Biased Algorithms, Biased World

Very interesting listen by data scientist Cathy O’Neil about her book, Weapons of Math Destruction, which describes the dangers of...

How Jim Simons Built the Best Hedge Fund Ever The former code breaker and math professor figured out how to do one thing very well in...

How Jim Simons Built the Best Hedge Fund Ever The former code breaker and math professor figured out how to do one thing very well in...

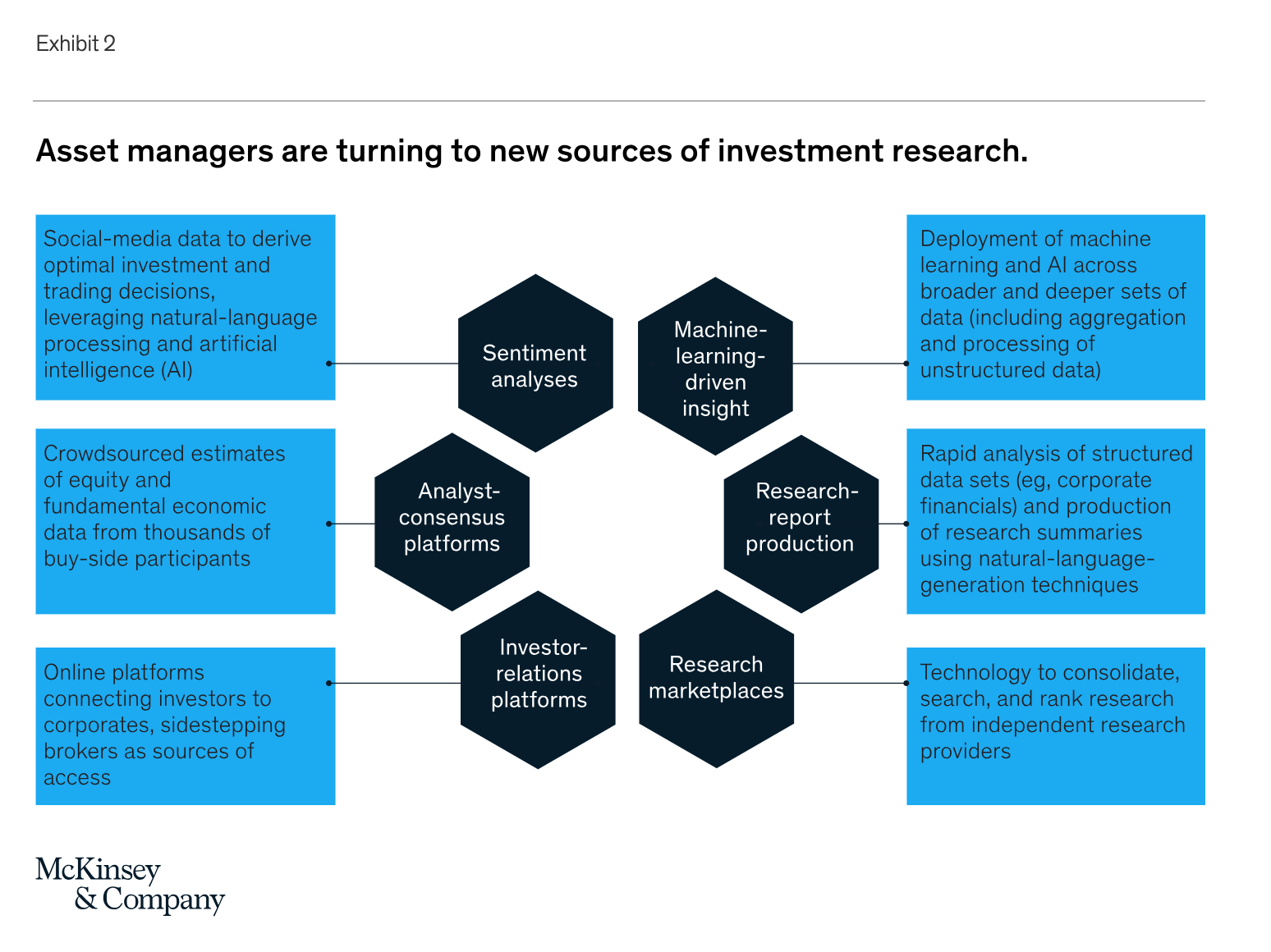

If you haven’t read the longish McKinsey piece I linked to earlier this week, then consider this a homework assignment. I...

If you haven’t read the longish McKinsey piece I linked to earlier this week, then consider this a homework assignment. I...

Get subscriber-only insights and news delivered by Barry every two weeks.