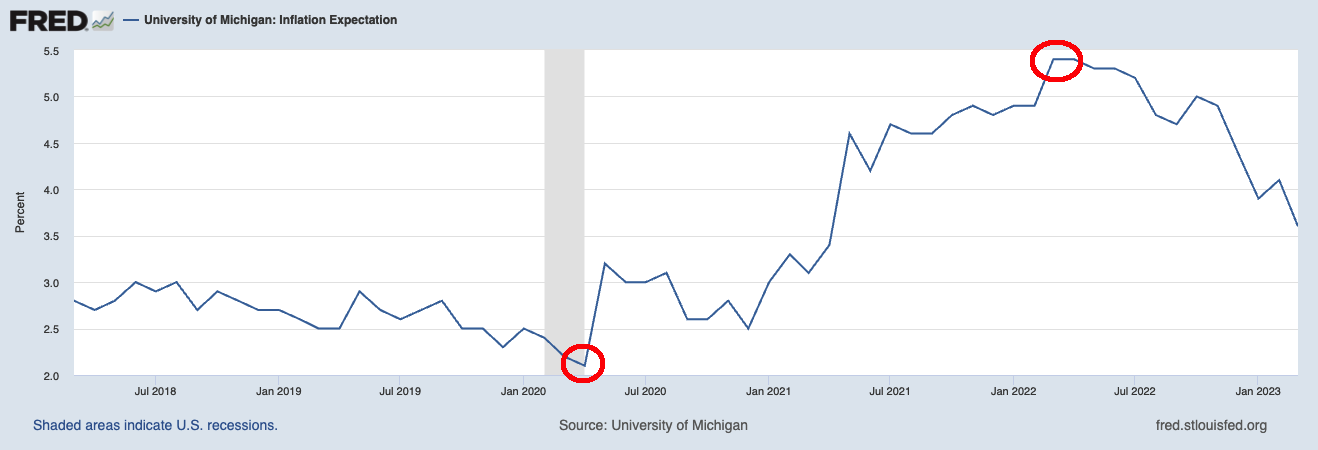

Jerome Powell and the Federal Reserve spend a lot of time worrying about Inflation Expectations. They shouldn’t. Generally,...

Jerome Powell and the Federal Reserve spend a lot of time worrying about Inflation Expectations. They shouldn’t. Generally,...

Read More

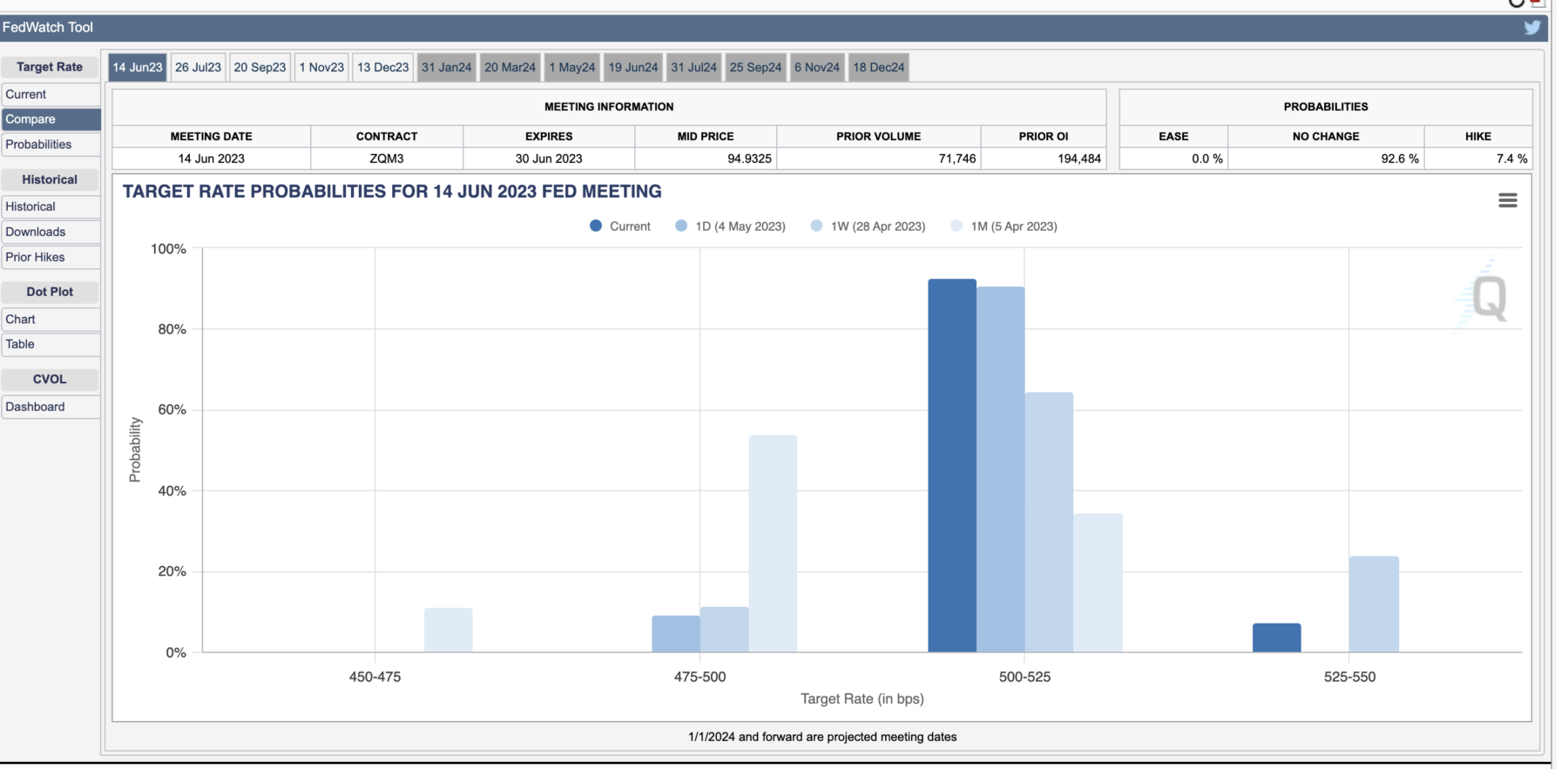

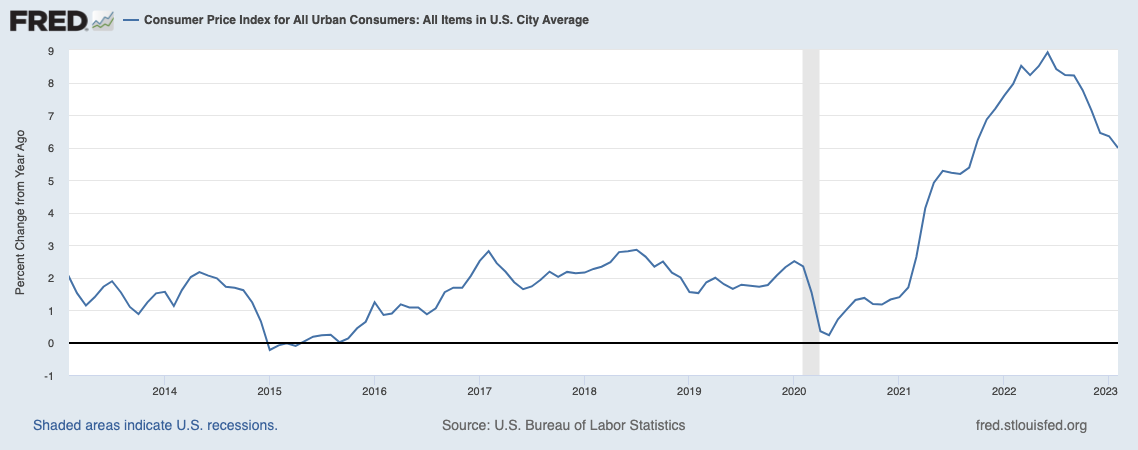

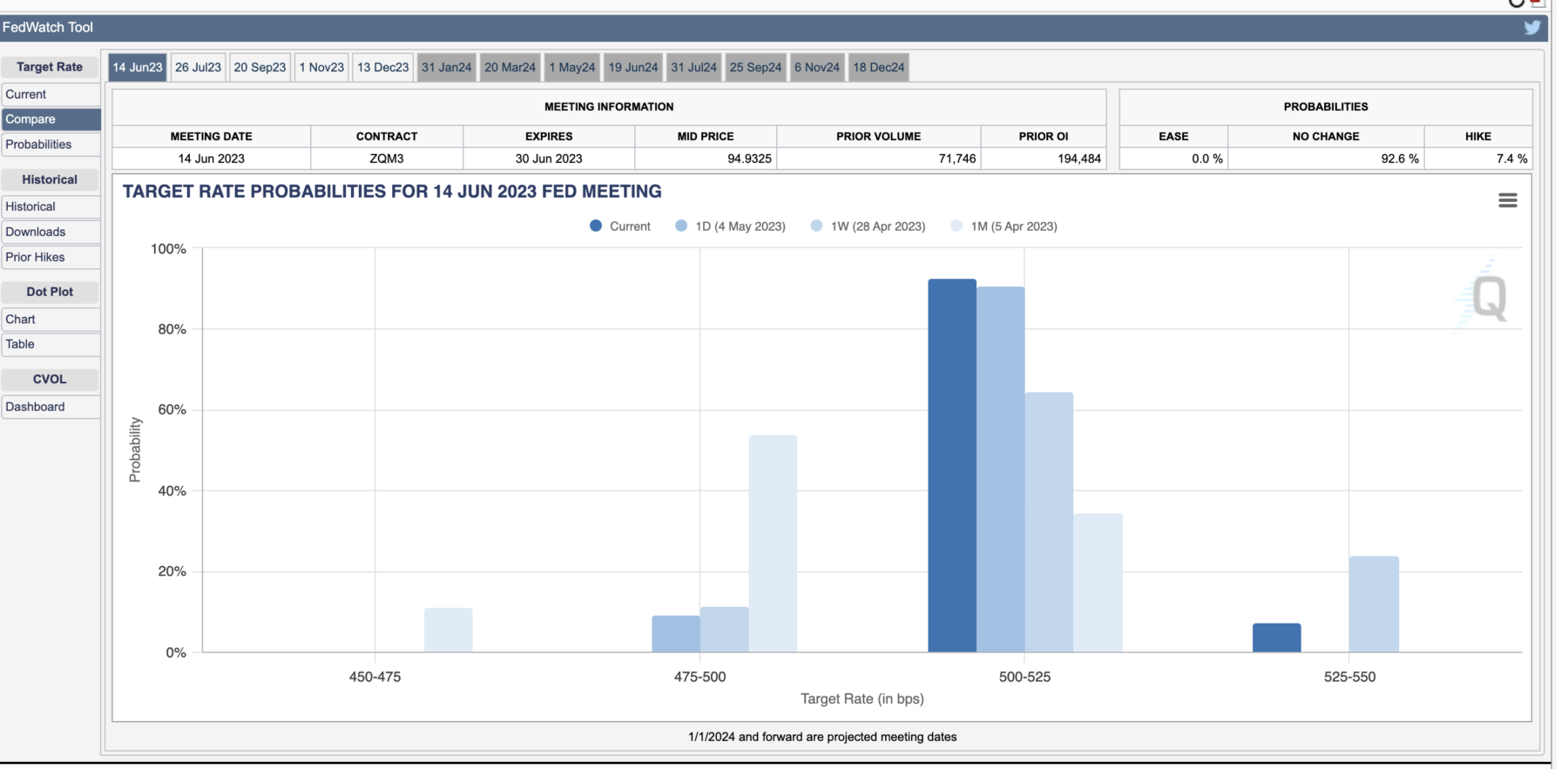

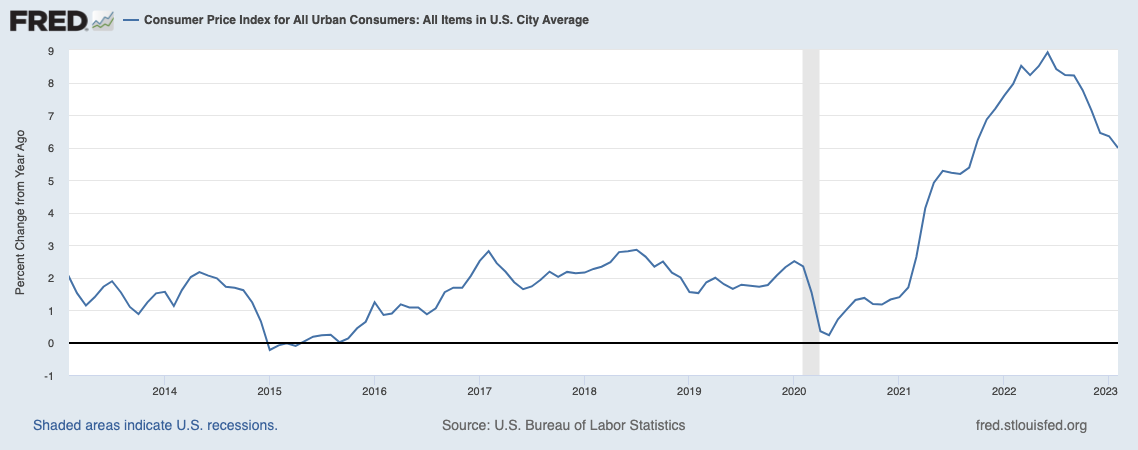

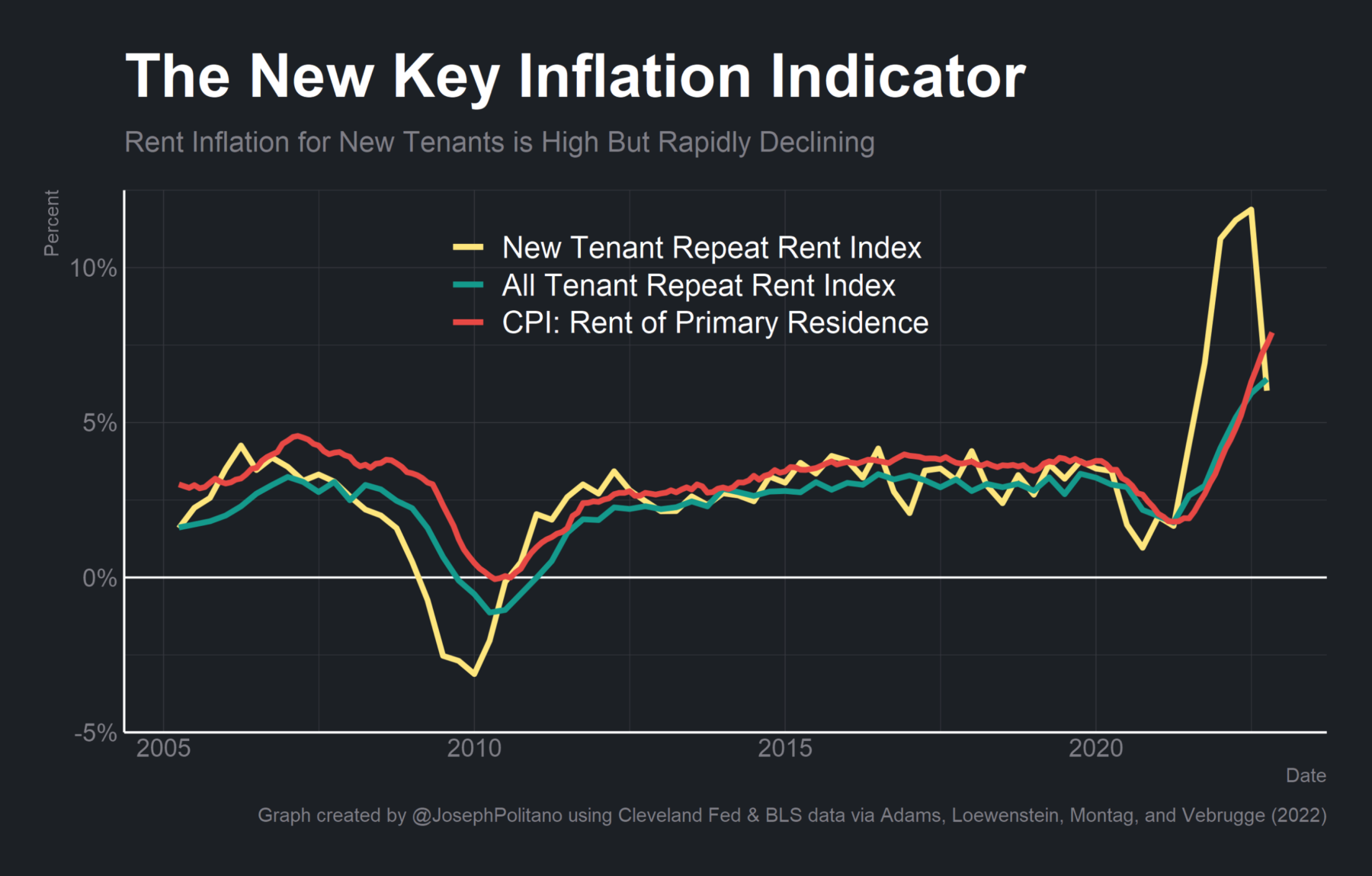

First, the good news: Consumer Price Index (CPI) came in modest at 0.4%, with a year-over-year print of 4.9%. I love the 4 handle...

First, the good news: Consumer Price Index (CPI) came in modest at 0.4%, with a year-over-year print of 4.9%. I love the 4 handle...

Read More

Imagine you had a device that allowed you to peer into the future. You enter a subject matter into this machine, requesting a...

Imagine you had a device that allowed you to peer into the future. You enter a subject matter into this machine, requesting a...

Read More

At least they told us what they were going to do. As much as critics of the Federal Reserve have been up in arms over the fastest...

At least they told us what they were going to do. As much as critics of the Federal Reserve have been up in arms over the fastest...

Read More

U.S. Bureau of Labor Statistics: The Consumer Price Index for All Urban Consumers (CPI-U) rose 0.1 percent in March on a...

U.S. Bureau of Labor Statistics: The Consumer Price Index for All Urban Consumers (CPI-U) rose 0.1 percent in March on a...

Read More

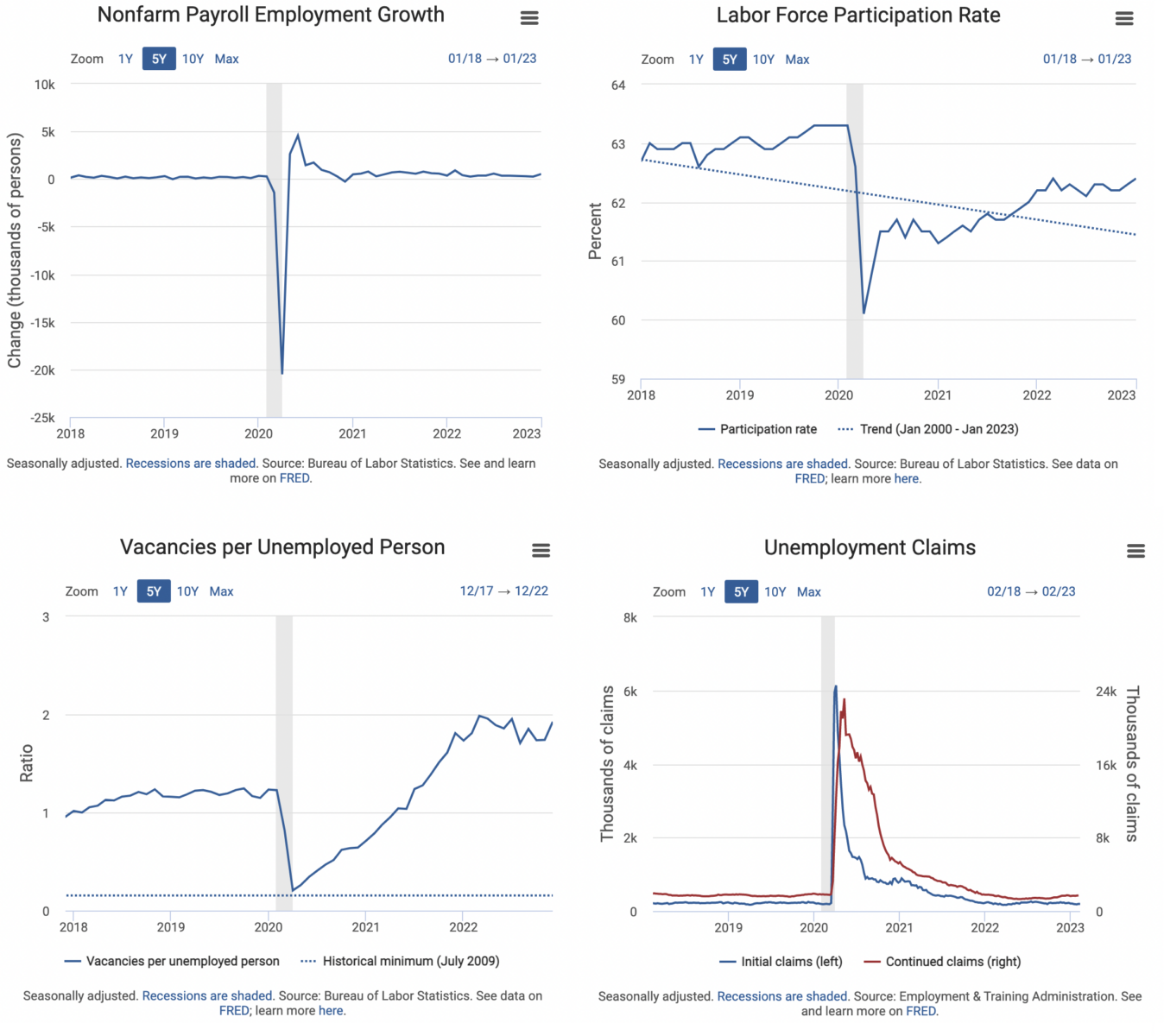

Very useful dashboard via the St. Louis Fed, which maintains the fabulous FRED database. With a clean and simple interface, it puts all...

Very useful dashboard via the St. Louis Fed, which maintains the fabulous FRED database. With a clean and simple interface, it puts all...

Read More

Most podcasts have a Q&A between a guest and the host. Whenever I get together with Pete, it’s just two idiot friends...

Read More

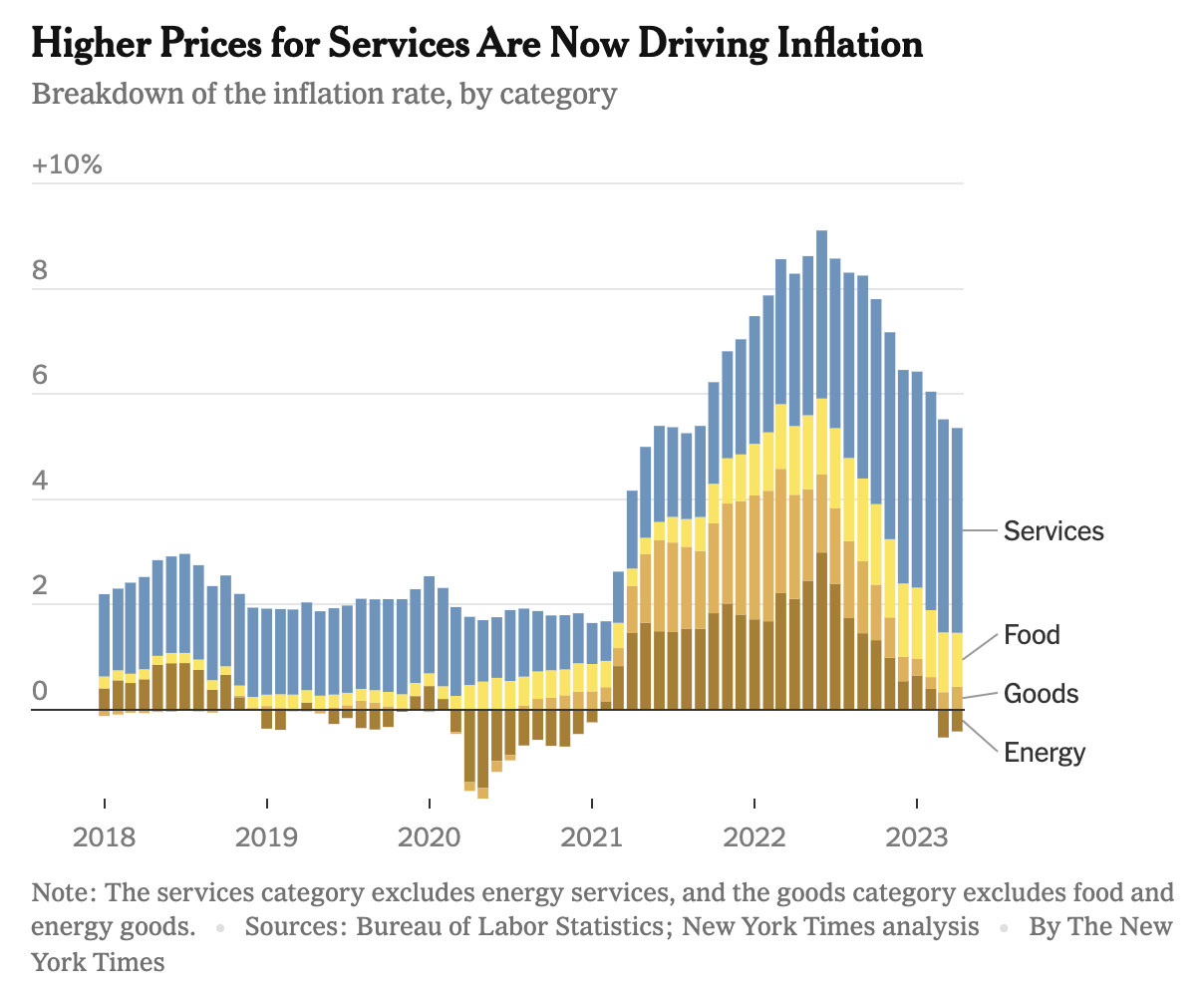

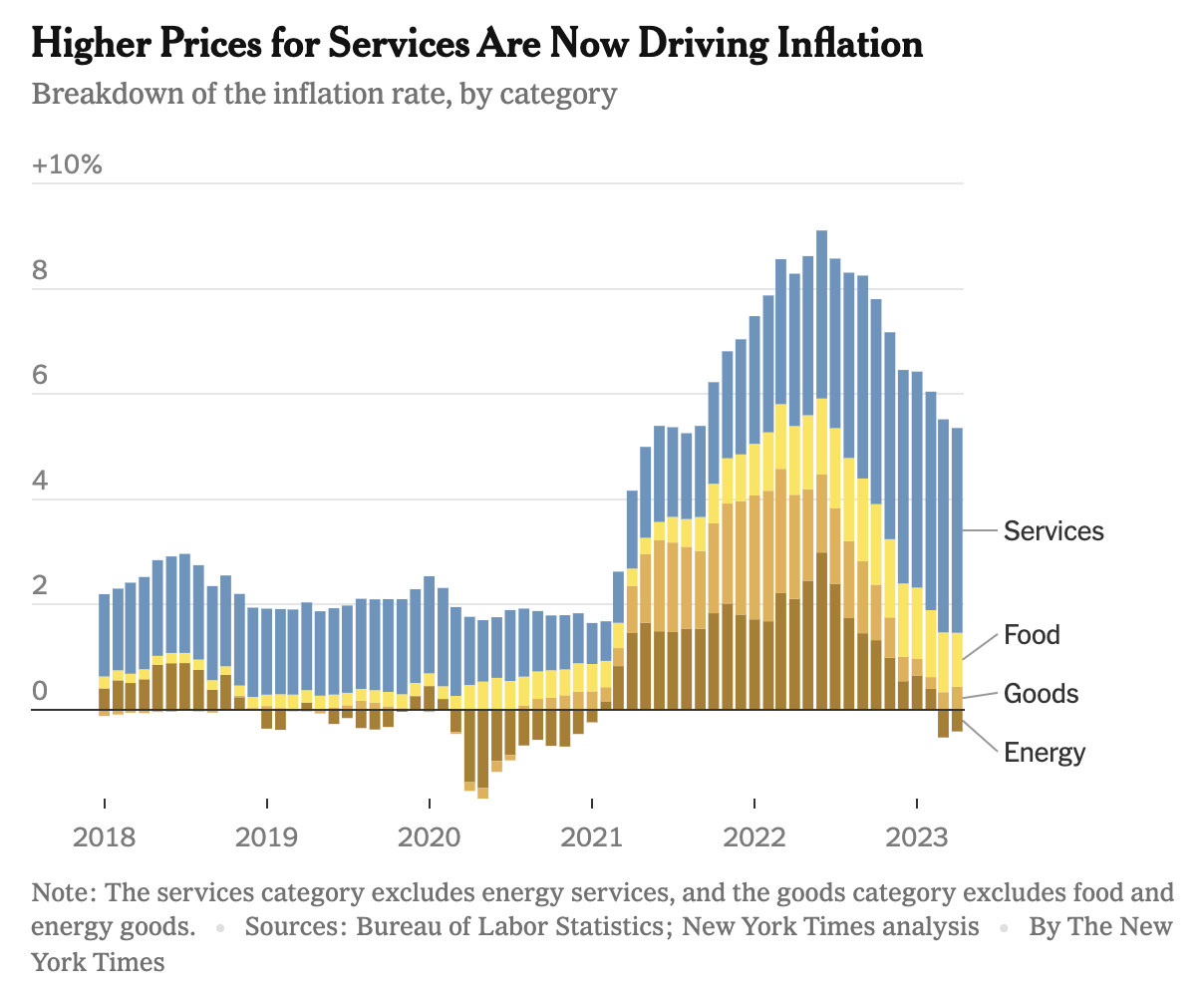

Last week, I discussed the December CPI print; it showed further evidence that inflation is coming down substantially. But...

Last week, I discussed the December CPI print; it showed further evidence that inflation is coming down substantially. But...

Read More

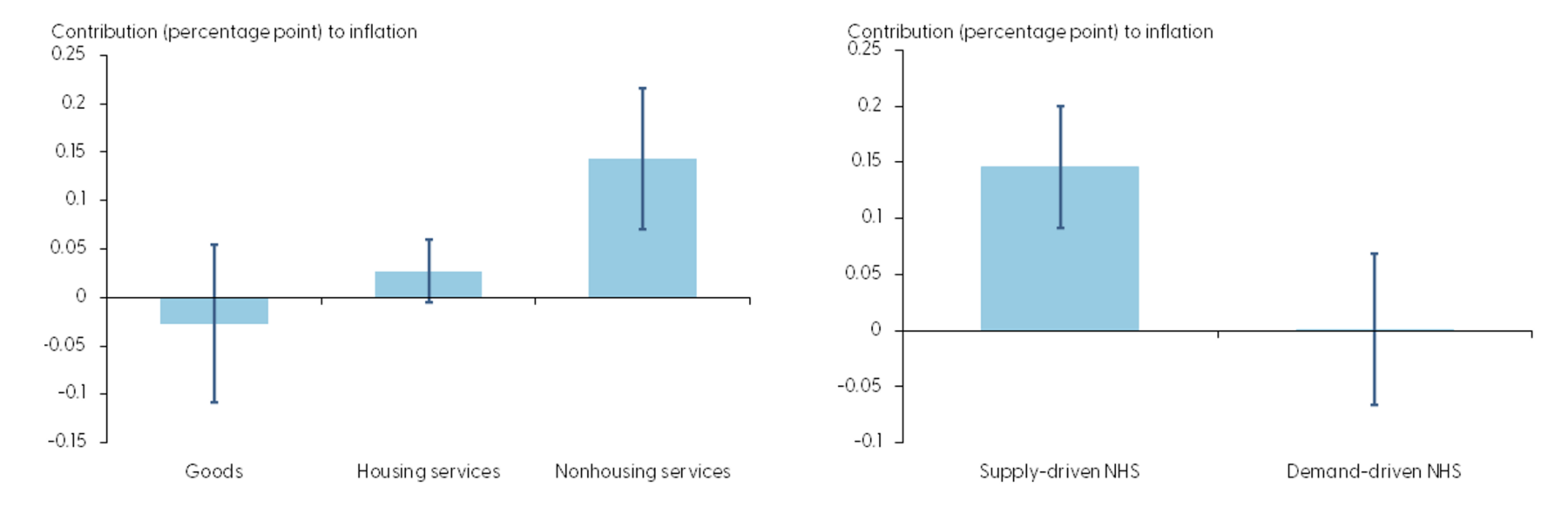

“Tight labor markets have raised concerns about the role of labor costs in persistently high inflation readings....

“Tight labor markets have raised concerns about the role of labor costs in persistently high inflation readings....

“Tight labor markets have raised concerns about the role of labor costs in persistently high inflation readings....

“Tight labor markets have raised concerns about the role of labor costs in persistently high inflation readings....