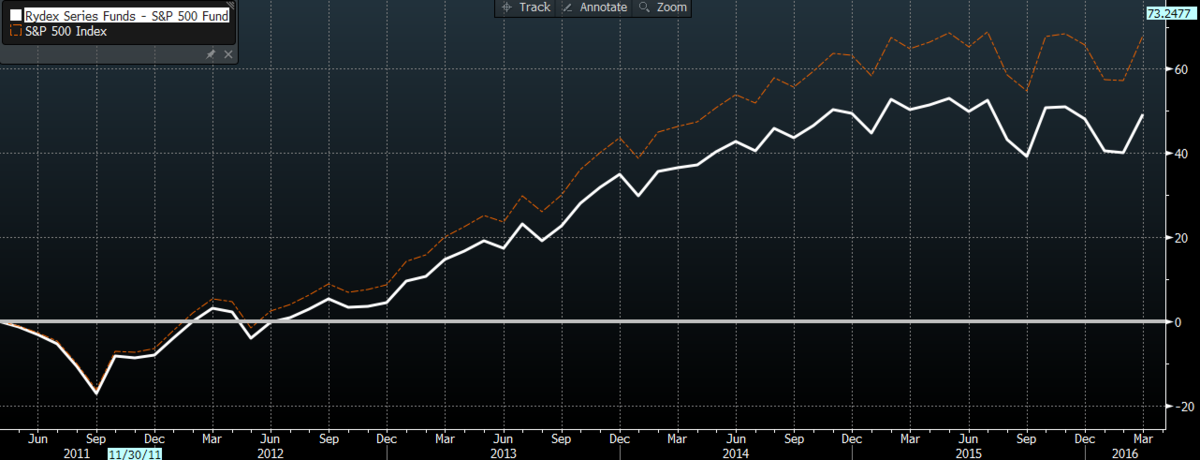

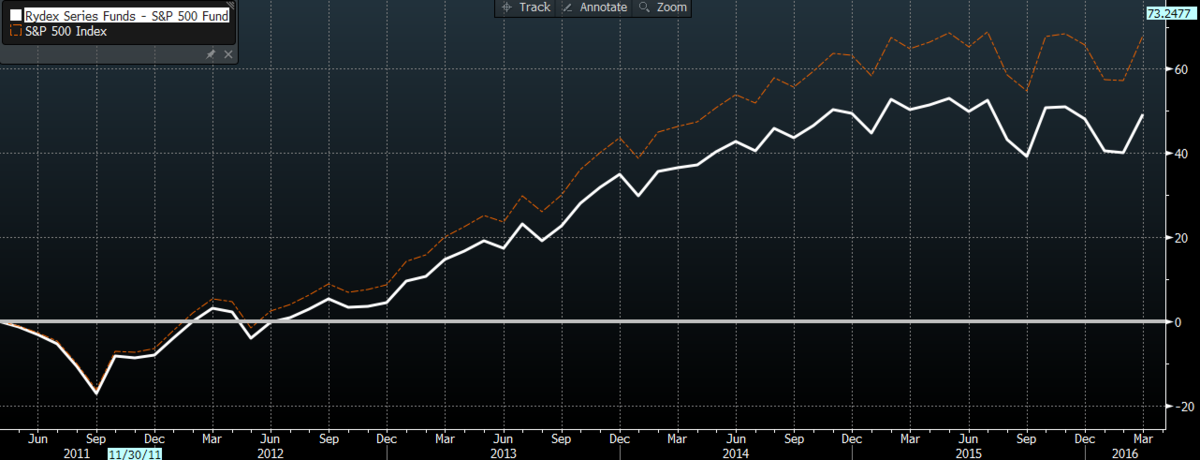

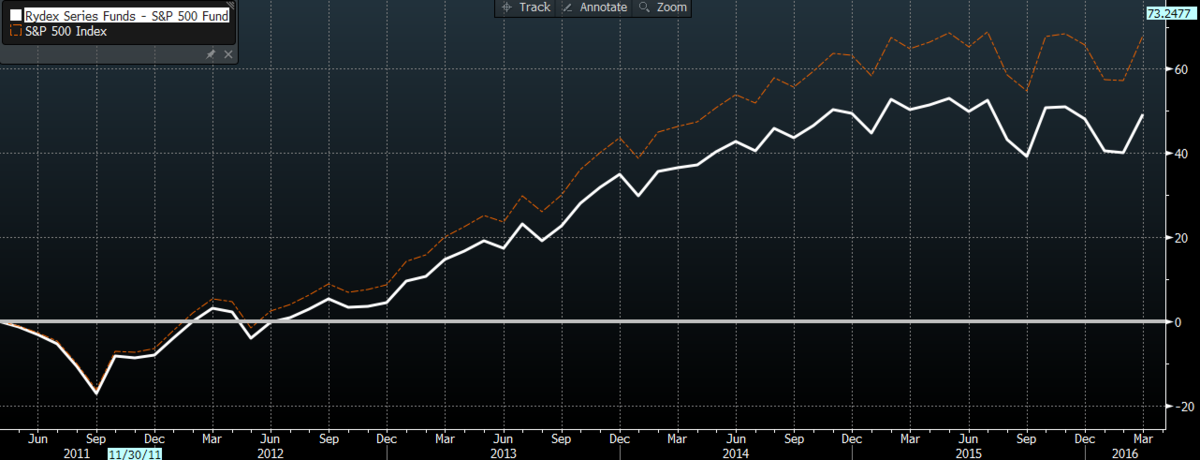

Many traders and investors acts as if markets are efficient, meaning that asset prices fully reflect all available information. We see...

Many traders and investors acts as if markets are efficient, meaning that asset prices fully reflect all available information. We see...

Read More

The other day, I discussed our inverted research business model. A client was discussing this with us, asking for an example of a topic...

Read More

Over the past few weeks, I have been highlighting all of the blog redesigns we have been rolling out in the office....

Read More

Nice comments from Kiplingers about your humble scribe about the “Worst Mistakes Investors Will Make in This Market” You Get...

Read More

Interesting column at Bloomberg asking “What Buffett wouldn’t do” Investing: Don’t be too fixated on daily moves in the stock...

Read More

This week, I am giving a presentation at the MIT/Sloan Annual Investment Conference. They have a great line up, including...

This week, I am giving a presentation at the MIT/Sloan Annual Investment Conference. They have a great line up, including...

Read More

1. You can’t make it alone. No one is complete, everyone needs help and guidance. 2. Be the best you you can be, that’s your...

Read More

Is there something you’ve always meant to do, wanted to do, but just … haven’t? Matt Cutts suggests: Try it for 30...

Read More

A couple of words about how Friday’s column, What Investors Should Ask Themselves, came about. When I initially...

Read More

George Mason University economist Tyler Cowen has an intriguingblog post asking a deceptively simple question: You are an investor with...

Read More

Many traders and investors acts as if markets are efficient, meaning that asset prices fully reflect all available information. We see...

Many traders and investors acts as if markets are efficient, meaning that asset prices fully reflect all available information. We see...

Many traders and investors acts as if markets are efficient, meaning that asset prices fully reflect all available information. We see...

Many traders and investors acts as if markets are efficient, meaning that asset prices fully reflect all available information. We see...