BBRG: Brexit, Facebook, Endowments and Other Errors

Brexit, Facebook, Endowments and Other Errors Acknowledging mistakes increases the odds of avoiding them in the future. Bloomberg,...

I am excited about our next Masters in Business: Live! This time, we will be chatting with Nobel Laureate Gene...

I am excited about our next Masters in Business: Live! This time, we will be chatting with Nobel Laureate Gene...

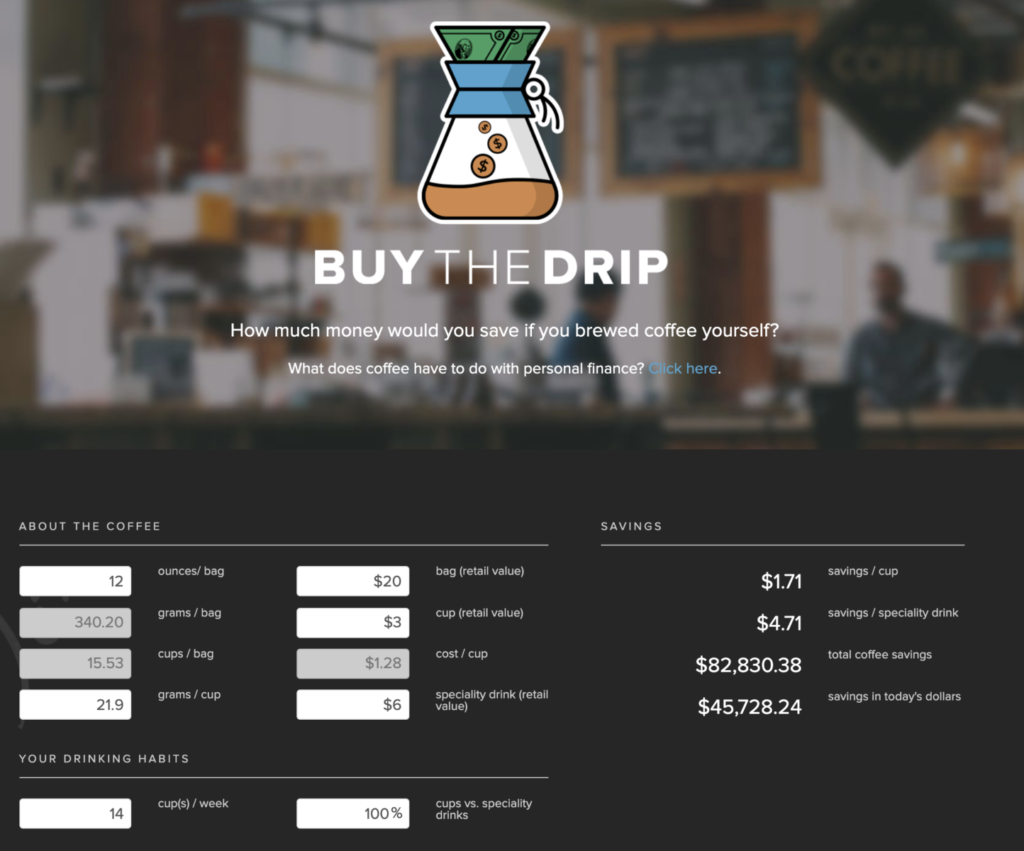

Its a Summer Friday — a perfect time for something I have been meaning to get to posting on: Buy the Drip! (Kashana Cauley post...

Its a Summer Friday — a perfect time for something I have been meaning to get to posting on: Buy the Drip! (Kashana Cauley post...

Get subscriber-only insights and news delivered by Barry every two weeks.