Graduates: Here’s an Honor Code for Life Amid a national epidemic of dishonesty, acting with integrity is more important than ever. By...

Graduates: Here’s an Honor Code for Life Amid a national epidemic of dishonesty, acting with integrity is more important than ever. By...

Read More

Cardigan’s Commencement Address by Chief Justice John G. Roberts, Jr. Source: Time

Read More

Source: Principles Dalio: Whatever success I’ve had in life hasn’t been because of anything unique about me—it’s because...

Source: Principles Dalio: Whatever success I’ve had in life hasn’t been because of anything unique about me—it’s because...

Read More

Katia Porzecanski reported yesterday that legendary banker Richard Jenrette — he is the “J” in DLJ — passed away,...

Read More

Click for the full, enormous list. Source: Information Is Beautiful

Click for the full, enormous list. Source: Information Is Beautiful

Read More

Last year, I wrote a brief explanation as to why there are so many people in my firm who write. Why we do what we do explains the...

Read More

NEVER PROMOTE BEFORE AVAILABILITY You’re lucky if someone’s noticed, if they’re aware of what you’re...

Read More

This is utterly fascinating. Stay with it, towards the second half about how laws are — quite literally –different for the...

Read More

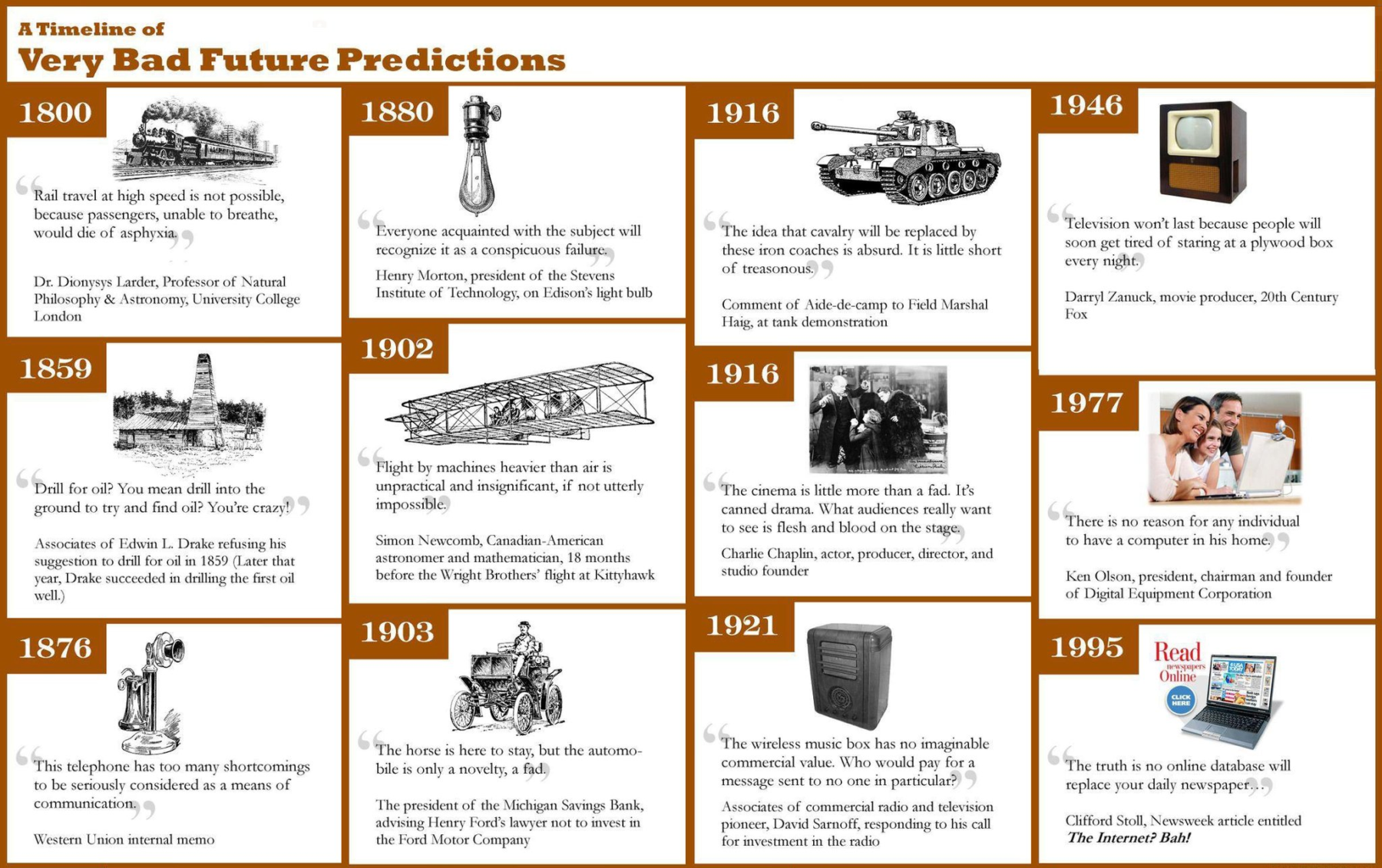

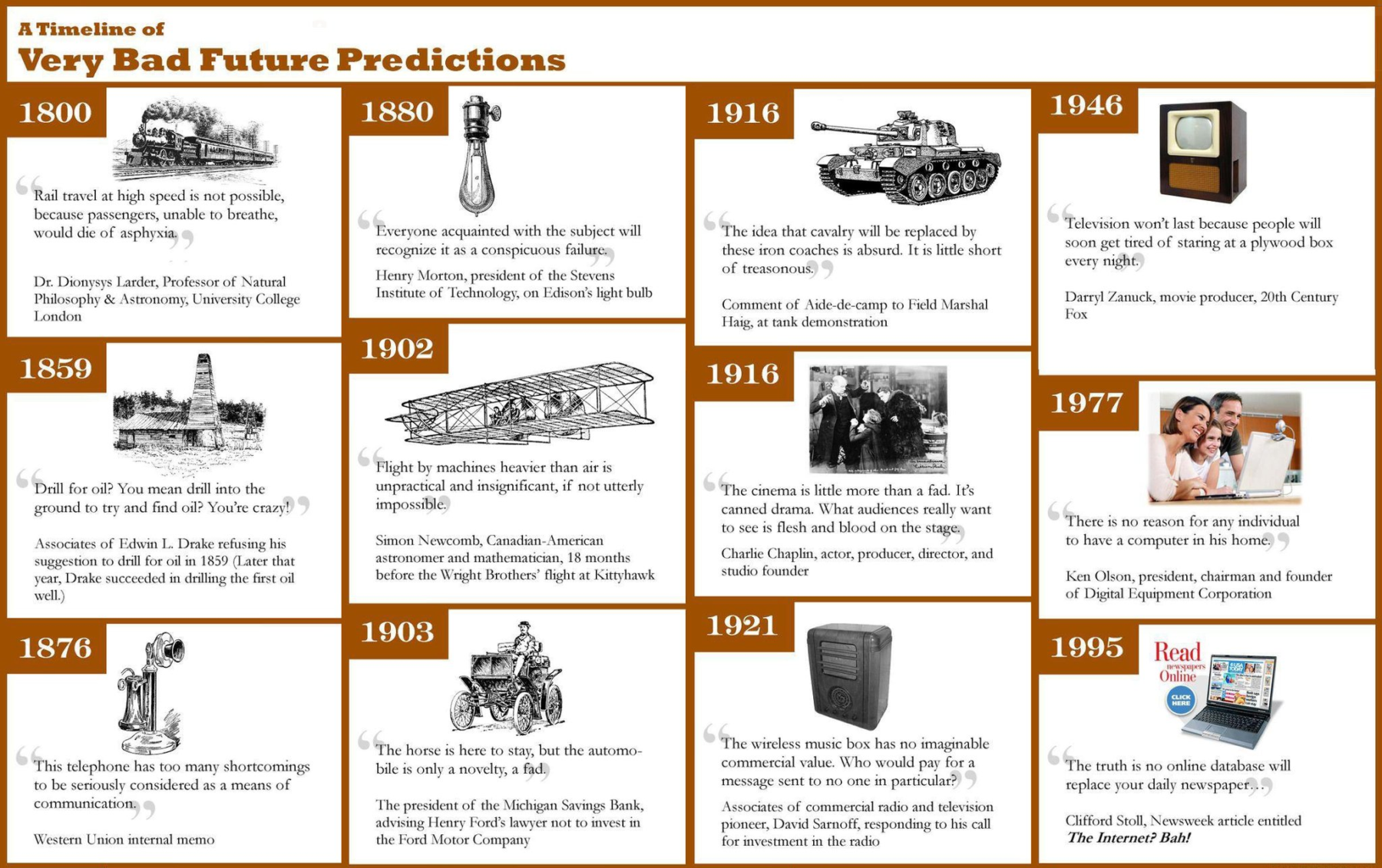

click for complete graphic Source: Infographic City Presented without comment . . . Previously: Apprenticed...

click for complete graphic Source: Infographic City Presented without comment . . . Previously: Apprenticed...

Read More

One Question Investors Should Ask Now and Then The answer might reveal flaws in your thought processes. Bloomberg, February 16, 2018...

Read More

Graduates: Here’s an Honor Code for Life Amid a national epidemic of dishonesty, acting with integrity is more important than ever. By...

Graduates: Here’s an Honor Code for Life Amid a national epidemic of dishonesty, acting with integrity is more important than ever. By...

Graduates: Here’s an Honor Code for Life Amid a national epidemic of dishonesty, acting with integrity is more important than ever. By...

Graduates: Here’s an Honor Code for Life Amid a national epidemic of dishonesty, acting with integrity is more important than ever. By...