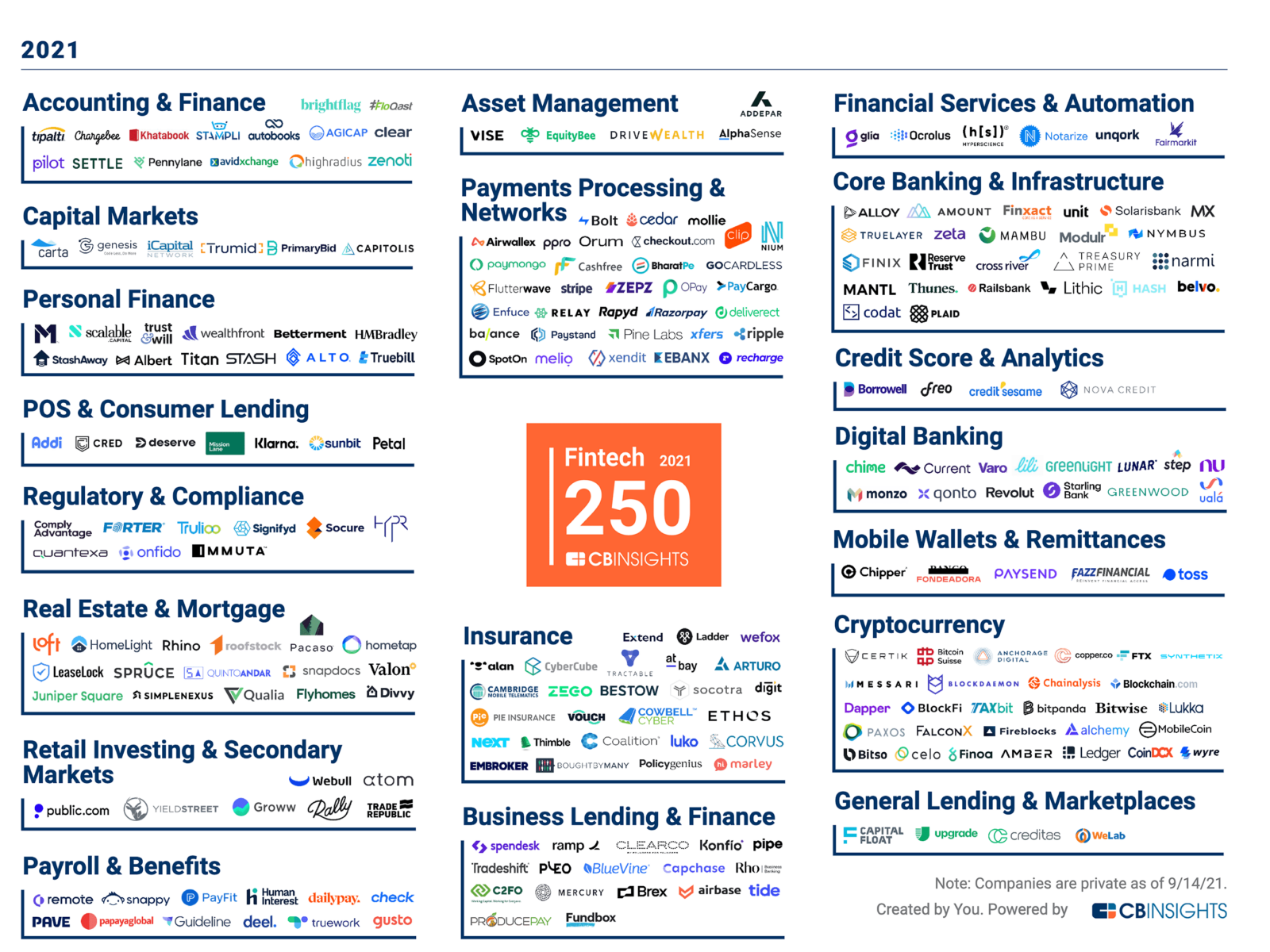

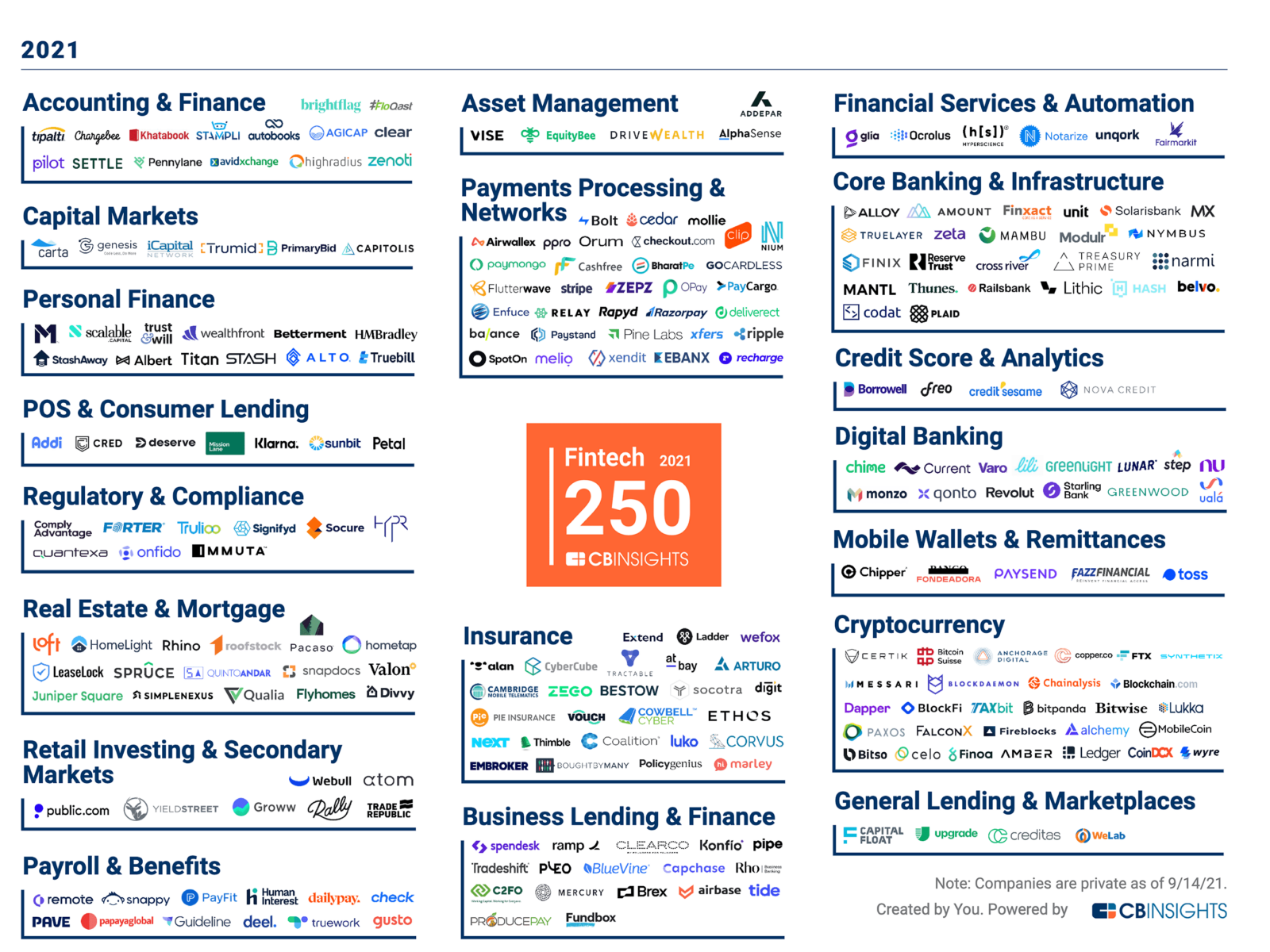

Source: CB Insights I have been discussing technology-driven productivity gains a lot lately (see this, this, or this). And...

Source: CB Insights I have been discussing technology-driven productivity gains a lot lately (see this, this, or this). And...

Read More

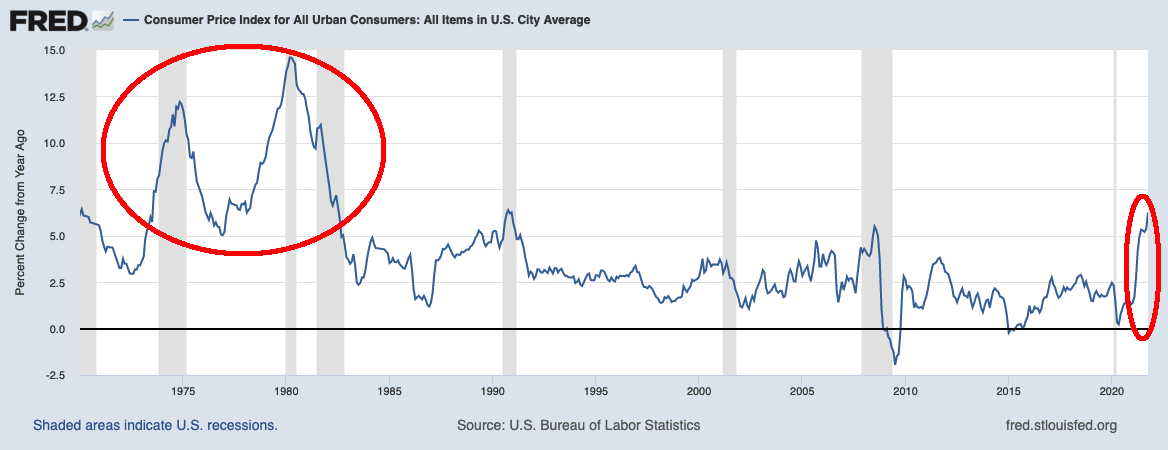

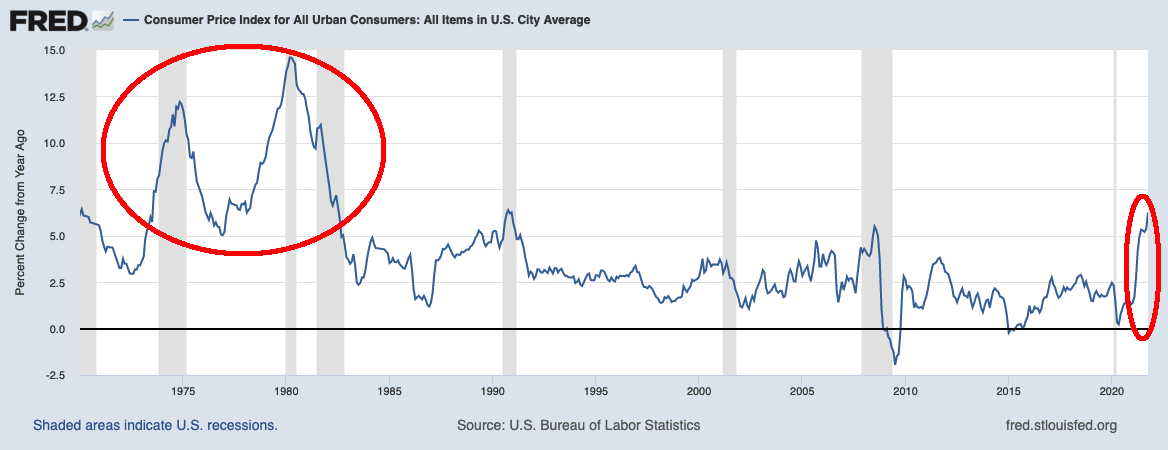

To hear an audio spoken word version of this post, click here. The Consumer Price Index print today of 6.2% is the...

To hear an audio spoken word version of this post, click here. The Consumer Price Index print today of 6.2% is the...

Read More

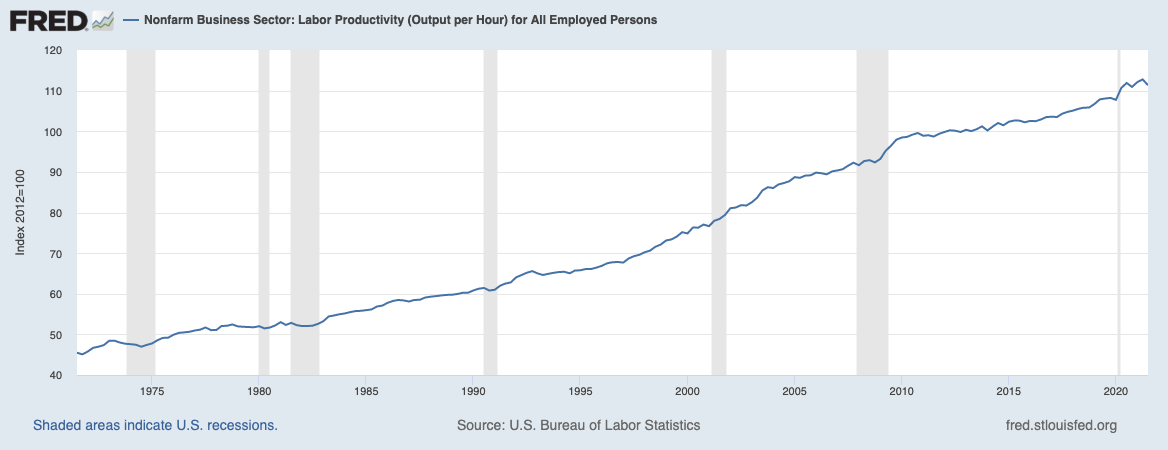

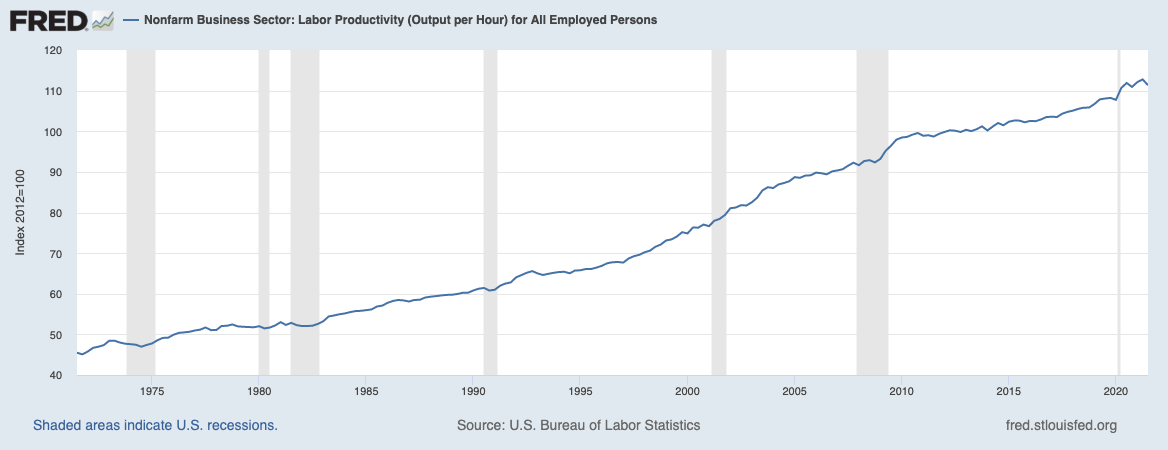

50 Years of Productivity Gains To hear an audio spoken word version of this post, click here. There has been lots...

50 Years of Productivity Gains To hear an audio spoken word version of this post, click here. There has been lots...

Read More

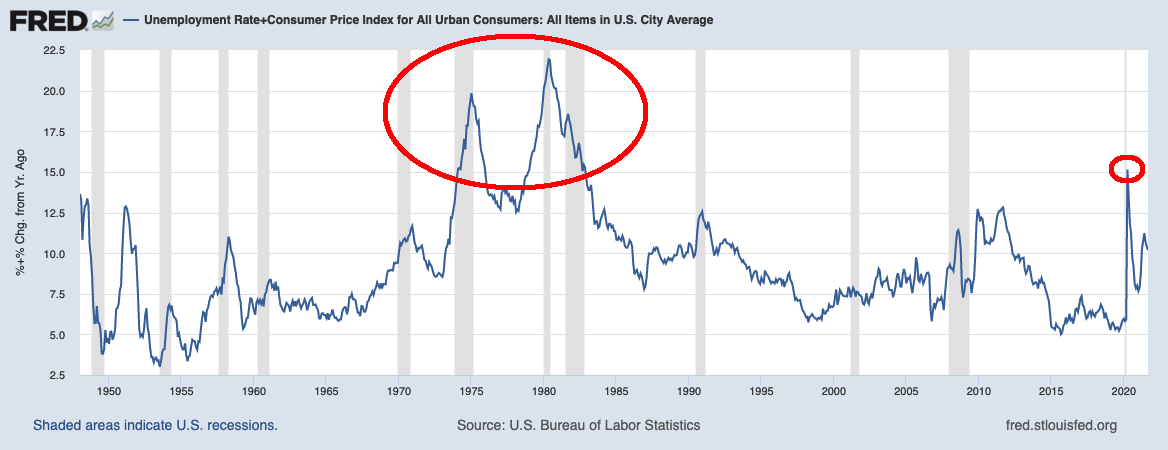

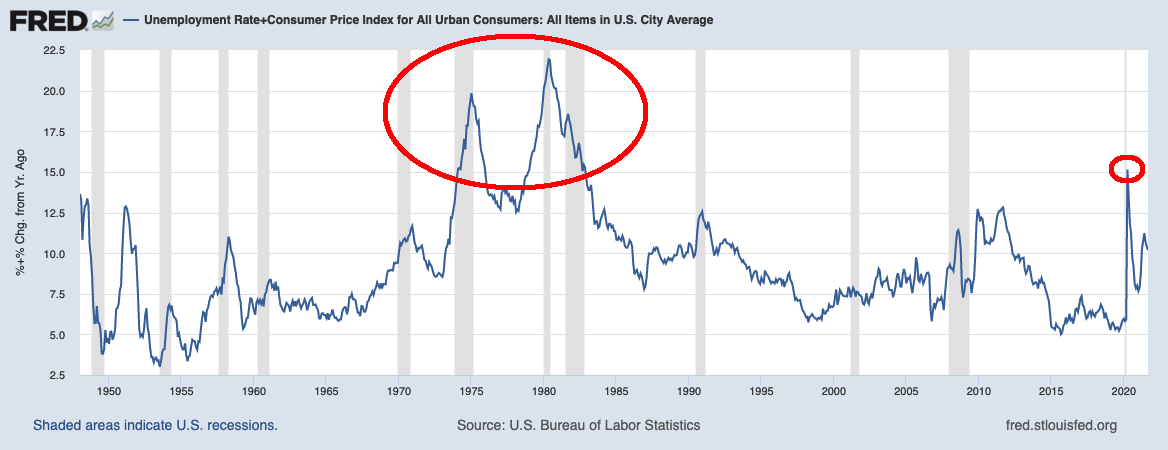

To hear an audio spoken word version of this post, click here. “Stagflation Is All Anyone in Markets...

To hear an audio spoken word version of this post, click here. “Stagflation Is All Anyone in Markets...

Read More

To hear an audio spoken word version of this post, click here. I believe the consensus about inflation is...

To hear an audio spoken word version of this post, click here. I believe the consensus about inflation is...

Read More

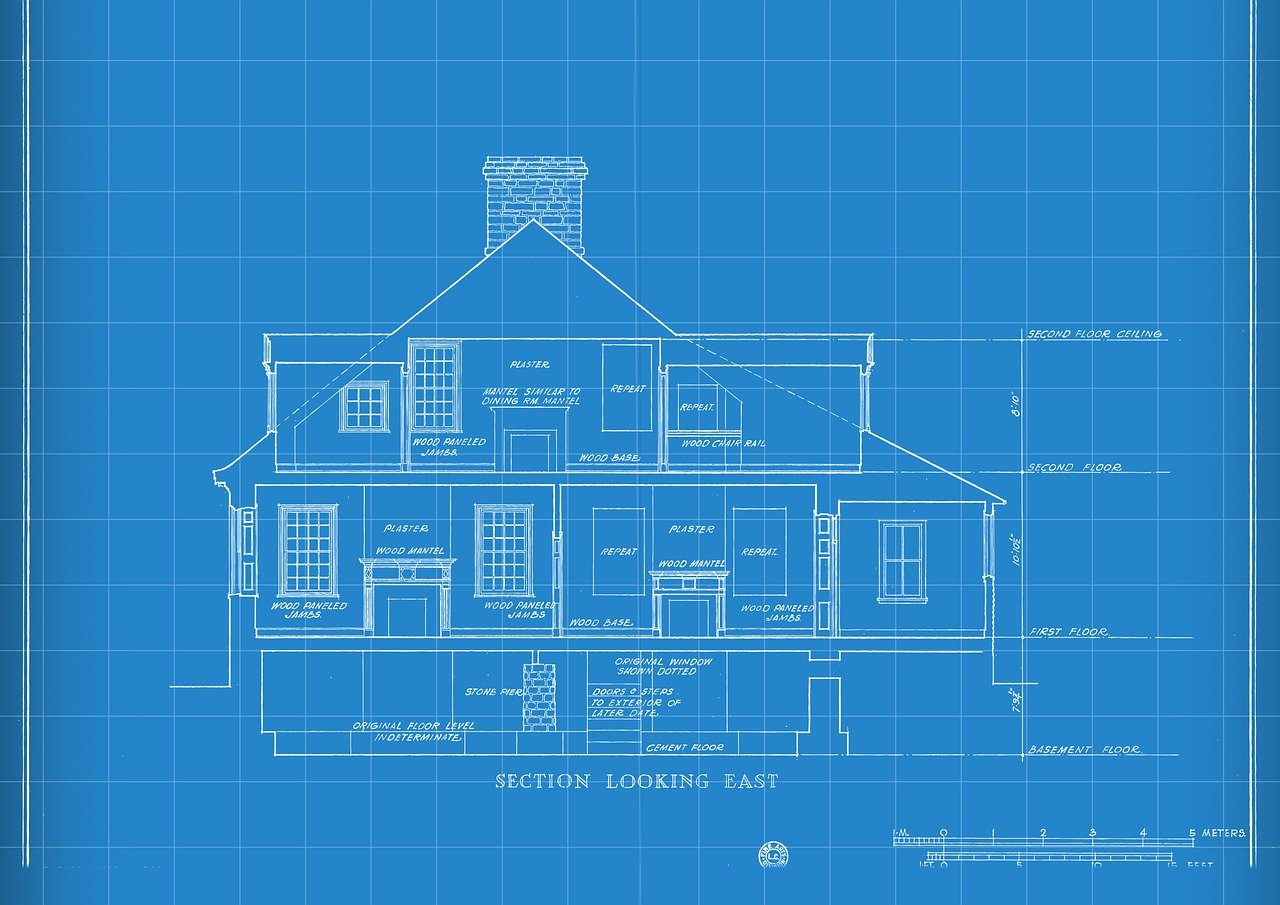

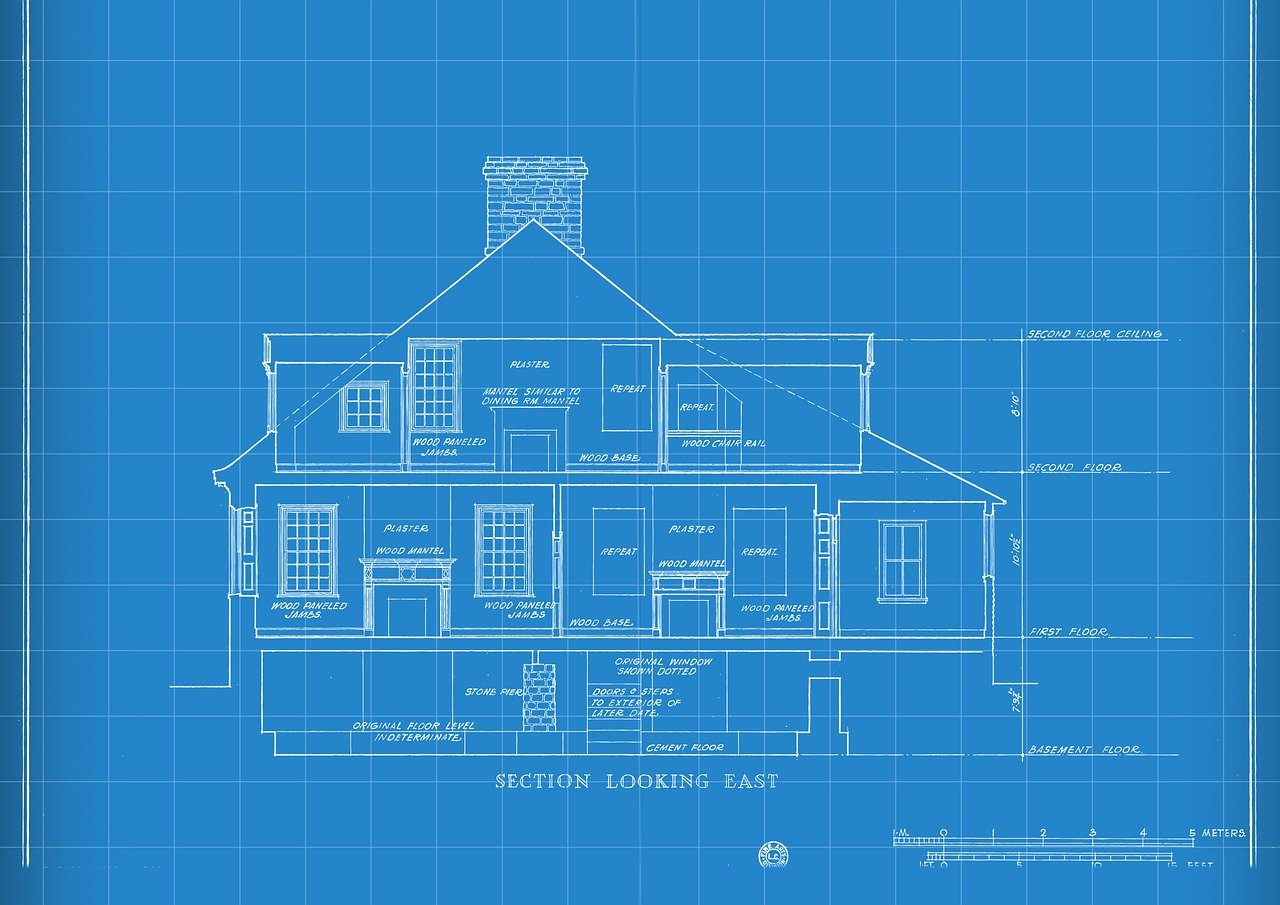

To hear an audio spoken word version of this post, click here. Residential Real Estate in the United States is worth...

To hear an audio spoken word version of this post, click here. Residential Real Estate in the United States is worth...

Read More

Lumber Back to Pre-Pandemic levels Source: Liz Ann Sonders, Schwab The inflation debate seems to be conflating a variety of...

Lumber Back to Pre-Pandemic levels Source: Liz Ann Sonders, Schwab The inflation debate seems to be conflating a variety of...

Read More

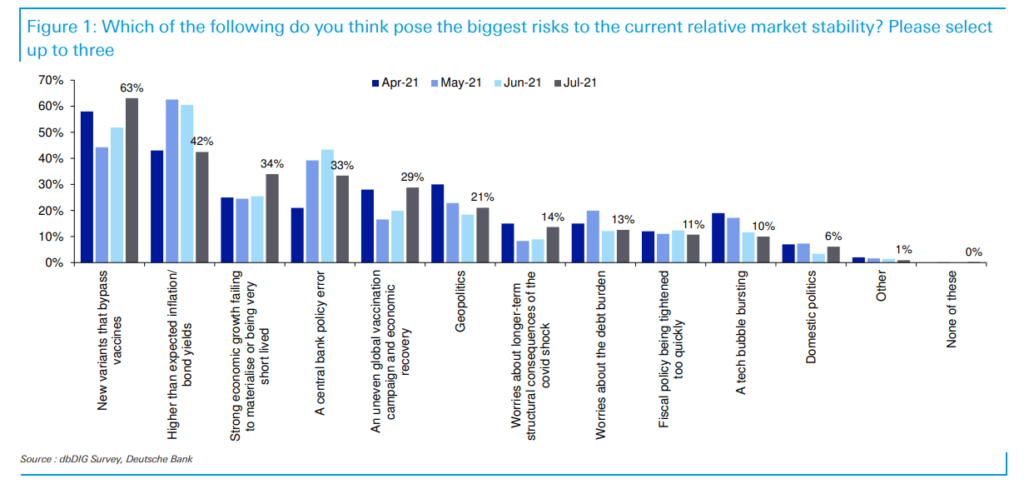

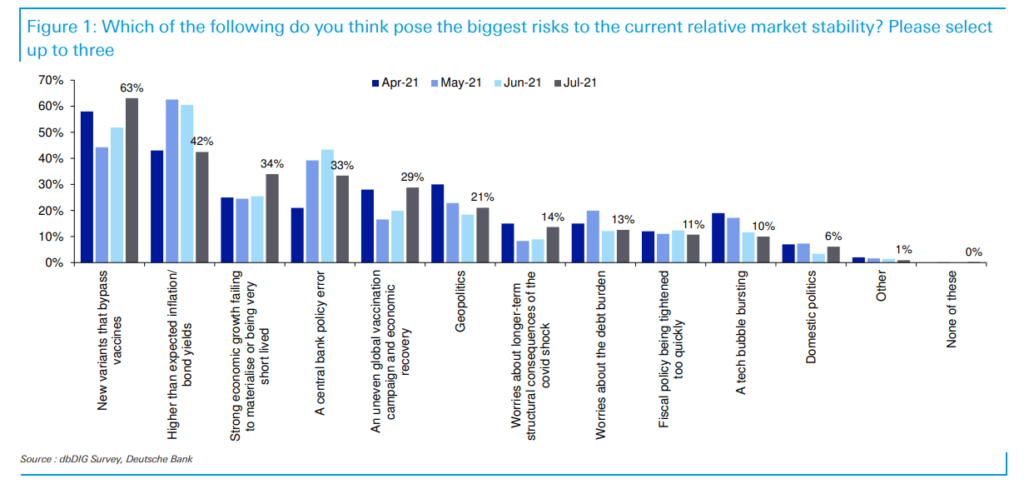

Source: Deutsche Bank A couple of weeks ago, we discussed The Economic Risks from Anti-Vaxxers. It was a deep dive into the risks...

Source: Deutsche Bank A couple of weeks ago, we discussed The Economic Risks from Anti-Vaxxers. It was a deep dive into the risks...

Read More

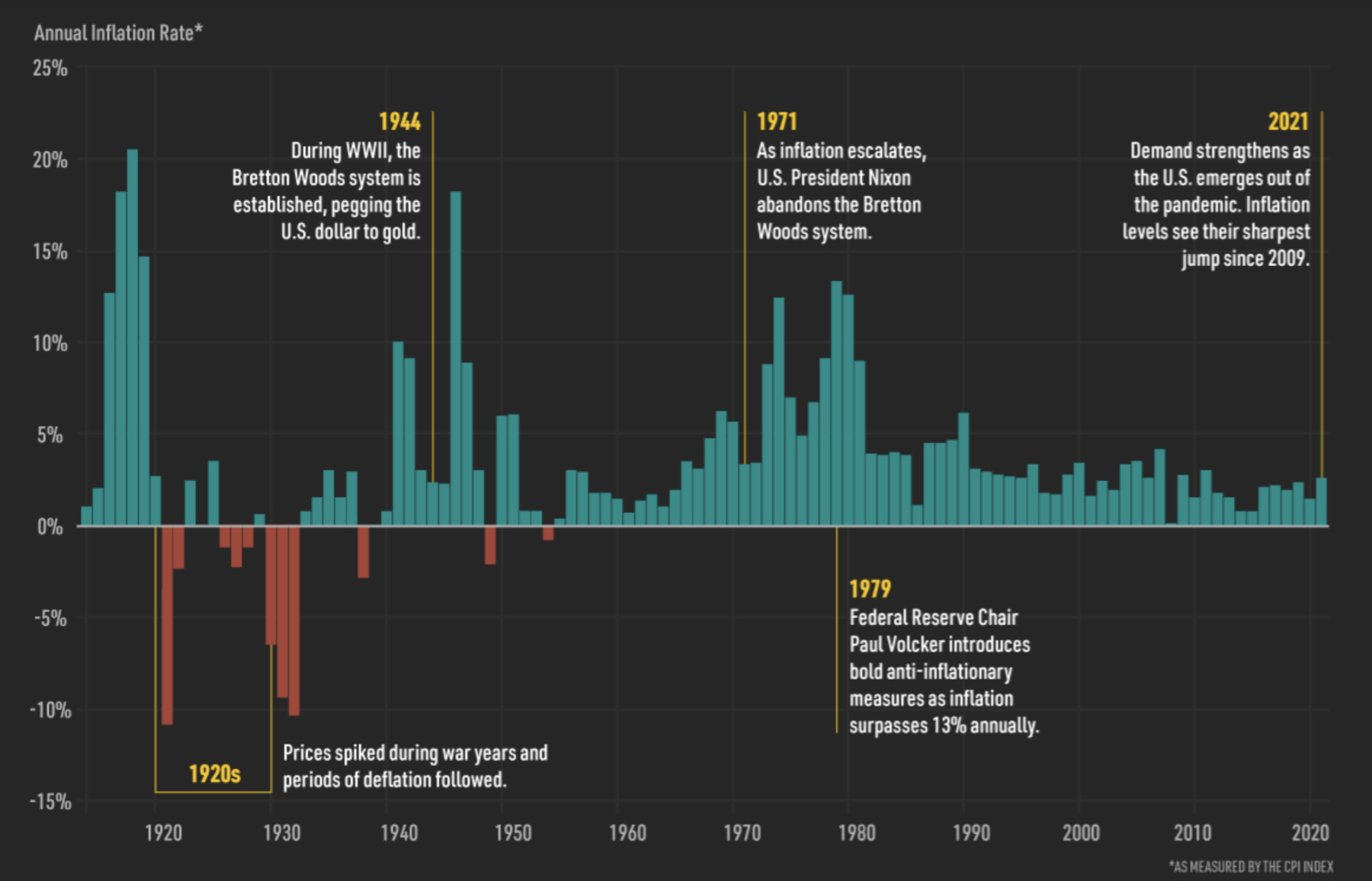

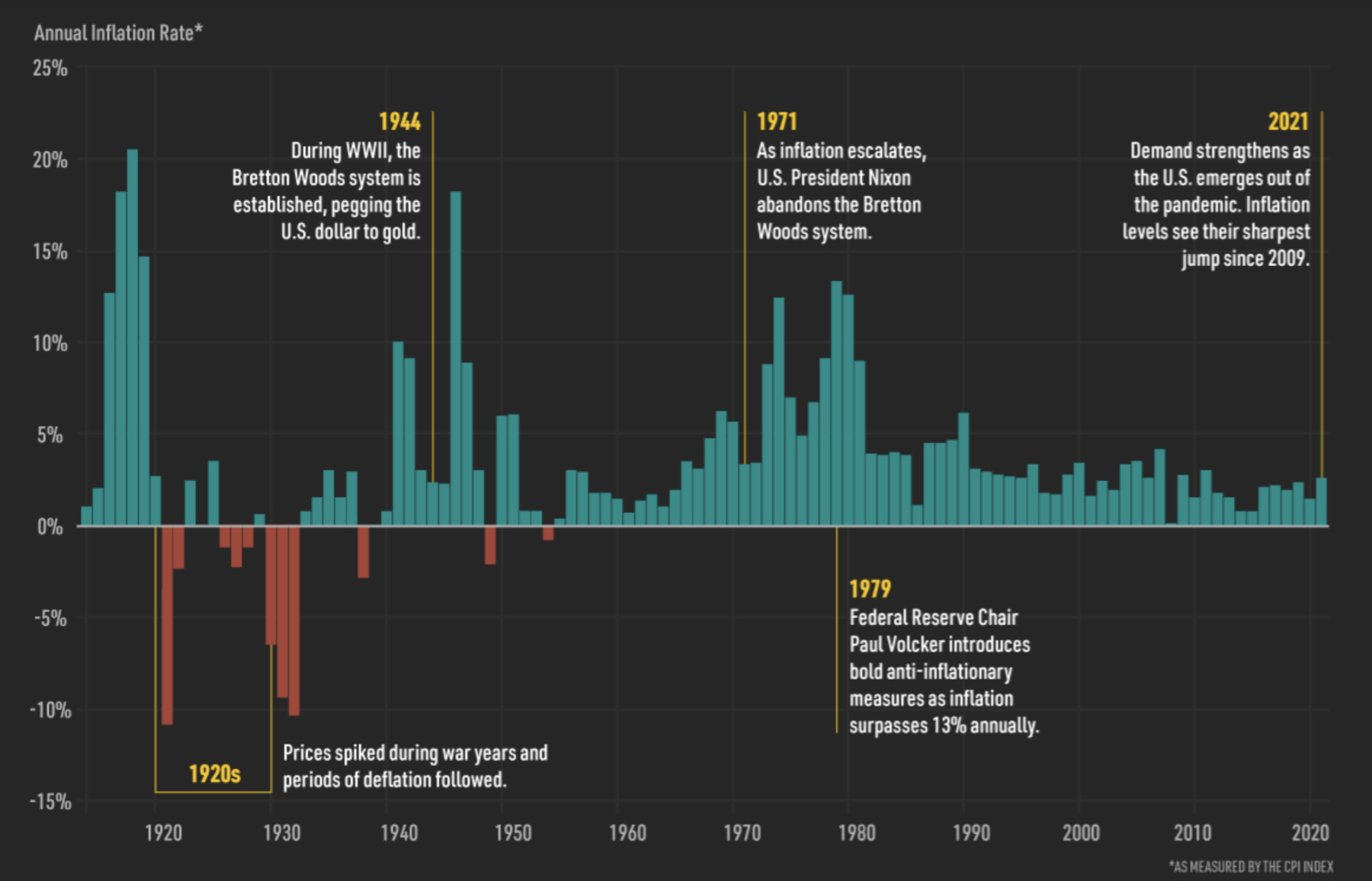

History of U.S. Inflation Over 100 Years Source: Visual Capitalist I have been thinking a lot about inflation lately, which...

History of U.S. Inflation Over 100 Years Source: Visual Capitalist I have been thinking a lot about inflation lately, which...

Read More

Peter Boockvar is the CIO of Bleakley Advisory Group and Editor of The Boock Report. So Powell was asked...

Peter Boockvar is the CIO of Bleakley Advisory Group and Editor of The Boock Report. So Powell was asked...

Read More

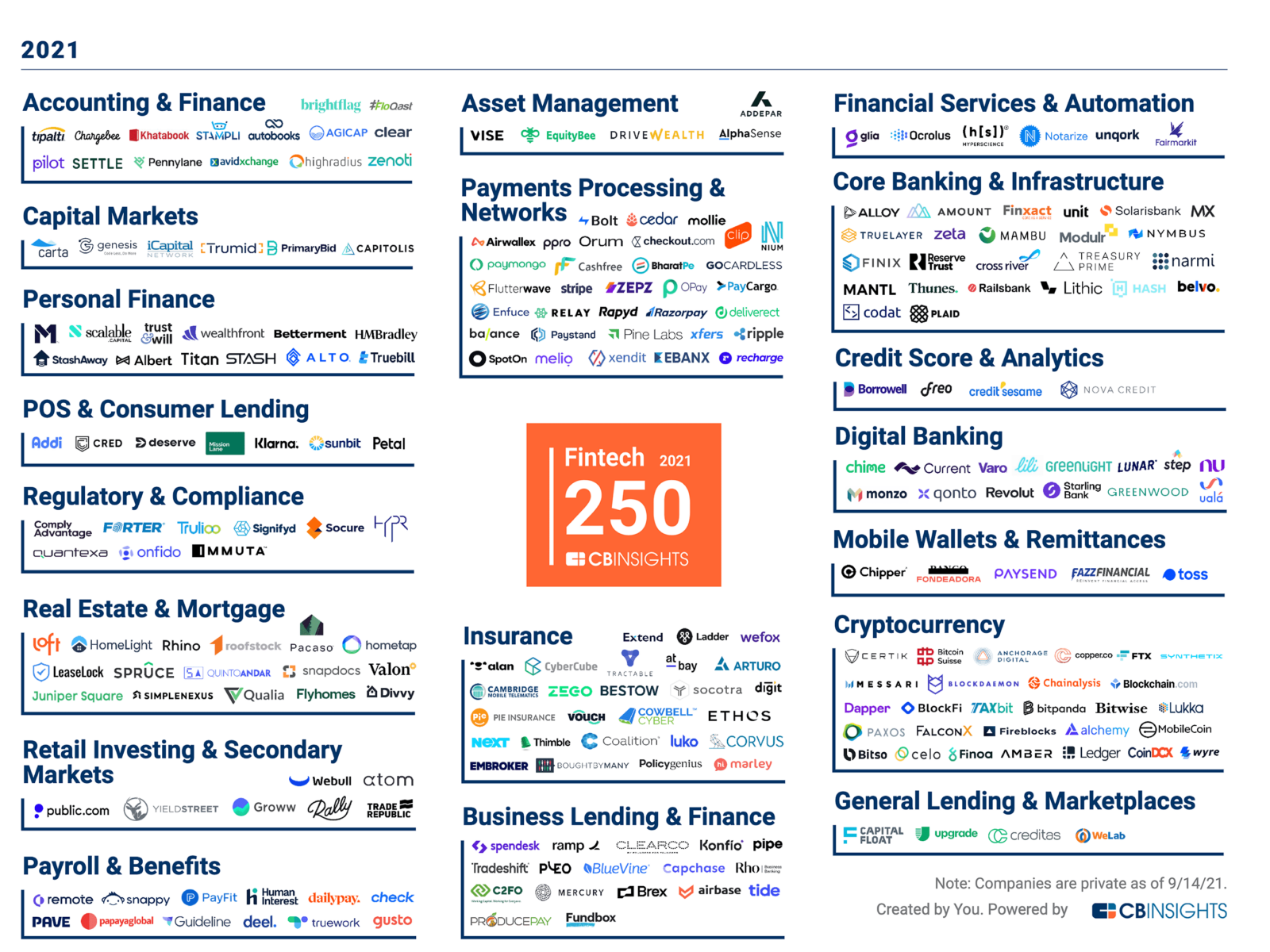

Source: CB Insights I have been discussing technology-driven productivity gains a lot lately (see this, this, or this). And...

Source: CB Insights I have been discussing technology-driven productivity gains a lot lately (see this, this, or this). And...

Source: CB Insights I have been discussing technology-driven productivity gains a lot lately (see this, this, or this). And...

Source: CB Insights I have been discussing technology-driven productivity gains a lot lately (see this, this, or this). And...