Bottoms Are Easier to Spot than Tops

This is perhaps the most profound thing I could say about market timing: “Bottoms are easier to spot and harder to act on; It is...

Fun conversation with my pal Pete Dominick for his podcast “Stand Up with Pete Dominick.” Before we began we...

Fun conversation with my pal Pete Dominick for his podcast “Stand Up with Pete Dominick.” Before we began we...

I built my reputation on being a blunt, honest and a bit off the center of mainstream. At the same time, no one wants to...

I built my reputation on being a blunt, honest and a bit off the center of mainstream. At the same time, no one wants to...

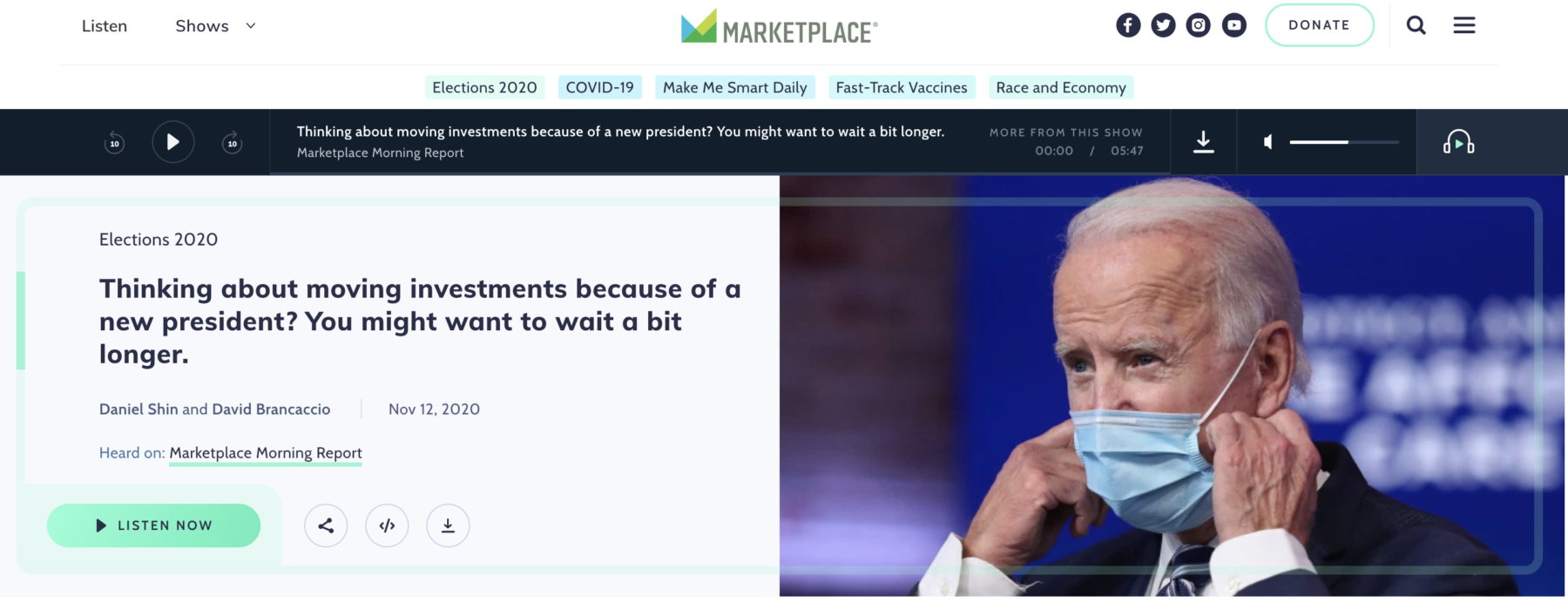

Short answer? None. Longer answer: “For the most part, none of this is something that people should use as a basis for...

Short answer? None. Longer answer: “For the most part, none of this is something that people should use as a basis for...

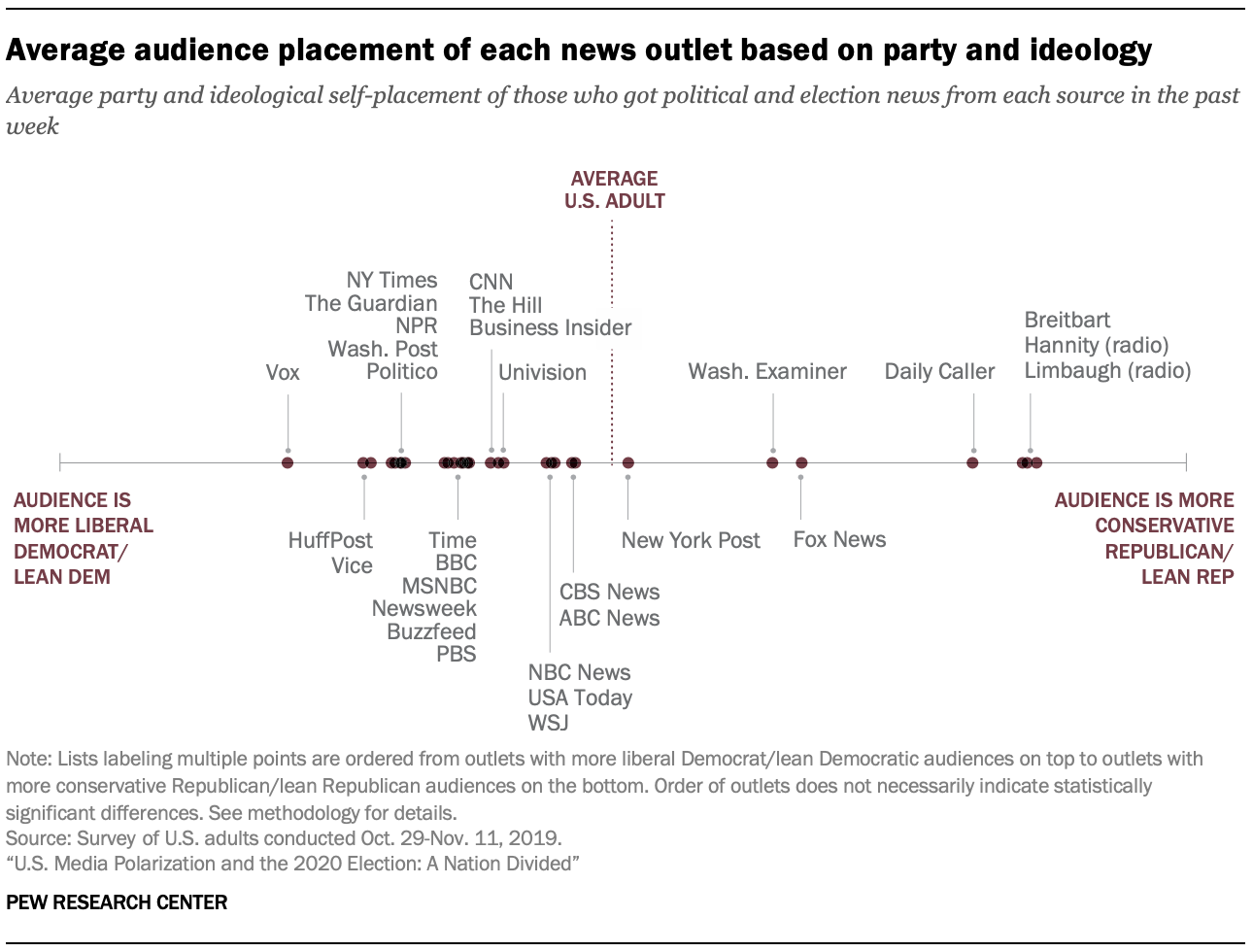

Source: Pew Research Pew Research Center is a nonpartisan “fact tank” whose mission is to inform the public...

Source: Pew Research Pew Research Center is a nonpartisan “fact tank” whose mission is to inform the public...

Get subscriber-only insights and news delivered by Barry every two weeks.