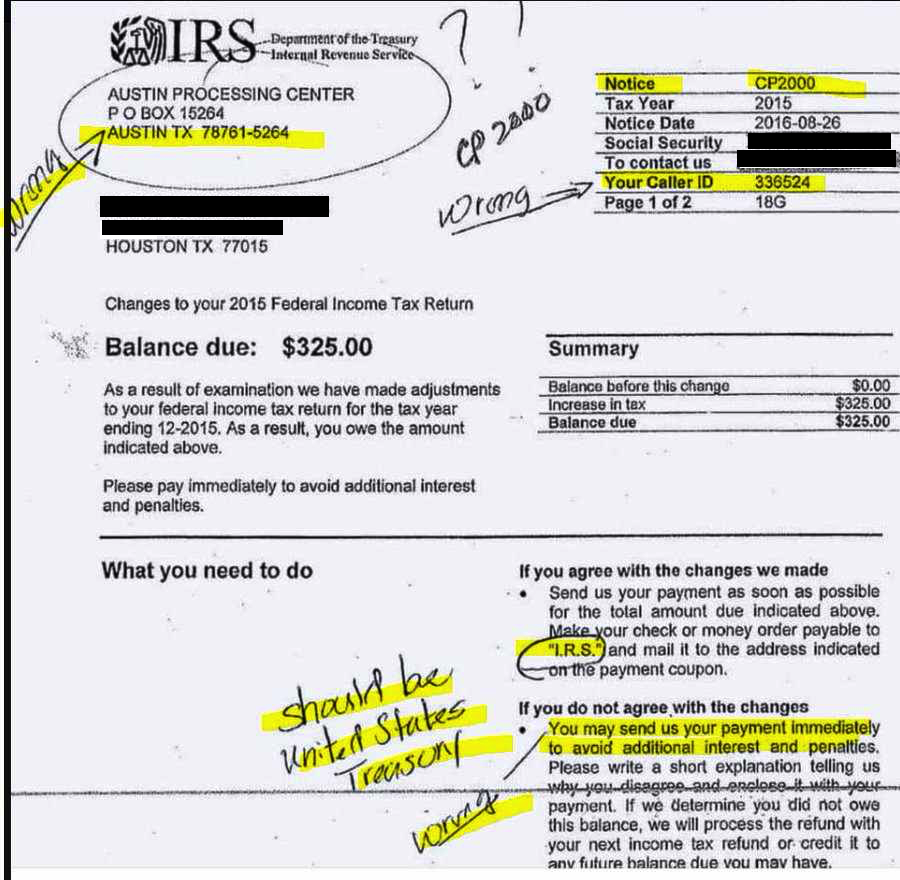

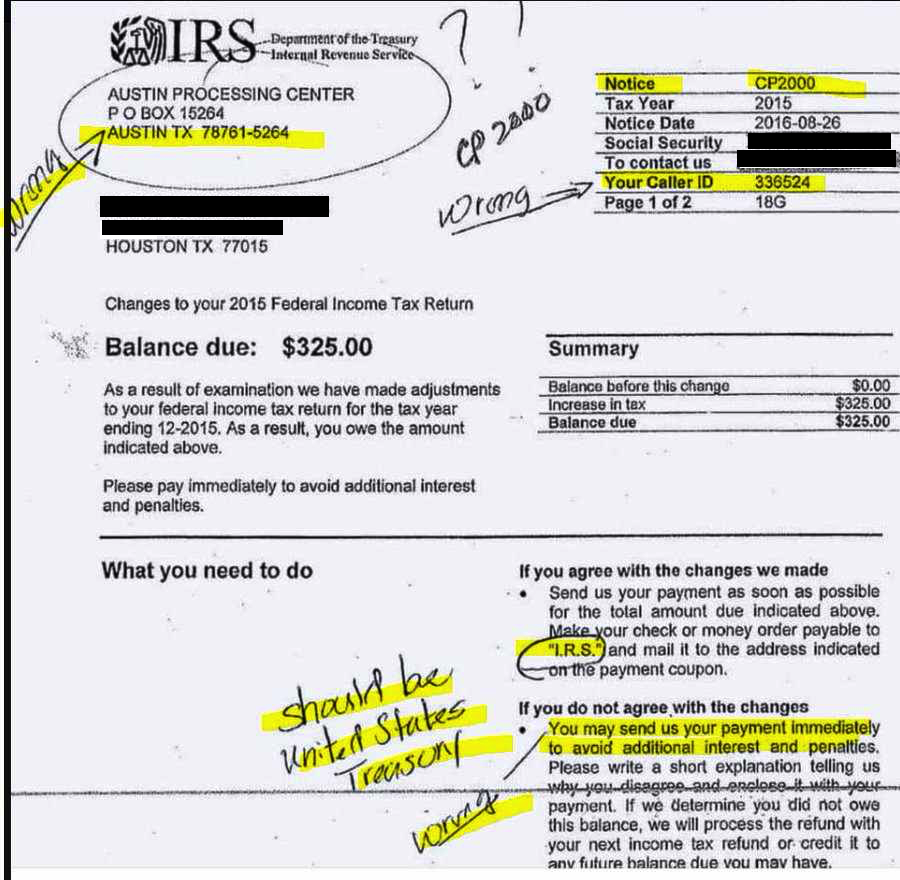

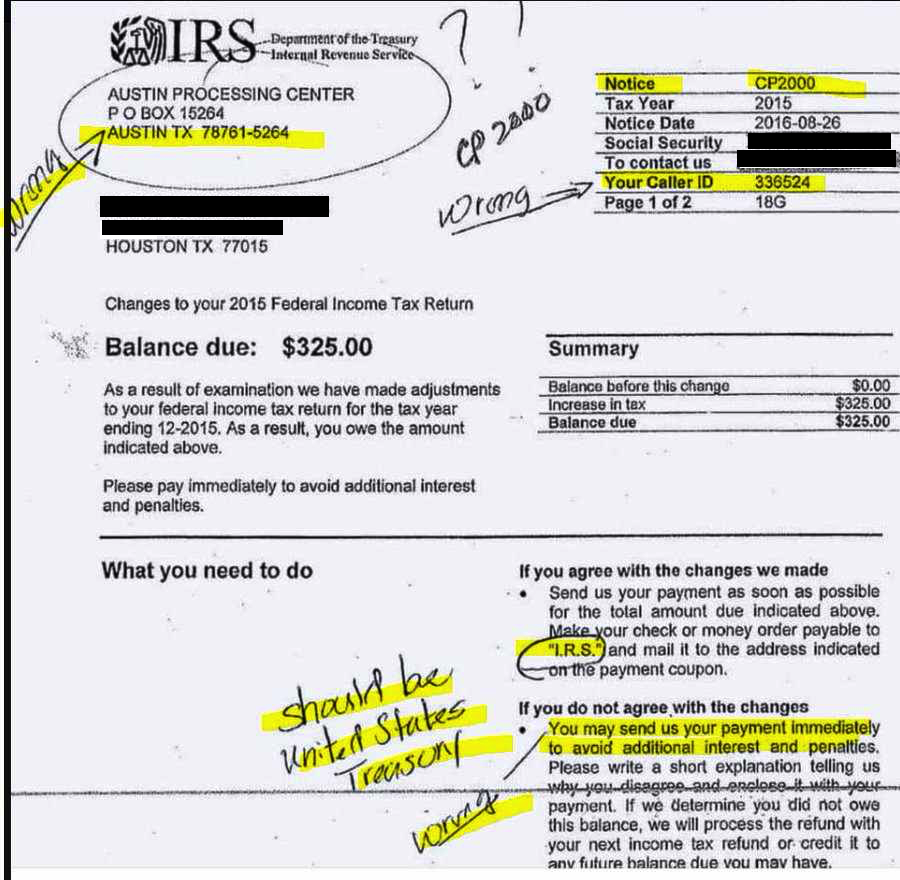

Before we get into the specifics of this fraud, some reminders: (1) The IRS will never call you to initiate an...

Before we get into the specifics of this fraud, some reminders: (1) The IRS will never call you to initiate an...

Read More

I have referenced my colleague Matt Levine’s work at Bloomberg Opinion many times in the past. What he wrote about yesterday struck...

Read More

According to veteran Wall Street Journal and New York Times reporter David Enrich, Deutsche Bank is a rogue financial institution –...

Read More

Matt Levine writes the Money Stuff daily column covering finance at Bloomberg. He was an editor of Dealbreaker, an investment banker at...

Read More

Hedge Funds and Private Equity Need Full Disclosure Many function just like mutual funds or ETFs, yet operate behind a veil of secrecy....

Read More

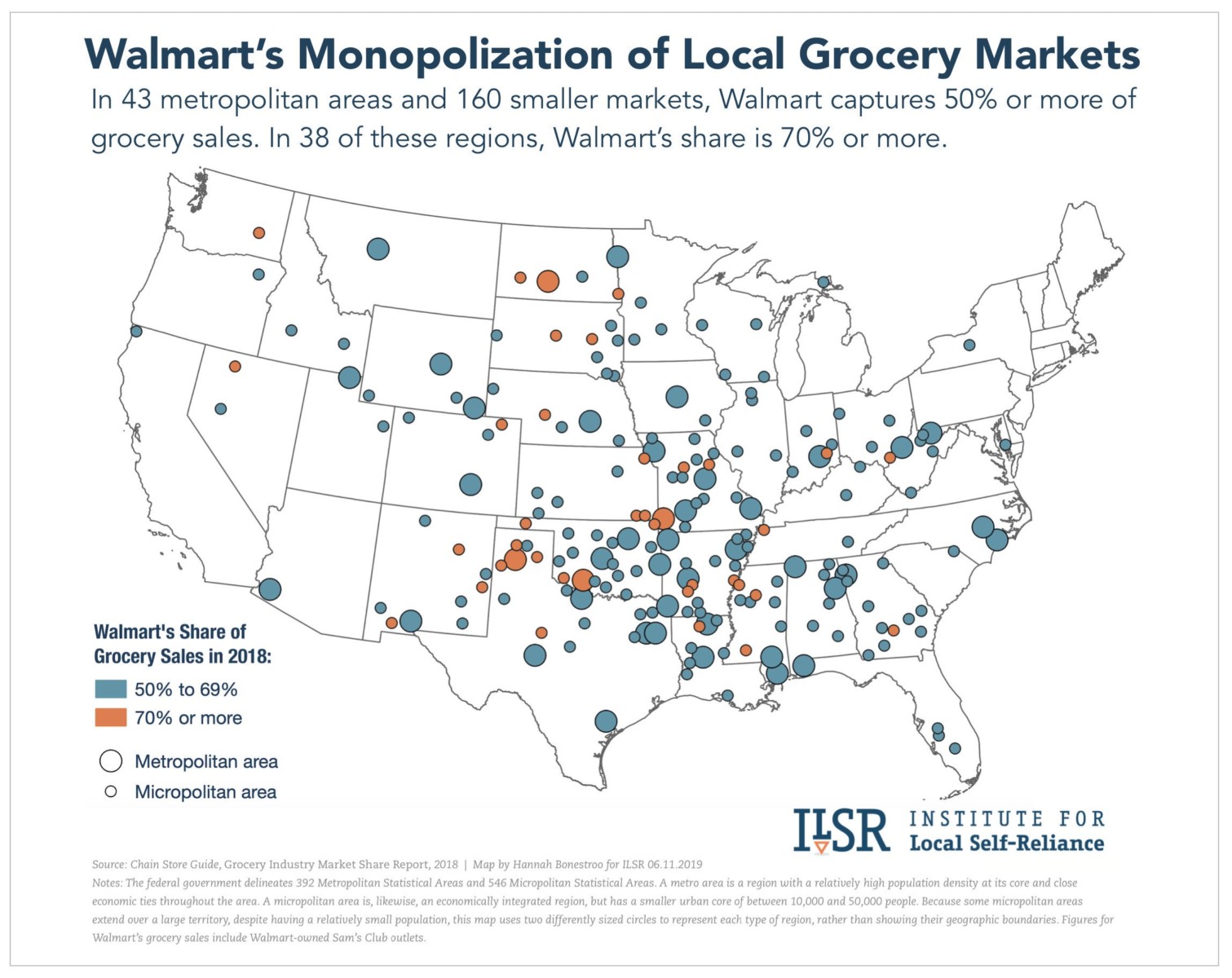

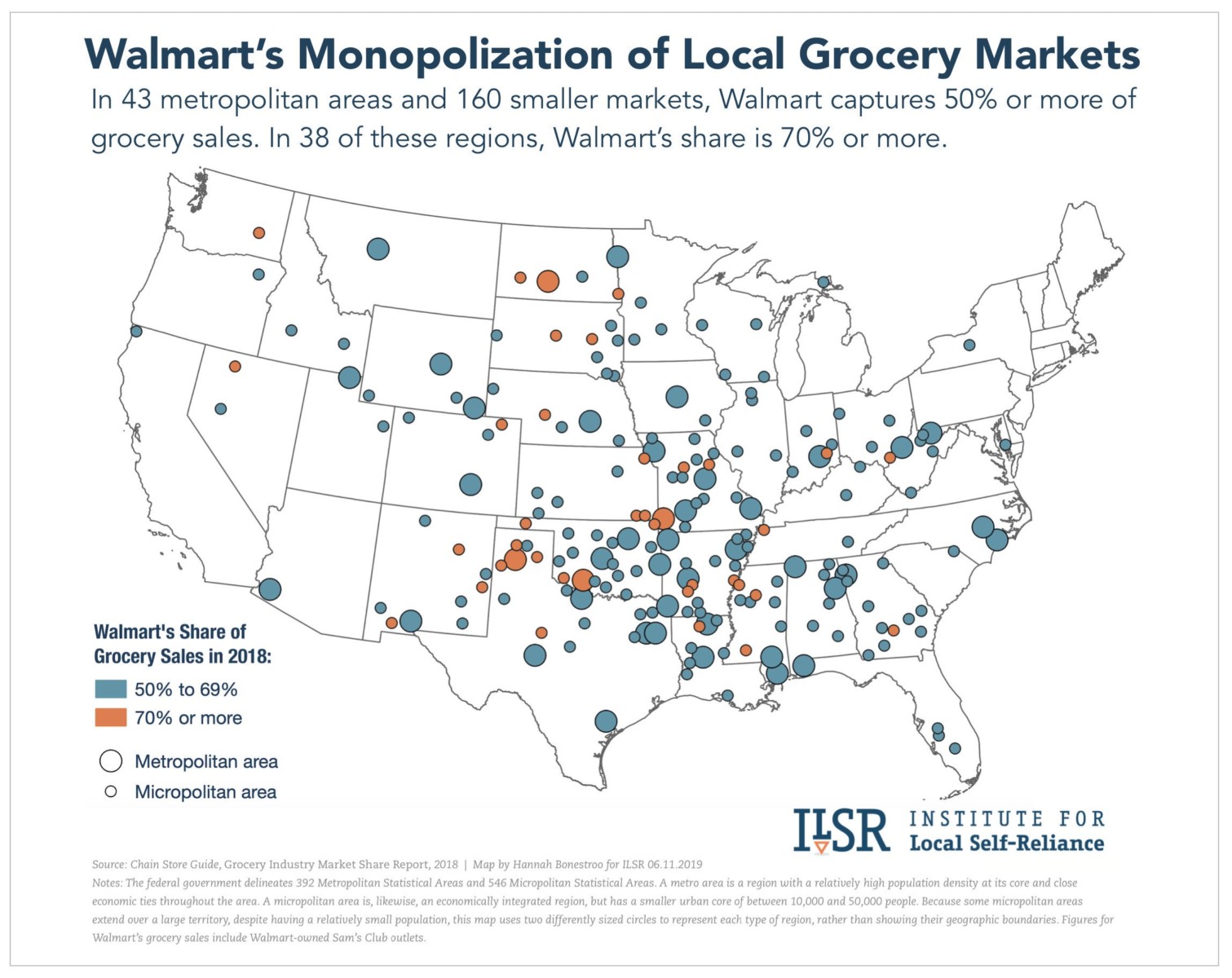

Source: ILSR; Hat tip Stacy Mitchell This is a fascinating read from ILSR as to how Wal-Mart became the dominant grocer in the...

Source: ILSR; Hat tip Stacy Mitchell This is a fascinating read from ILSR as to how Wal-Mart became the dominant grocer in the...

Read More

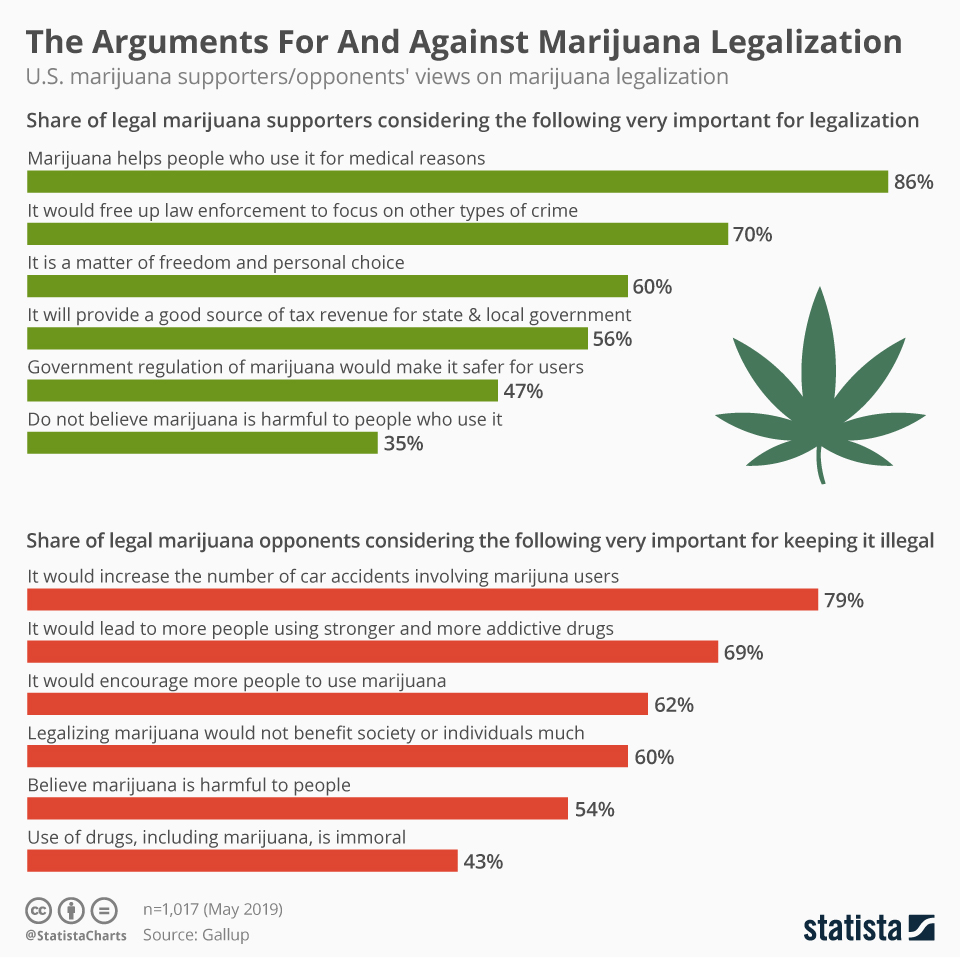

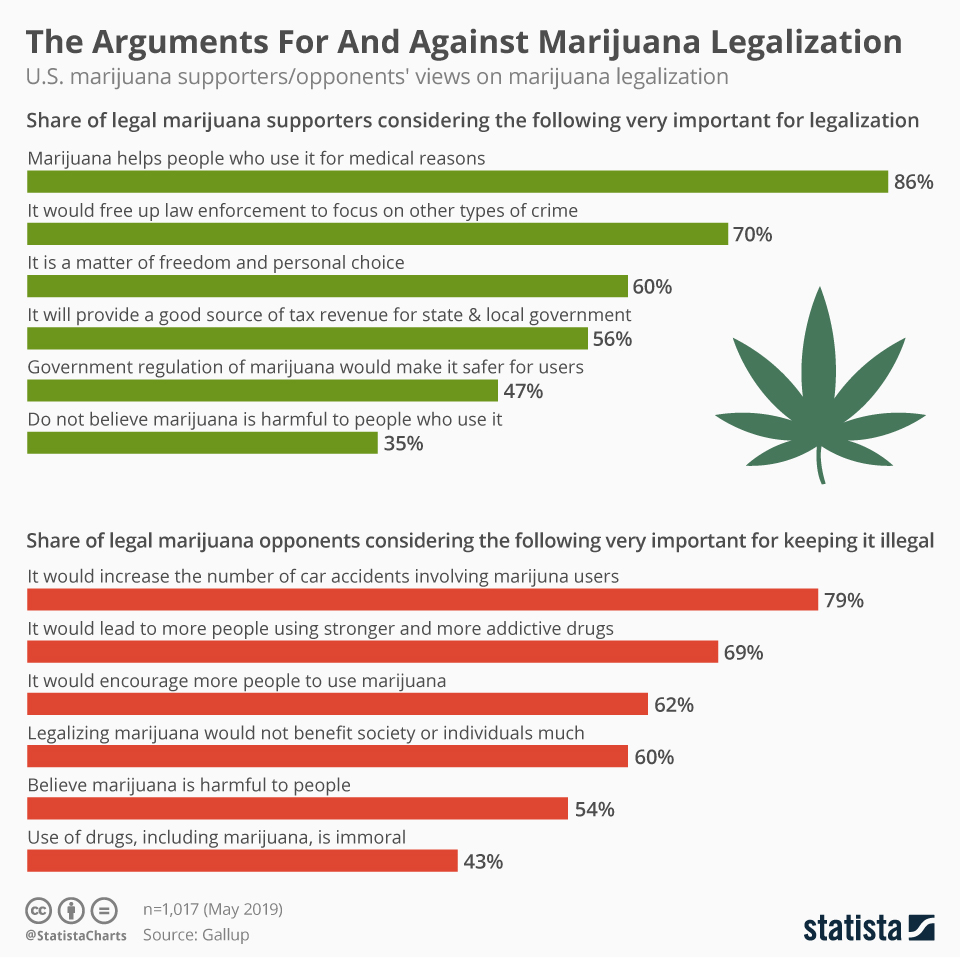

Gallup: “Sixty-six percent of Americans now support legalizing marijuana, another new high in Gallup’s trend over nearly half...

Gallup: “Sixty-six percent of Americans now support legalizing marijuana, another new high in Gallup’s trend over nearly half...

Read More

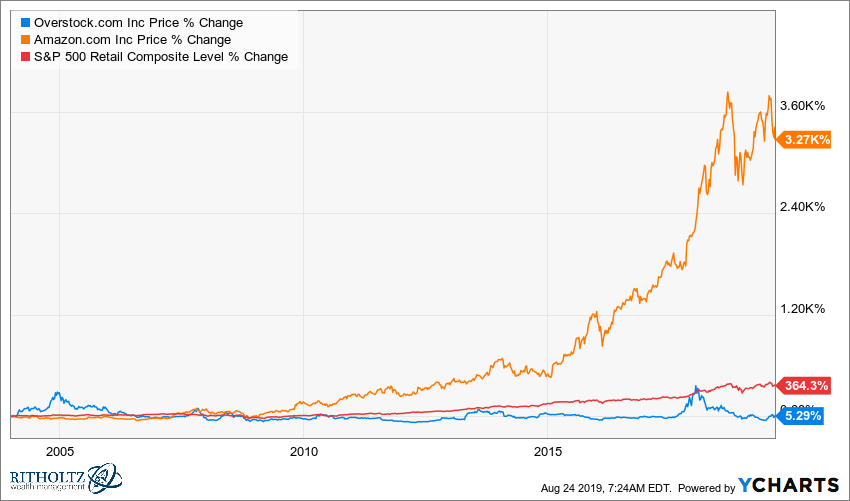

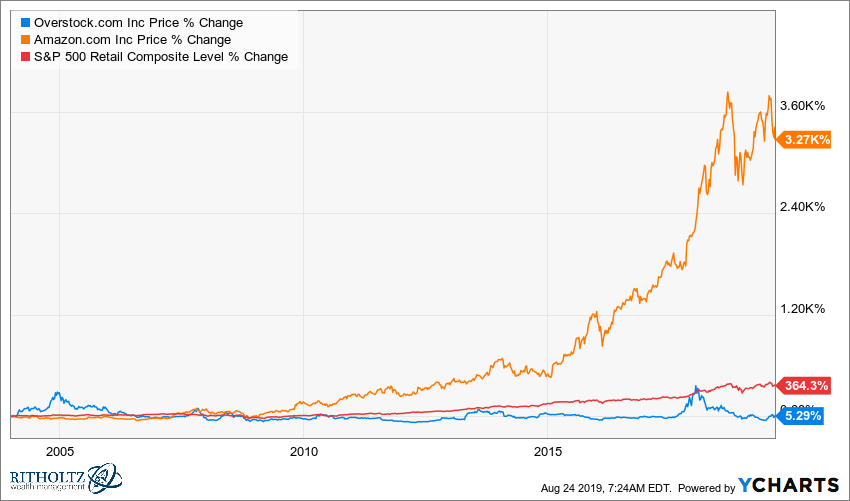

I never went looking for a fight with Overstock. It is not what I cover, and its weird collection of oddball employees, sycophants and...

I never went looking for a fight with Overstock. It is not what I cover, and its weird collection of oddball employees, sycophants and...

Read More

It could be the biggest money-laundering scheme in history, with suspicious money flowing from Russia and former Soviet republics

Read More

Index Funds Don’t Hurt Consumers, But Monopolies Do Critics of passive investing blame the wrong thing for higher prices in some...

Read More

Before we get into the specifics of this fraud, some reminders: (1) The IRS will never call you to initiate an...

Before we get into the specifics of this fraud, some reminders: (1) The IRS will never call you to initiate an...

Before we get into the specifics of this fraud, some reminders: (1) The IRS will never call you to initiate an...

Before we get into the specifics of this fraud, some reminders: (1) The IRS will never call you to initiate an...