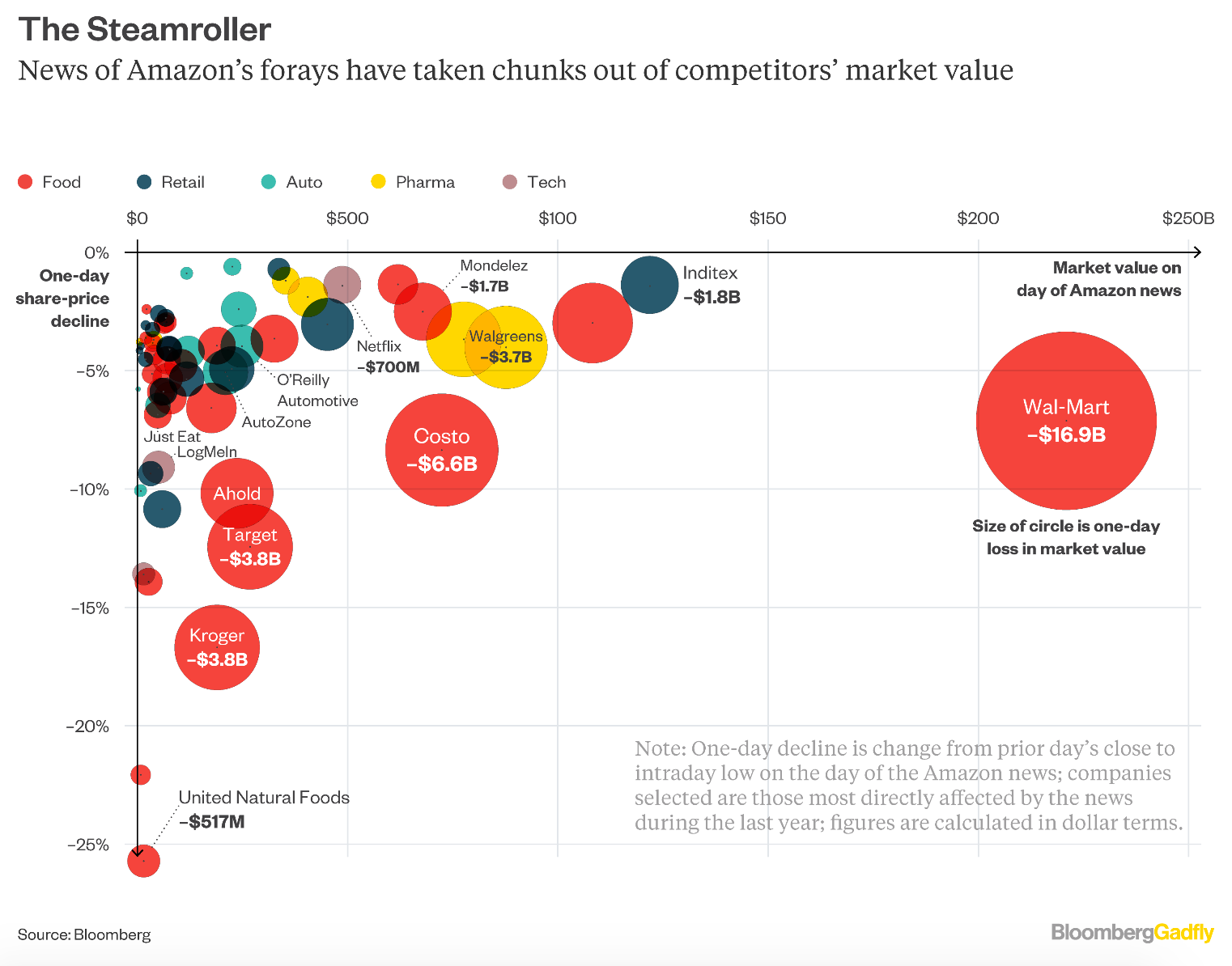

Very cool graphic : Source: Bloomberg Gadfly

Very cool graphic : Source: Bloomberg Gadfly

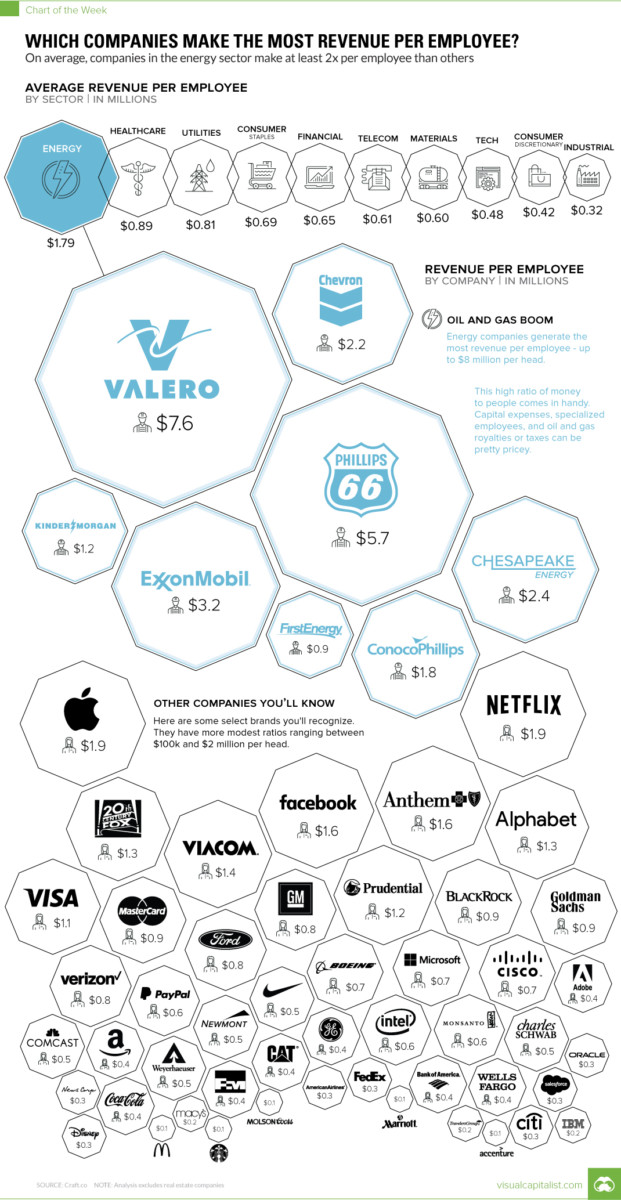

Which Companies Make The Most Revenue Per Employee?

In light of today’s big Whole Foods acquisition by Amazon, this is a kinda intriguing metric; its worth pointing out that on...

In light of today’s big Whole Foods acquisition by Amazon, this is a kinda intriguing metric; its worth pointing out that on...

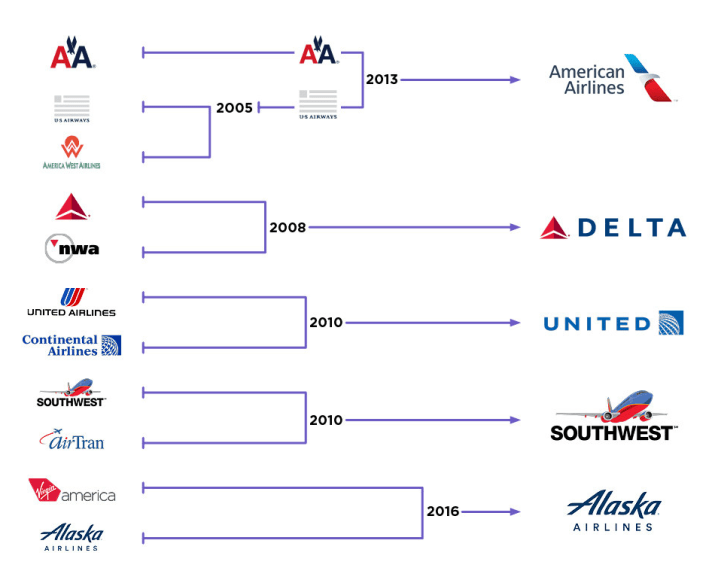

Airline Deregulation #Fail

We have all been suitably horrified by the #United Airlines video of the customer who was knocked unconscious and had his teeth broken....

We have all been suitably horrified by the #United Airlines video of the customer who was knocked unconscious and had his teeth broken....

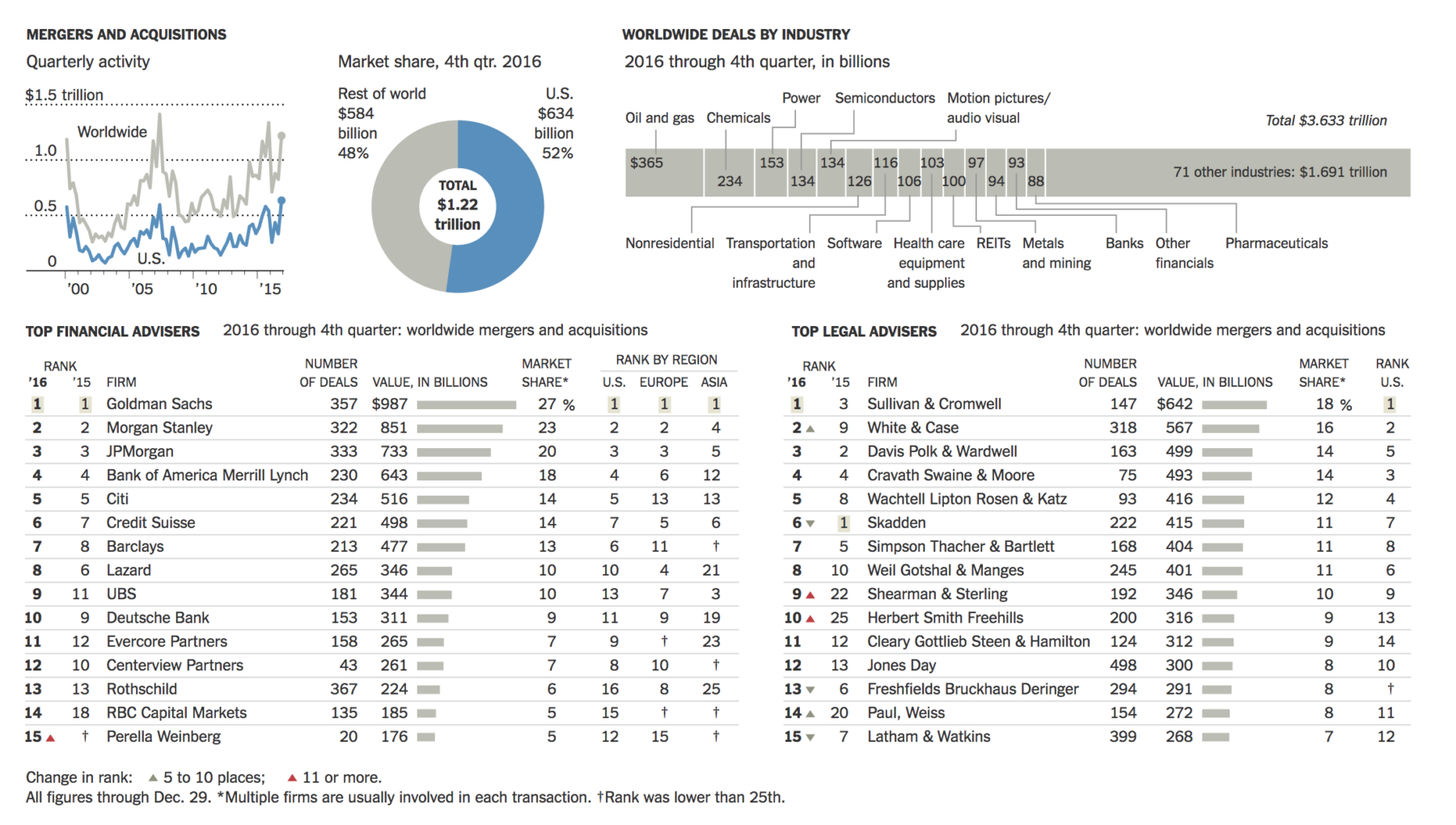

2016: $3.6 Trillion in M&A Deals (3rd all time highest)

Companies announced $3.6 trillion worth of deals in 2016, a decline of 16.6 percent from the previous year. It was the third biggest year...

Companies announced $3.6 trillion worth of deals in 2016, a decline of 16.6 percent from the previous year. It was the third biggest year...

Twitter For Sale

“He not busy being born is busy dying.” Bob Dylan wrote that. It’s a line from “It’s Alright, Ma (I’m...

MIB: J.P. Morgan’s Chris Ventresca & Elizabeth Myers

This week on Masters in Business I sit down very busy bankers in the world of M&A and IPOs: Chris Ventresca is Global Co-Head of...

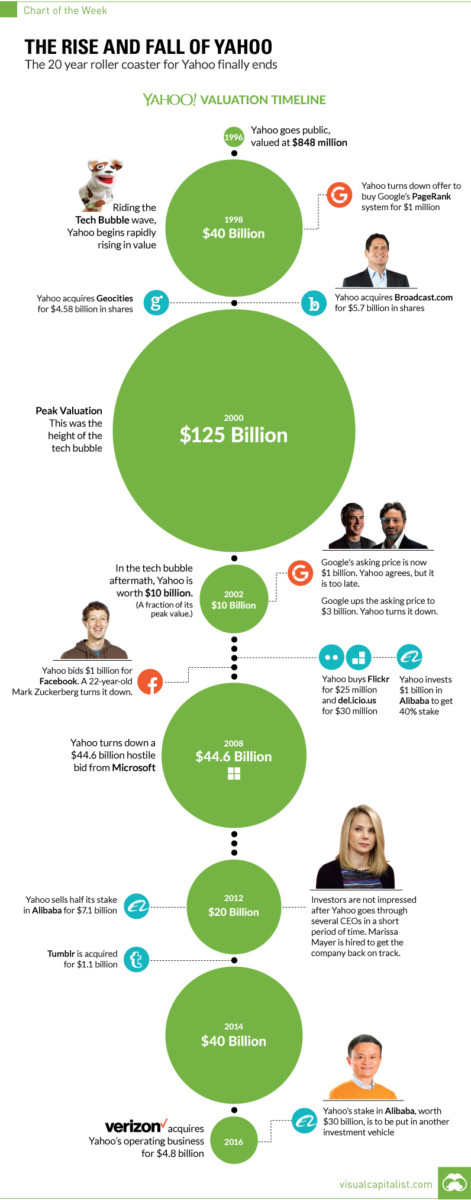

Yahoo Lessons

1. He not busy being born is busy dying. That which is high-flying today might crash tomorrow. Always be looking in the rearview mirror,...

What Caused the Demise of the US Coal Industry?

Coal Isn’t Dying Because There’s a War on It Regulation is often blamed for the industry’s woes. There’s more to...

Biggest Chinese Owned American Companies

The Biggest American Companies Now Owned by the Chinese by Stephen Gandel @stephengandel...