Graham on Risk

Since I am giving a presentation about Risk just about . . . Now . . . I thought it might be a good time to reference a classic quote...

To fully appreciate this you have to run through the entire set of 30 or so panels . . . Click to see more cows. Source: Imgur...

To fully appreciate this you have to run through the entire set of 30 or so panels . . . Click to see more cows. Source: Imgur...

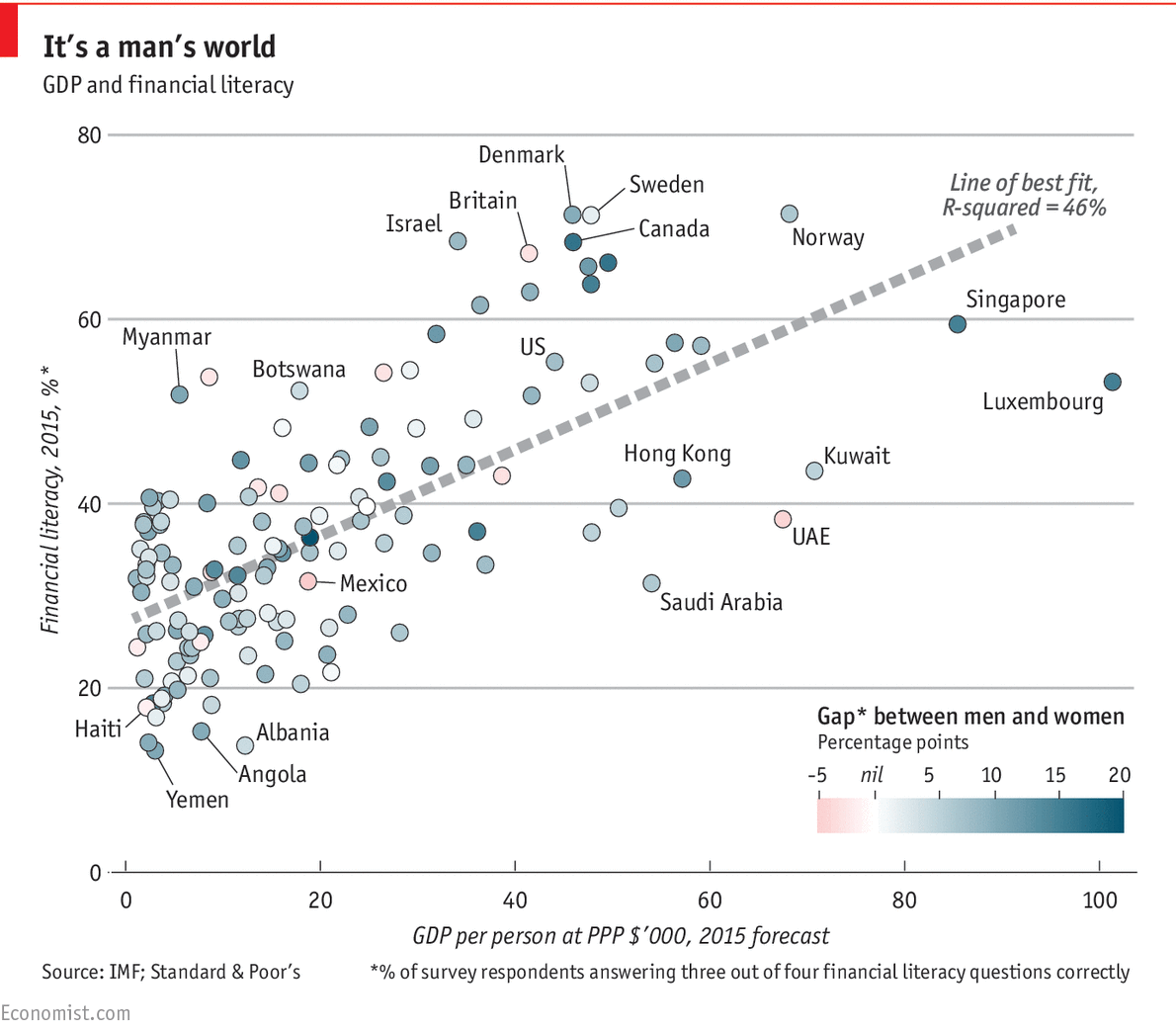

This chart and the accompanying discussion is amazing: Financial knowledge seems to be gained only through pain and bad...

This chart and the accompanying discussion is amazing: Financial knowledge seems to be gained only through pain and bad...

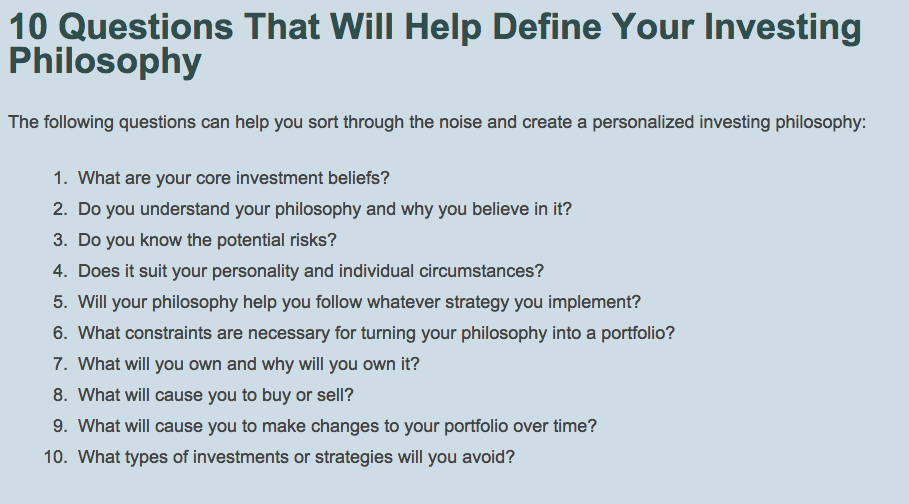

Fantastic in depth discussion by my colleague Ben Carlson looking at defining your investment philosophy: Source: AAII

Fantastic in depth discussion by my colleague Ben Carlson looking at defining your investment philosophy: Source: AAII

Get subscriber-only insights and news delivered by Barry every two weeks.