Defending Bernanke

Randall Forsyth does a good job explaining what FOMC Chair Ben Bernanke has done right: "Yet much of the criticism seems unfair and...

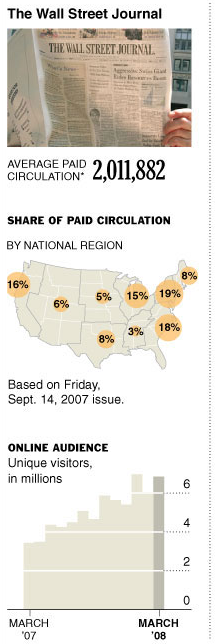

Is Rupert Murdoch’s altering of the Wall Street Journal creating an opening for his competitors? That was one of the topics we...

Is Rupert Murdoch’s altering of the Wall Street Journal creating an opening for his competitors? That was one of the topics we...

NYT’s special Dealbook section today had a deliciously giant graphic on the global path money takes in today’s deal...

NYT’s special Dealbook section today had a deliciously giant graphic on the global path money takes in today’s deal...

Former U.S. Securities and Exchange Commissioner Arthur Levitt talks with Bloomberg’s Carol Massar from Palm Beach Gardens,...

Former U.S. Securities and Exchange Commissioner Arthur Levitt talks with Bloomberg’s Carol Massar from Palm Beach Gardens,...

Nice bit of chart porn via Forbes, which writes: "JPMorgan’s Jamie Dimon may prove to be the latest in a line of investors to...

Nice bit of chart porn via Forbes, which writes: "JPMorgan’s Jamie Dimon may prove to be the latest in a line of investors to...

Get subscriber-only insights and news delivered by Barry every two weeks.