Hilarious: click for interactive media

Hilarious: click for interactive media

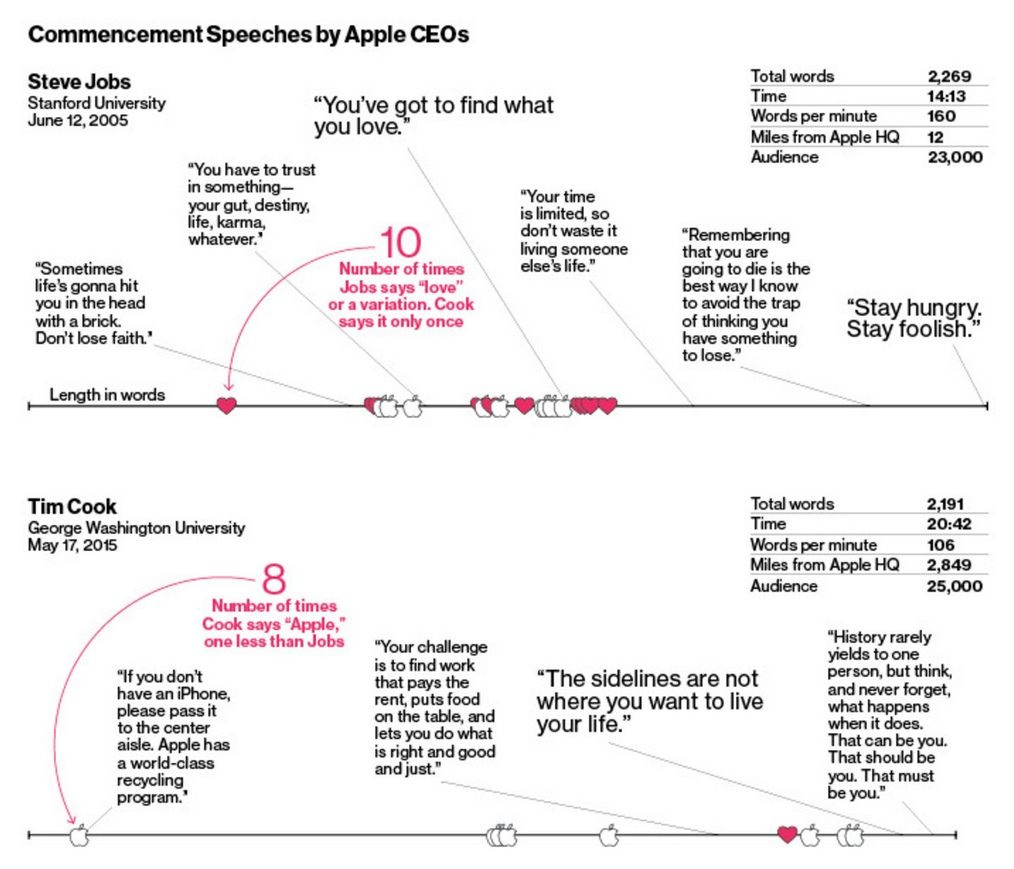

The Days Are Long, But The Decades Are Short . . .

Dictionary of Obscure Sorrows: time is passing more quickly as we get older.

Buffett on Stock Prices

Its early in this potential correction, but let me remind you of Buffett’s interesting (1997) comments: “If you plan to eat...

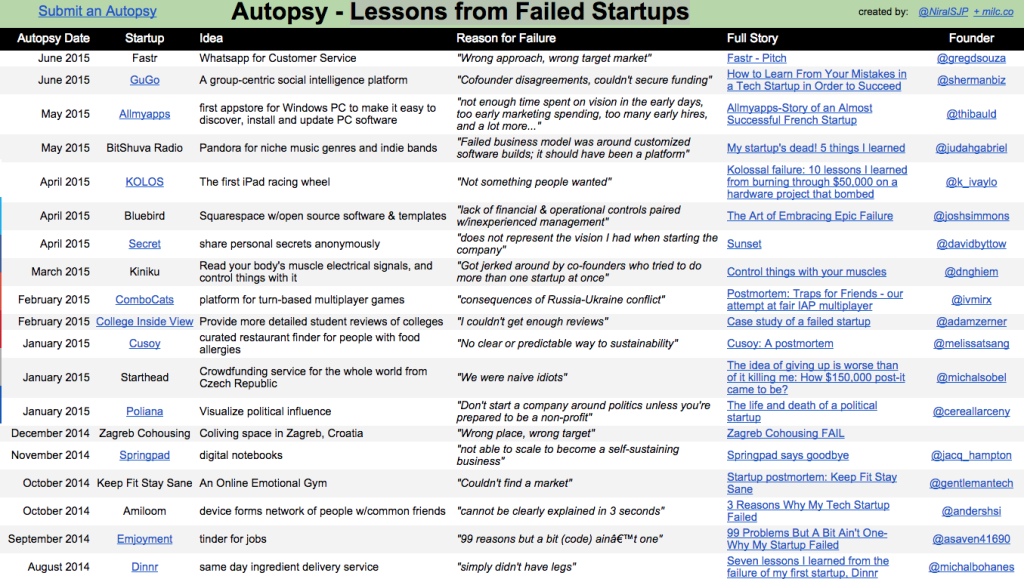

Learning From Failure: Performing an Autopsy on Dead Start Ups

Postmortems for Startup Failures A new website autopsies the flops. Bloomberg, June 10, 2015 There has been relentless...

Postmortems for Startup Failures A new website autopsies the flops. Bloomberg, June 10, 2015 There has been relentless...

NFP: Is Good News Bad News?

Over the years, I have spilled far too many pixels on how overhyped the monthly nonfarm payroll report is. What matters...

Are Polls Always “Skewed” Against Republicans?

In my widely-discussed recent paper on Fox News, I suggested that its Republican bias was hurting the GOP in many ways. One specific...