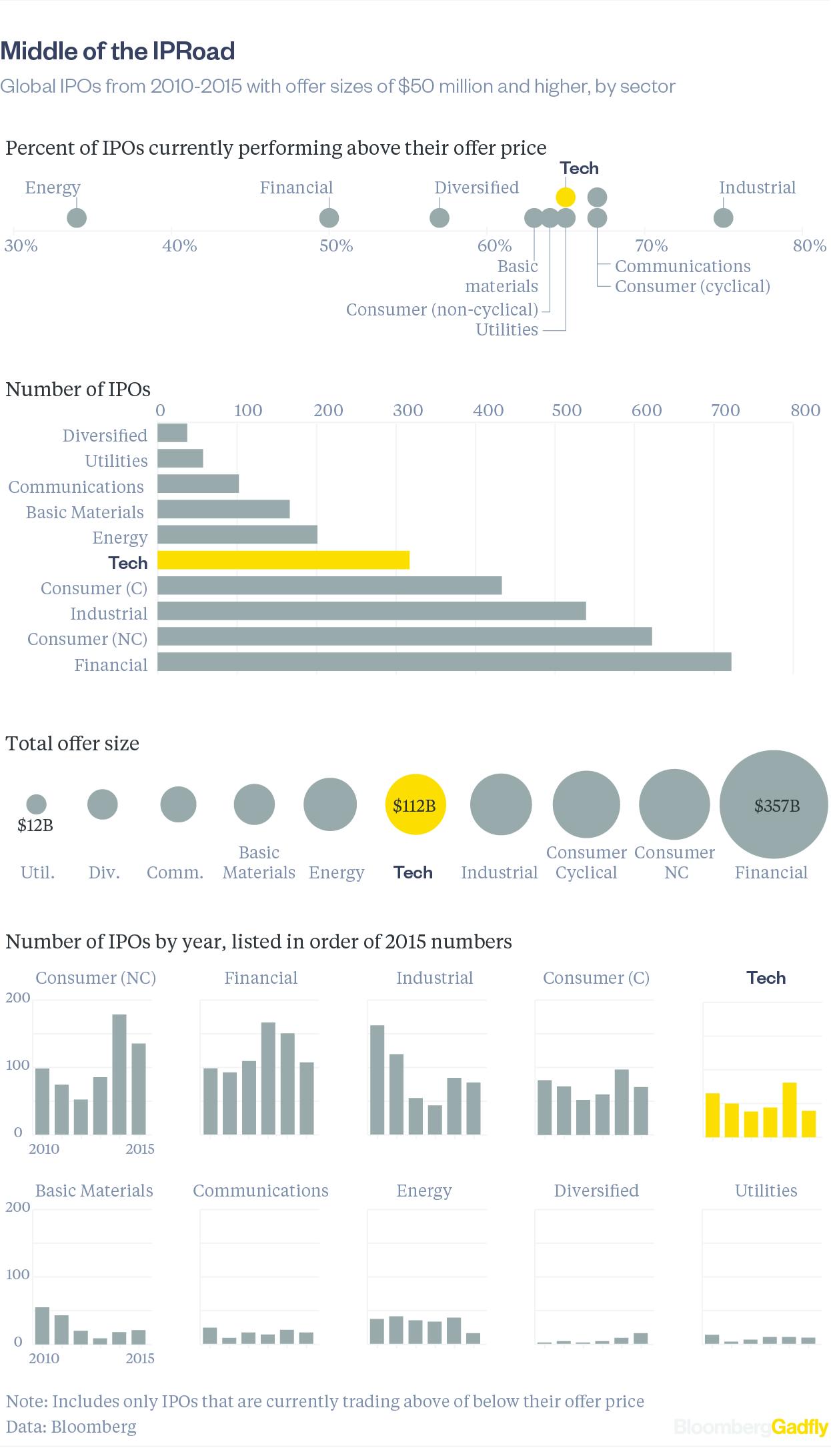

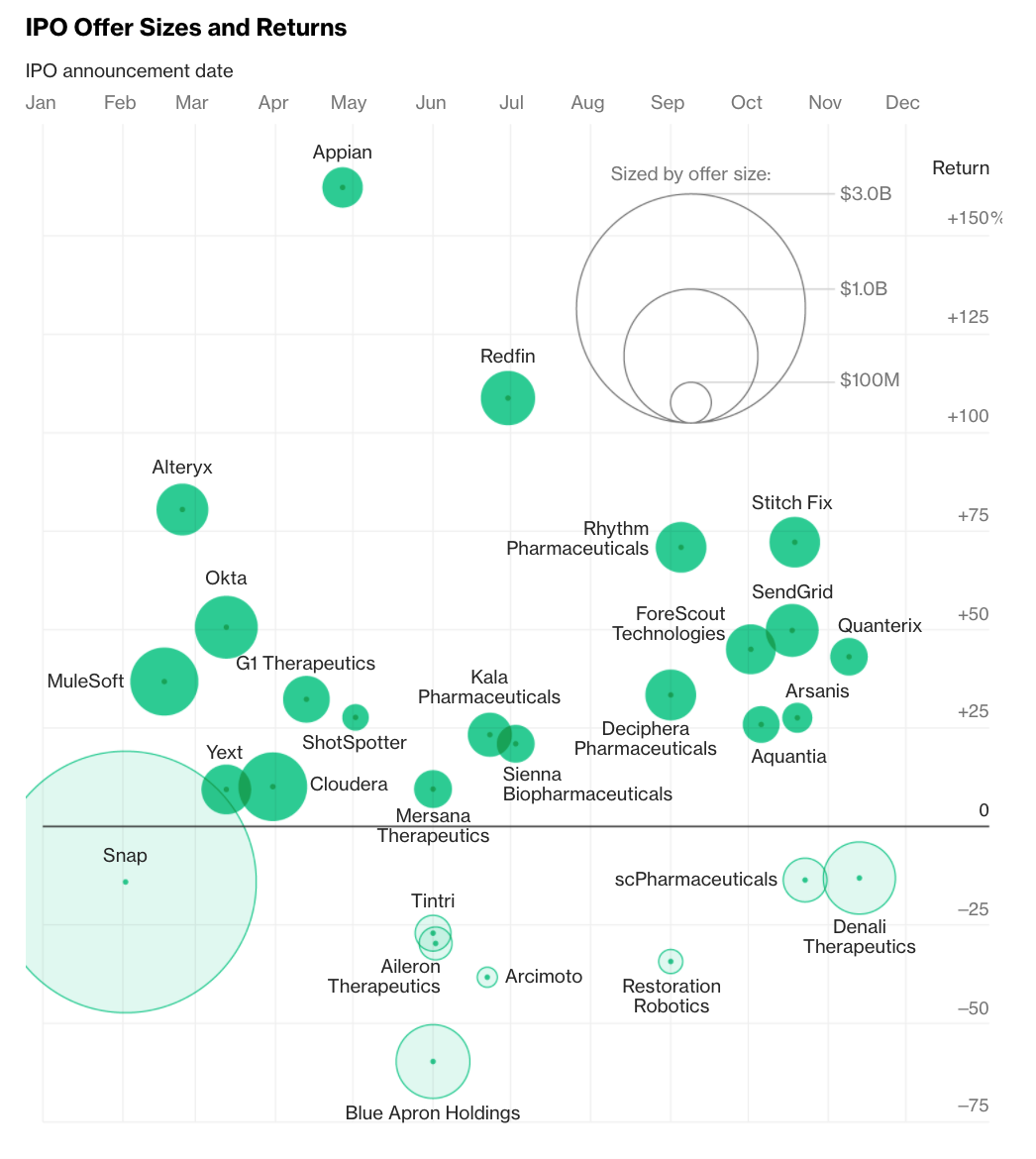

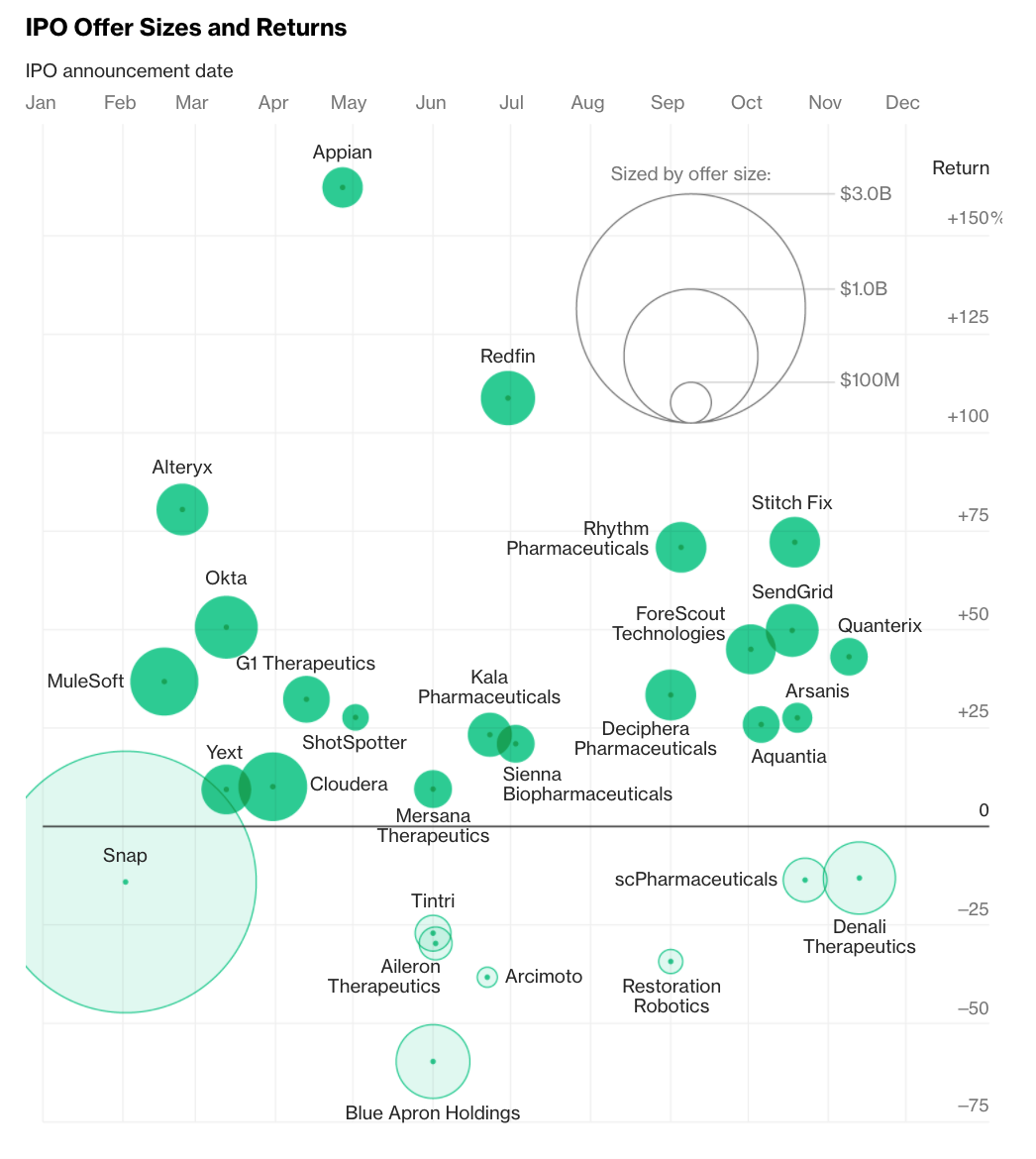

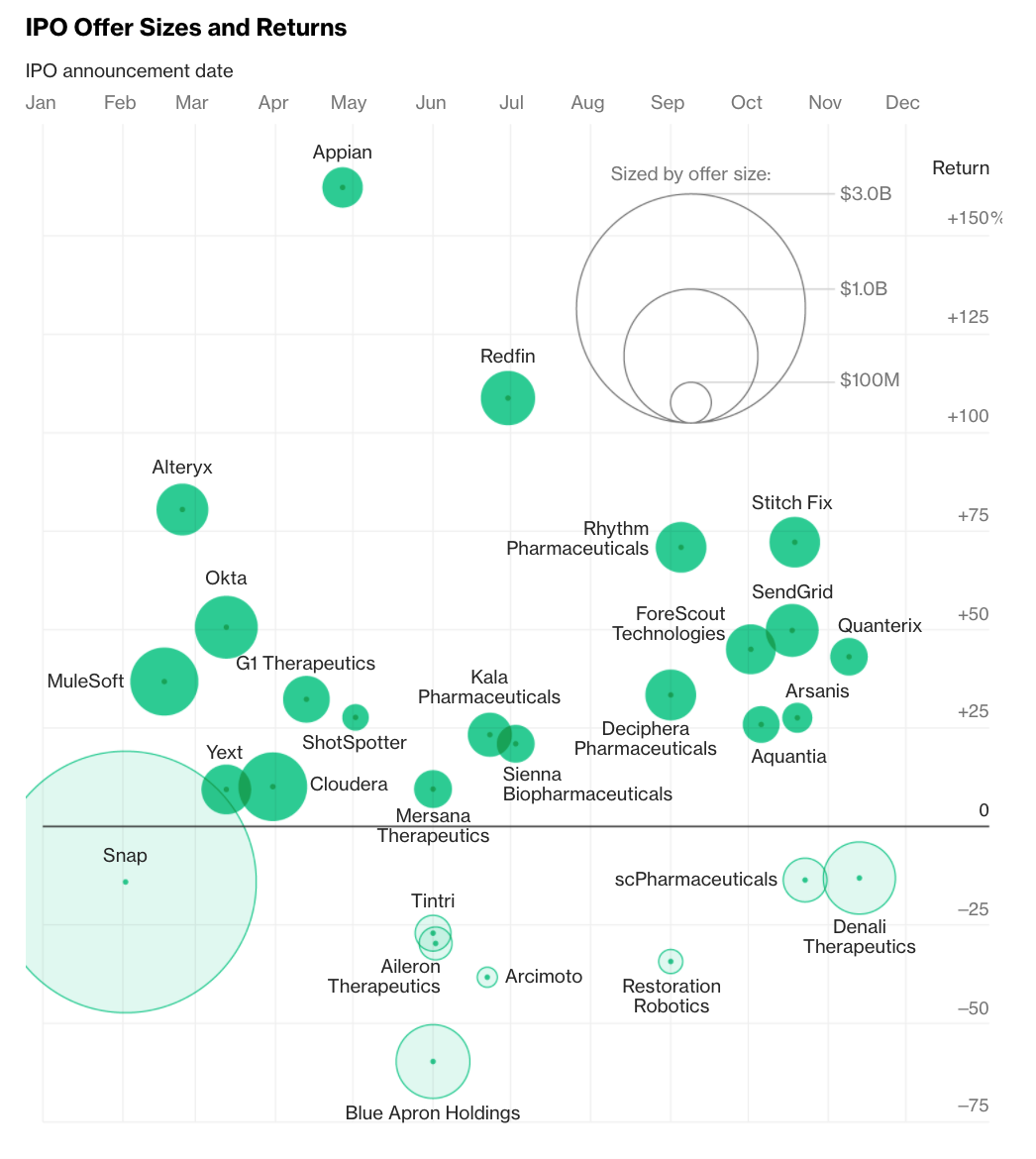

Interesting set of charts: The three largest offerings in 2017 had negative returns. Snap, the biggest offering of the year and...

Interesting set of charts: The three largest offerings in 2017 had negative returns. Snap, the biggest offering of the year and...

Read More

This week on Masters in Business I sit down very busy bankers in the world of M&A and IPOs: Chris Ventresca is Global Co-Head of...

Read More

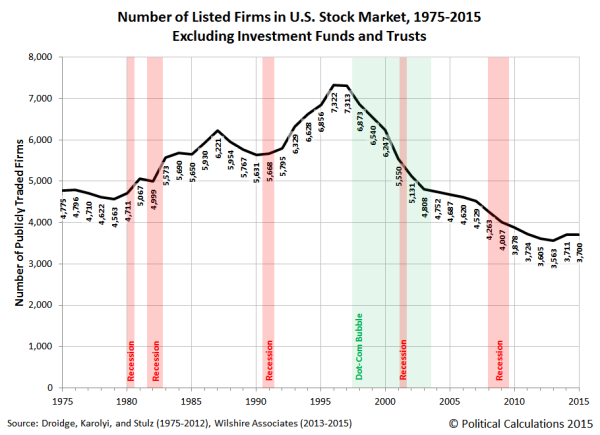

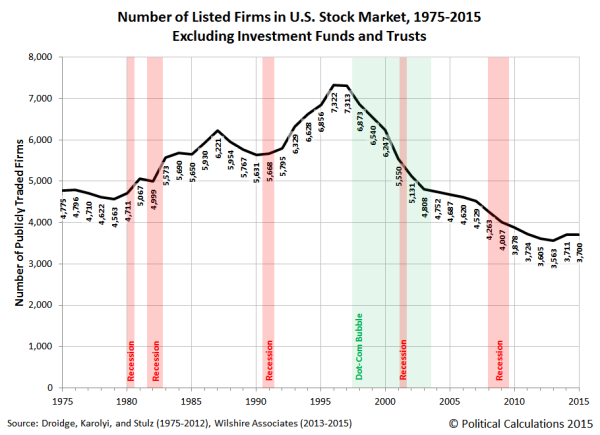

Source: NBER, Political Calculations The U.S. now has half as many publicly listed companies trading on its exchanges as it did at...

Source: NBER, Political Calculations The U.S. now has half as many publicly listed companies trading on its exchanges as it did at...

Read More

If there was ever a more widely anticipated and publicized IPO than PALM, a commenter will have to remind me what it was. [BR: Google?]...

Read More

Interesting set of charts: The three largest offerings in 2017 had negative returns. Snap, the biggest offering of the year and...

Interesting set of charts: The three largest offerings in 2017 had negative returns. Snap, the biggest offering of the year and...

Interesting set of charts: The three largest offerings in 2017 had negative returns. Snap, the biggest offering of the year and...

Interesting set of charts: The three largest offerings in 2017 had negative returns. Snap, the biggest offering of the year and...