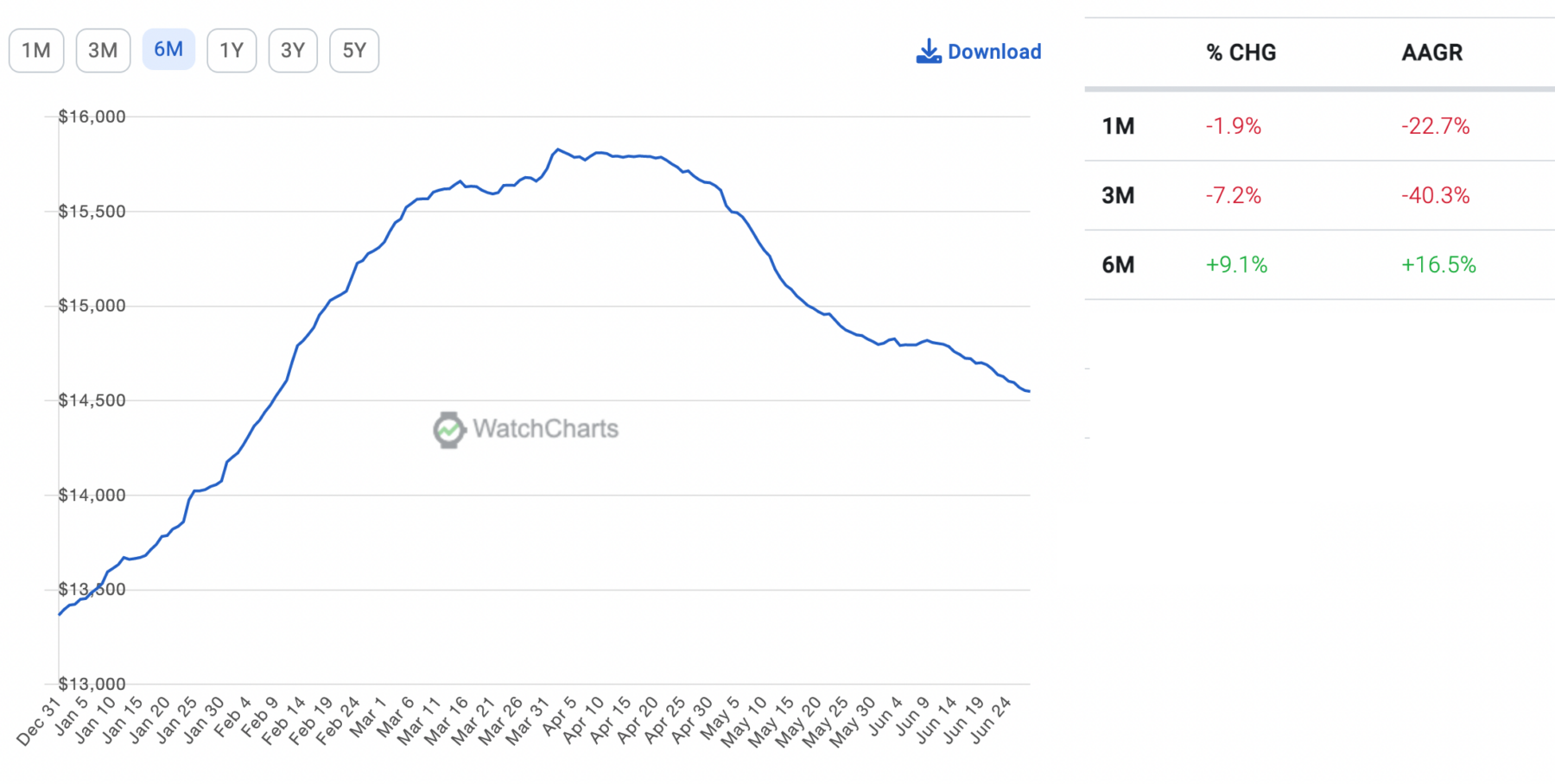

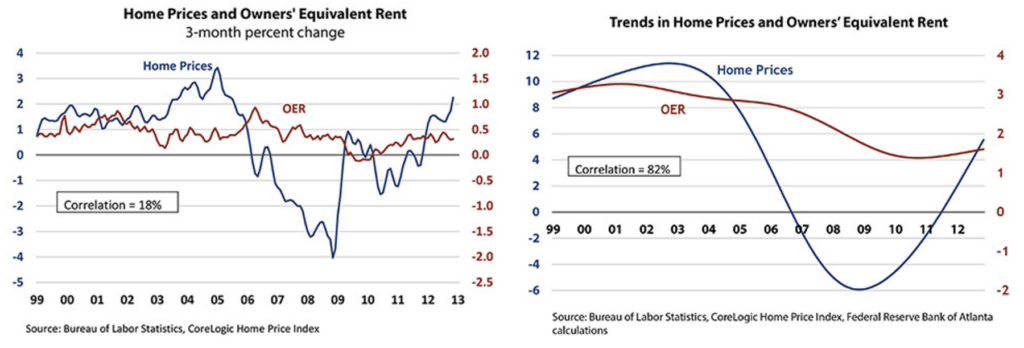

My colleague Ben Carlson asked the question “Why Isn’t Inflation Falling?” There are some technical explanations, but before...

My colleague Ben Carlson asked the question “Why Isn’t Inflation Falling?” There are some technical explanations, but before...

Read More

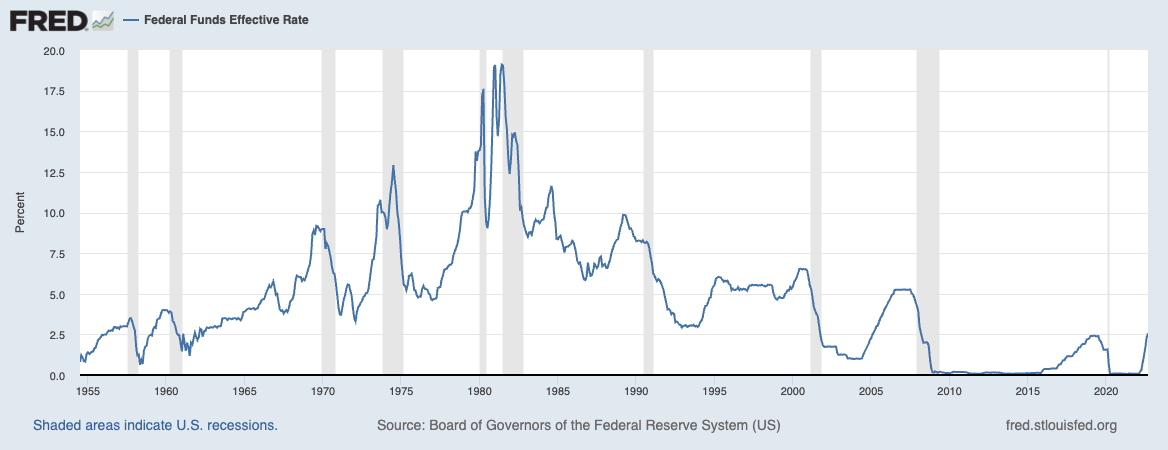

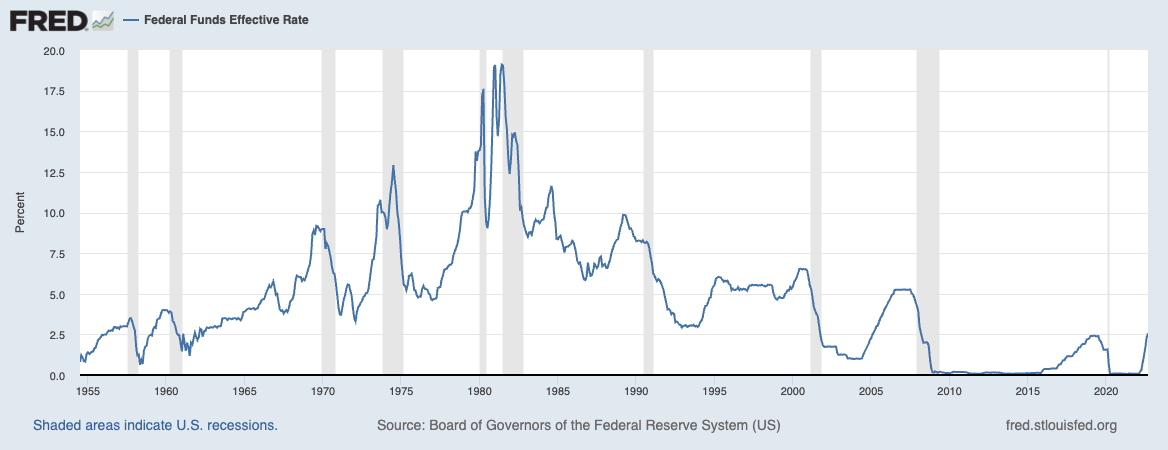

One of the really strange things about watching Federal Reserve policy is the excess of deference that is given to the Fed’s...

One of the really strange things about watching Federal Reserve policy is the excess of deference that is given to the Fed’s...

Read More

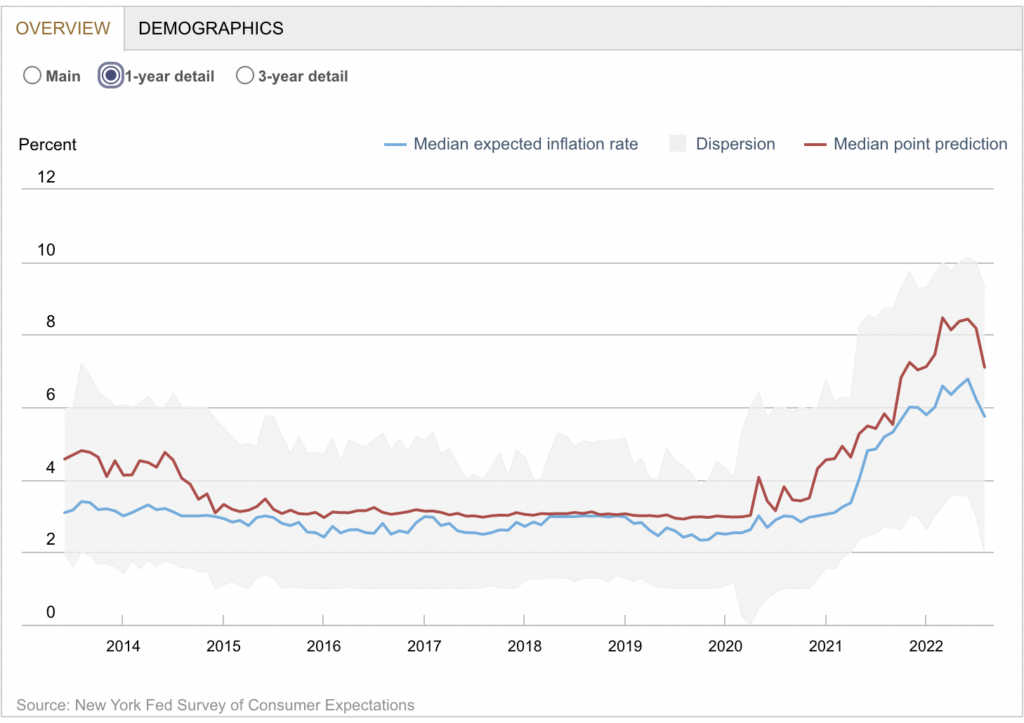

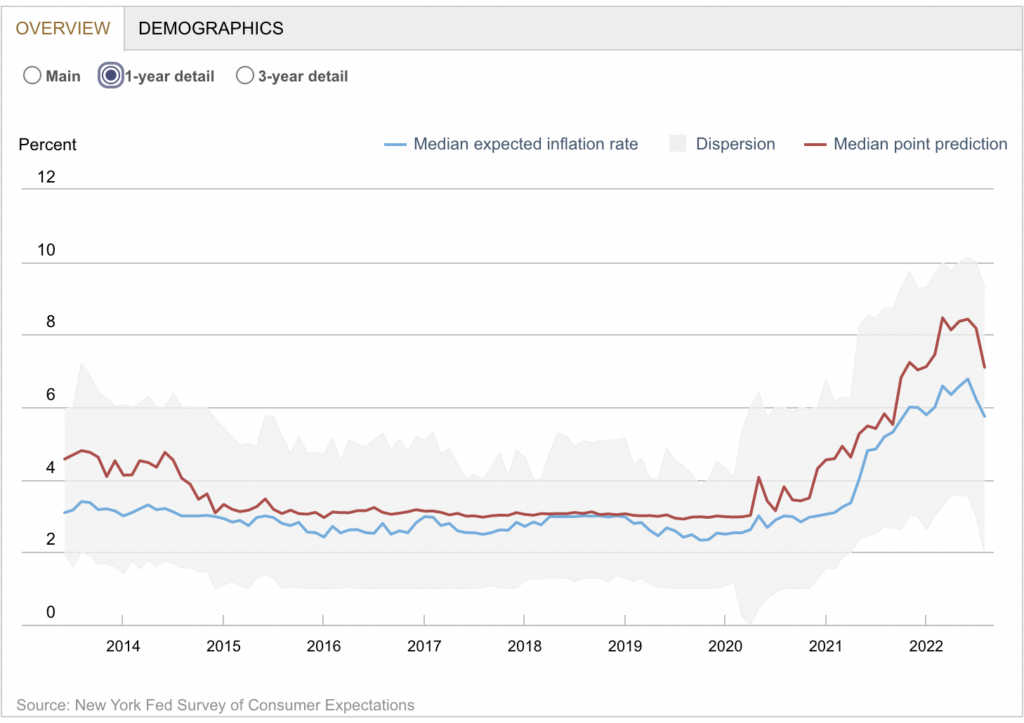

One of the things we know about inflation expectations is that Federal Reserve Chairman Jerome Powell relies heavily on them. He...

One of the things we know about inflation expectations is that Federal Reserve Chairman Jerome Powell relies heavily on them. He...

Read More

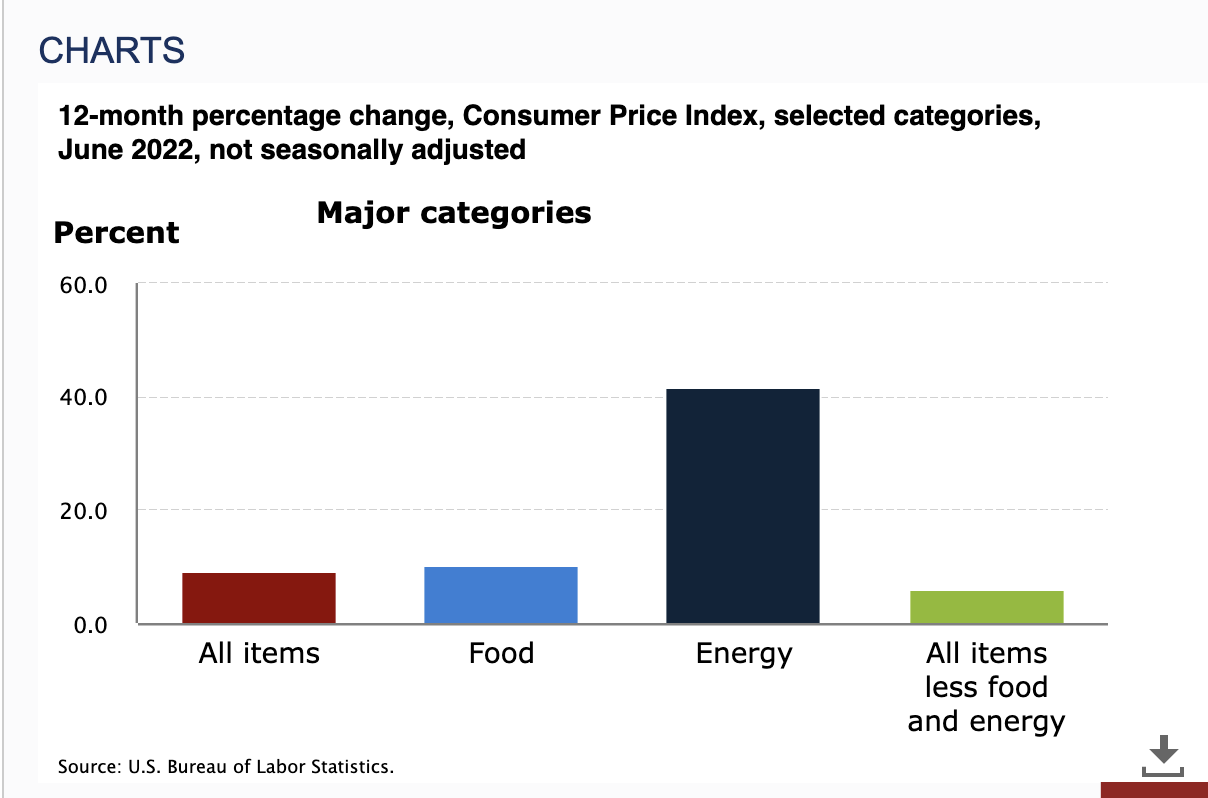

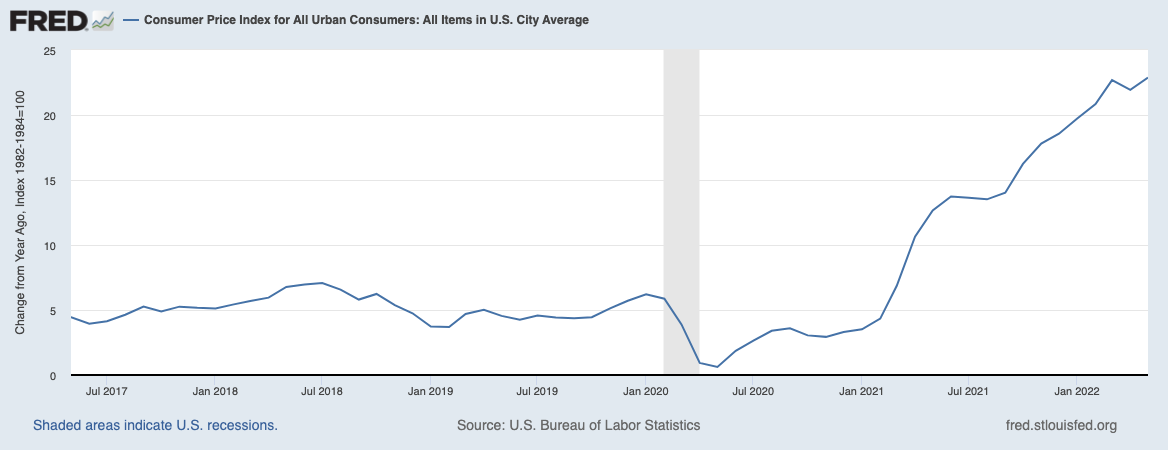

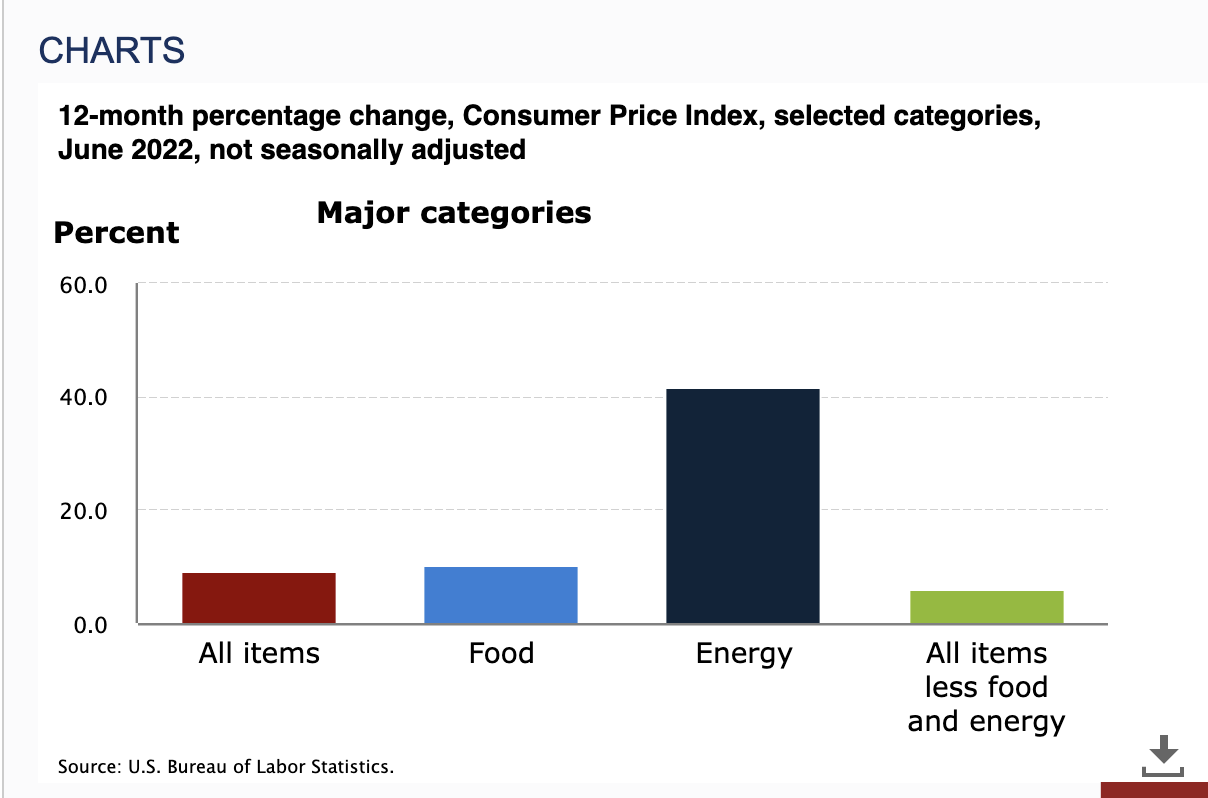

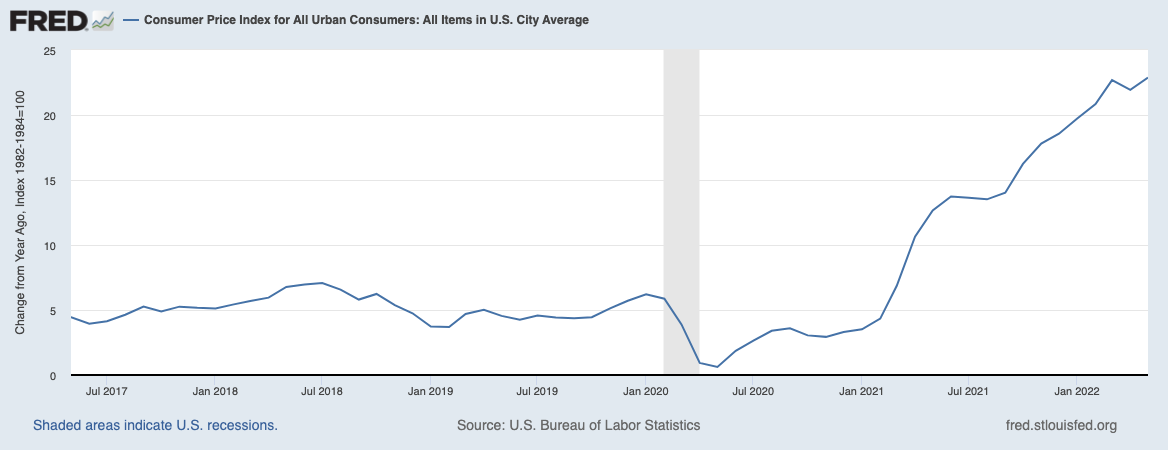

The CPI data came out today sizzling hot at 9.1%: “Over the last 12 months, the all items index increased 9.1 percent...

The CPI data came out today sizzling hot at 9.1%: “Over the last 12 months, the all items index increased 9.1 percent...

Read More

We discuss the upcoming CPI report and says the Fed should be looking at a 50 basis point hike, rather than 75 basis points. Signs...

Read More

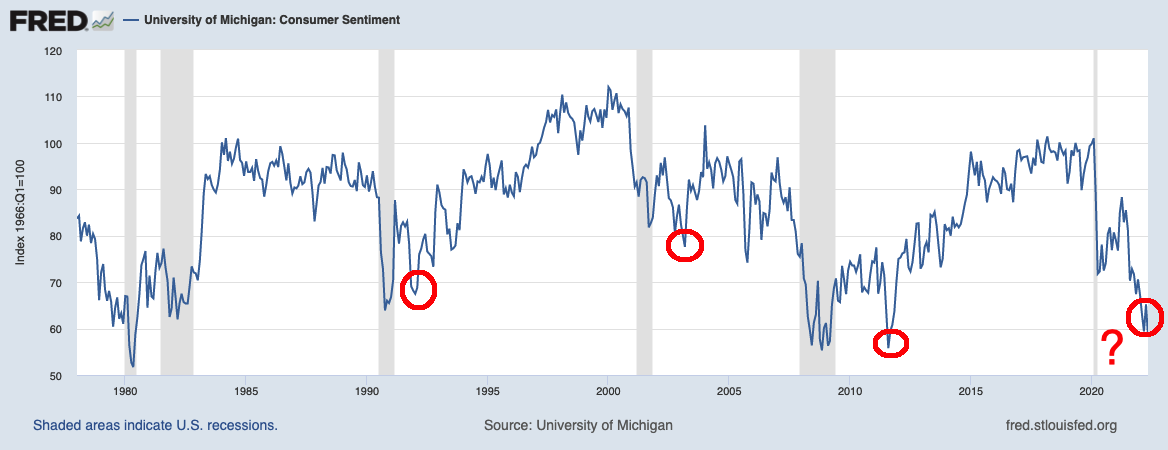

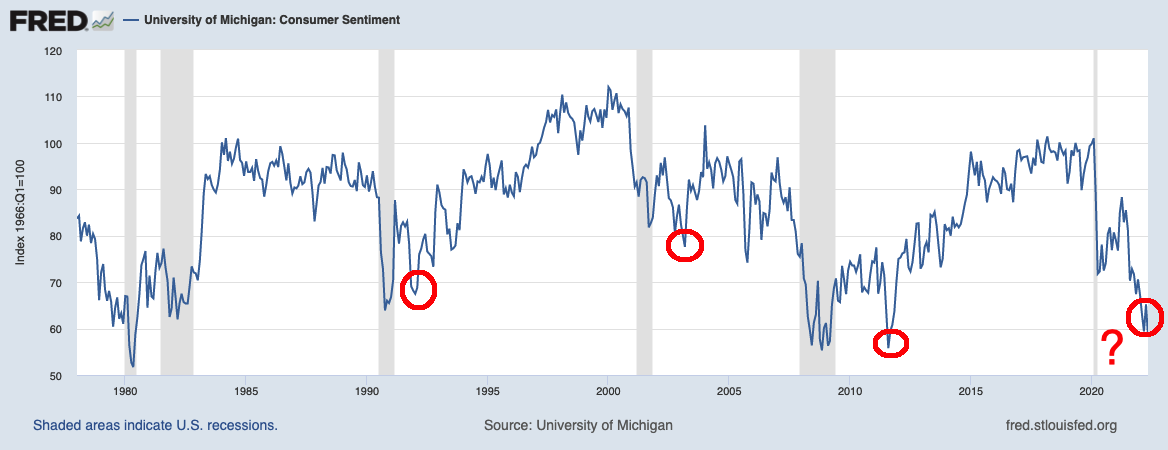

Something odd happens every time the economy slides into a recession: Consumer Sentiment takes a shellacking, recovers, and then...

Something odd happens every time the economy slides into a recession: Consumer Sentiment takes a shellacking, recovers, and then...

Read More

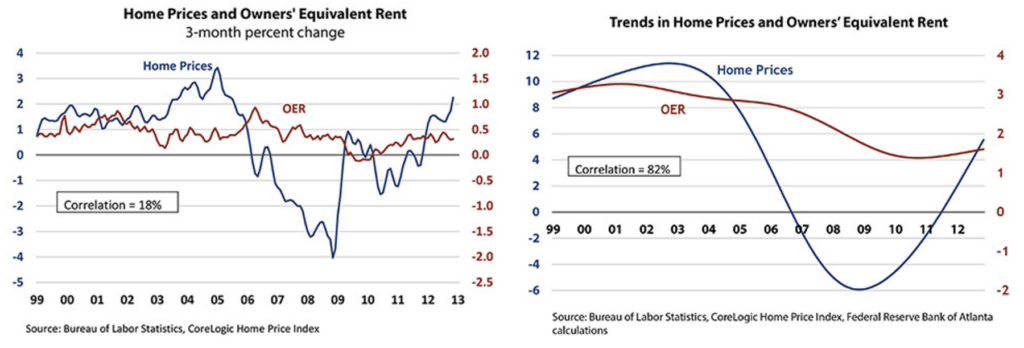

A month ago, I asked: Has Inflation Peaked? There were persuasive indications that at least in terms of three major drivers...

A month ago, I asked: Has Inflation Peaked? There were persuasive indications that at least in terms of three major drivers...

Read More

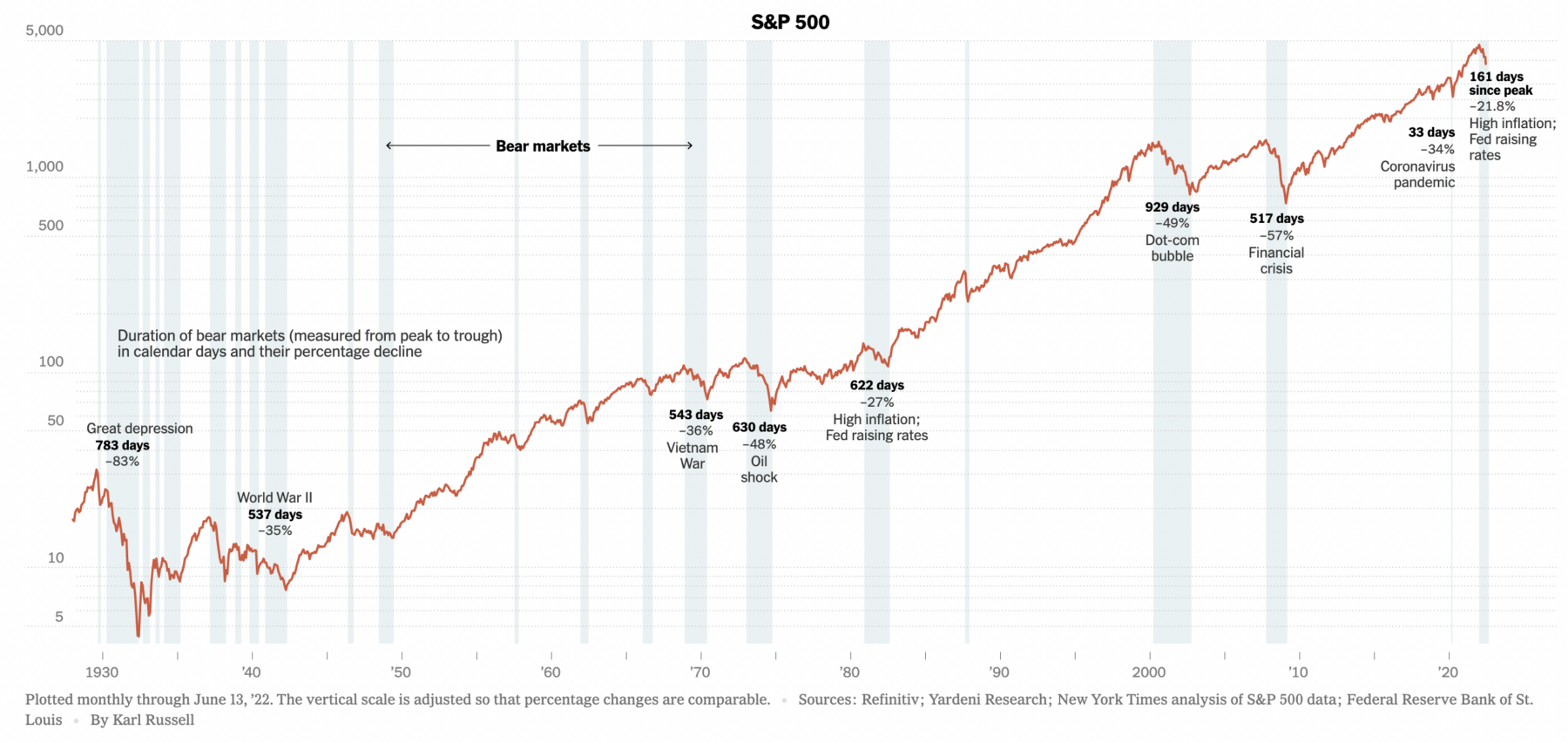

Who is to blame for the rampant inflation the United States (and the entire world) have been experiencing over the past 12...

Who is to blame for the rampant inflation the United States (and the entire world) have been experiencing over the past 12...

Read More

Tomorrow is my first full day back at work after a week of leave with family; I am slowly easing myself into my regular...

Tomorrow is my first full day back at work after a week of leave with family; I am slowly easing myself into my regular...

Read More

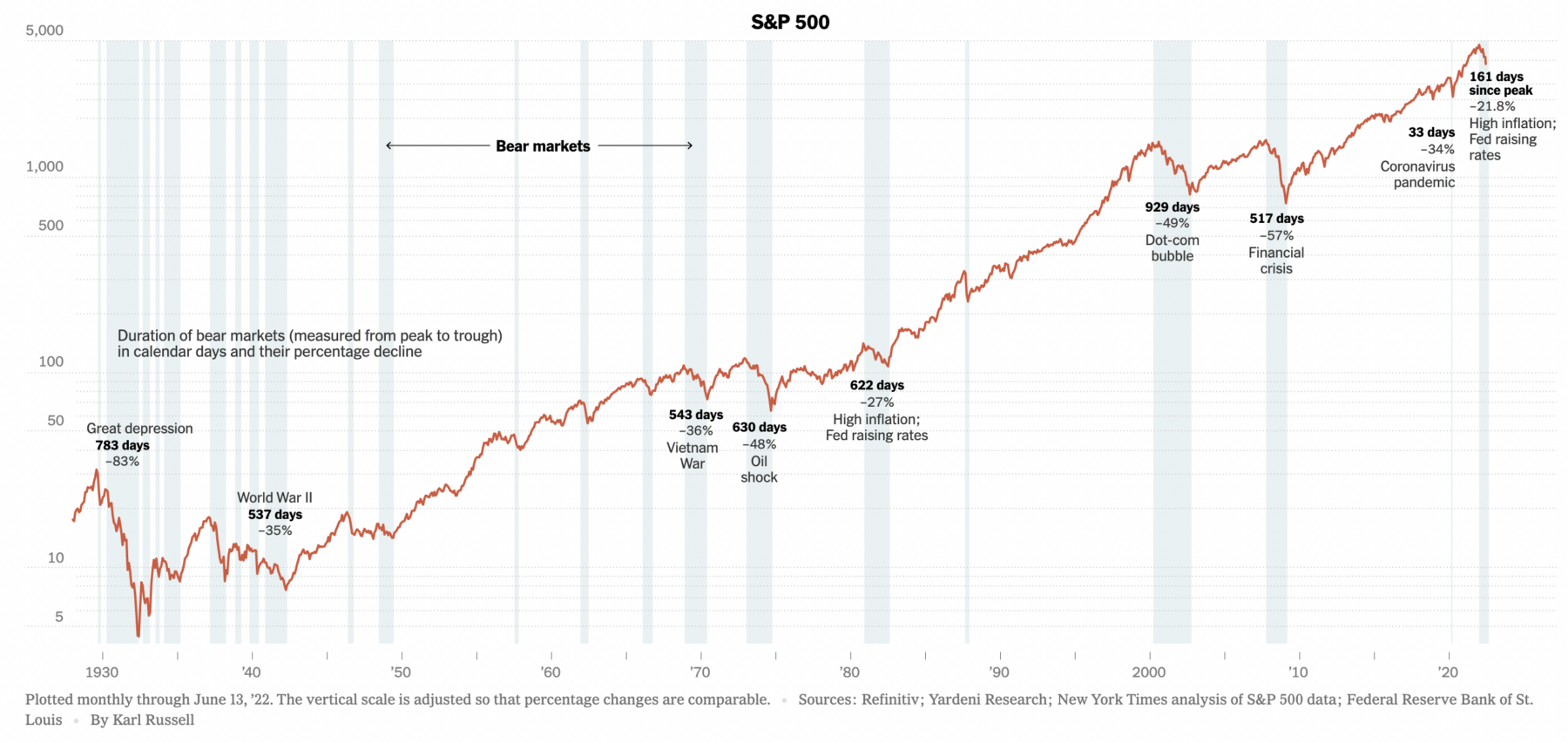

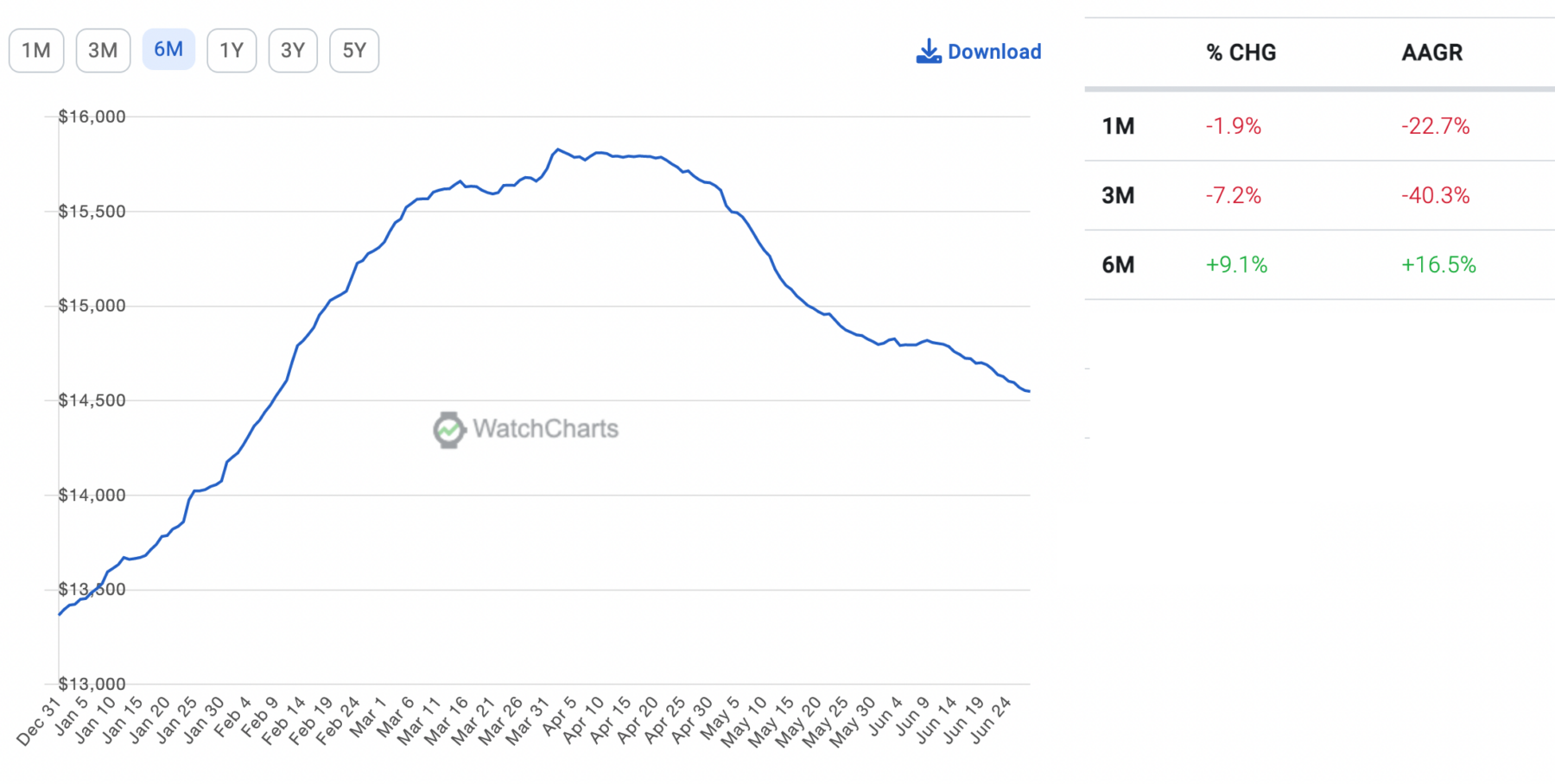

Periods of flux are always fascinating. If you look in the right places, you can find evidence that the dominant trend is giving way,...

Periods of flux are always fascinating. If you look in the right places, you can find evidence that the dominant trend is giving way,...

Read More

My colleague Ben Carlson asked the question “Why Isn’t Inflation Falling?” There are some technical explanations, but before...

My colleague Ben Carlson asked the question “Why Isn’t Inflation Falling?” There are some technical explanations, but before...

My colleague Ben Carlson asked the question “Why Isn’t Inflation Falling?” There are some technical explanations, but before...

My colleague Ben Carlson asked the question “Why Isn’t Inflation Falling?” There are some technical explanations, but before...