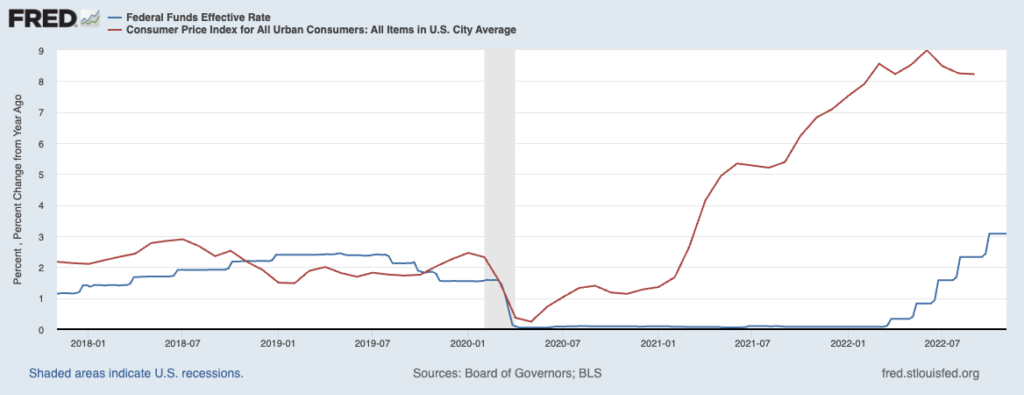

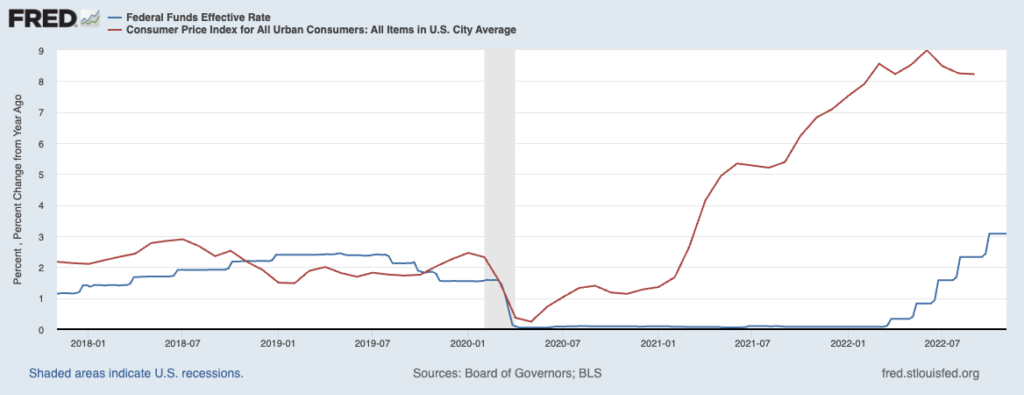

It may surprise you to learn that during this cycle of falling inflation, there seems to be little correlation with rising...

It may surprise you to learn that during this cycle of falling inflation, there seems to be little correlation with rising...

Read More

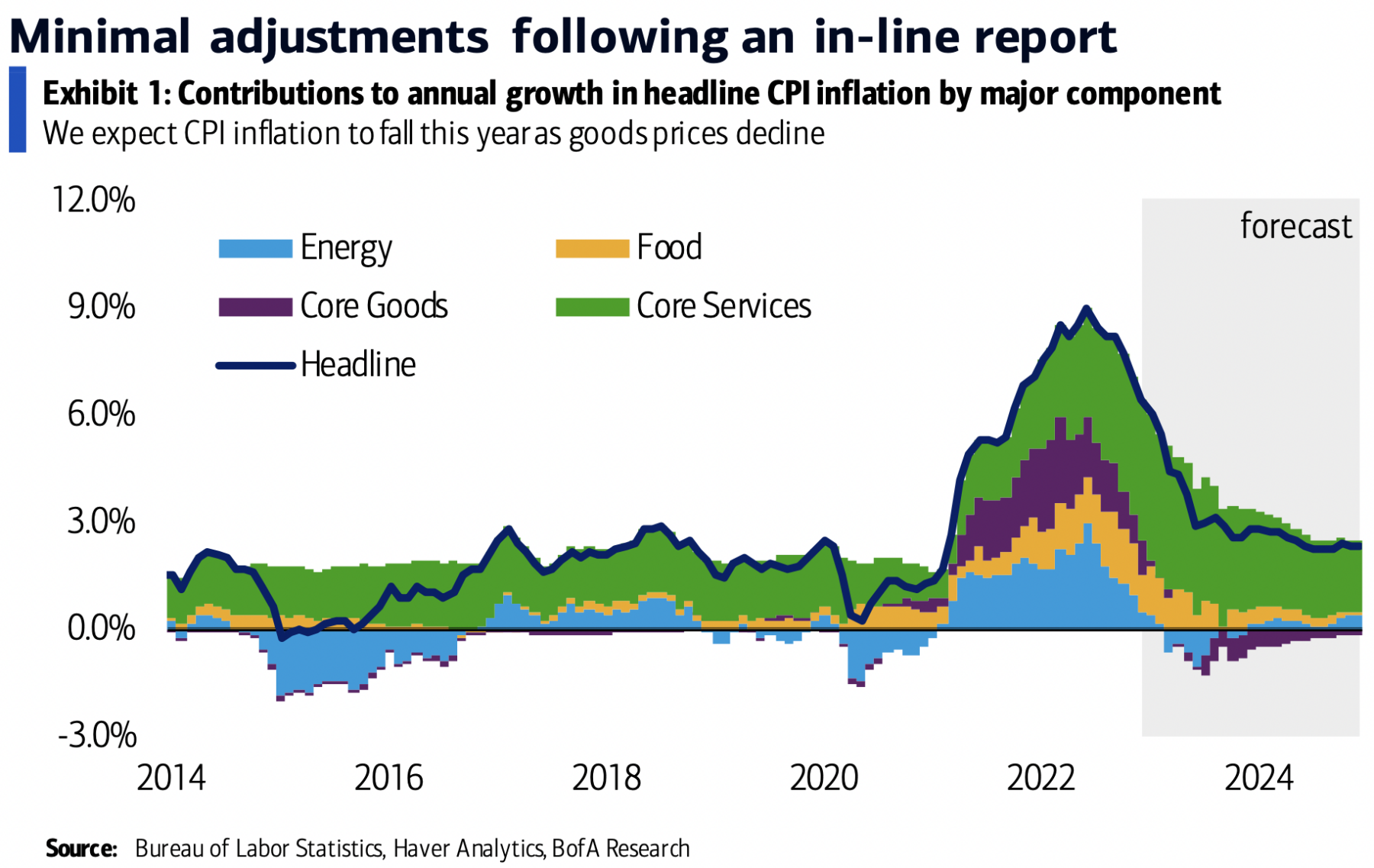

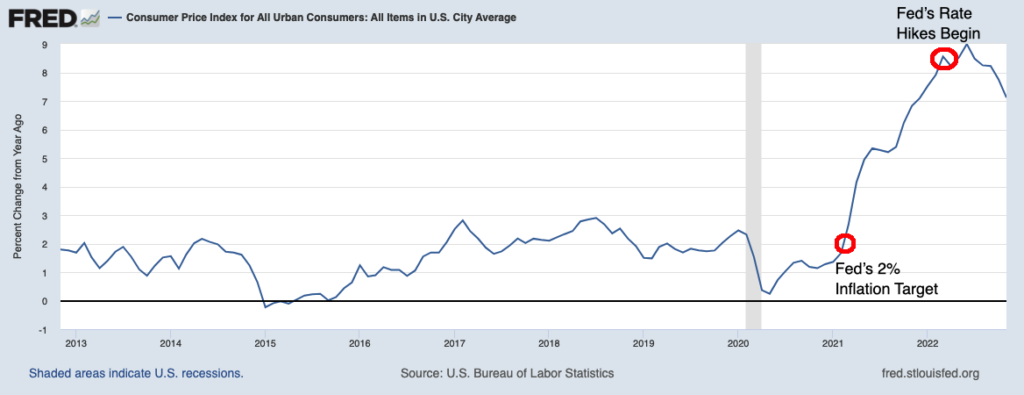

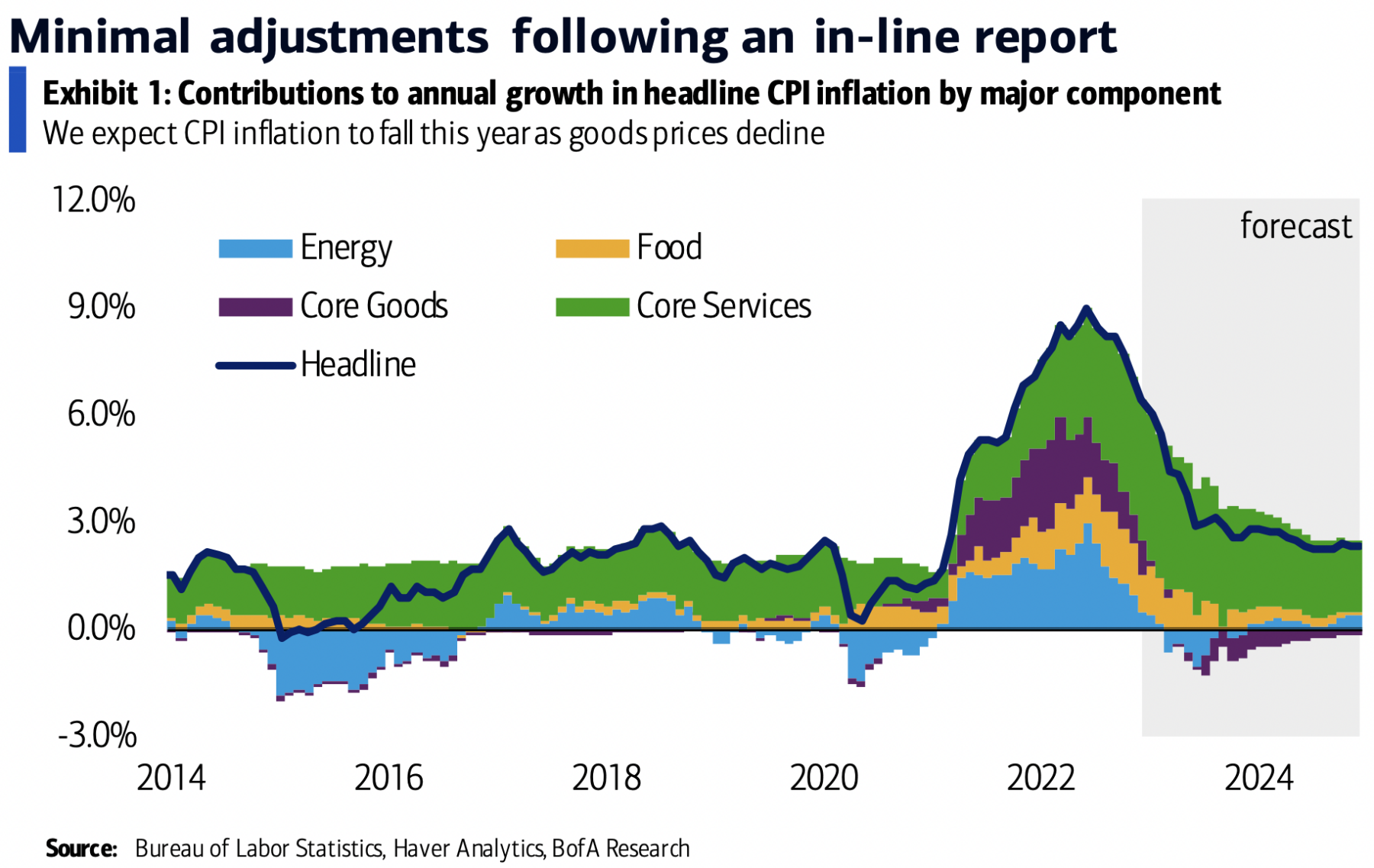

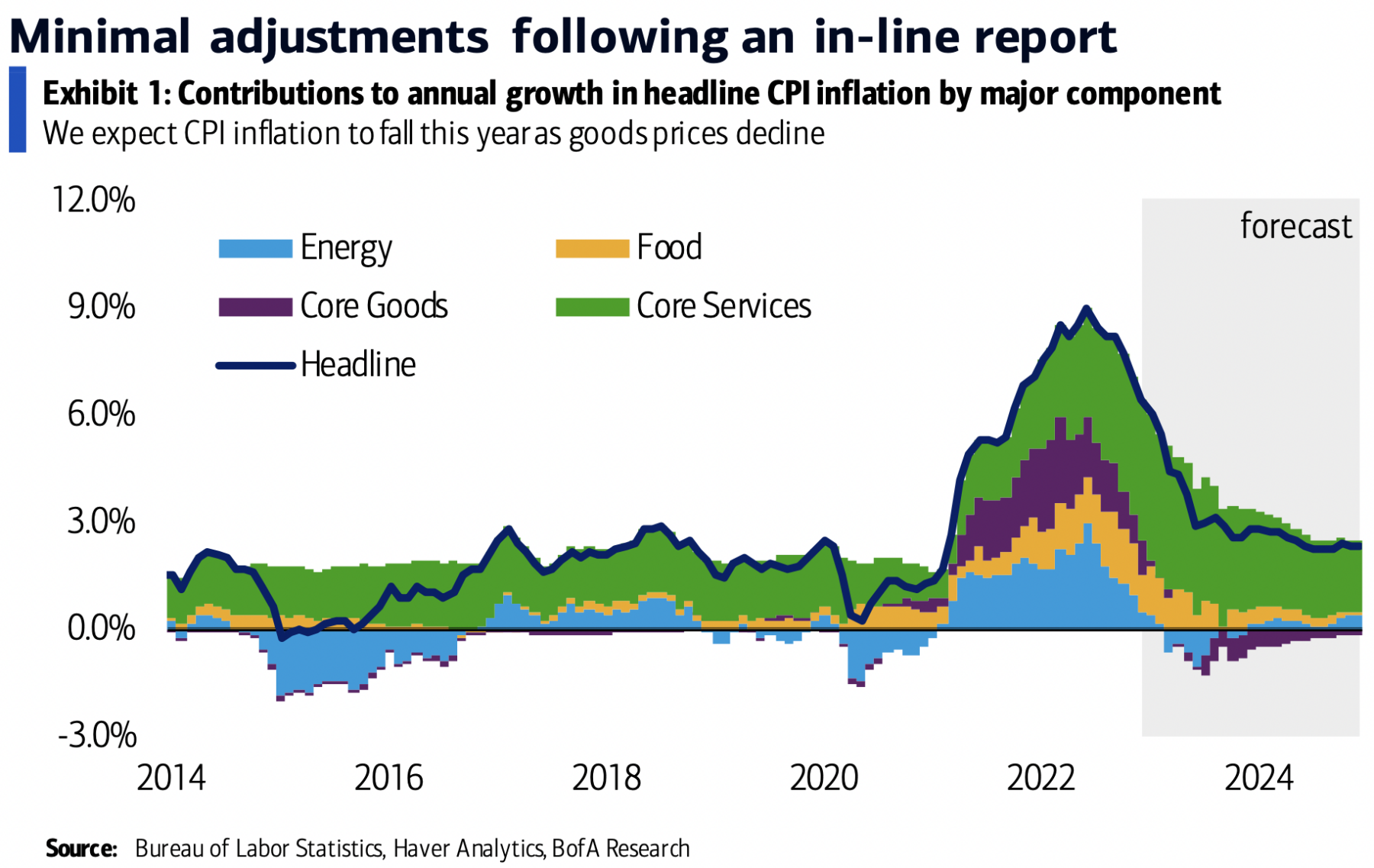

CPI for December 2021 came in as expected, showing a decrease in core inflation is driven primarily by falling gasoline prices....

CPI for December 2021 came in as expected, showing a decrease in core inflation is driven primarily by falling gasoline prices....

Read More

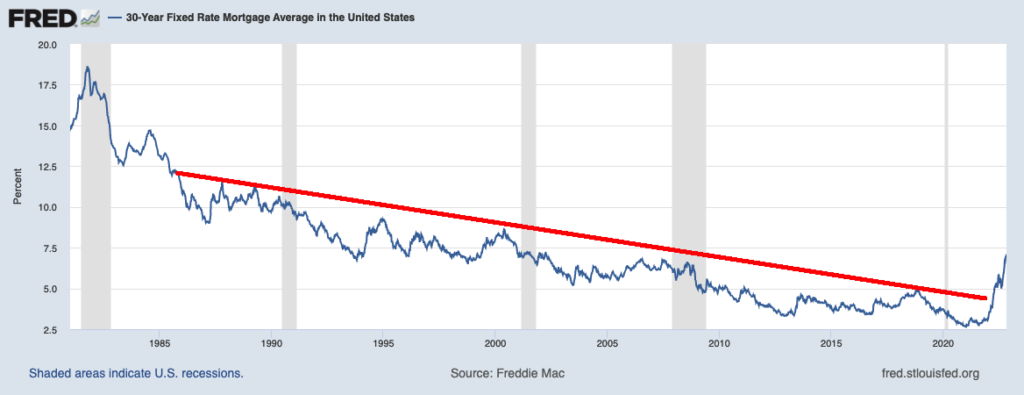

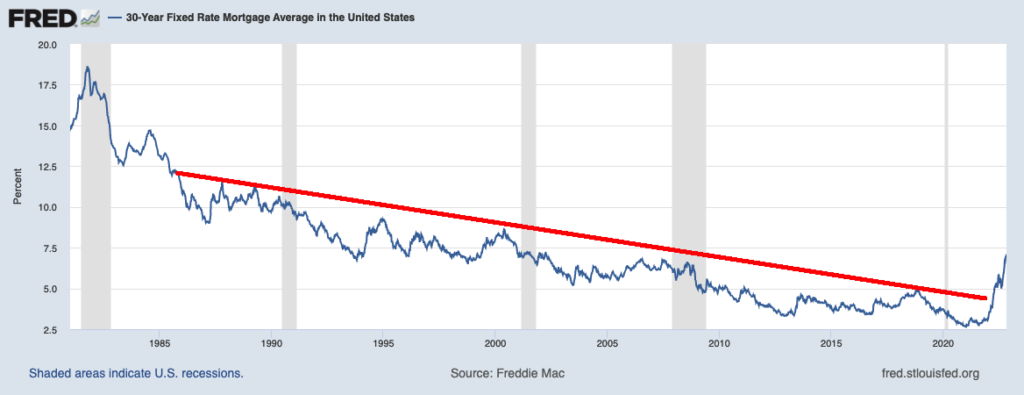

There seems to be a lot of confusion going on today with respect to inflation, interest rates, and ongoing Federal Reserve...

There seems to be a lot of confusion going on today with respect to inflation, interest rates, and ongoing Federal Reserve...

Read More

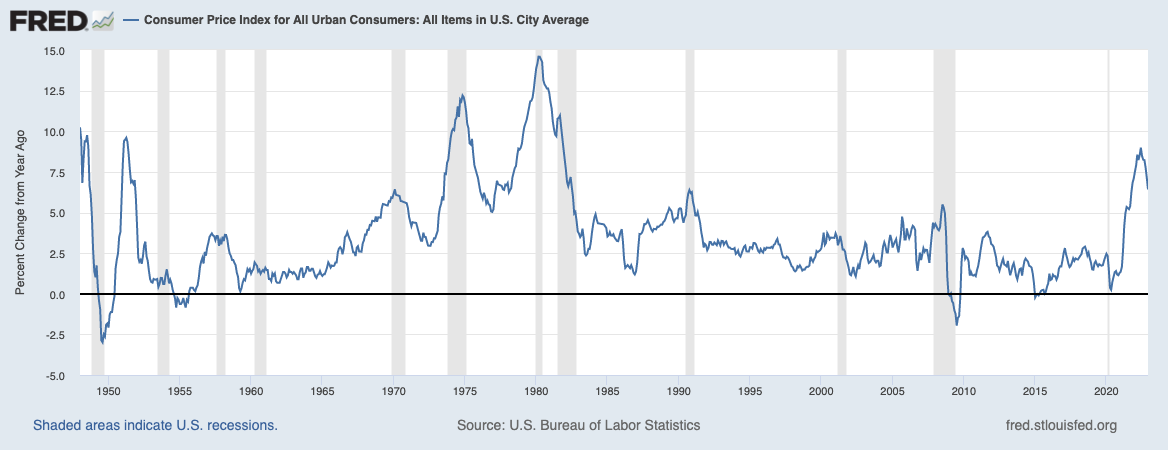

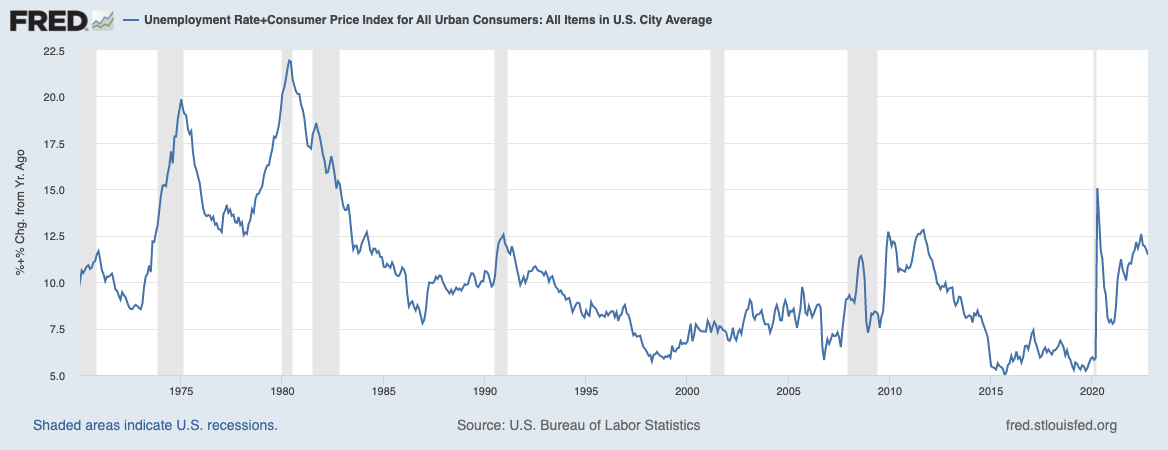

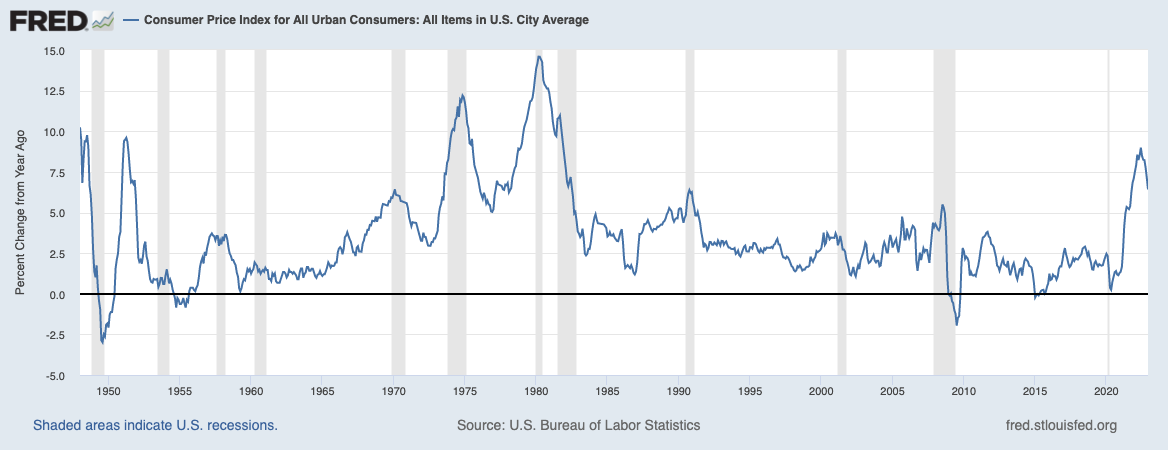

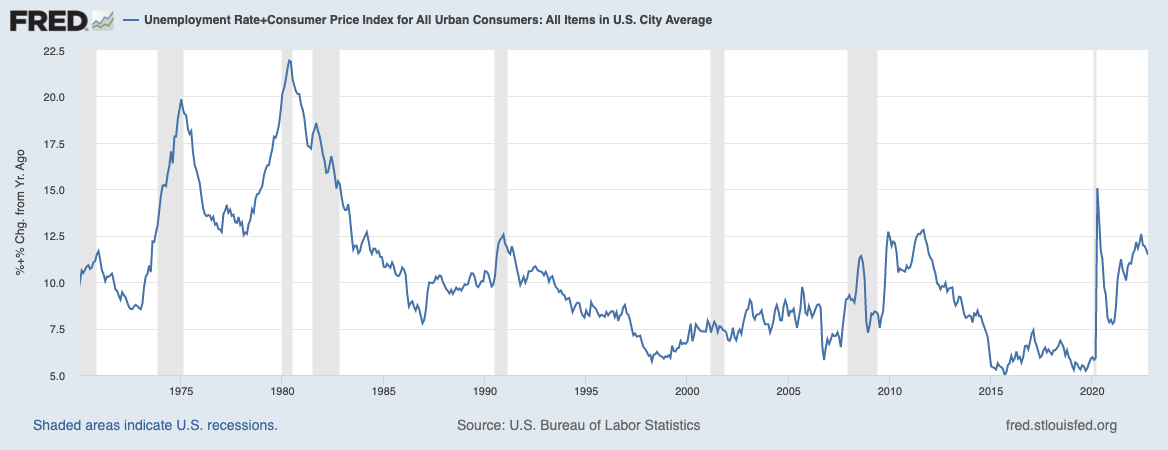

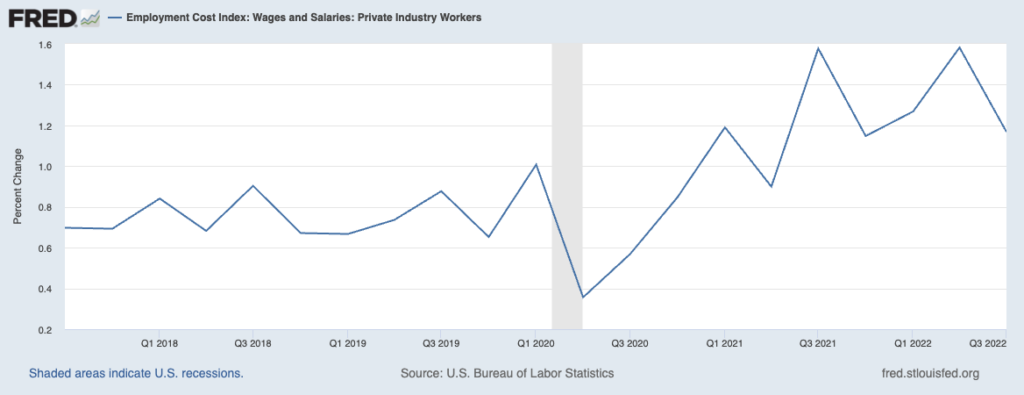

You may have missed this wonderful Josh Zumbrun column in the Wall Street Journal last week: “Inflation and Unemployment Both...

You may have missed this wonderful Josh Zumbrun column in the Wall Street Journal last week: “Inflation and Unemployment Both...

Read More

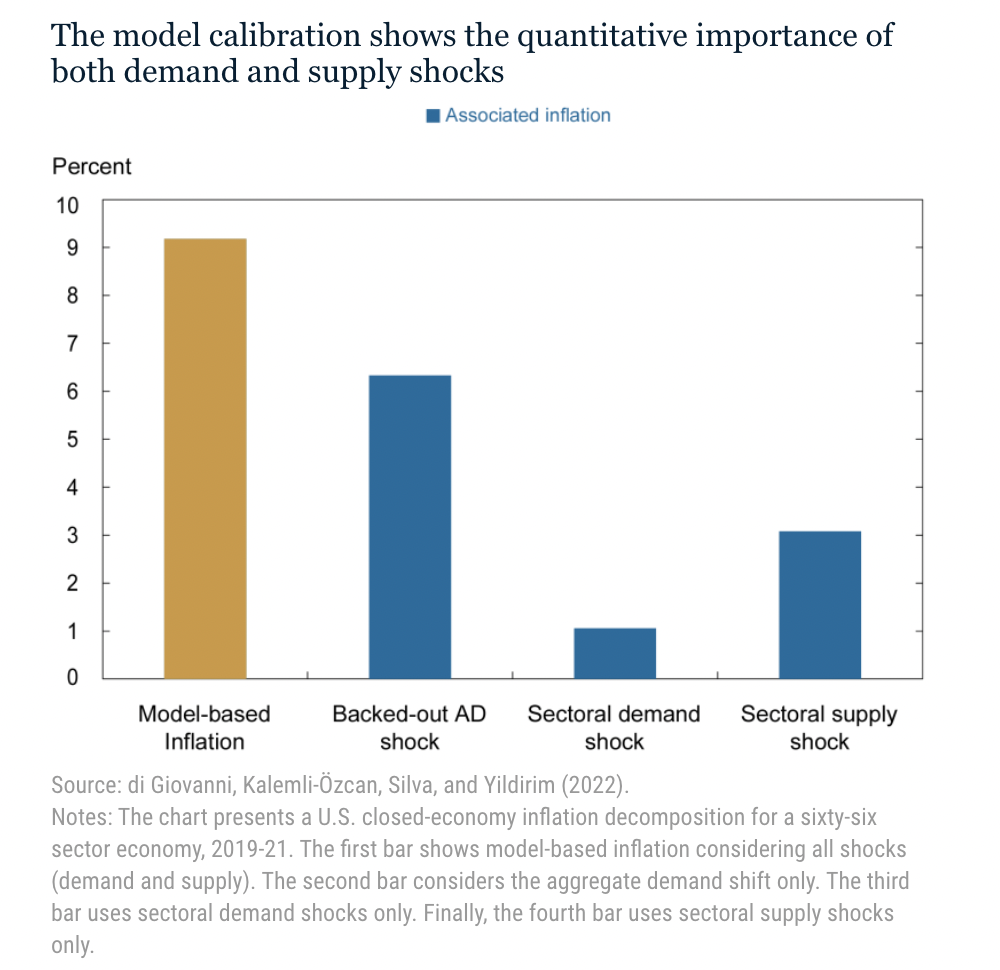

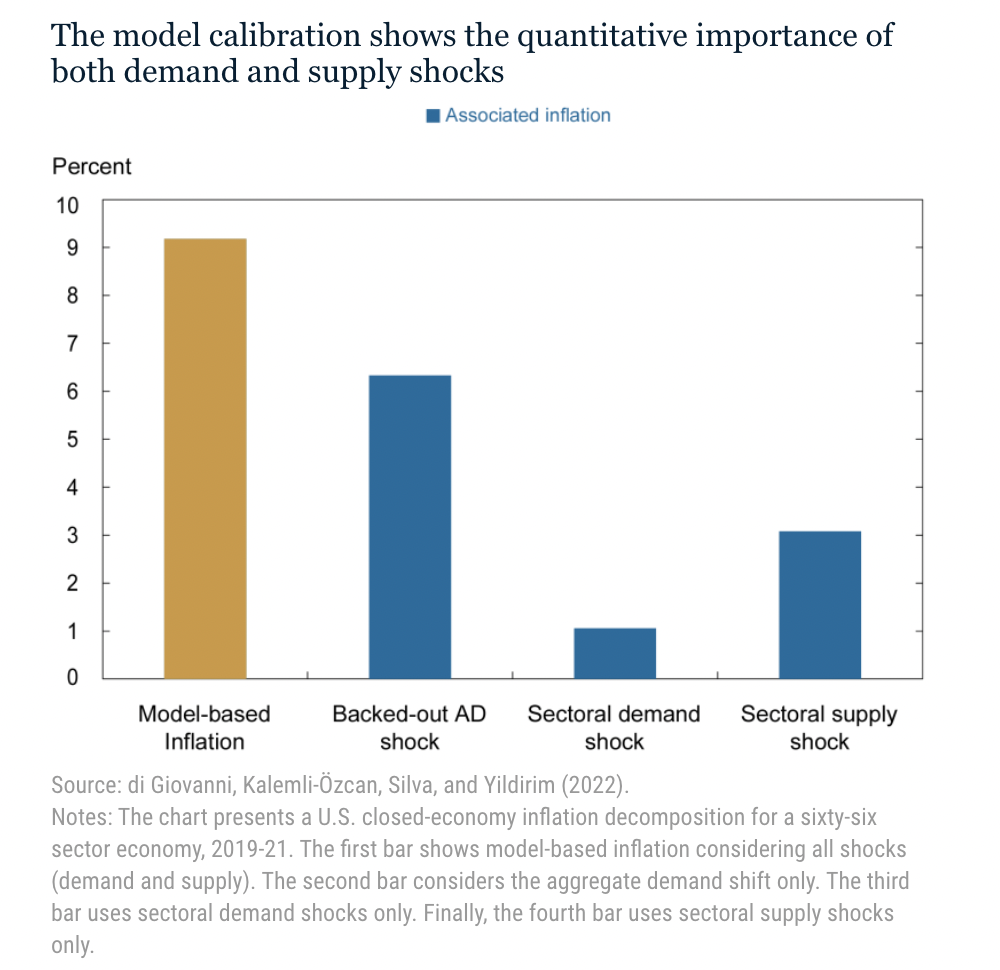

There is a new 60/40 in town, and it is the contribution to inflation from consumer demand for goods and the pandemic-broken supply...

There is a new 60/40 in town, and it is the contribution to inflation from consumer demand for goods and the pandemic-broken supply...

Read More

My views on inflation continue to evolve: I was correct in identifying inflation during the mid-2000s; during the post-crash 2010s...

My views on inflation continue to evolve: I was correct in identifying inflation during the mid-2000s; during the post-crash 2010s...

Read More

Since it is late on a Friday, I thought I might share some quick thoughts about the week. I have been wondering, more than usual,...

Since it is late on a Friday, I thought I might share some quick thoughts about the week. I have been wondering, more than usual,...

Read More

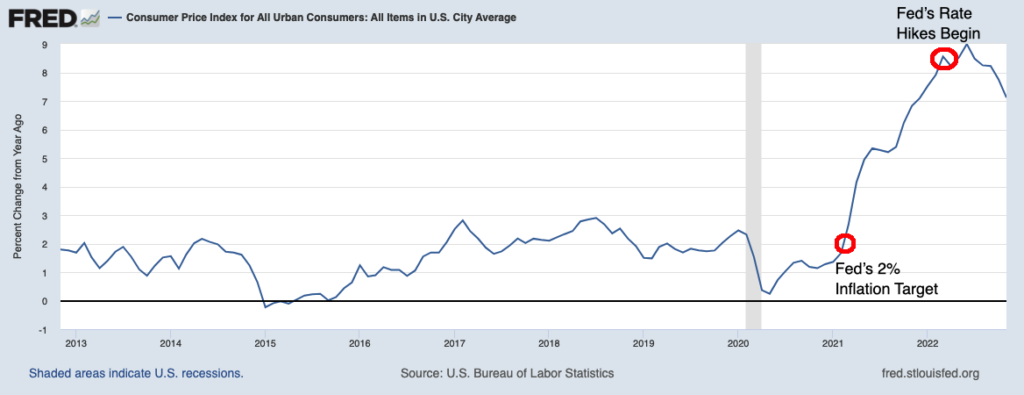

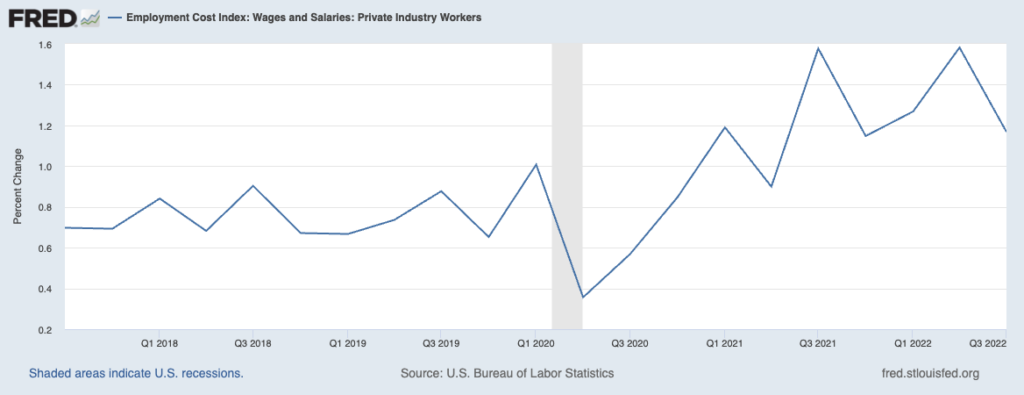

Fed Chair Jerome Powell and the FOMC increased the Fed Funds Rate another 75 bps yesterday, to 3.75-4.0%. Markets have given back...

Fed Chair Jerome Powell and the FOMC increased the Fed Funds Rate another 75 bps yesterday, to 3.75-4.0%. Markets have given back...

Read More

Today and tomorrow the Federal Reserve will hold its 7th Federal Open Market Committee meeting of the year. It is given that we...

Today and tomorrow the Federal Reserve will hold its 7th Federal Open Market Committee meeting of the year. It is given that we...

Read More

is Mr. Market daring Jerome Powell to keep raising rates? That’s one way to read into today’s surging market...

is Mr. Market daring Jerome Powell to keep raising rates? That’s one way to read into today’s surging market...

Read More

It may surprise you to learn that during this cycle of falling inflation, there seems to be little correlation with rising...

It may surprise you to learn that during this cycle of falling inflation, there seems to be little correlation with rising...

It may surprise you to learn that during this cycle of falling inflation, there seems to be little correlation with rising...

It may surprise you to learn that during this cycle of falling inflation, there seems to be little correlation with rising...