Short answer? None. Longer answer: “For the most part, none of this is something that people should use as a basis for...

Short answer? None. Longer answer: “For the most part, none of this is something that people should use as a basis for...

Read More

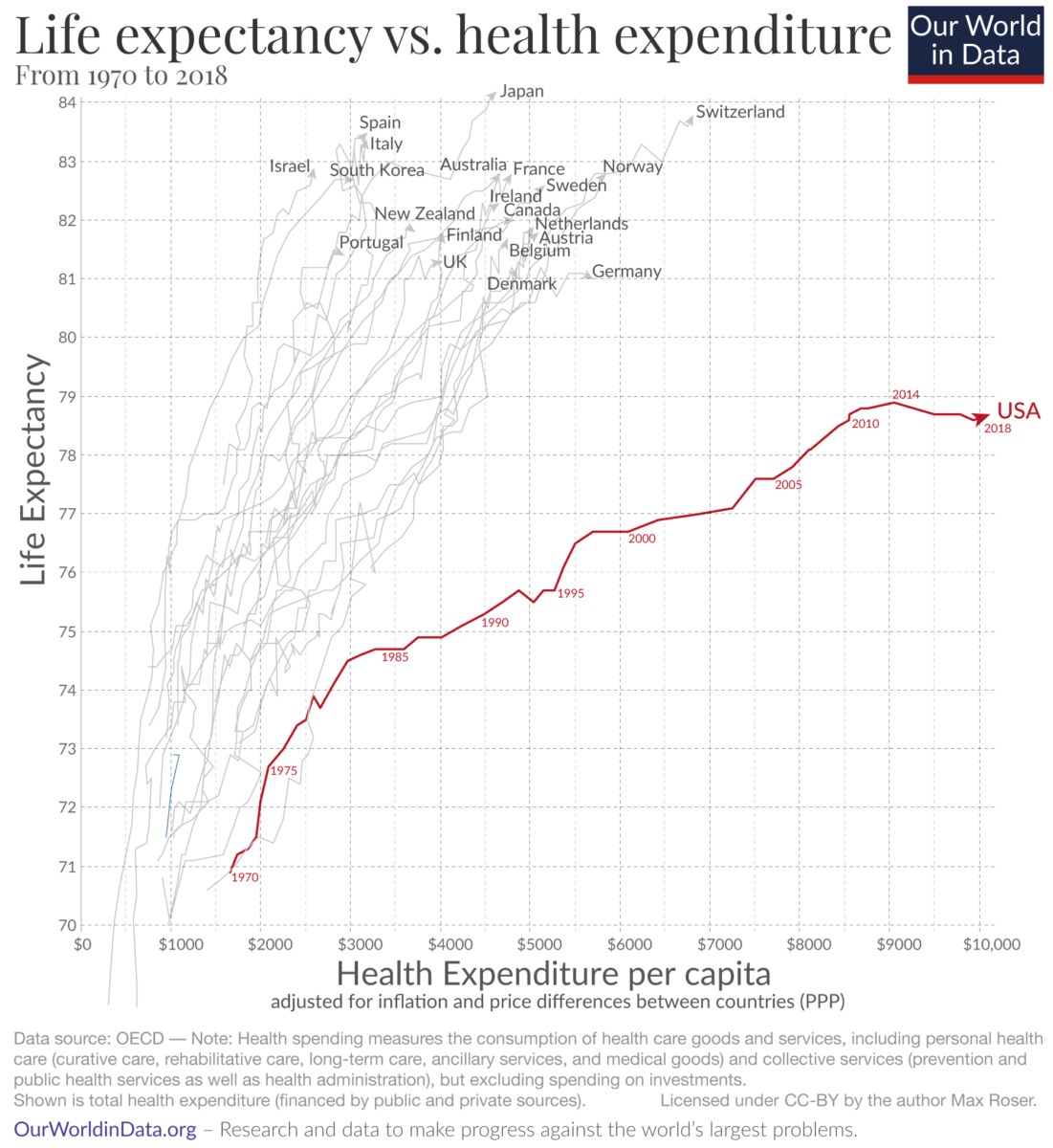

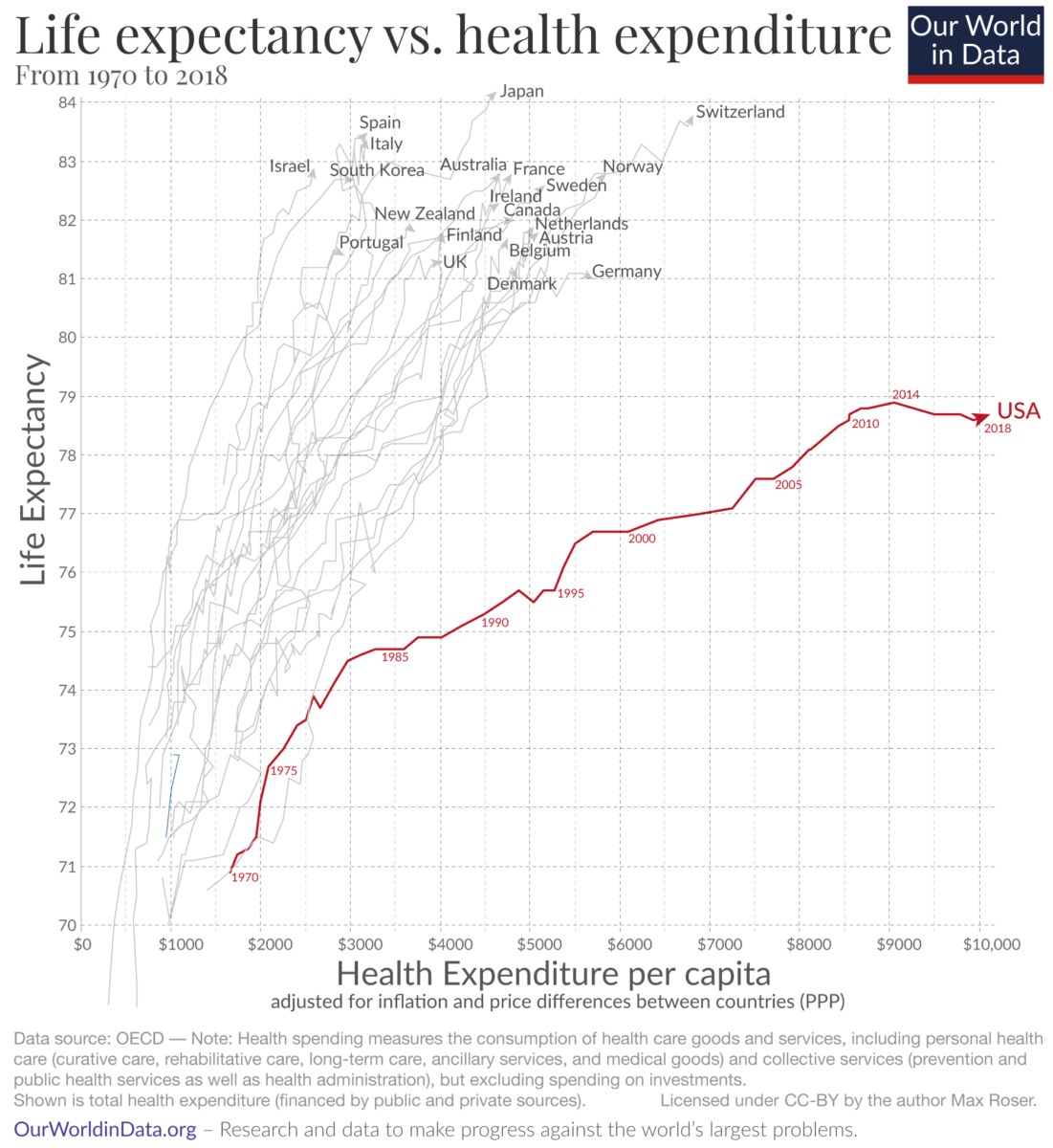

Why is life expectancy in the US lower than in other rich countries? Source: Our World In Data In terms of life expectancy...

Why is life expectancy in the US lower than in other rich countries? Source: Our World In Data In terms of life expectancy...

Read More

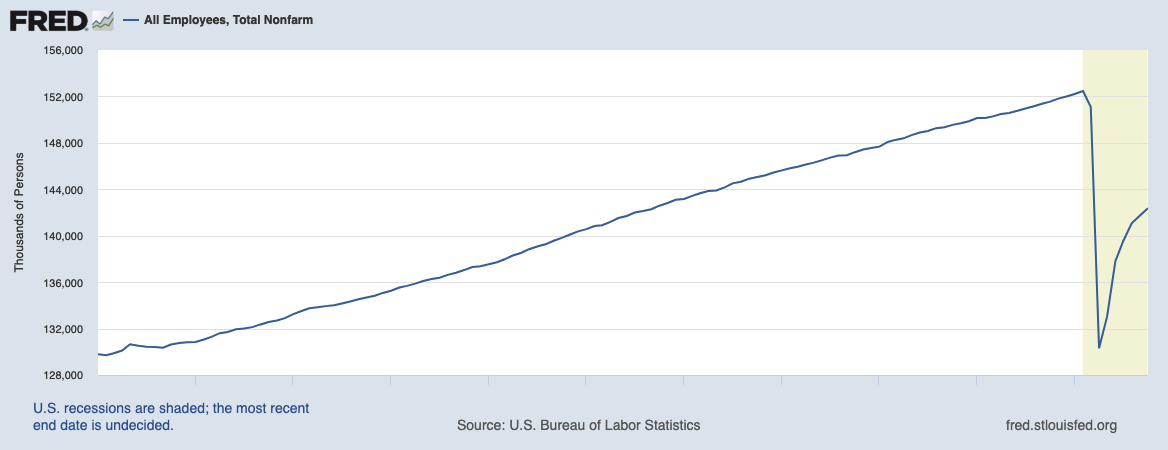

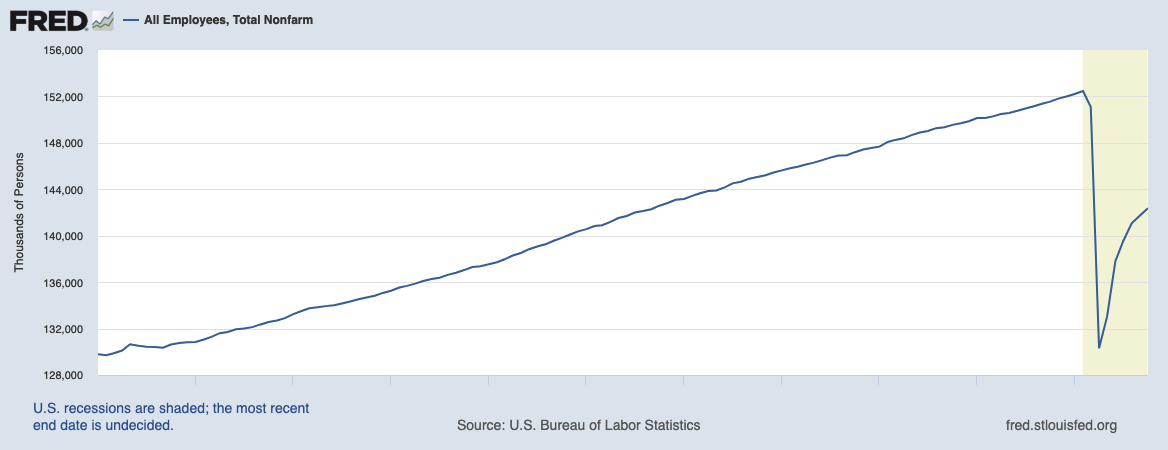

Total Nonfarm Employees: Where does each admin begin or end? Source: FRED A quick note this AM about an important issue I...

Total Nonfarm Employees: Where does each admin begin or end? Source: FRED A quick note this AM about an important issue I...

Read More

Today, I want to discuss the sentiment/behavior divide. If you have been reading this site any length of time, you know of my...

Today, I want to discuss the sentiment/behavior divide. If you have been reading this site any length of time, you know of my...

Read More

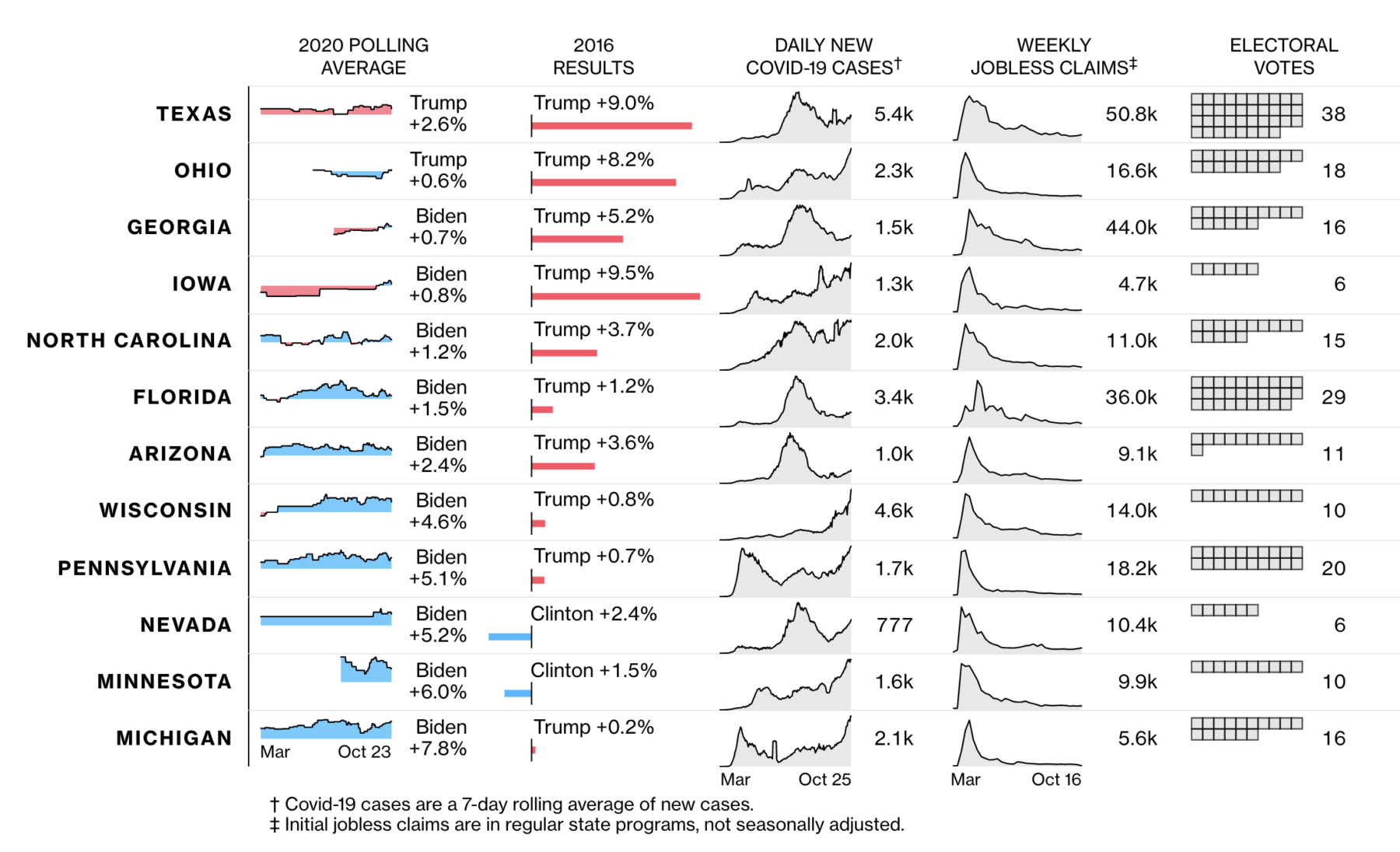

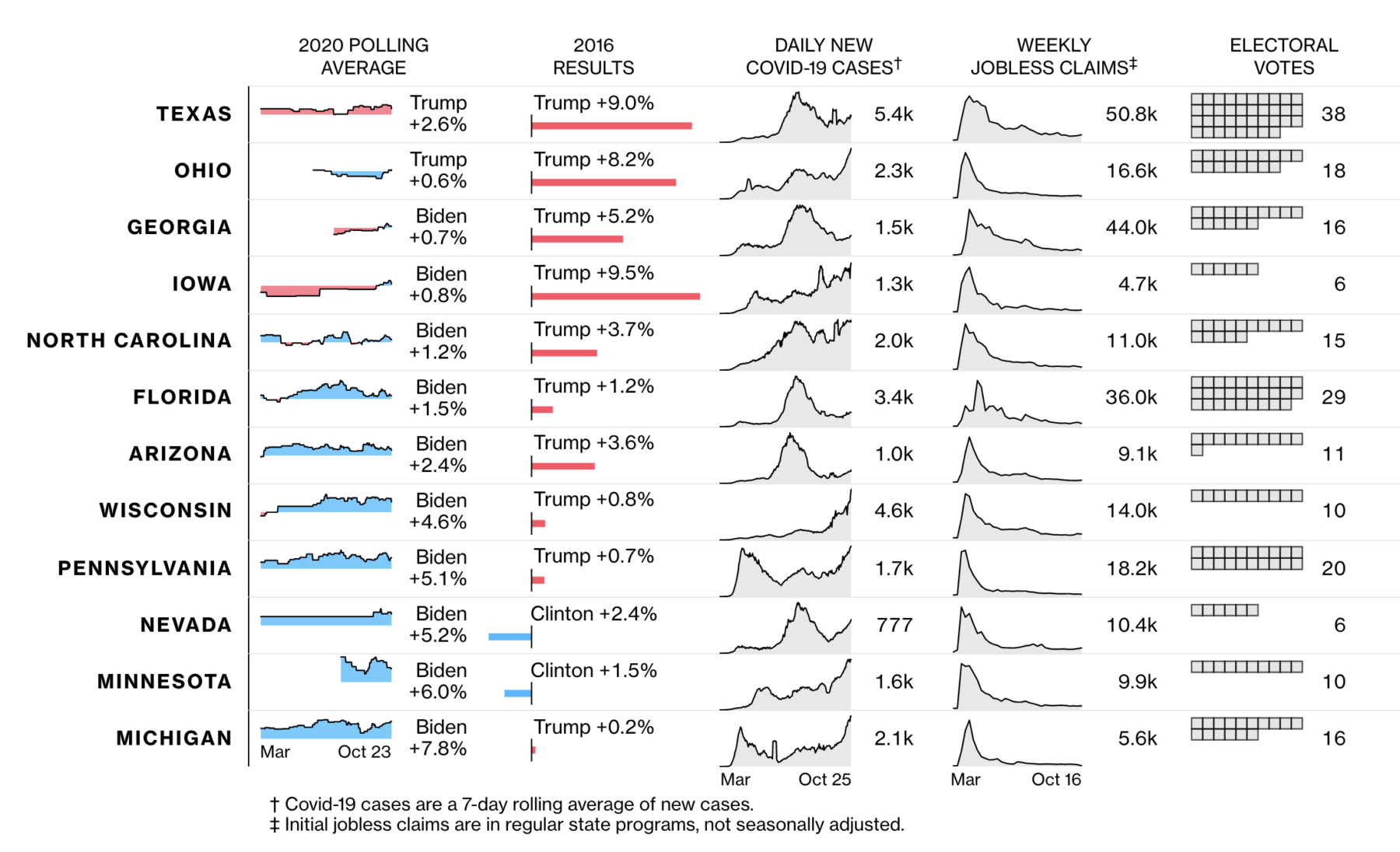

Election day is finally here. Last month, I shared some random facts related to markets and the election. Here are some more small items...

Election day is finally here. Last month, I shared some random facts related to markets and the election. Here are some more small items...

Read More

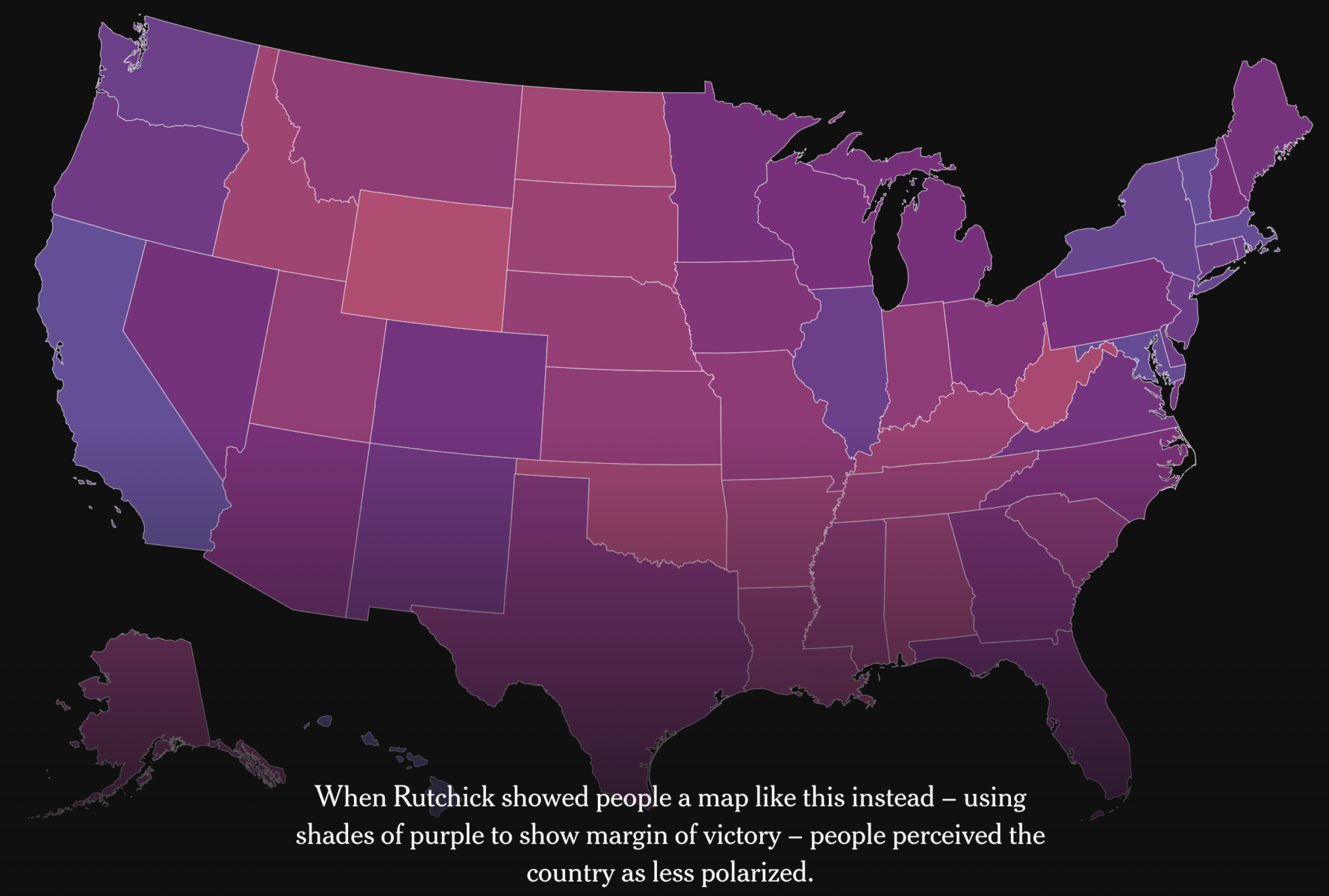

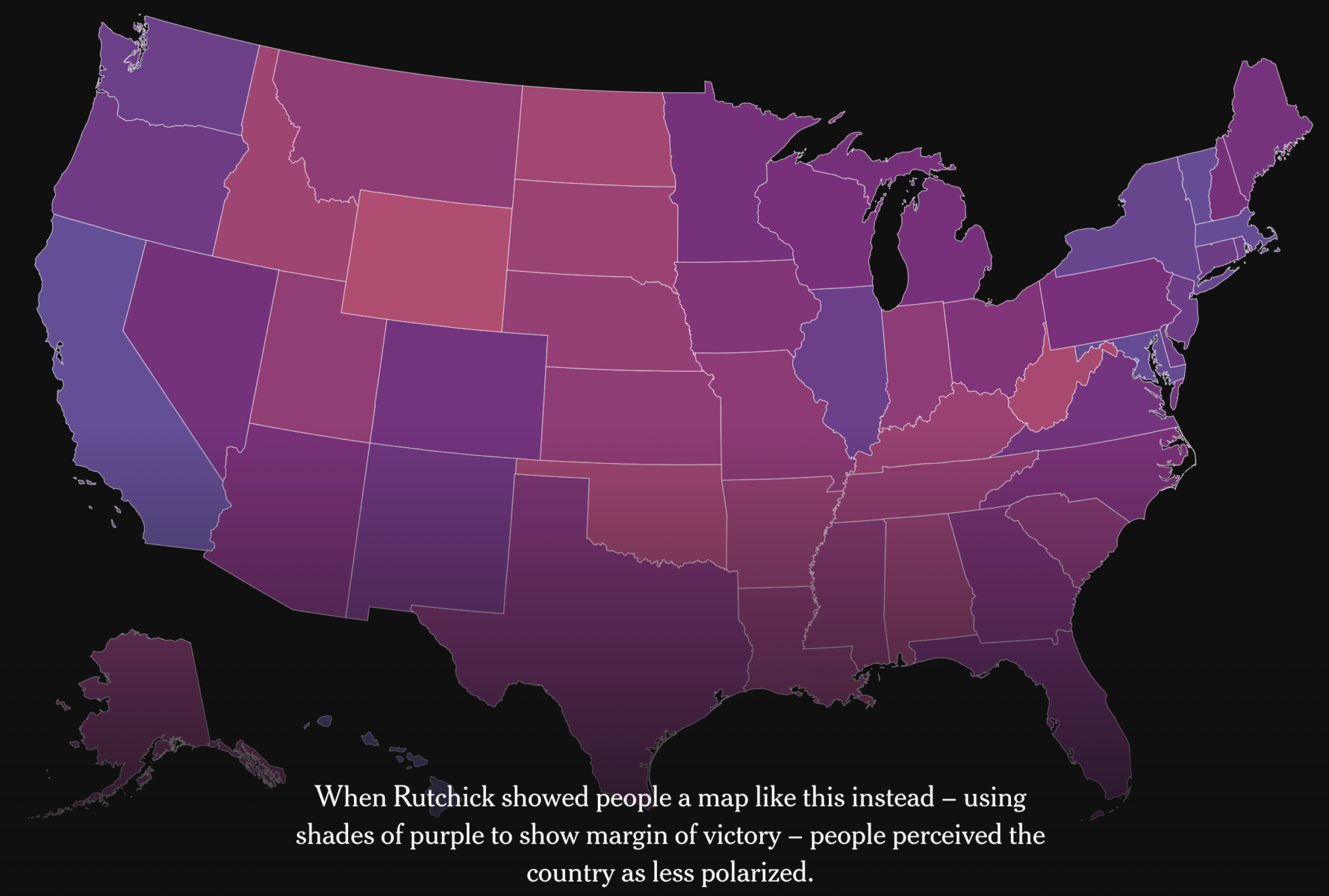

I have always hated those red & blue election maps — they are a highly misleading model of reality for several reasons. First,...

I have always hated those red & blue election maps — they are a highly misleading model of reality for several reasons. First,...

Read More

Biden Pulling Off a Strategy Clinton Couldn’t in 2016: Recreate Obama’s Map Source: Bloomberg Interesting analysis from...

Biden Pulling Off a Strategy Clinton Couldn’t in 2016: Recreate Obama’s Map Source: Bloomberg Interesting analysis from...

Read More

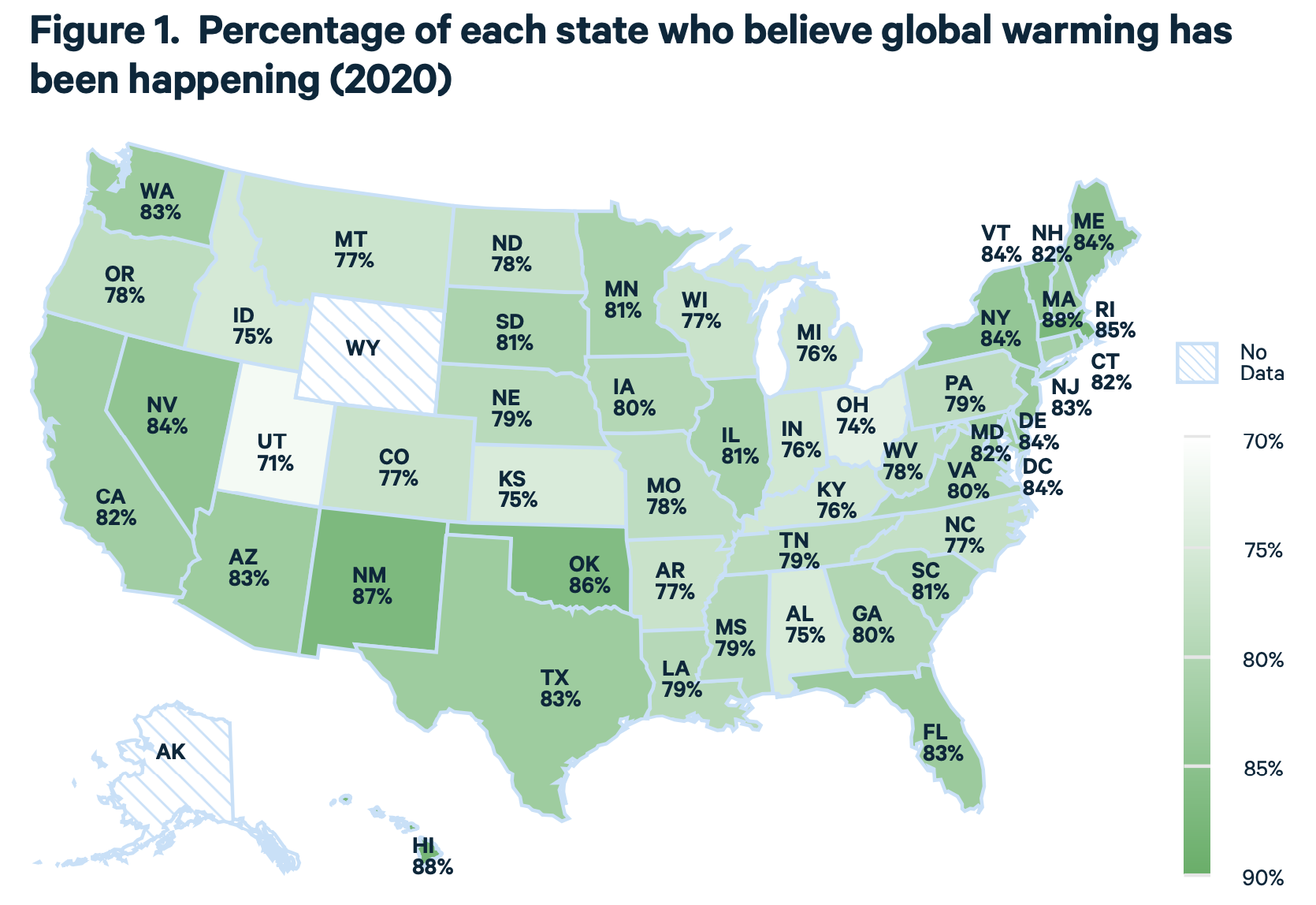

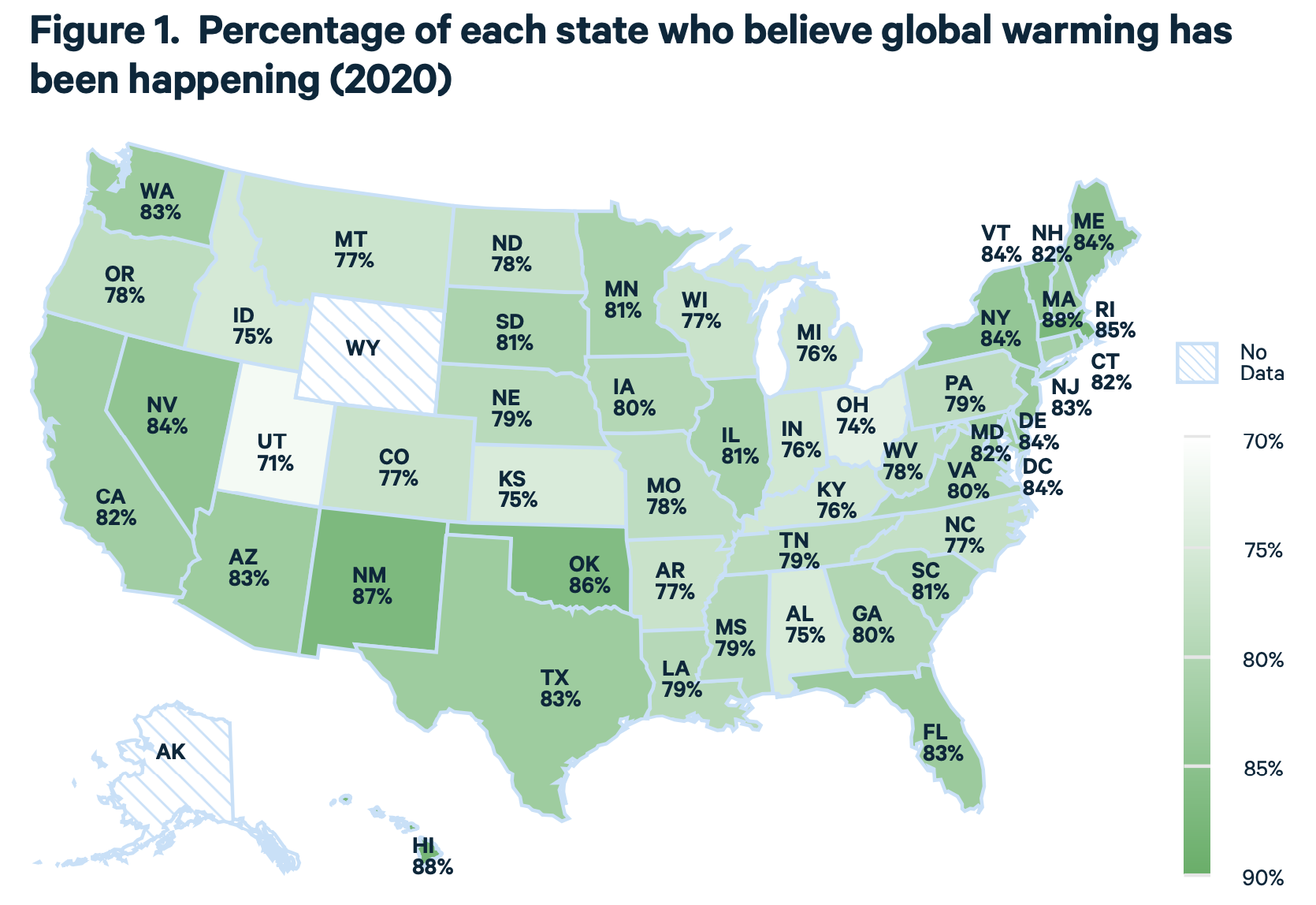

Source: Resources for the Future From Resources From The Future: In 2020, people are more sure than ever about whether...

Source: Resources for the Future From Resources From The Future: In 2020, people are more sure than ever about whether...

Read More

Josh and I have a chat about our 2020 election bet – who will win, what will happen afterwards.

Read More

A Broken Census Can Break Democracy The census is best known for determining how we the people are represented. But it also quietly...

A Broken Census Can Break Democracy The census is best known for determining how we the people are represented. But it also quietly...

Read More

Short answer? None. Longer answer: “For the most part, none of this is something that people should use as a basis for...

Short answer? None. Longer answer: “For the most part, none of this is something that people should use as a basis for...

Short answer? None. Longer answer: “For the most part, none of this is something that people should use as a basis for...

Short answer? None. Longer answer: “For the most part, none of this is something that people should use as a basis for...