Transcript: Sean Dobson, Amherst Holdings

The transcript from this week’s, MiB: Sean Dobson, Amherst Holdings, is below. You can stream and download our full...

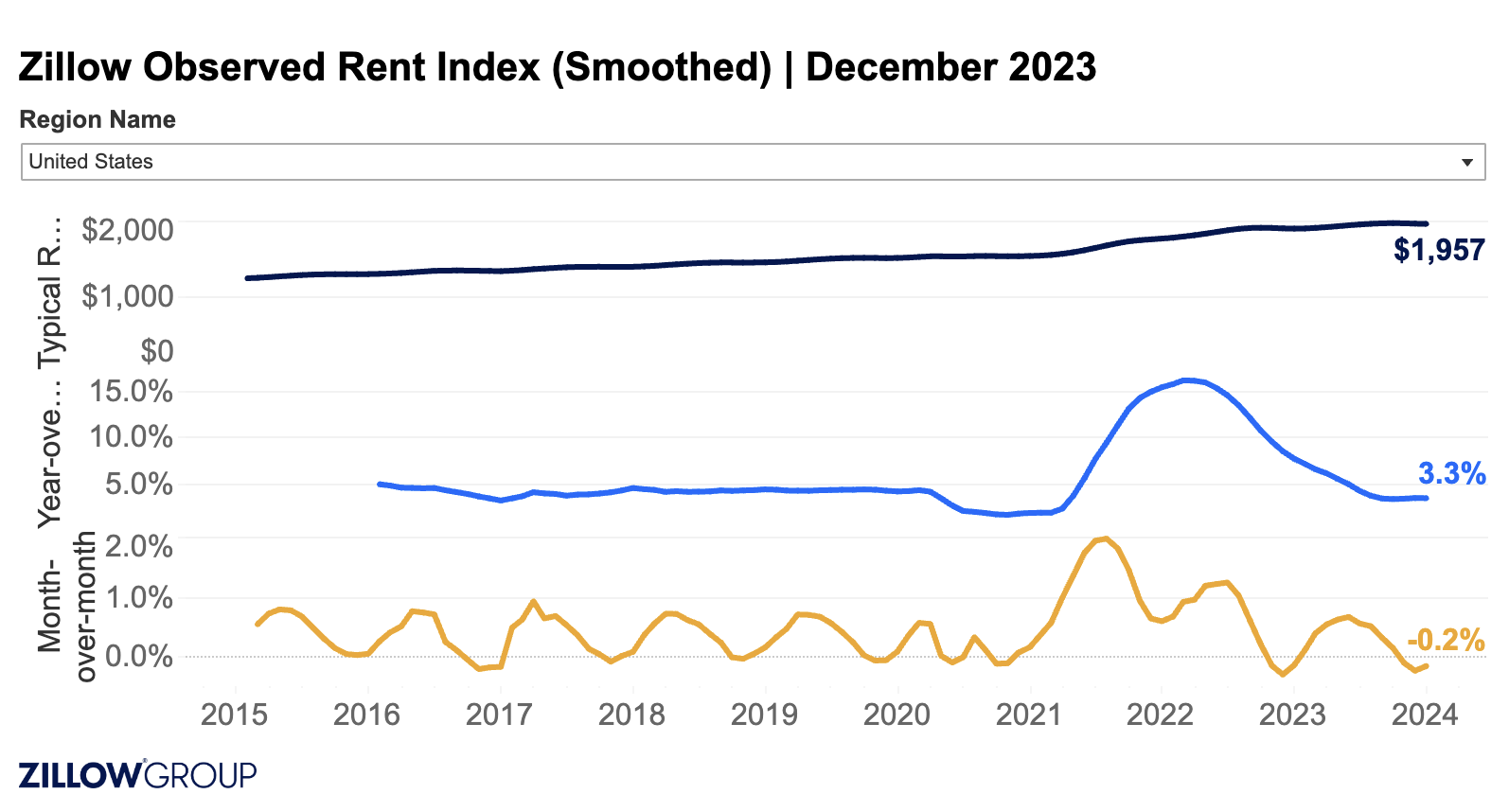

Last month, I mentioned that CPI inflation measures were based on lagging BLS measures of Owners’ Equivalent Rent...

Last month, I mentioned that CPI inflation measures were based on lagging BLS measures of Owners’ Equivalent Rent...

Back in the bad old days of mainframes, “Time-sharing” was how computing power and database storage were provided to...

Back in the bad old days of mainframes, “Time-sharing” was how computing power and database storage were provided to...

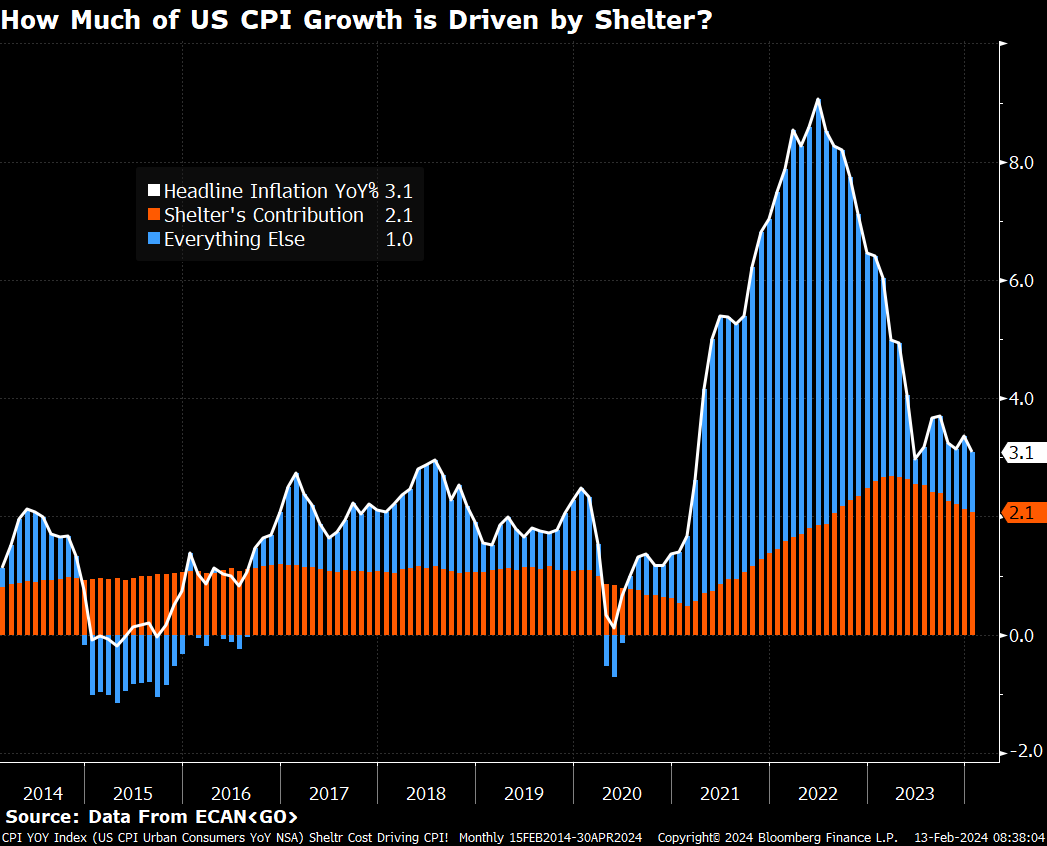

I am popping out of book leave to just throw a few charts at you regarding the Inflation data for December. CPI came in a 0.3%...

I am popping out of book leave to just throw a few charts at you regarding the Inflation data for December. CPI came in a 0.3%...

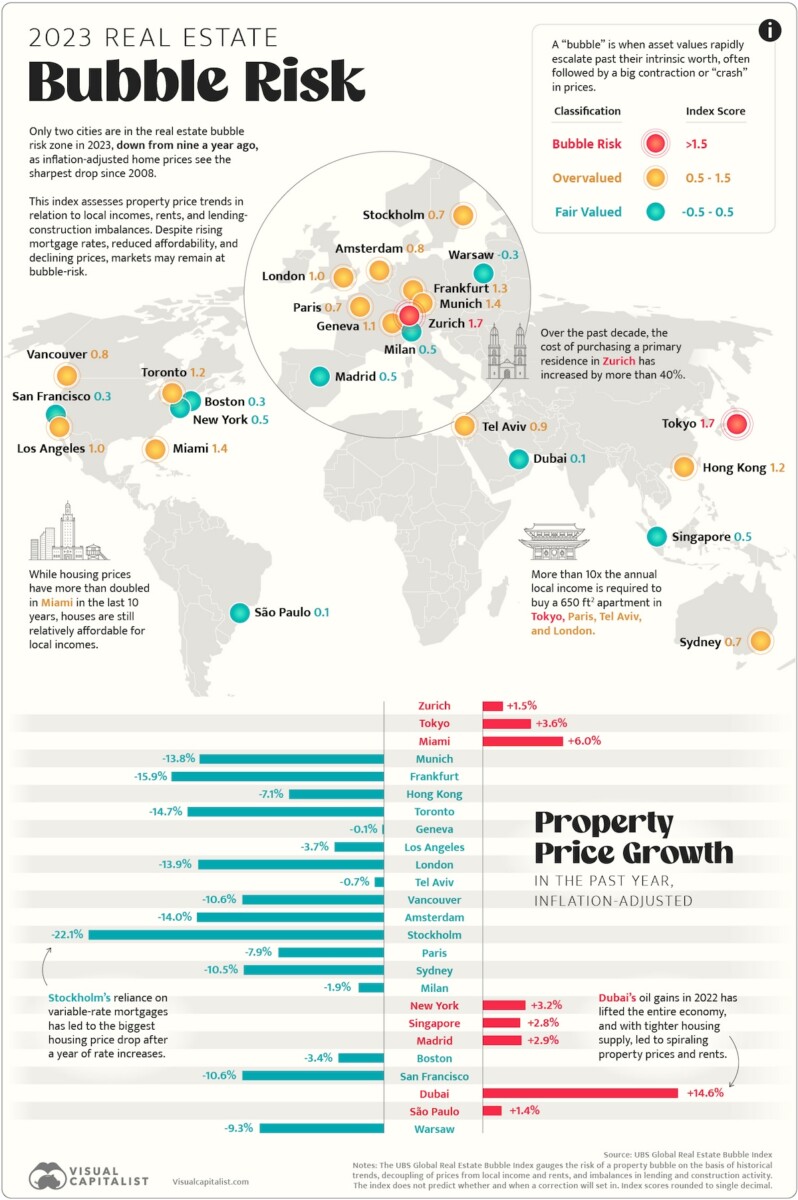

Buoyed by low interest rates for the last decade, many property markets have seen substantial price growth since 2010. Experts...

Buoyed by low interest rates for the last decade, many property markets have seen substantial price growth since 2010. Experts...

Get subscriber-only insights and news delivered by Barry every two weeks.