The latest "Apprentice Investor" column is up: Time Waits for No One. It asks the question "Have you made sure the...

The latest "Apprentice Investor" column is up: Time Waits for No One. It asks the question "Have you made sure the...

Read More

The task of calculating the enormous damage from Katrina – in Human lives, in property damage, and in economic terms – continues. As...

Read More

Wall Street has been sifting through the horrific reports out of the Gulf of Mexico. Their rose-colored glasses allowed them to see...

Read More

More than a few of you have emailed me about Richard Russell’s "Bullish reversal." Jeff Saut made short work of that...

Read More

I wanted to address some of the historical comparos as to why the market has been moving higher, despite what is obviosuly (at least to...

Read More

As long as we are pulling out the key graphs from that Rydex pdf, here’s another interesting chart: > Historical Betas of...

As long as we are pulling out the key graphs from that Rydex pdf, here’s another interesting chart: > Historical Betas of...

Read More

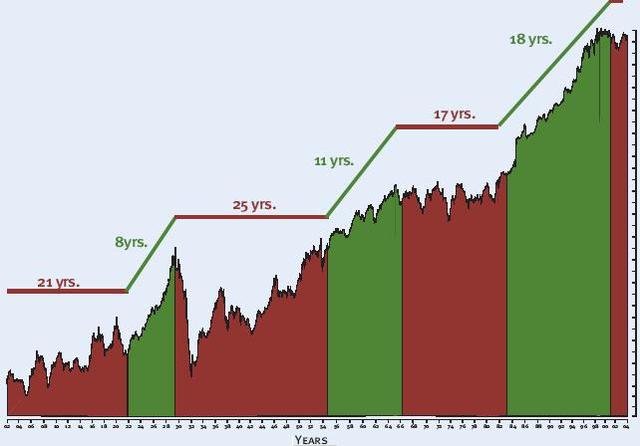

The previous chart reveals the long standing secular moves of the markets; What’s an investor to do during one of the long periods...

The previous chart reveals the long standing secular moves of the markets; What’s an investor to do during one of the long periods...

Read More

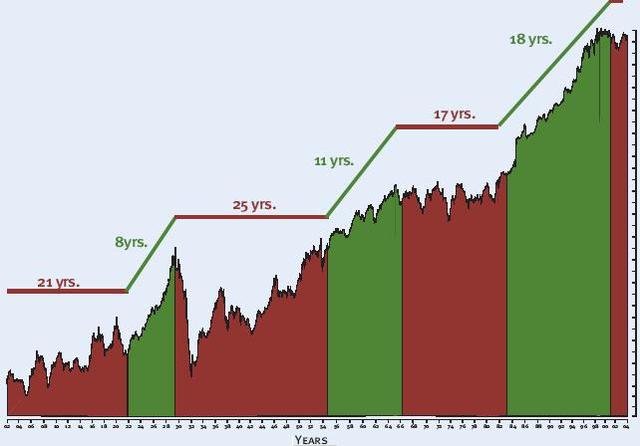

Yet another look (see prior takes here and here) at the concept of market cycles. The past century shows alternating Bullish and...

Yet another look (see prior takes here and here) at the concept of market cycles. The past century shows alternating Bullish and...

Read More

Forget most of what you are reading about the post-Katrina recovery. This is an unprecedented U.S. disaster that will have repercussions...

Read More

I’m a big believer in accountability — both on Wall Street and in D.C. That’s why I admit my (all too frequent) errors...

Read More

The latest "Apprentice Investor" column is up: Time Waits for No One. It asks the question "Have you made sure the...

The latest "Apprentice Investor" column is up: Time Waits for No One. It asks the question "Have you made sure the...

The latest "Apprentice Investor" column is up: Time Waits for No One. It asks the question "Have you made sure the...

The latest "Apprentice Investor" column is up: Time Waits for No One. It asks the question "Have you made sure the...