MIB: One of the Original Quant Shops

Acadian Asset Management was a quant shop before it was fashionable. They began running money on the basis of quantitative analysis in...

My quant panel is up — here are my questions for this sharp group. 1. Complexity: is it really required or is it just noise?...

My quant panel is up — here are my questions for this sharp group. 1. Complexity: is it really required or is it just noise?...

I am heading up to Boston for some hosting duties at Friday’s annual MIT Sloan Investment Conference. Its my third...

I am heading up to Boston for some hosting duties at Friday’s annual MIT Sloan Investment Conference. Its my third...

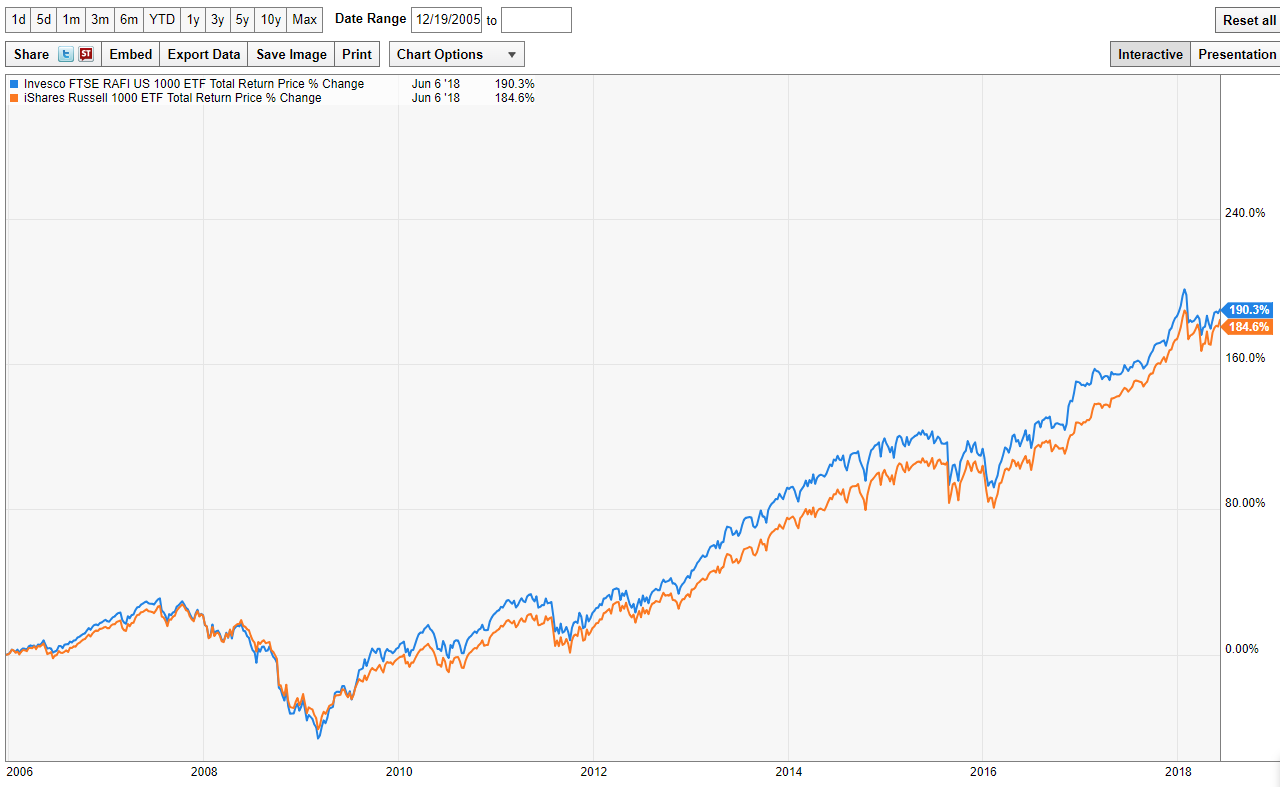

This afternoon, I am speaking at the Inside Smart Beta Conference, playing the role of curious skeptic in a room full of enthusiasts....

This afternoon, I am speaking at the Inside Smart Beta Conference, playing the role of curious skeptic in a room full of enthusiasts....

Algos all go? Francis Breedon, Louisa Chen, Angelo Ranaldo and Nicholas Vause Bank Underground, 02 May 2018 ...

Algos all go? Francis Breedon, Louisa Chen, Angelo Ranaldo and Nicholas Vause Bank Underground, 02 May 2018 ...

Get subscriber-only insights and news delivered by Barry every two weeks.