Politics and Your Portfolio

I had fun chatting with David L. Bahnsen of The Bahnsen Group. David hosts a podcast on National Review with the...

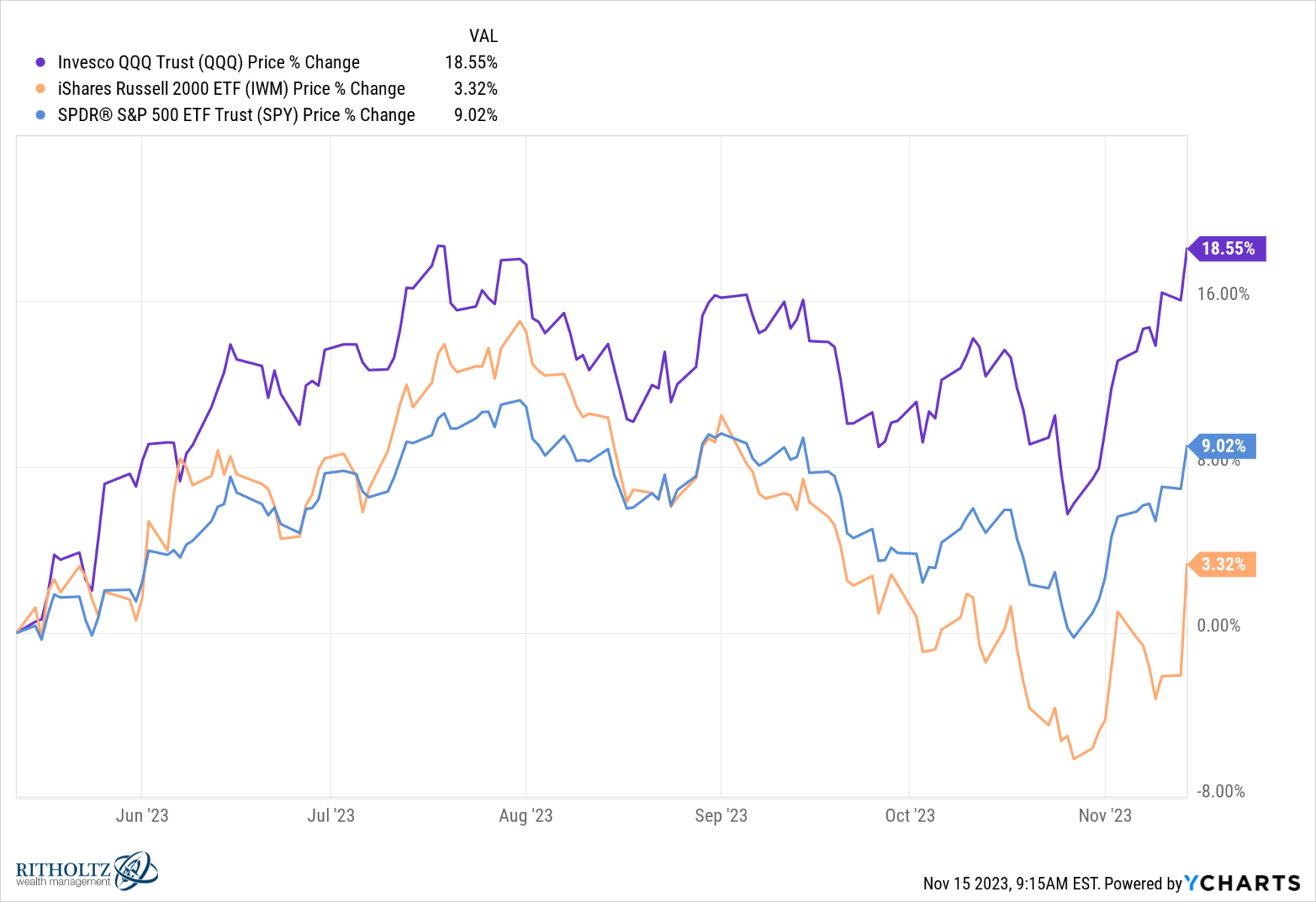

Markets screamed higher yesterday after a benign CPI report showed a 0.0% monthly price increase and inflation falling to 3.2%...

Markets screamed higher yesterday after a benign CPI report showed a 0.0% monthly price increase and inflation falling to 3.2%...

Today, Jerome Powell is making the opening remarks at the 24th Jacques Polak Annual Research Conference in DC. I’ll be on...

Today, Jerome Powell is making the opening remarks at the 24th Jacques Polak Annual Research Conference in DC. I’ll be on...

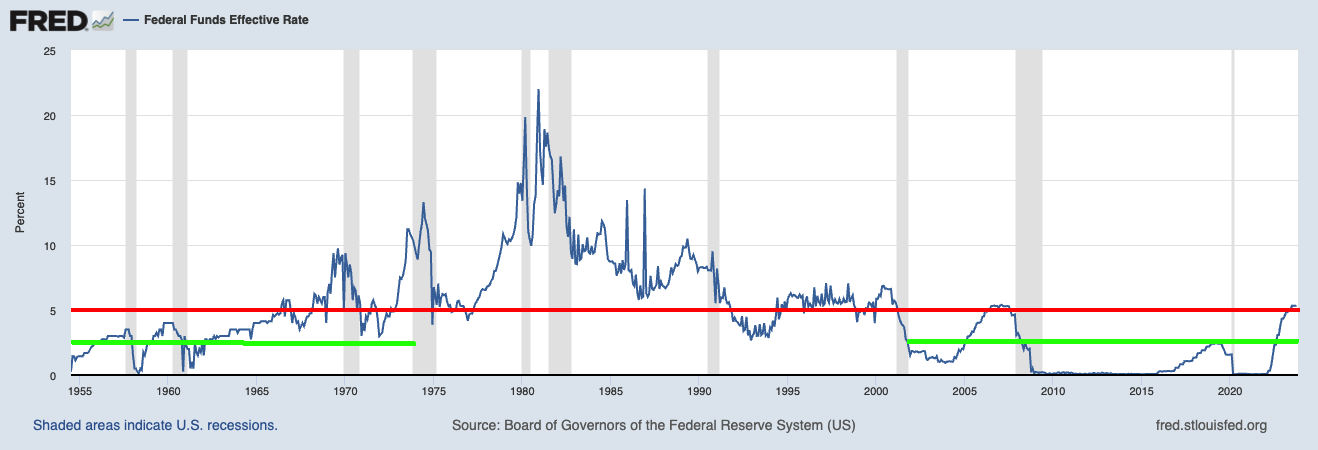

Before yesterday’s FOMC meeting, I reiterated my view from July 2023 that this hiking cycle was – or at least should be...

Before yesterday’s FOMC meeting, I reiterated my view from July 2023 that this hiking cycle was – or at least should be...

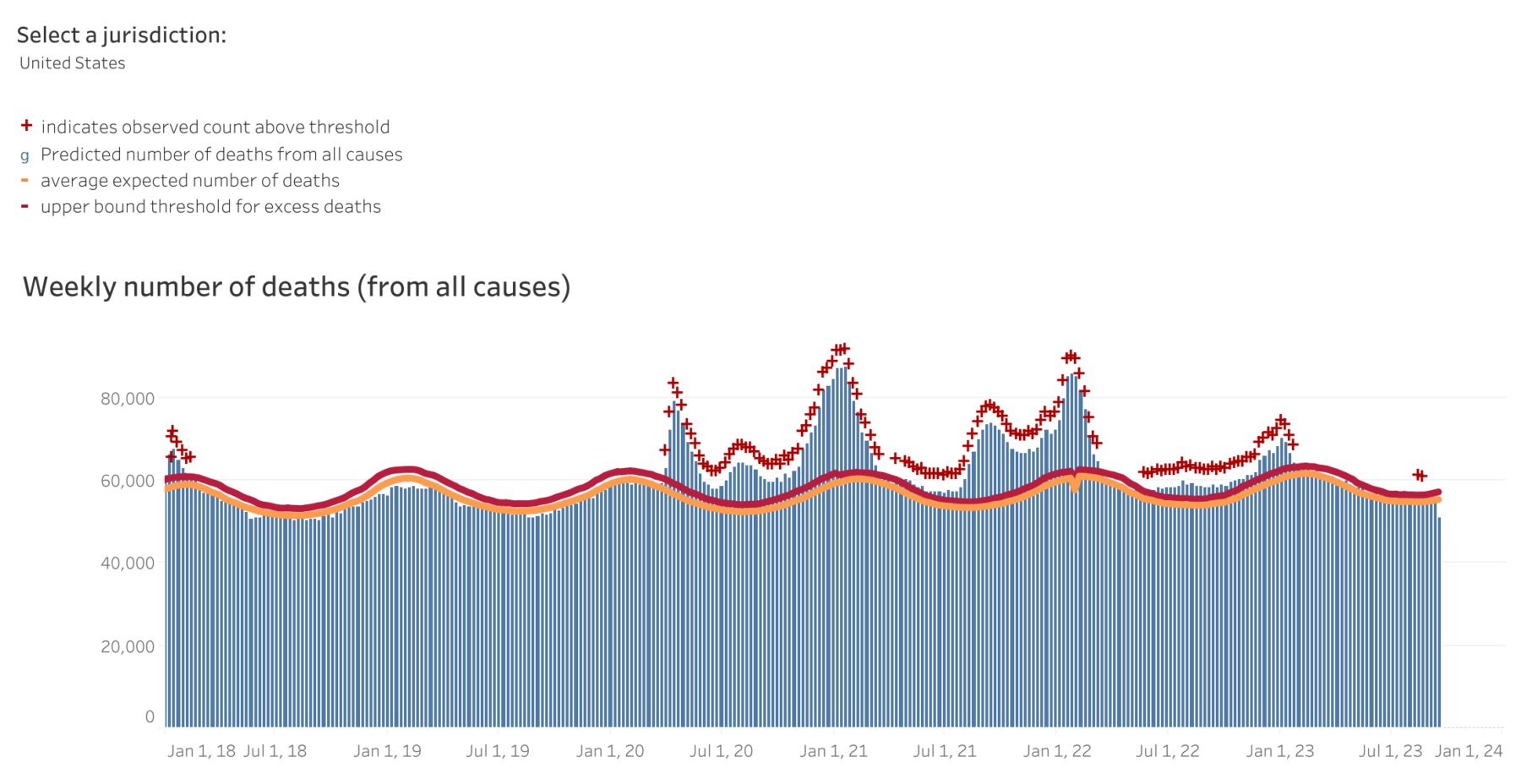

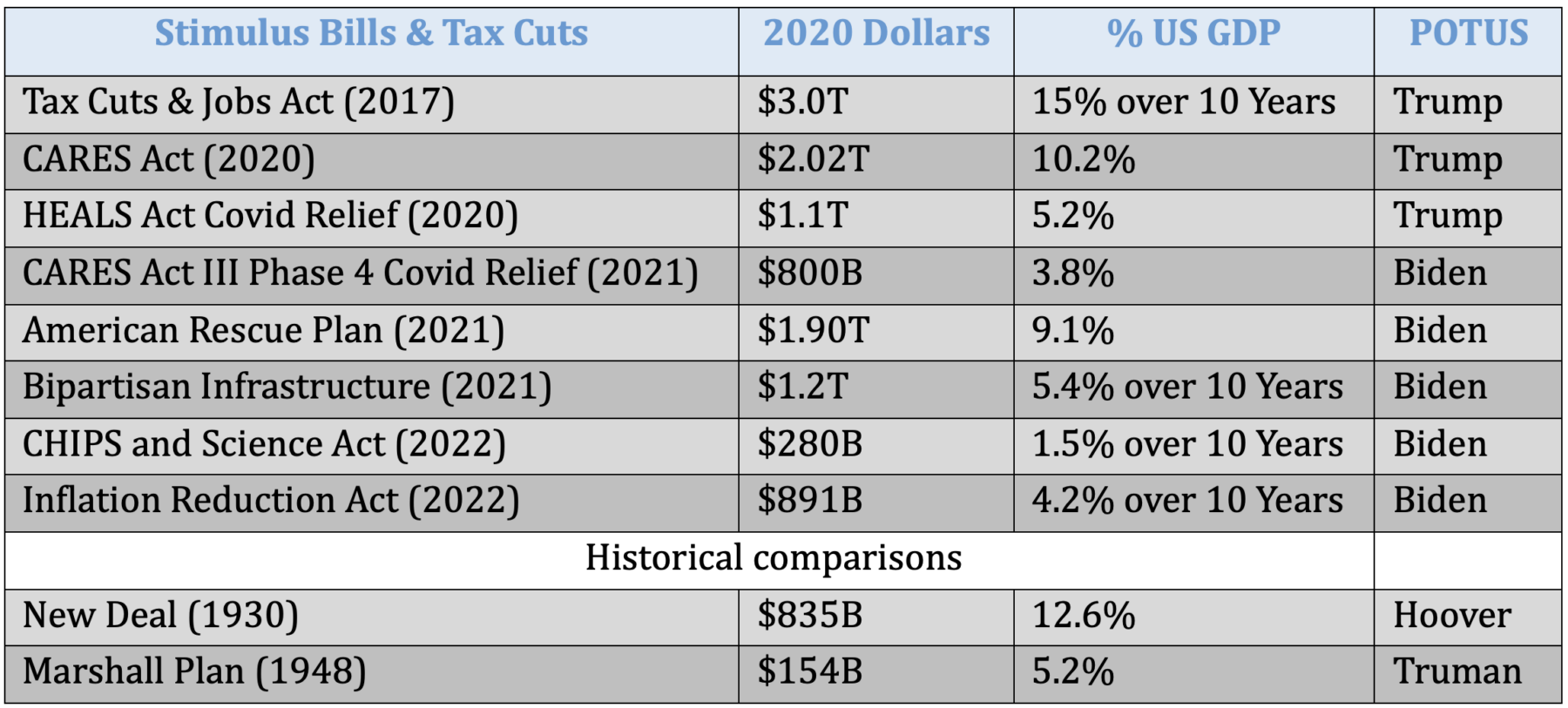

As promised, here is my presentation “Navigating Financial Disasters” from today at the Orlando Money Show…

As promised, here is my presentation “Navigating Financial Disasters” from today at the Orlando Money Show…

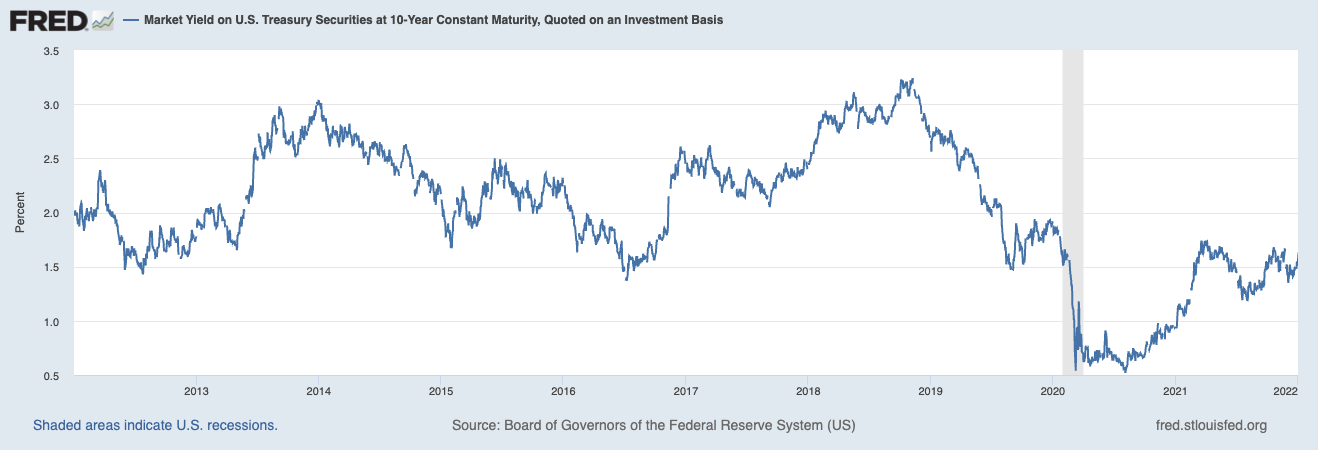

Since the Great Financial Crisis in 2008-09, the income portion of portfolios has been almost an afterthought. Your...

Since the Great Financial Crisis in 2008-09, the income portion of portfolios has been almost an afterthought. Your...

Earlier this year, I gave my first presentation since the pandemic began. I discussed all of the many ways we hurt ourselves...

Earlier this year, I gave my first presentation since the pandemic began. I discussed all of the many ways we hurt ourselves...

Last week, I mentioned the quarterly conference calls I do for clients of RWM, which led to a broad discussion of...

Last week, I mentioned the quarterly conference calls I do for clients of RWM, which led to a broad discussion of...

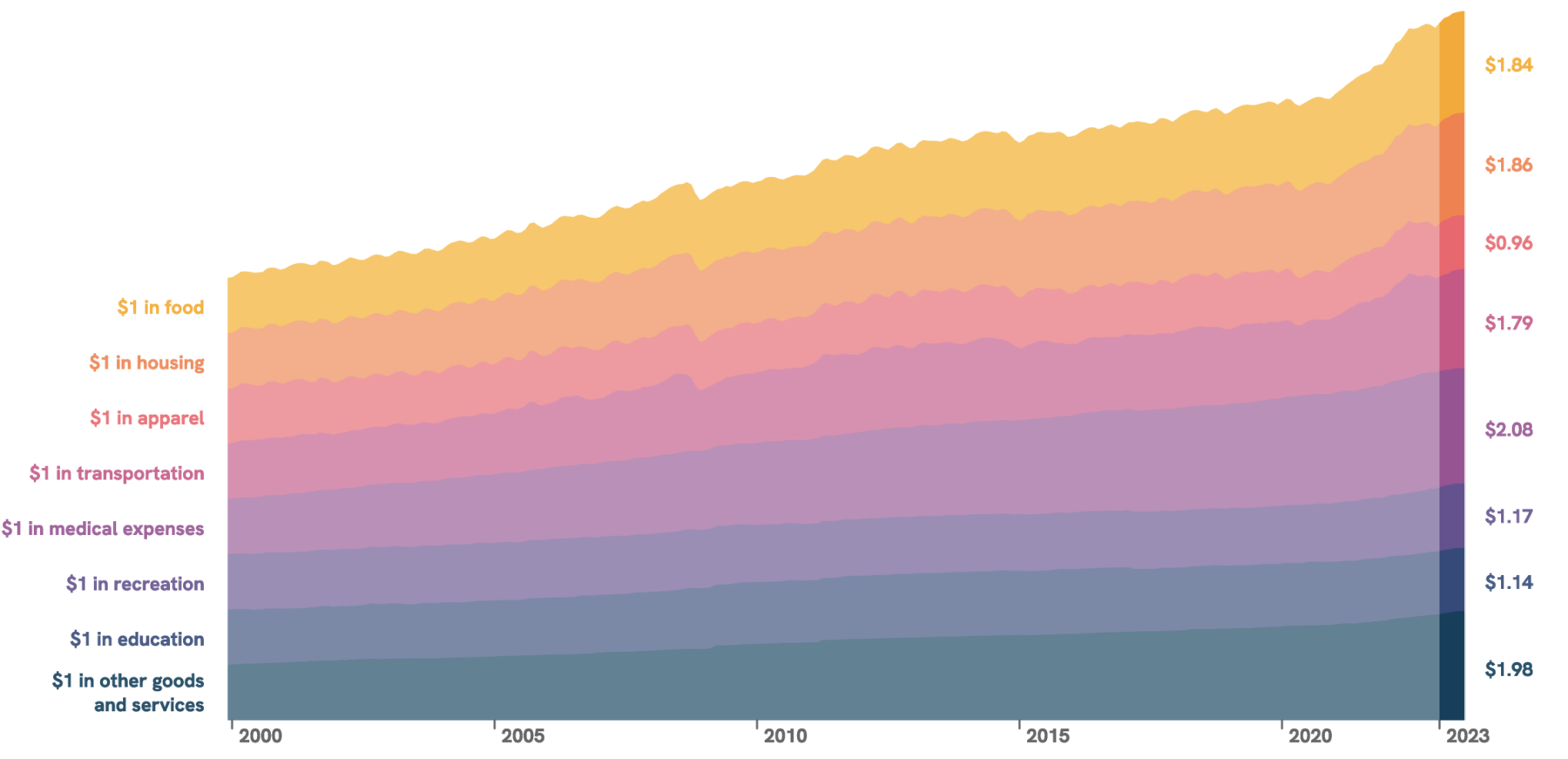

“I need the US Dollar to be a store of value between the time I make it until I spend it, invest it, pay my...

“I need the US Dollar to be a store of value between the time I make it until I spend it, invest it, pay my...

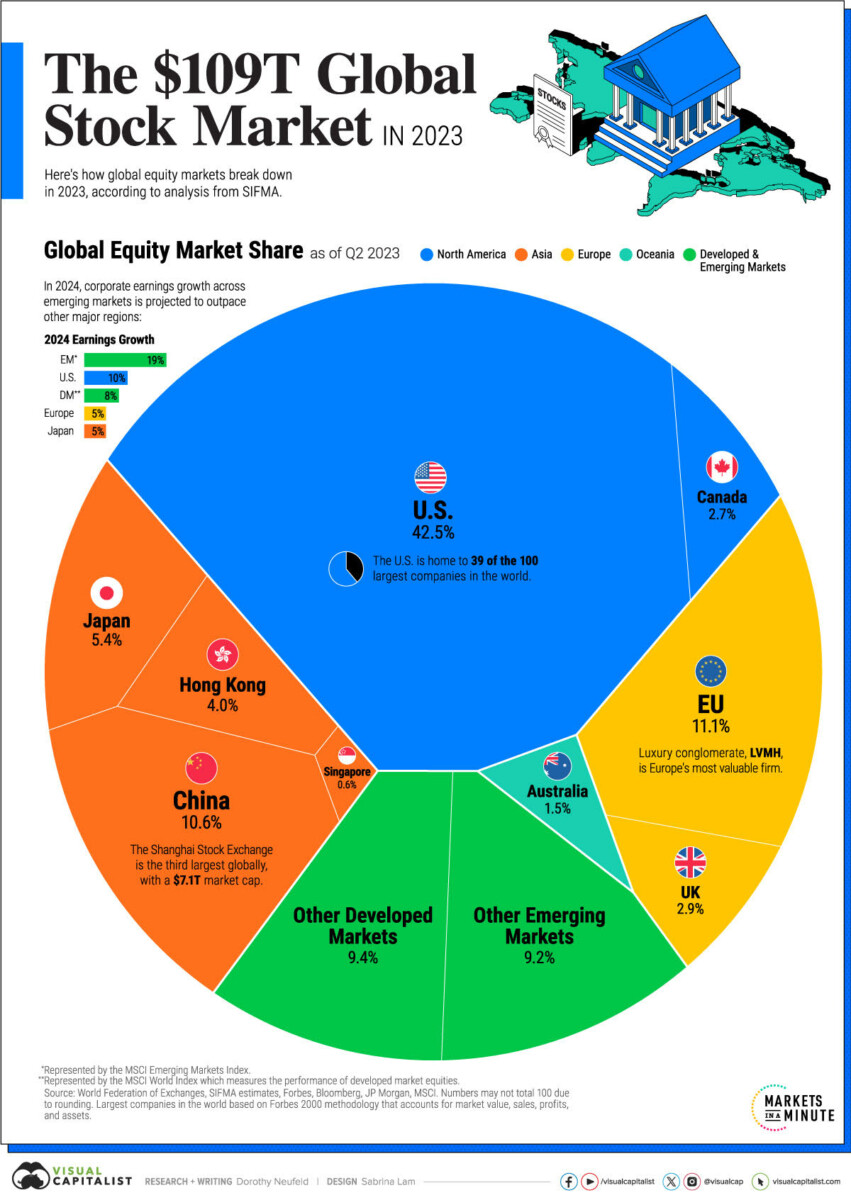

Pretty astonishing number. Here is Visual Capitalist with the details: Global equity markets have nearly tripled in size since...

Pretty astonishing number. Here is Visual Capitalist with the details: Global equity markets have nearly tripled in size since...

Get subscriber-only insights and news delivered by Barry every two weeks.