There is a fascinating long-form article in the Washington Post about the murder of an investigative reporter who was...

There is a fascinating long-form article in the Washington Post about the murder of an investigative reporter who was...

Read More

I am genuinely excited about a new presentation I have been working on since the holidays: How to Avoid Financial Disasters. My...

I am genuinely excited about a new presentation I have been working on since the holidays: How to Avoid Financial Disasters. My...

Read More

The transcript from this week’s, MiB: Bill Browder on Finance, Murder and Justice, is below. You can stream...

Read More

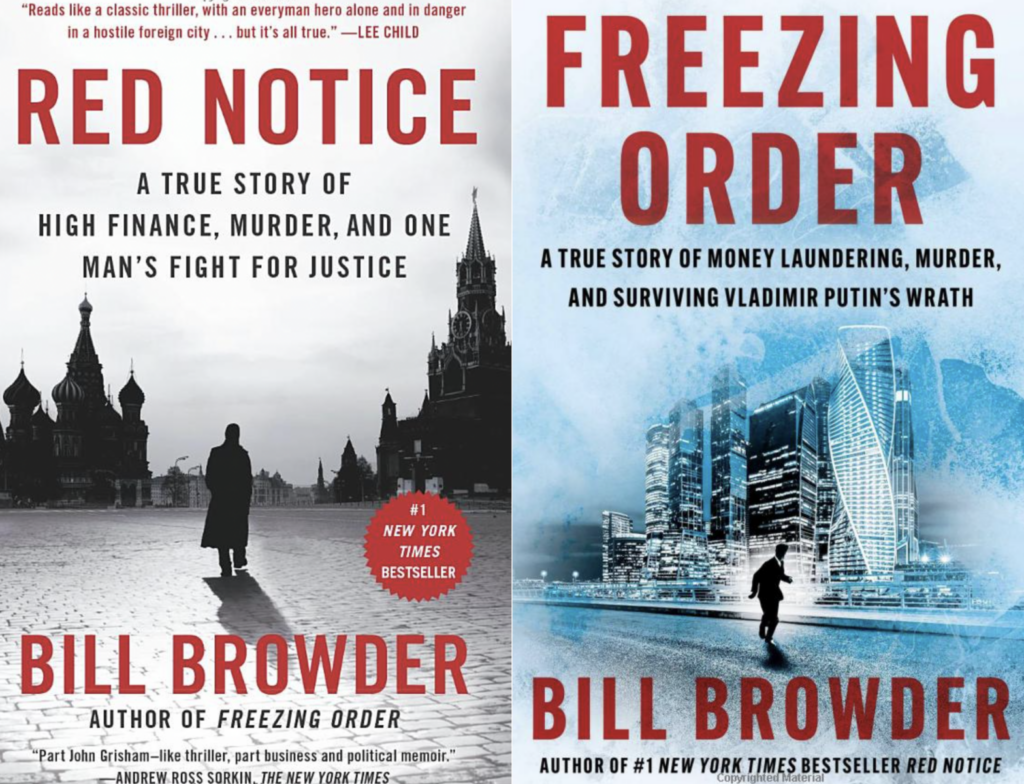

This week, we speak with Bill Browder, who is head of the Global Magnitsky Justice Campaign and author of the recently released...

Read More

“Freezing Order: A True Story of Money Laundering, Murder, and Surviving Vladimir Putin’s Wrath“...

“Freezing Order: A True Story of Money Laundering, Murder, and Surviving Vladimir Putin’s Wrath“...

Read More

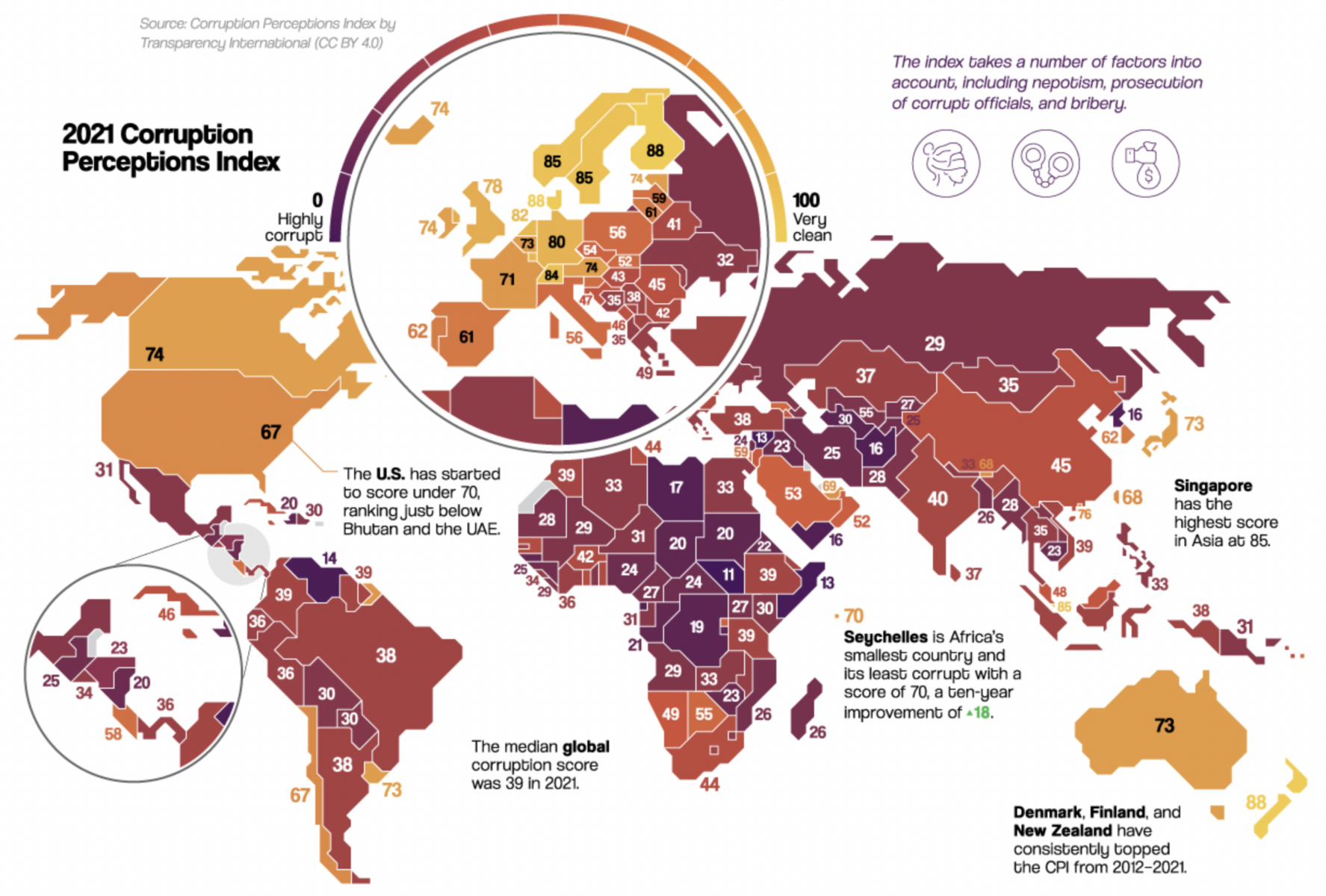

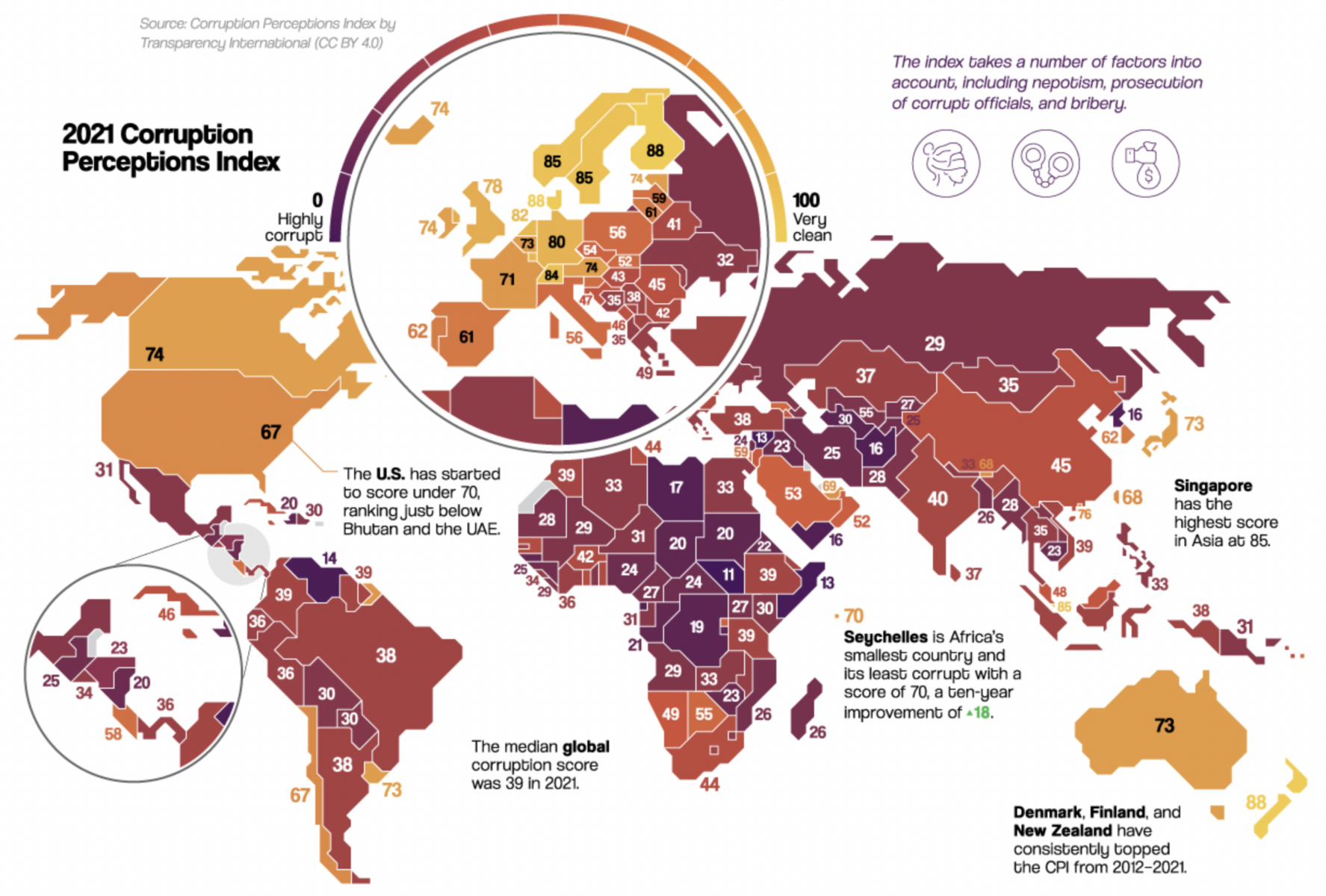

Source: Visual Capitalist As the Russian invasion of Ukraine wears on, this is as good a time as any to share this map of...

Source: Visual Capitalist As the Russian invasion of Ukraine wears on, this is as good a time as any to share this map of...

Read More

“And I know I’m fakin’ it, I’m not really makin’ it.” –Simon & Garfunkle...

Read More

Now that’s a rock star. You remember rock stars, don’t you? Probably not if you’re a millennial or younger. Rock...

Now that’s a rock star. You remember rock stars, don’t you? Probably not if you’re a millennial or younger. Rock...

Read More

To hear an audio spoken word version of this post, click here. Maybe it is a coincidence. Or maybe there are only...

To hear an audio spoken word version of this post, click here. Maybe it is a coincidence. Or maybe there are only...

Read More

To hear an audio spoken word version of this post, click here. “In every...

To hear an audio spoken word version of this post, click here. “In every...

Read More

There is a fascinating long-form article in the Washington Post about the murder of an investigative reporter who was...

There is a fascinating long-form article in the Washington Post about the murder of an investigative reporter who was...

There is a fascinating long-form article in the Washington Post about the murder of an investigative reporter who was...

There is a fascinating long-form article in the Washington Post about the murder of an investigative reporter who was...