What Should You Expect After Flat Years in US Markets ?

U.S. markets essentially made no gains in 2015. The major indexes are more or less flat for the year to date. The Nasdaq-100 Index has...

The most interesting thing I read today comes from Michael Batnick (Director of Research at RWM). In a post titled “The Power of...

The most interesting thing I read today comes from Michael Batnick (Director of Research at RWM). In a post titled “The Power of...

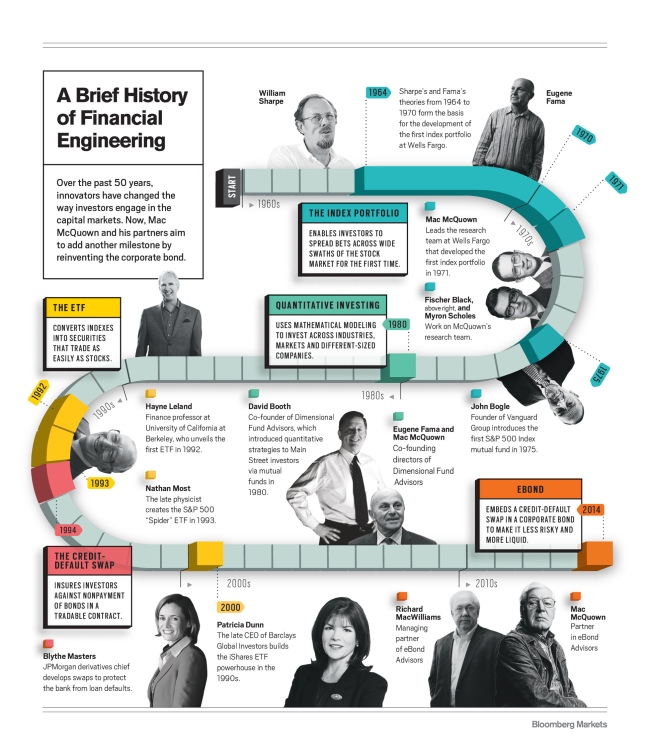

Killer slice of history from Bloomberg Business: click for utterly ginormous infographic Source: Bloomberg Business

Killer slice of history from Bloomberg Business: click for utterly ginormous infographic Source: Bloomberg Business

> "At the start of the year, profits at banks, brokers and insurance companies were projected to rise 22 percent in 2008,...

> "At the start of the year, profits at banks, brokers and insurance companies were projected to rise 22 percent in 2008,...

My partner Kevin sends me a reminder this morning that "When the markets break down investors look for alternative ways to make...

My partner Kevin sends me a reminder this morning that "When the markets break down investors look for alternative ways to make...

While I am traveling, I wanted to CHERRY PICK a few charts from my day job: Fusion IQ: AMGN had a buy signal on 6/23/2008 DNA had a buy...

While I am traveling, I wanted to CHERRY PICK a few charts from my day job: Fusion IQ: AMGN had a buy signal on 6/23/2008 DNA had a buy...

Get subscriber-only insights and news delivered by Barry every two weeks.