The public is responsible. There’s this fiction that no one knew about the Holocaust, that concentration...

The public is responsible. There’s this fiction that no one knew about the Holocaust, that concentration...

Read More

We all love to use quotations in our arguments. It’s both an appeal to higher authority as well as social proof (Hey!...

We all love to use quotations in our arguments. It’s both an appeal to higher authority as well as social proof (Hey!...

Read More

This year, we lost one of Wall Street’s brightest lights. Beginning in 1974, and over the next 50 years of investing, Laszlo...

This year, we lost one of Wall Street’s brightest lights. Beginning in 1974, and over the next 50 years of investing, Laszlo...

Read More

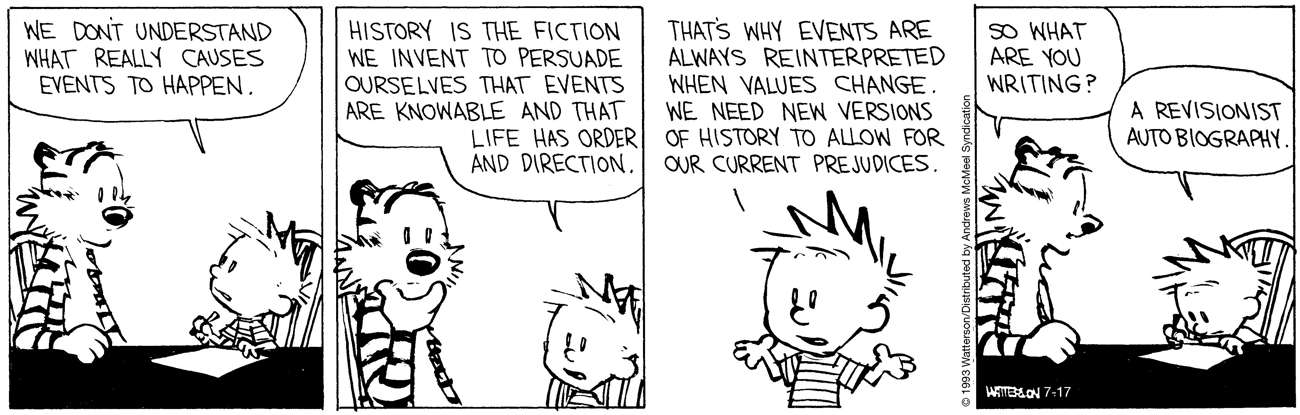

There is a particular type of analysis I keep seeing, one that easily misleads investors. Typically, it starts with an important,...

There is a particular type of analysis I keep seeing, one that easily misleads investors. Typically, it starts with an important,...

Read More

Previously: Nobody Knows Nuthin’ (May 5, 2016) Can Anyone Catch Nokia? (October 26, 2022) Why the Apple...

Previously: Nobody Knows Nuthin’ (May 5, 2016) Can Anyone Catch Nokia? (October 26, 2022) Why the Apple...

Read More

I had a very fun conversation with my friend Roben Farzad about the business of culture, the culture of business, media and...

I had a very fun conversation with my friend Roben Farzad about the business of culture, the culture of business, media and...

Read More

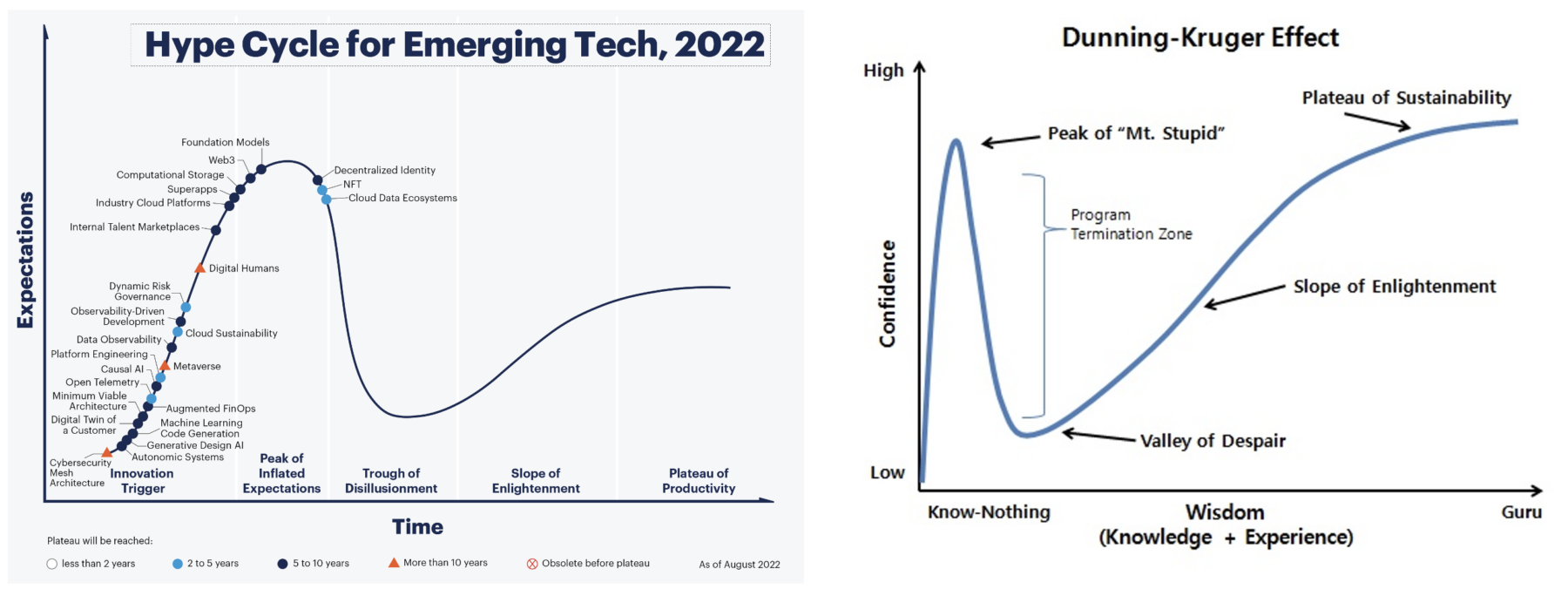

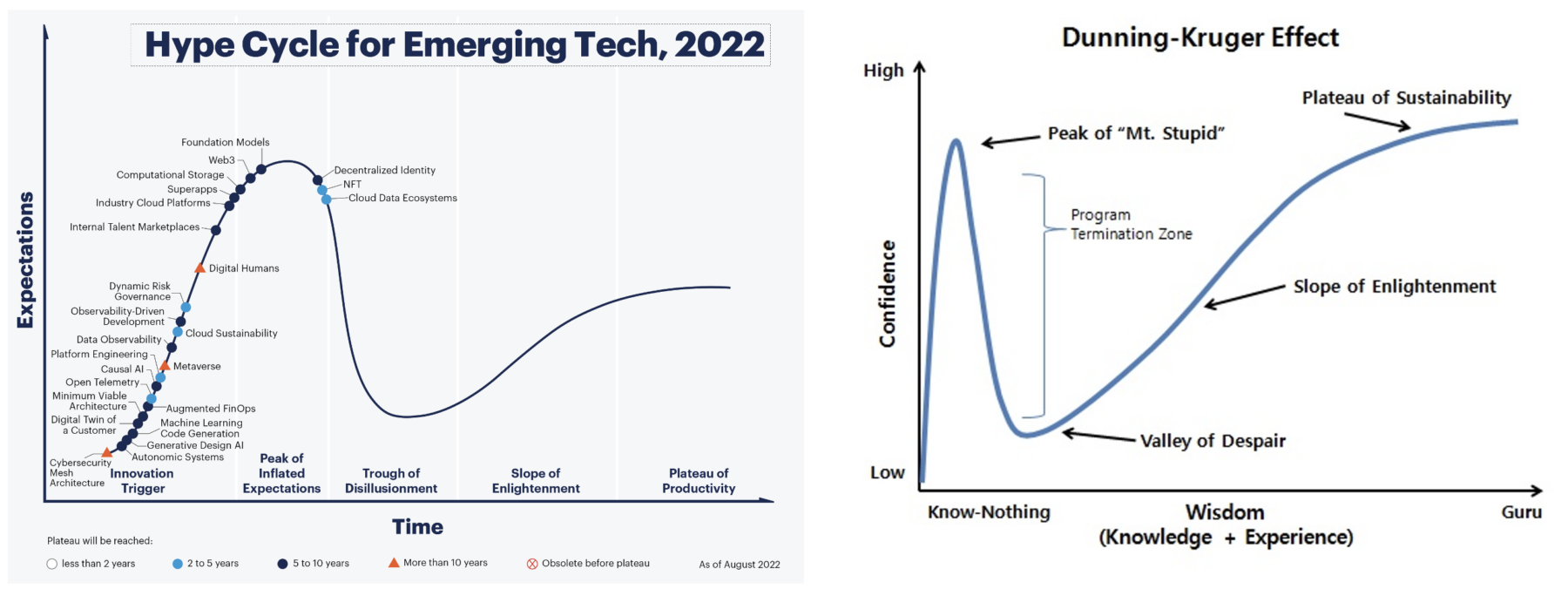

I am always fascinated when seemingly random sources converge on the same concept. The current convergence involved some research...

I am always fascinated when seemingly random sources converge on the same concept. The current convergence involved some research...

Read More

Merry Christmas, Happy New Year, and all the rest of the seasonal glad tidings for you and yours in 2023. Before we roll up...

Merry Christmas, Happy New Year, and all the rest of the seasonal glad tidings for you and yours in 2023. Before we roll up...

Read More

One of the reasons people in the investment community respect Howard Marks so much is he says what he believes and lets the...

One of the reasons people in the investment community respect Howard Marks so much is he says what he believes and lets the...

Read More

Every now and again, we reach a moment in time when the scales fall from our eyes, and reality is revealed to us. We are now at...

Every now and again, we reach a moment in time when the scales fall from our eyes, and reality is revealed to us. We are now at...

Read More

The public is responsible. There’s this fiction that no one knew about the Holocaust, that concentration...

The public is responsible. There’s this fiction that no one knew about the Holocaust, that concentration...

The public is responsible. There’s this fiction that no one knew about the Holocaust, that concentration...

The public is responsible. There’s this fiction that no one knew about the Holocaust, that concentration...