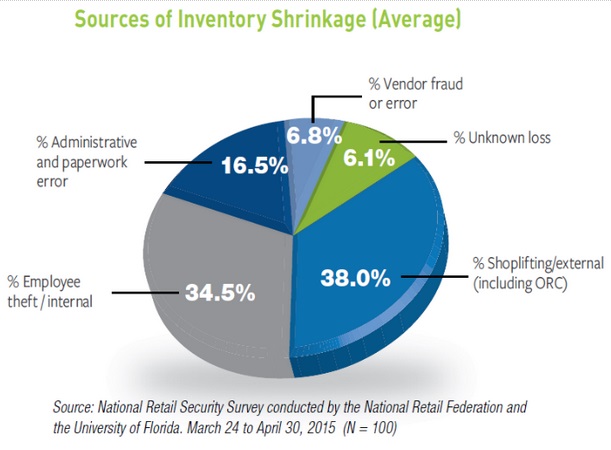

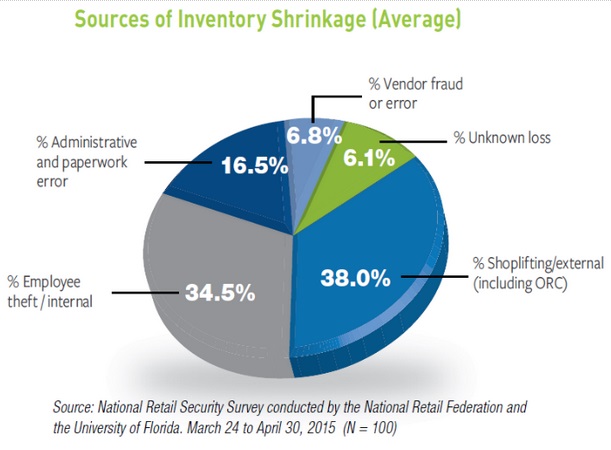

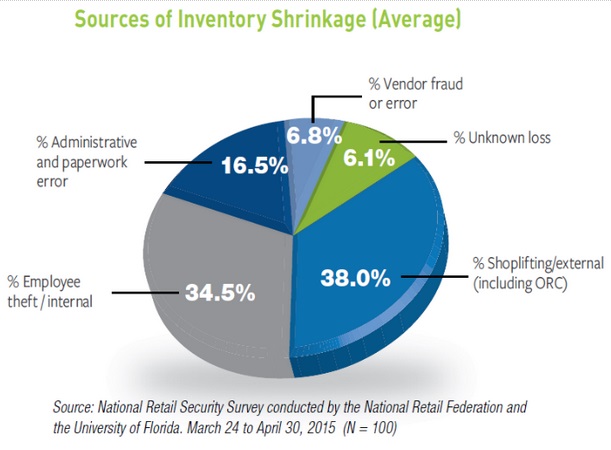

No, “nearly half” of $94.5 billion in retail inventory losses in 2021 was not “attributable to organized retail crime.”...

No, “nearly half” of $94.5 billion in retail inventory losses in 2021 was not “attributable to organized retail crime.”...

Read More

The transcript from this week’s, MiB: Zeke Faux, Number Go Up, is below. You can stream and download our full...

Read More

This week, we speak with Zeke Faux,1 an investigative reporter for Bloomberg Businessweek and Bloomberg News....

Read More

Earlier this year, I gave my first presentation since the pandemic began. I discussed all of the many ways we hurt ourselves...

Earlier this year, I gave my first presentation since the pandemic began. I discussed all of the many ways we hurt ourselves...

Read More

The transcript from this week’s, MiB: Michael Lewis on SBF & FTX, is below. You can stream and download...

Read More

This week, we speak with Michael Lewis, whose latest book is “Going Infinite: The Rise and Fall of a New Tycoon,”...

Read More

The transcript from this week’s MiB Cass Sunstein on Decision Making, is below. You can stream and download our full...

Read More

This week, we speak with legal scholar Cass Sunstein, who founded and leads Harvard Law School’s Program on Behavioral...

Read More

The transcript from this week’s, MiB: Brian Hamburger, MarketCounsel, is below. You can stream and download...

Read More

This week, we speak with Brian Hamburger, founder and chief executive officer of the business / regulatory...

Read More

No, “nearly half” of $94.5 billion in retail inventory losses in 2021 was not “attributable to organized retail crime.”...

No, “nearly half” of $94.5 billion in retail inventory losses in 2021 was not “attributable to organized retail crime.”...

No, “nearly half” of $94.5 billion in retail inventory losses in 2021 was not “attributable to organized retail crime.”...

No, “nearly half” of $94.5 billion in retail inventory losses in 2021 was not “attributable to organized retail crime.”...