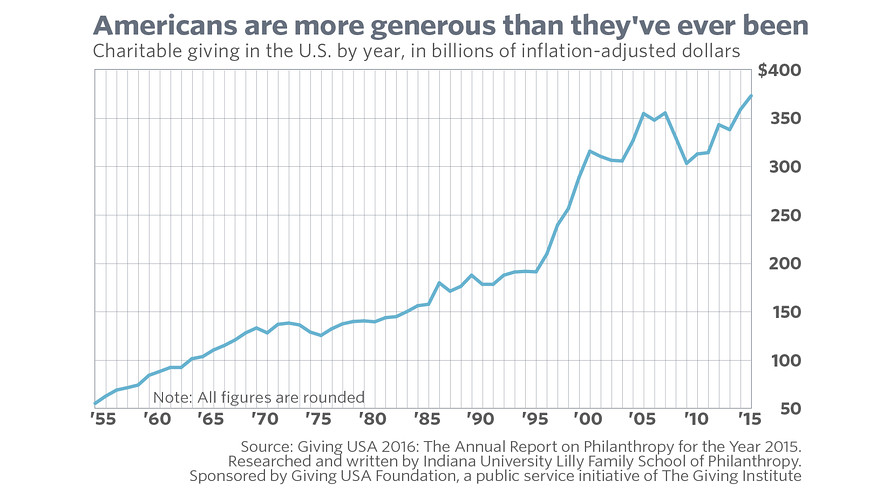

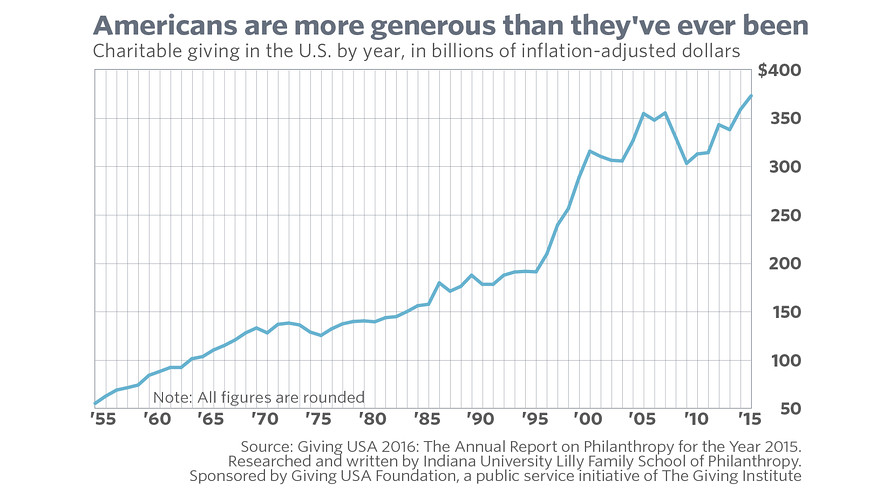

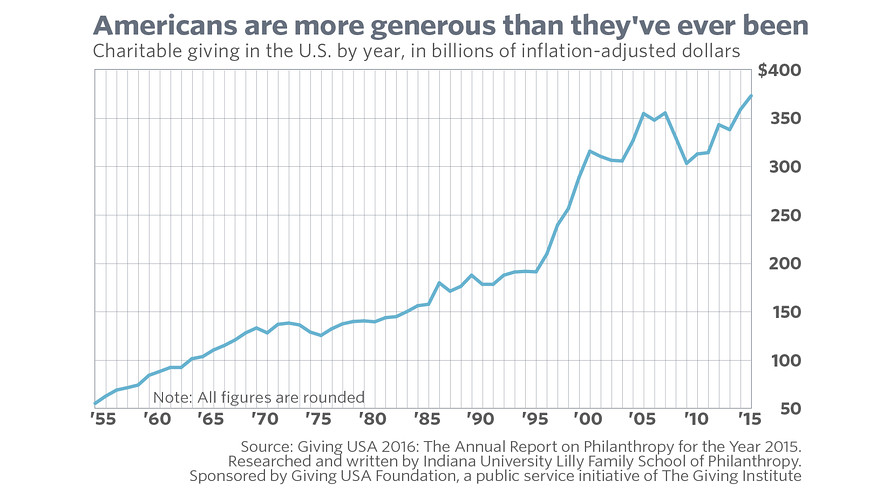

This is really a fascinating datapoint, via the Consumerist: “According to a report released today by the Giving USA Foundation,...

This is really a fascinating datapoint, via the Consumerist: “According to a report released today by the Giving USA Foundation,...

Read More

Right after the financial crisis, we threw our first conference. It was a modestly successful event, one that we built on over the years....

Right after the financial crisis, we threw our first conference. It was a modestly successful event, one that we built on over the years....

Read More

Memorial Day weekend is fast approaching. If you are anything like me, you are probably looking forward to delving into several new and...

Memorial Day weekend is fast approaching. If you are anything like me, you are probably looking forward to delving into several new and...

Read More

Election ‘Uncertainty’ Isn’t Messing With Markets The outcome of the presidential race is merely unknown. That’s...

Election ‘Uncertainty’ Isn’t Messing With Markets The outcome of the presidential race is merely unknown. That’s...

Read More

“Do not spoil what you have by desiring what you have not; remember that what you now have was once among the things you only hoped...

Read More

Unless you experience the unpleasant symptoms of being wrong, your brain will never revise its models. Before your neurons can succeed,...

Read More

Let’s Say It All Together: Nobody Knows Anything The primary elections are another case study in the futility of making...

Read More

This is really a fascinating datapoint, via the Consumerist: “According to a report released today by the Giving USA Foundation,...

This is really a fascinating datapoint, via the Consumerist: “According to a report released today by the Giving USA Foundation,...

This is really a fascinating datapoint, via the Consumerist: “According to a report released today by the Giving USA Foundation,...

This is really a fascinating datapoint, via the Consumerist: “According to a report released today by the Giving USA Foundation,...