Why do stocks pay more than bonds? That’s the question a NYT column looks at this Sunday. Interestingly, why the risk premium is so...

Why do stocks pay more than bonds? That’s the question a NYT column looks at this Sunday. Interestingly, why the risk premium is so...

Read More

On occasion, I come across interesting and — inadvertantly telling — stuff in the Personal section of the Journal. Today was...

Read More

Part II of the Paul Desmond Q&A is posted at thestreet.com (free) This is the half that really focuses on market tops. If you read...

Part II of the Paul Desmond Q&A is posted at thestreet.com (free) This is the half that really focuses on market tops. If you read...

Read More

Part I of the Paul Desmond Q&A is posted at thestreet.com (free) This is probably the coolest thing I’ve done at The...

Part I of the Paul Desmond Q&A is posted at thestreet.com (free) This is probably the coolest thing I’ve done at The...

Read More

Back on June 1, 2005, Dallas Fed President Richard Fisher told CNBC: “We are clearly in an 8th inning of a tightening cycle, and we...

Read More

Are Bears really more rigorous than Bulls? I don’t know the basis of that statement, but I hear it alot, most recently from Jim Cramer....

Read More

Small World: On Saturday, I mentioned problems with Citibank’s Panic/Euphoria sentiment measure. Then, I discussed the work of...

Small World: On Saturday, I mentioned problems with Citibank’s Panic/Euphoria sentiment measure. Then, I discussed the work of...

Read More

As long as we are discussing fund/portfolio management today, have a read what Paul Farrell had to say in his Guide to Winning...

Read More

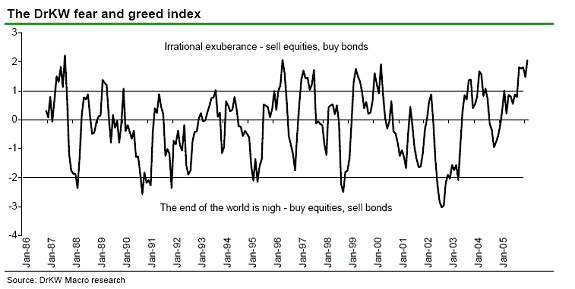

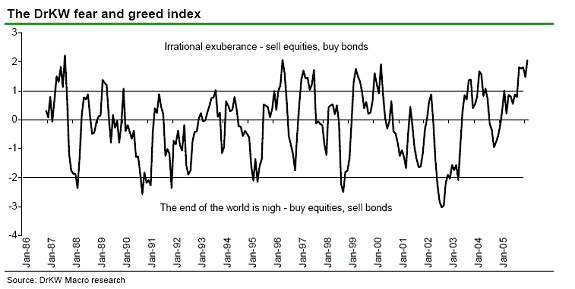

There is a terrific PDF (warning — its 105 pages) on the Seven Sins of Fund Management. It is a behavioural critique by James...

Read More

I have a new column up at TheStreet.com, titled The Street Gets Inflation Threat Backwards. It is an expansion of a few recent...

I have a new column up at TheStreet.com, titled The Street Gets Inflation Threat Backwards. It is an expansion of a few recent...

Read More

Why do stocks pay more than bonds? That’s the question a NYT column looks at this Sunday. Interestingly, why the risk premium is so...

Why do stocks pay more than bonds? That’s the question a NYT column looks at this Sunday. Interestingly, why the risk premium is so...

Why do stocks pay more than bonds? That’s the question a NYT column looks at this Sunday. Interestingly, why the risk premium is so...

Why do stocks pay more than bonds? That’s the question a NYT column looks at this Sunday. Interestingly, why the risk premium is so...