GE Retirees’ Classic Investment Error

How to Avoid a Retirement Disaster Be aware and be realistic. But most of all, diversify. Bloomberg, April 23, 2018 ...

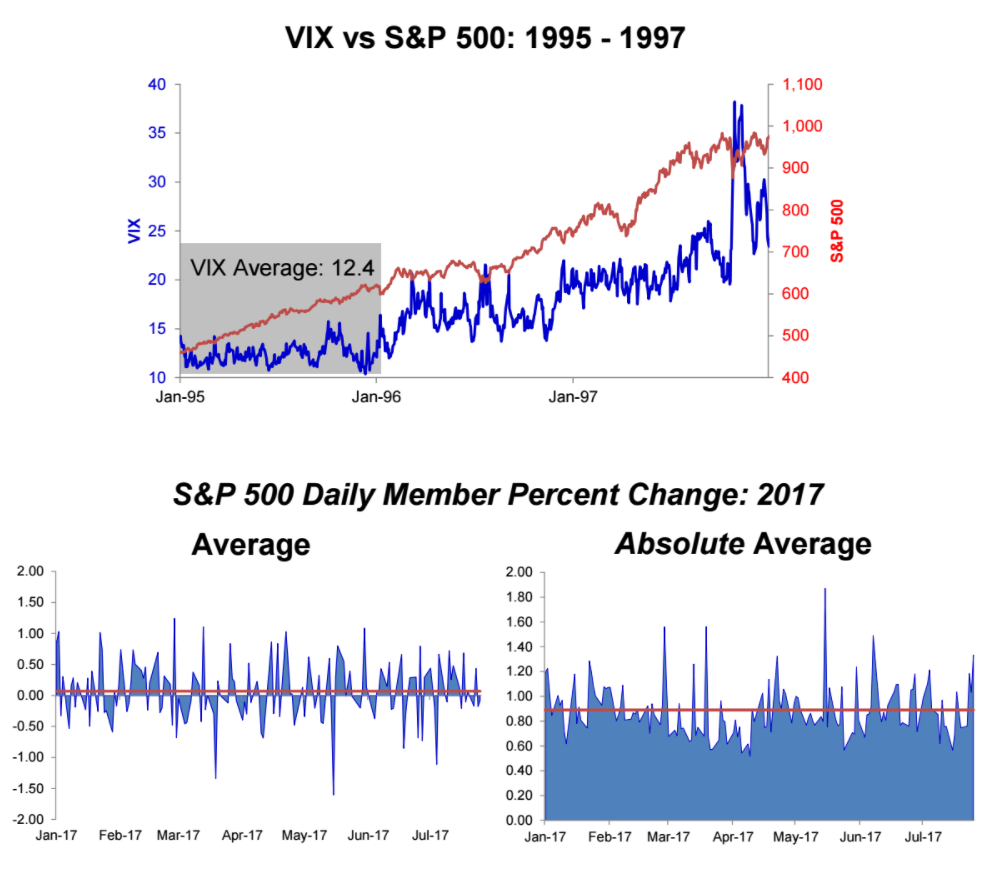

Source: Birinyi Jeffrey Yale Rubin of Birinyi looks at the issue of low volatility. He makes two interesting...

Source: Birinyi Jeffrey Yale Rubin of Birinyi looks at the issue of low volatility. He makes two interesting...

The VIX Tells Us Very Little About Tomorrow All the hand-wringing because the “fear index” has fallen below 10 is a waste of time....

The VIX Tells Us Very Little About Tomorrow All the hand-wringing because the “fear index” has fallen below 10 is a waste of time....

Volatility Index (VIX) 1 Year daily reading Chart via Yahoo > I haven’t done a study on the actual correlation between the...

Volatility Index (VIX) 1 Year daily reading Chart via Yahoo > I haven’t done a study on the actual correlation between the...

Sometimes, short term mechanical concerns can magnify market moves. Example: Consider option gamma and this week’s option...

Sometimes, short term mechanical concerns can magnify market moves. Example: Consider option gamma and this week’s option...

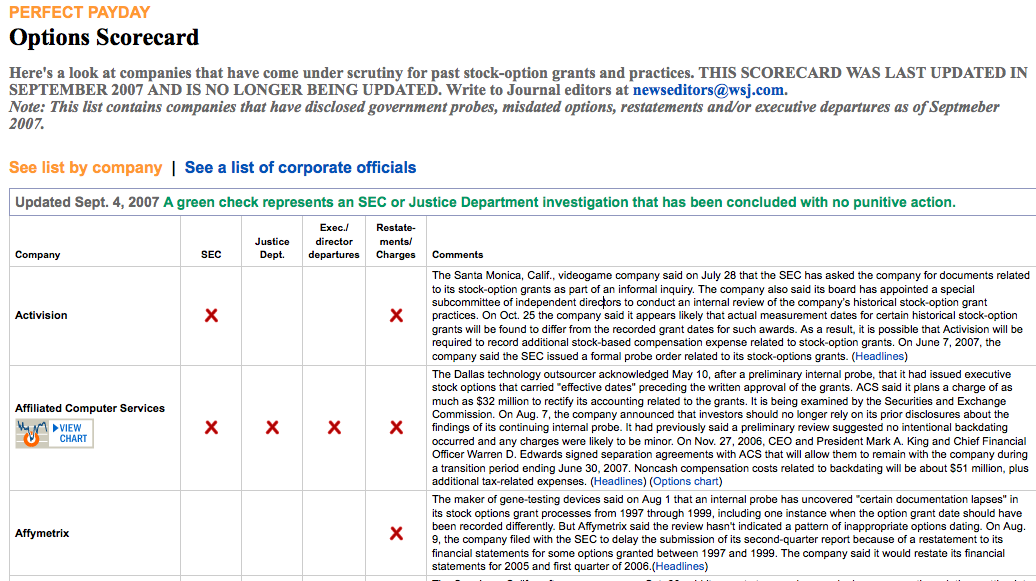

Here’s a nice free feature courtesy of the online WSJ.com: They posted an updated look at more than 120 companies that have come...

Here’s a nice free feature courtesy of the online WSJ.com: They posted an updated look at more than 120 companies that have come...

Get subscriber-only insights and news delivered by Barry every two weeks.