To hear an audio spoken word version of this post, click here. What is investing? This is a much more subtle and...

To hear an audio spoken word version of this post, click here. What is investing? This is a much more subtle and...

Read More

For the 4,540,927,002nd time, the third planet from the sun has once again returned to this randomly assigned point in its...

For the 4,540,927,002nd time, the third planet from the sun has once again returned to this randomly assigned point in its...

Read More

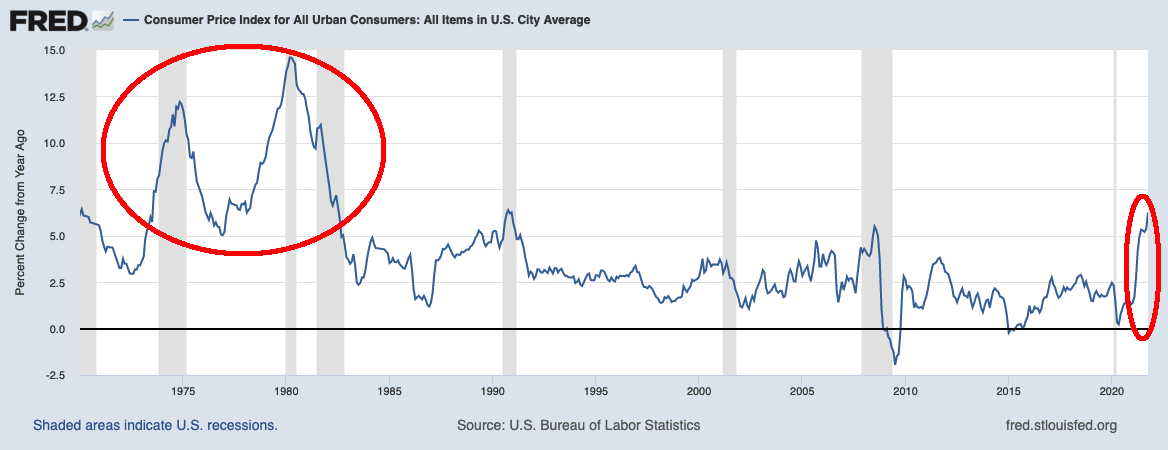

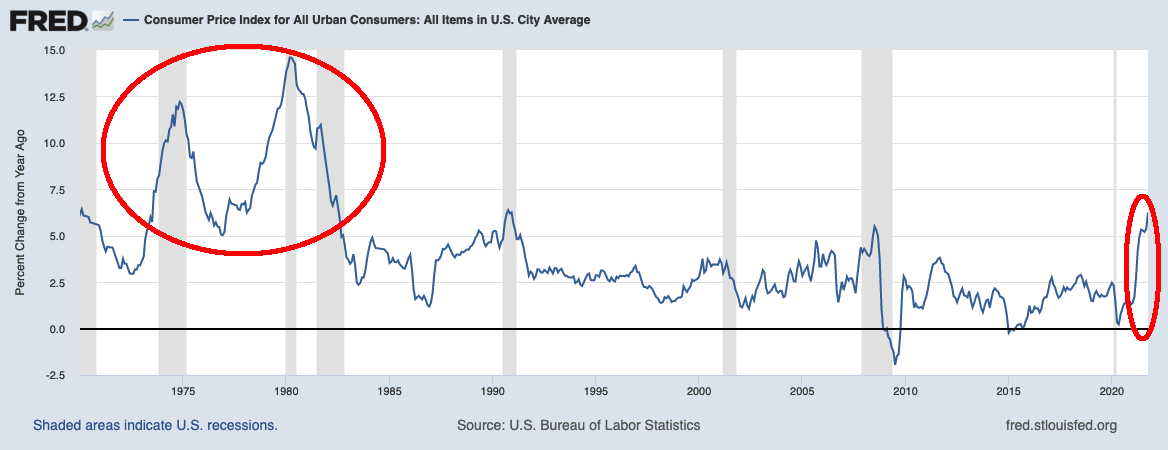

To hear an audio spoken word version of this post, click here. The Consumer Price Index print today of 6.2% is the...

To hear an audio spoken word version of this post, click here. The Consumer Price Index print today of 6.2% is the...

Read More

I spend some quality time on the other side of the Mic in this one: If you are unfamiliar with the works of Vishal...

Read More

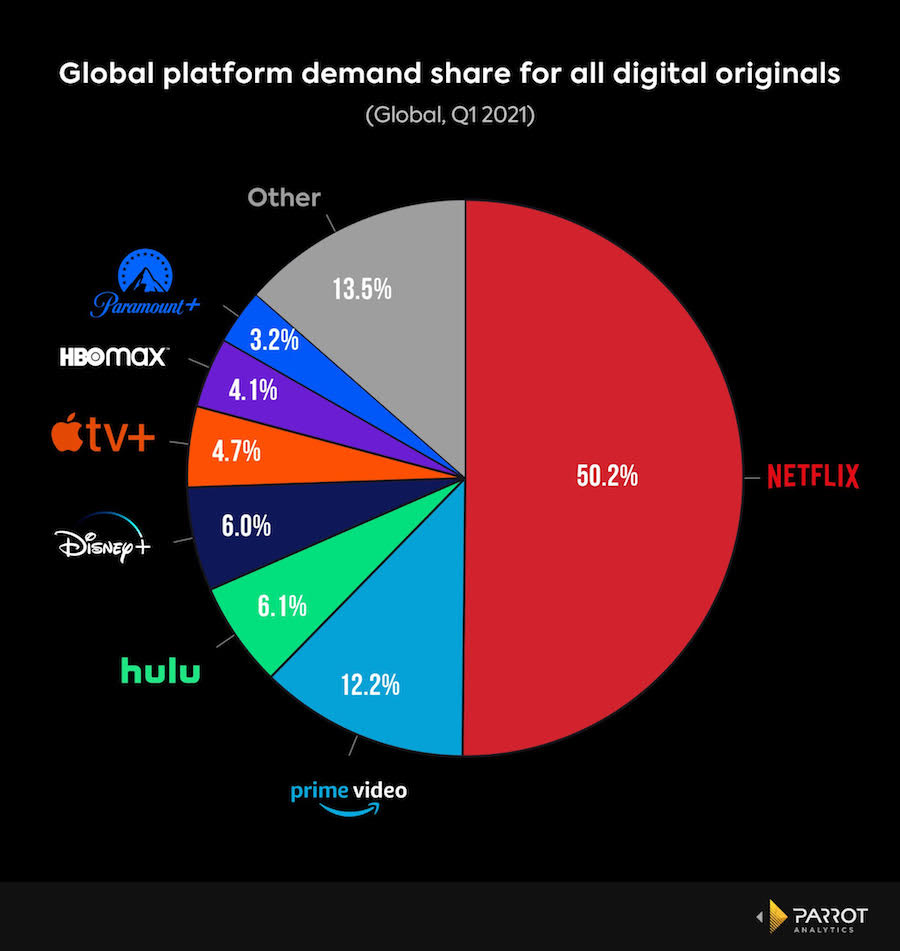

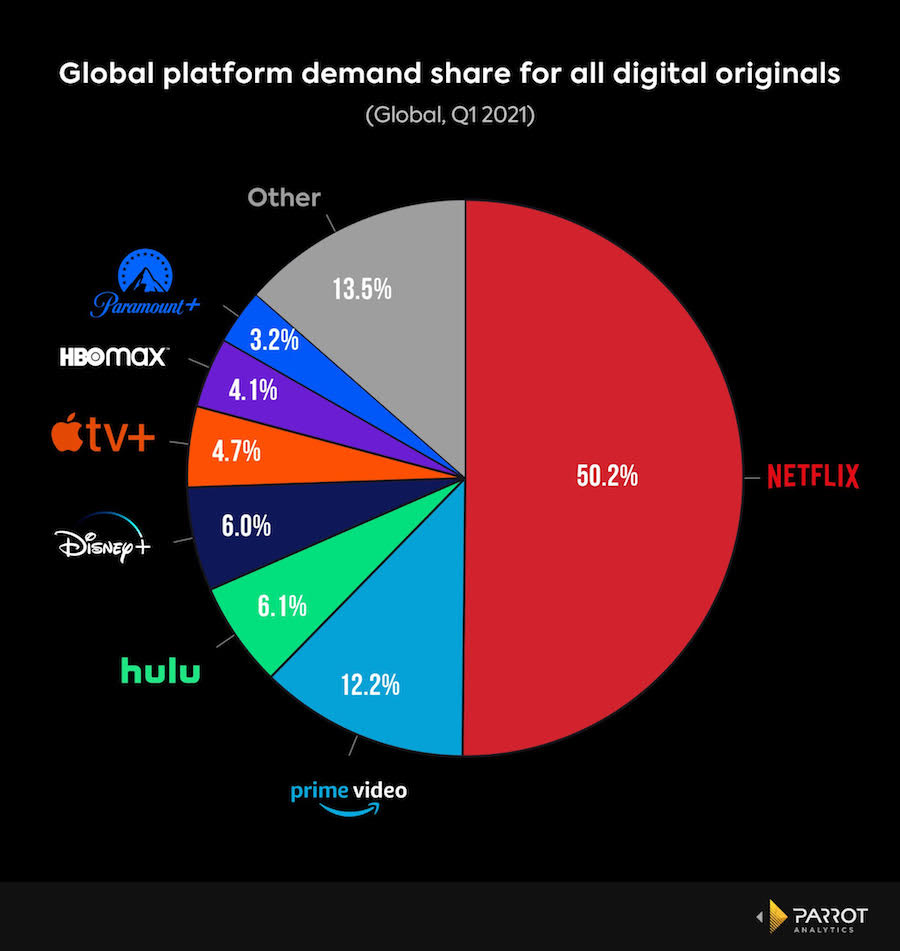

New Platforms Gaining Demand Share at Expense of Netflix Source: Media Play News Earlier this month, I discussed how money...

New Platforms Gaining Demand Share at Expense of Netflix Source: Media Play News Earlier this month, I discussed how money...

Read More

To hear an audio spoken word version of this post, click here. Incremental changes occur at a very deliberate pace....

To hear an audio spoken word version of this post, click here. Incremental changes occur at a very deliberate pace....

Read More

What I Wish I Understood When Starting Out In My Career From learning to “time travel” to good habits, here are 10 pieces of advice...

What I Wish I Understood When Starting Out In My Career From learning to “time travel” to good habits, here are 10 pieces of advice...

Read More

Speak from the heart, not the head. Go with what feels right. The more you think about it, the greater the chance...

Speak from the heart, not the head. Go with what feels right. The more you think about it, the greater the chance...

Read More

A colleague was debating launching a new pod, but seemed concerned about whether they might be “good enough.”...

A colleague was debating launching a new pod, but seemed concerned about whether they might be “good enough.”...

Read More

So, we were back in the office yesterday (officially) for the first time as a group in a year. We (unofficially) re-opened the...

So, we were back in the office yesterday (officially) for the first time as a group in a year. We (unofficially) re-opened the...

Read More

To hear an audio spoken word version of this post, click here. What is investing? This is a much more subtle and...

To hear an audio spoken word version of this post, click here. What is investing? This is a much more subtle and...

To hear an audio spoken word version of this post, click here. What is investing? This is a much more subtle and...

To hear an audio spoken word version of this post, click here. What is investing? This is a much more subtle and...