Socialism Is as American as Apple Pie The ideology that Republicans love to hate is woven through the fabric of the...

Socialism Is as American as Apple Pie The ideology that Republicans love to hate is woven through the fabric of the...

Read More

See full chart after the jump The top five most innovative economies include Switzerland, Sweden, U.S., U.K., and the...

See full chart after the jump The top five most innovative economies include Switzerland, Sweden, U.S., U.K., and the...

Read More

I Was a Rush Limbaugh Whisperer His radio show was once a vital outlet of conservative news—and I was one of his sources. But it became...

Read More

CEOs Exit the Trump Era With Reputations Intact Maybe the idea that “shareholder primacy” is no longer the sole purpose of a...

CEOs Exit the Trump Era With Reputations Intact Maybe the idea that “shareholder primacy” is no longer the sole purpose of a...

Read More

To hear an audio spoken word version of this post, click here. Debates between various schools of economic thought keep...

To hear an audio spoken word version of this post, click here. Debates between various schools of economic thought keep...

Read More

CEOs Exit the Trump Era With Reputations Intact Maybe the idea that “shareholder primacy” is no longer the sole purpose of a...

CEOs Exit the Trump Era With Reputations Intact Maybe the idea that “shareholder primacy” is no longer the sole purpose of a...

Read More

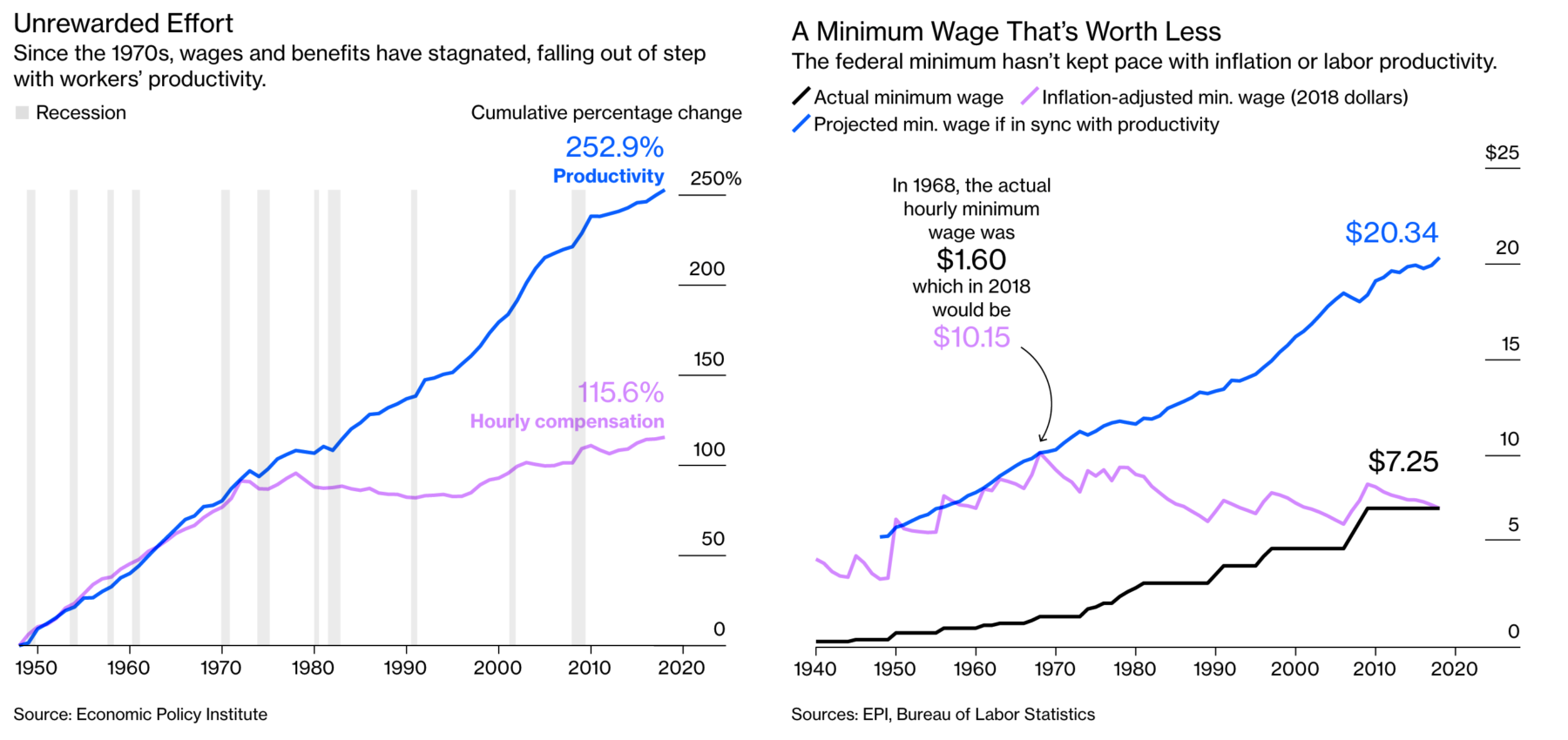

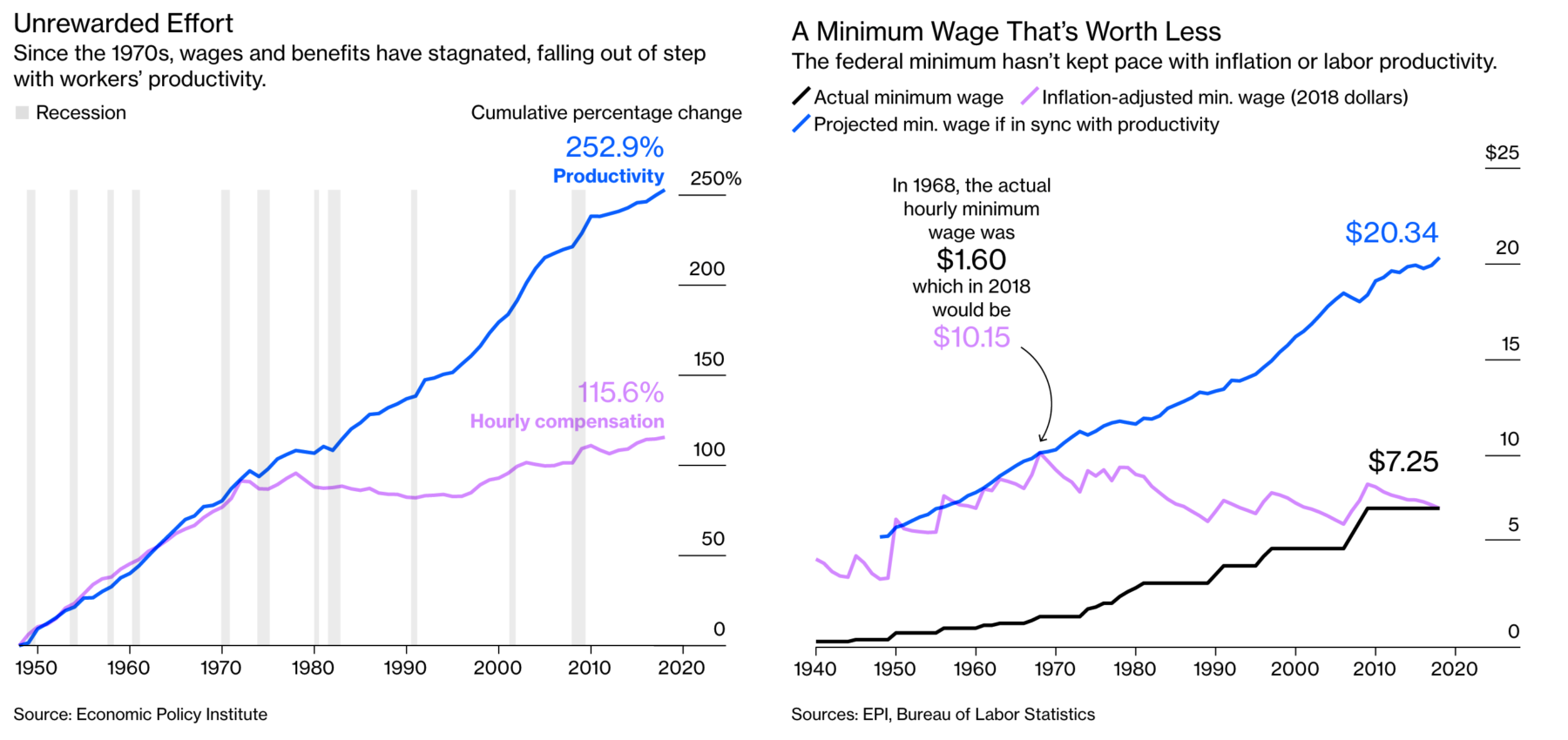

Source: Businessweek The debate about the $15 national minimum-wage has been generating more heat than light. It is an area...

Source: Businessweek The debate about the $15 national minimum-wage has been generating more heat than light. It is an area...

Read More

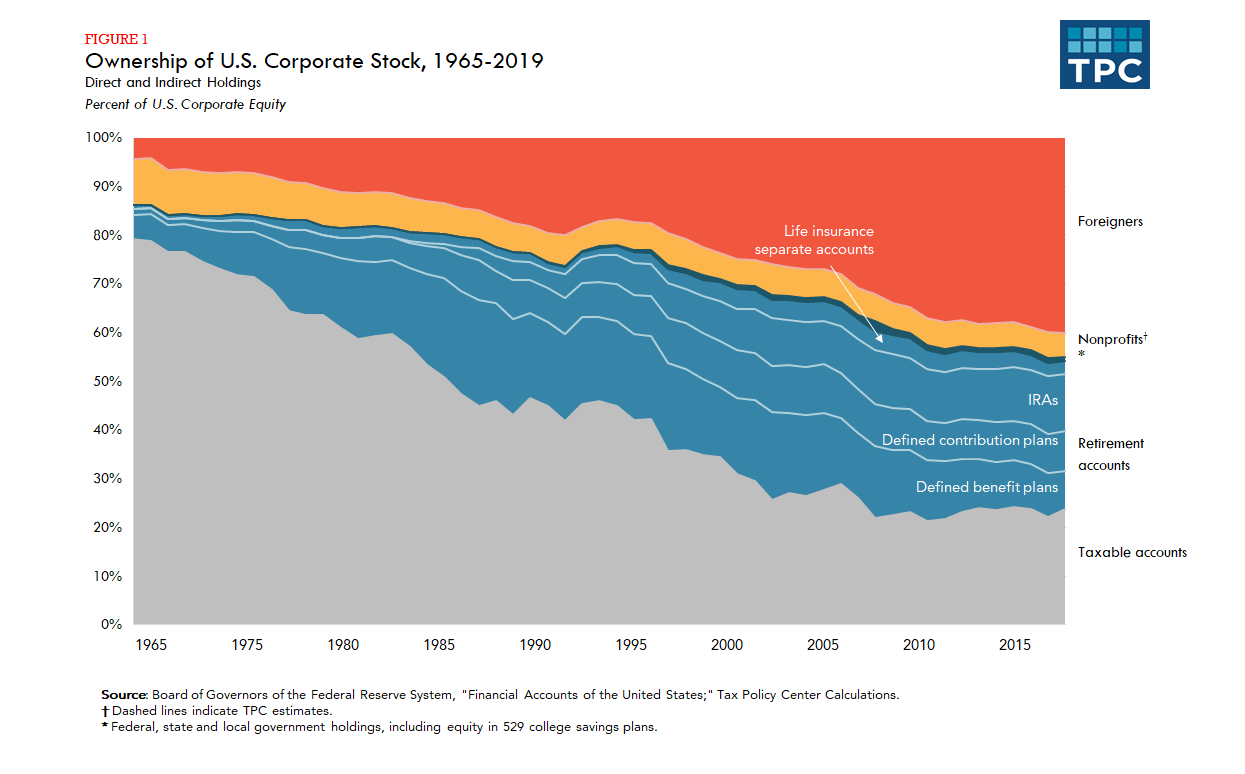

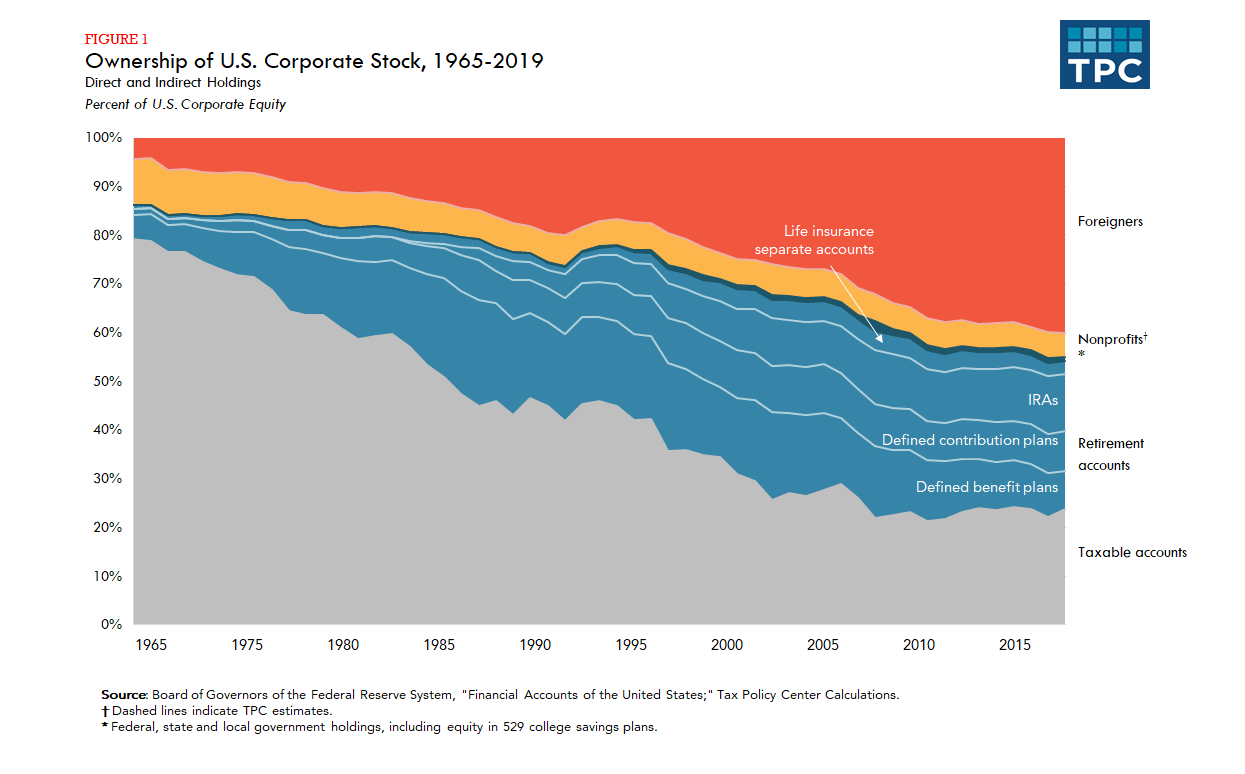

The GameStop Saga and the Incoherent Politics of the Stock Market Republicans have long encouraged stock ownership in the belief that it...

The GameStop Saga and the Incoherent Politics of the Stock Market Republicans have long encouraged stock ownership in the belief that it...

Read More

The Proud Boys, a far-right group, have tried to downplay their role in the Capitol riot. A WSJ investigation shows that at many of the...

Read More

Barry Ritholtz takes a victory lap Our discussion begins at 3:40 and we go over how close I came to losing. I won the bet, but...

Read More

Socialism Is as American as Apple Pie The ideology that Republicans love to hate is woven through the fabric of the...

Socialism Is as American as Apple Pie The ideology that Republicans love to hate is woven through the fabric of the...

Socialism Is as American as Apple Pie The ideology that Republicans love to hate is woven through the fabric of the...

Socialism Is as American as Apple Pie The ideology that Republicans love to hate is woven through the fabric of the...