At The Money: Andrew Slimmon on Closet Indexing (April 17, 2024) Are your expensive active mutual funds and...

Read More

At the Money: Mutual Funds vs. ETFs with Dave Nadig, Financial Futurist for Vetta Fi (December 13, 2023) What’s the...

Read More

This week, we speak with investing legend Joel Tillinghast. He has been a mutual fund manager in the equity division...

Read More

The transcript from this week’s, MiB: Jenny Johnson, Franklin Templeton CEO, is below. You can stream and download our...

Read More

This week, for our special 500th episode of Masters in Business, I speak with Jenny Johnson, president and chief executive...

Read More

Barry Ritholtz, Bloomberg Opinion Columnist and Ritholtz Wealth Management Chairman and CIO, weighs in on Former Fidelity Magellan fund...

Read More

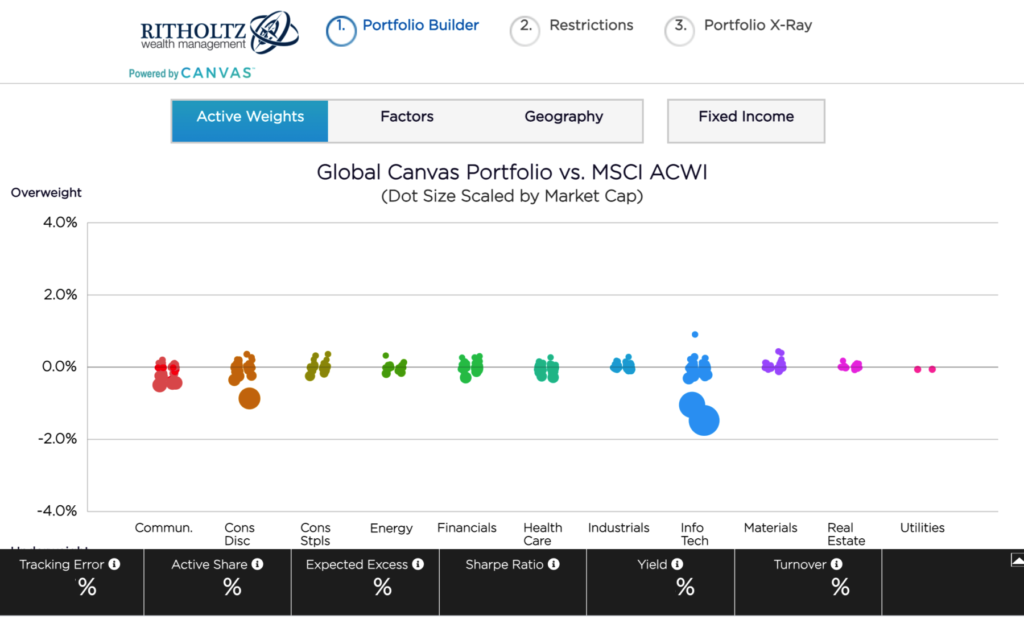

To hear an audio spoken word version of this post, click here. In 2019, Ritholtz Wealth...

To hear an audio spoken word version of this post, click here. In 2019, Ritholtz Wealth...

Read More

After my interview with Peter Lynch last week, I jotted down some of my favorite highlights from our conversation. I argued that Fidelity...

Read More

To hear an audio spoken word version of this post, click here. Who is the GOAT? What investor is your pick...

To hear an audio spoken word version of this post, click here. Who is the GOAT? What investor is your pick...

Read More

What if your investing process was to find attractive companies to buy, regardless of style, size, or location? Once you...

Read More

To hear an audio spoken word version of this post, click here. Who is the GOAT? What investor is your pick...

To hear an audio spoken word version of this post, click here. Who is the GOAT? What investor is your pick...