The Land Report 100 Meb Faber’s ideafarm shares this amazing dive into the largest U.S. Real Estate transactions and owners.

The Land Report 100 Meb Faber’s ideafarm shares this amazing dive into the largest U.S. Real Estate transactions and owners.

Read More

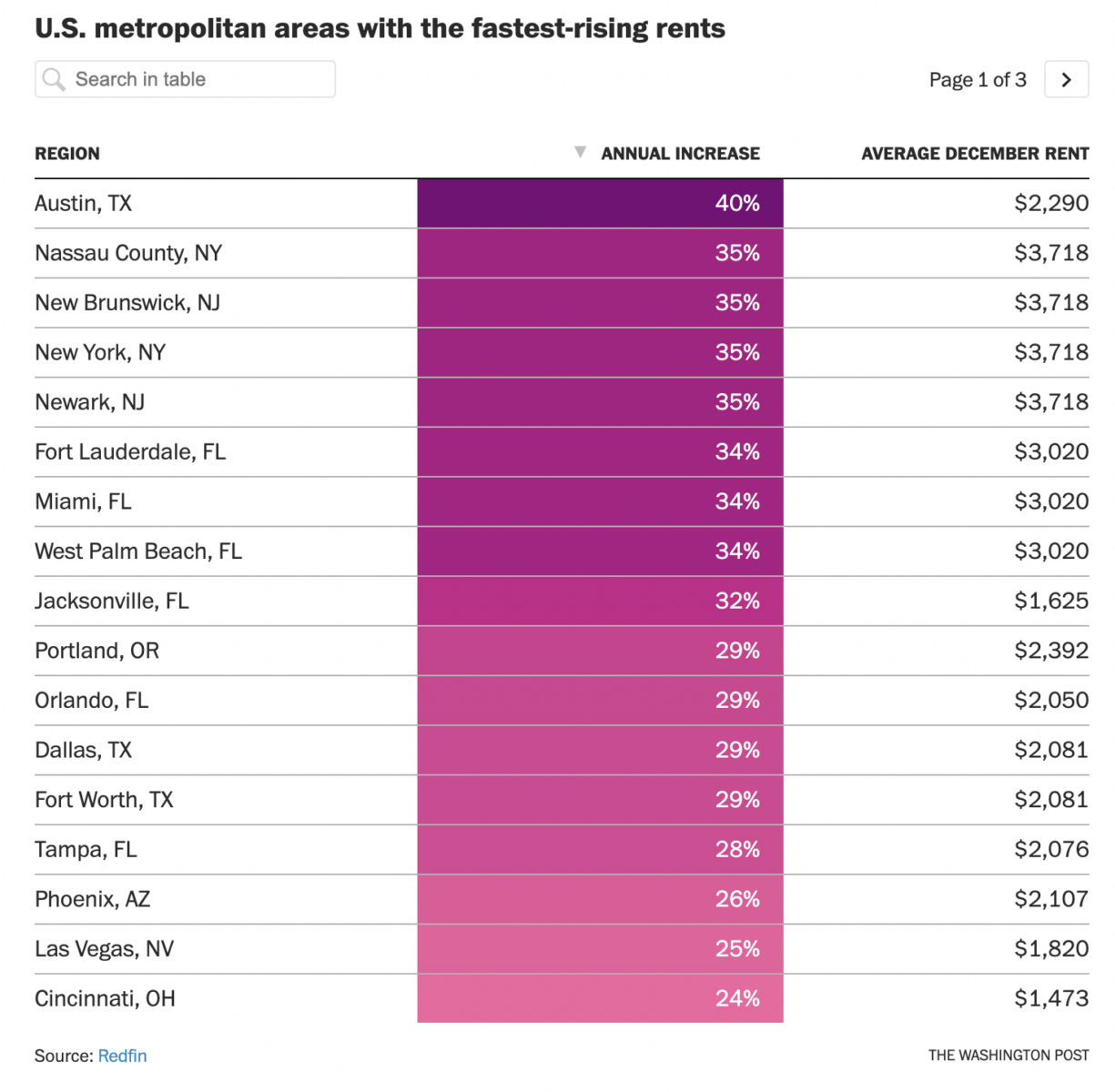

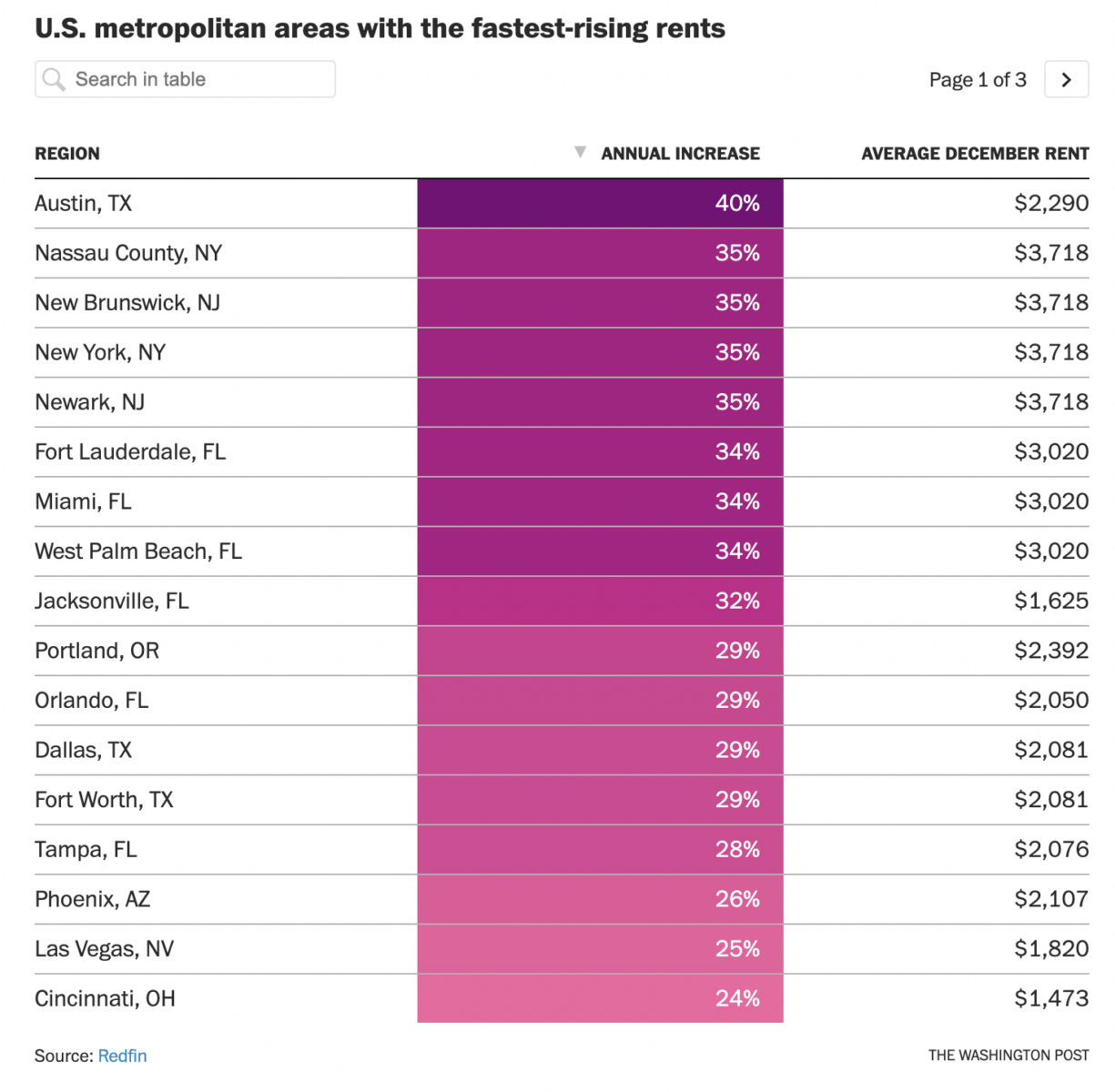

“Rent prices are up 40% in some cities, forcing millions to find another place to live” screamed the Washington Post...

“Rent prices are up 40% in some cities, forcing millions to find another place to live” screamed the Washington Post...

Read More

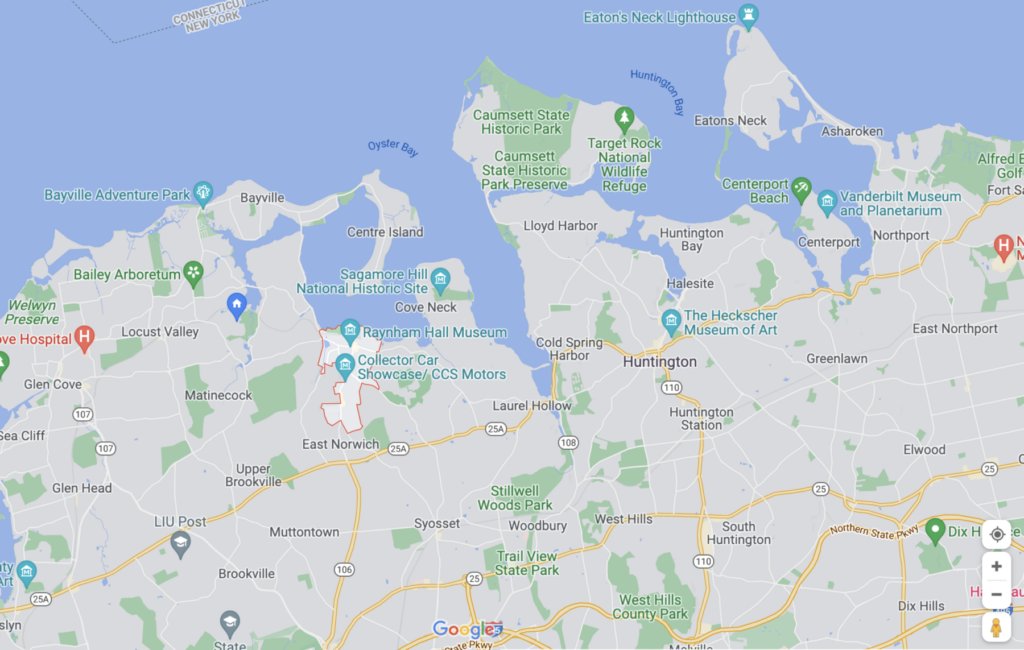

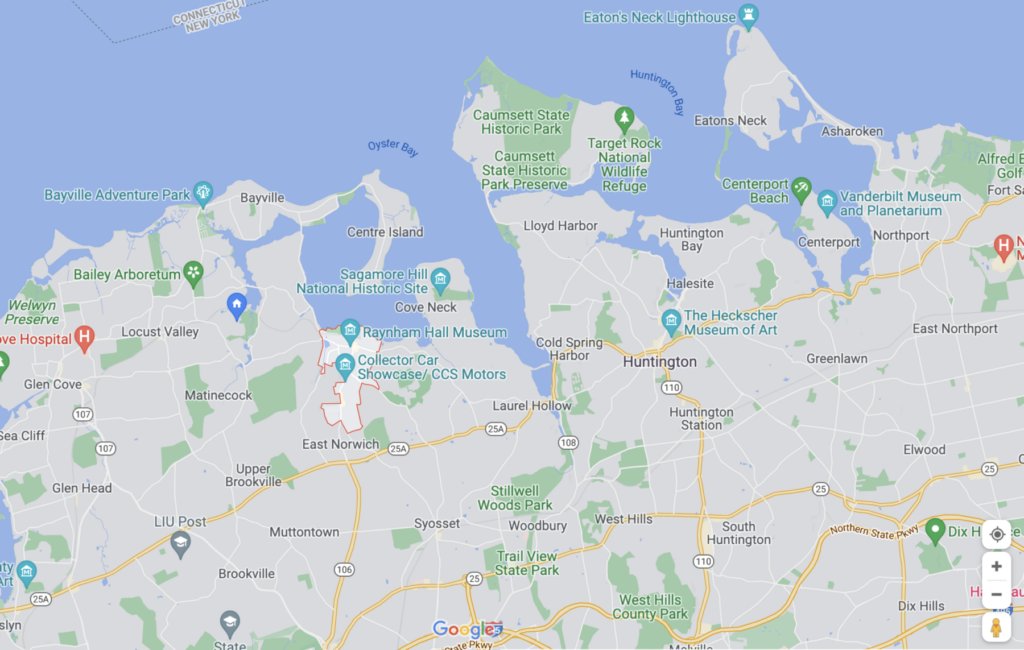

Lots of parks, preserves, and trails to explore… To hear an audio spoken word version of this post, click...

Lots of parks, preserves, and trails to explore… To hear an audio spoken word version of this post, click...

Read More

The transcript from this week’s, MiB: Maureen Farrell on the Cult of We is below. You can stream and download our...

Read More

This week, we speak with New York Times business reporter Maureen Farrell, who co-authored the 2021 book “The Cult of...

Read More

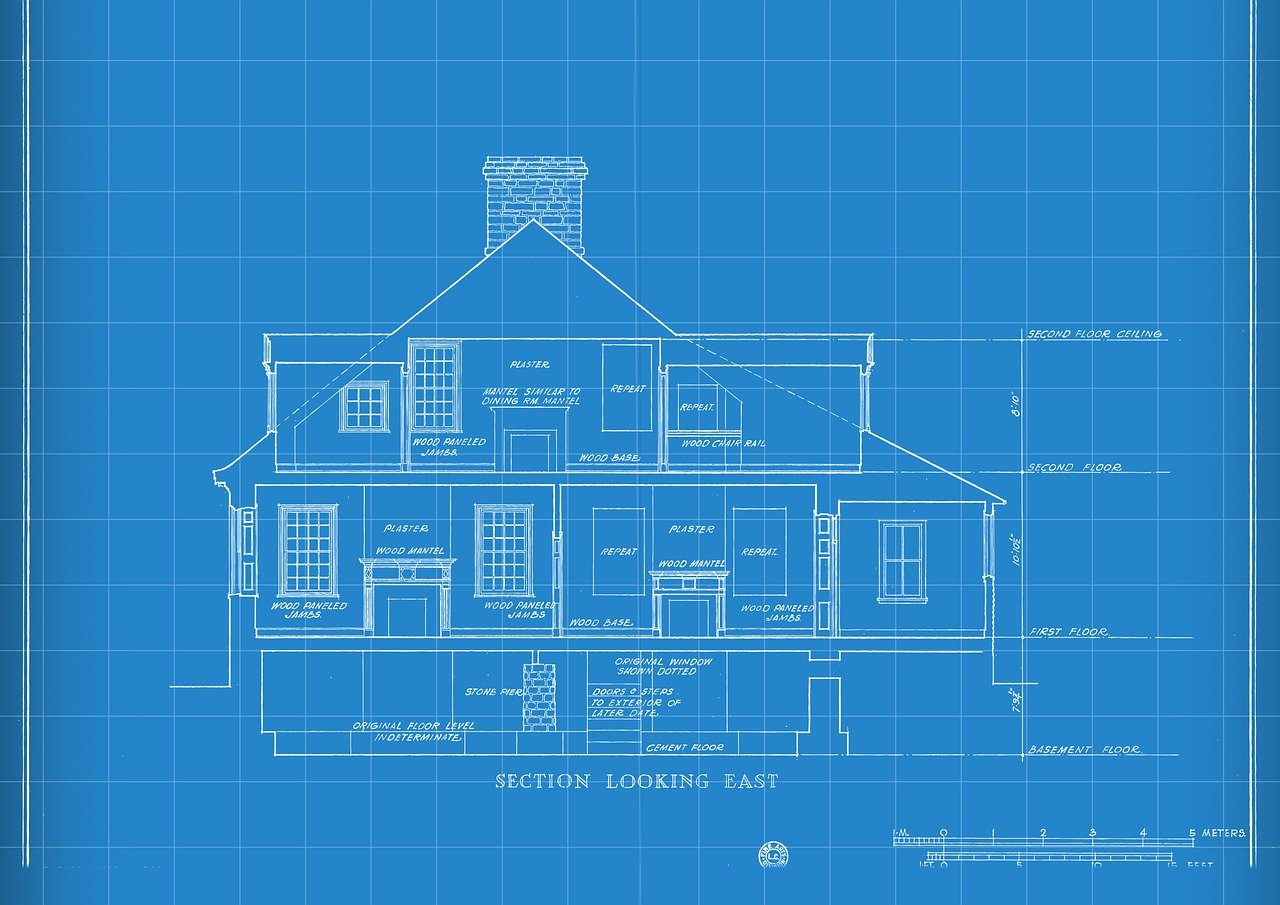

To hear an audio spoken word version of this post, click here. Residential Real Estate in the United States is worth...

To hear an audio spoken word version of this post, click here. Residential Real Estate in the United States is worth...

Read More

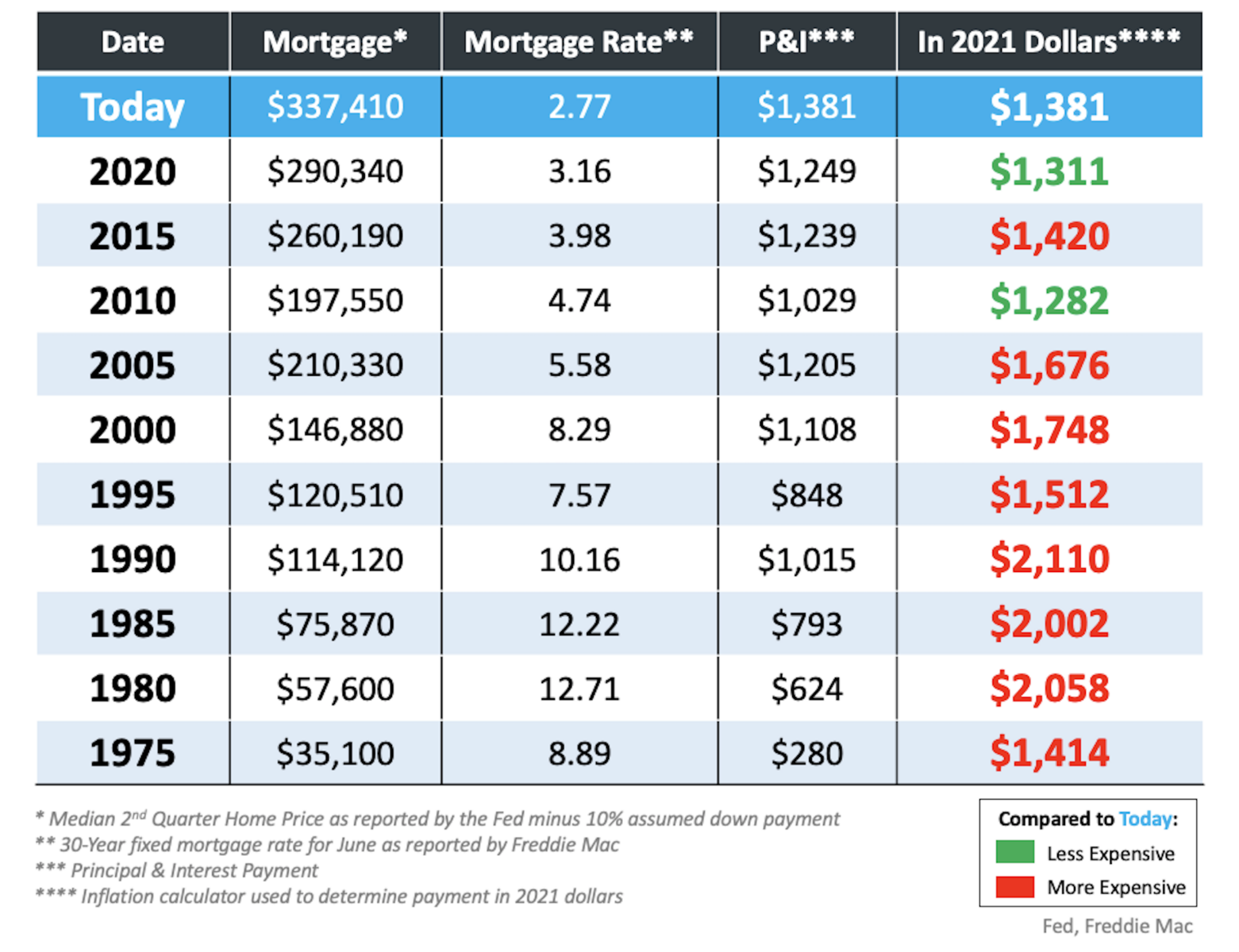

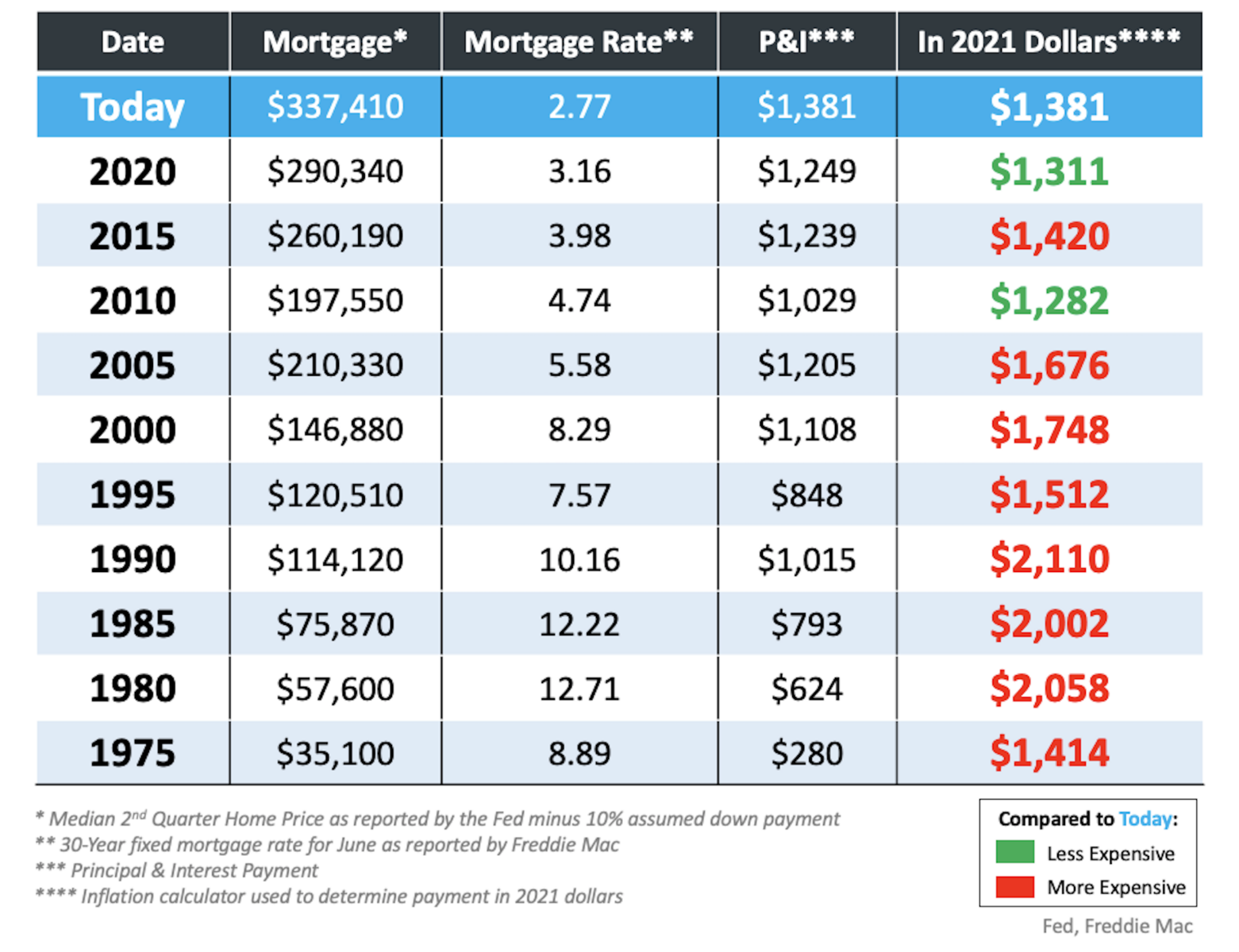

Are Houses Less Affordable Than They Were in Past Decades? Source: Simplifying the Market I have been fascinated by...

Are Houses Less Affordable Than They Were in Past Decades? Source: Simplifying the Market I have been fascinated by...

Read More

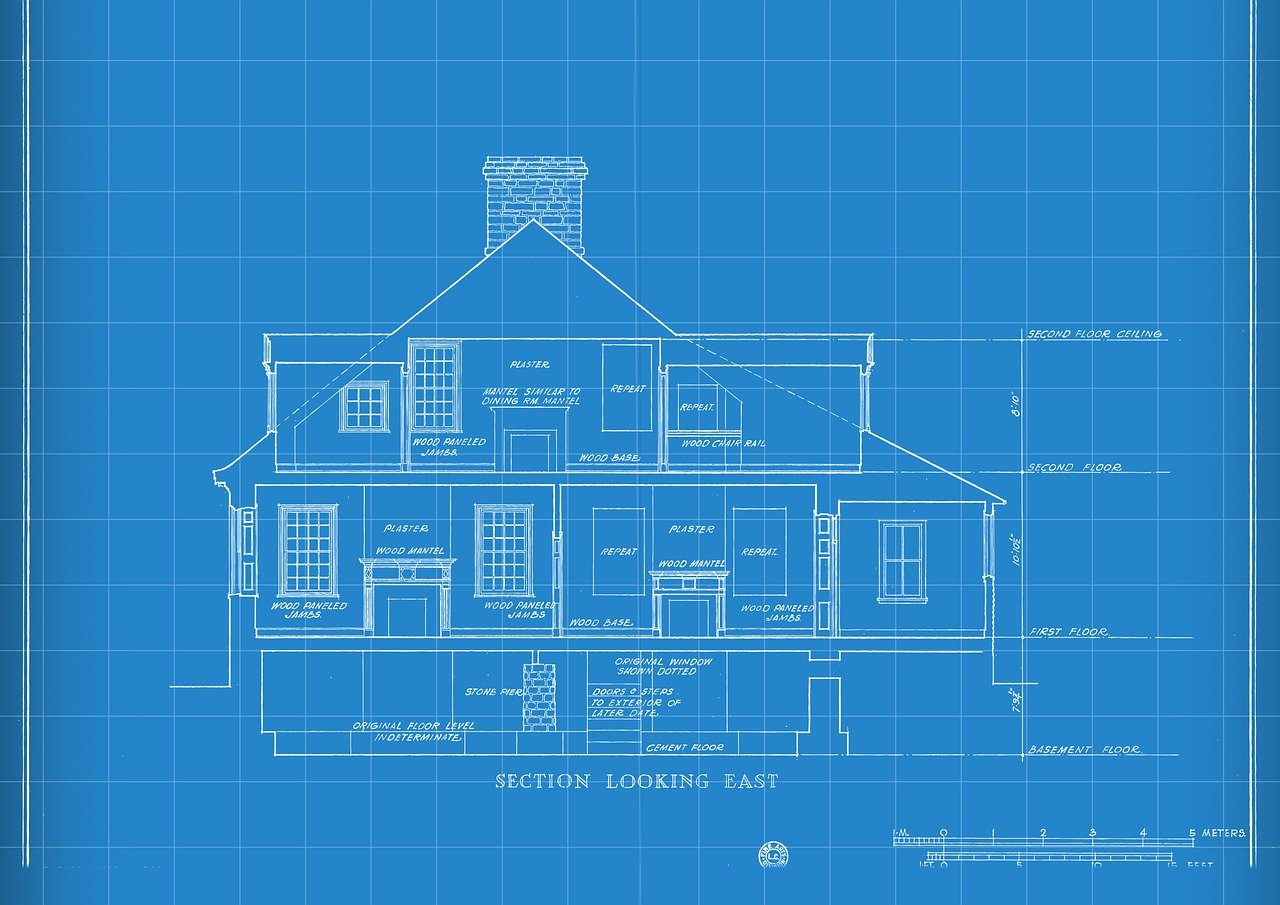

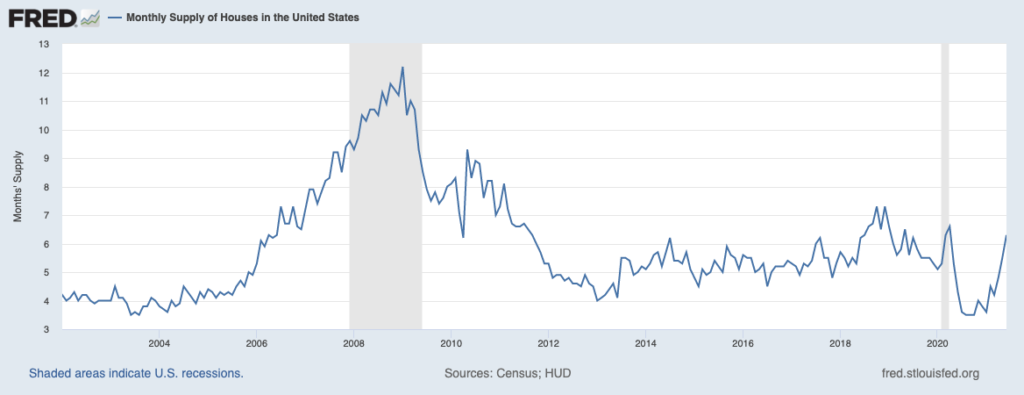

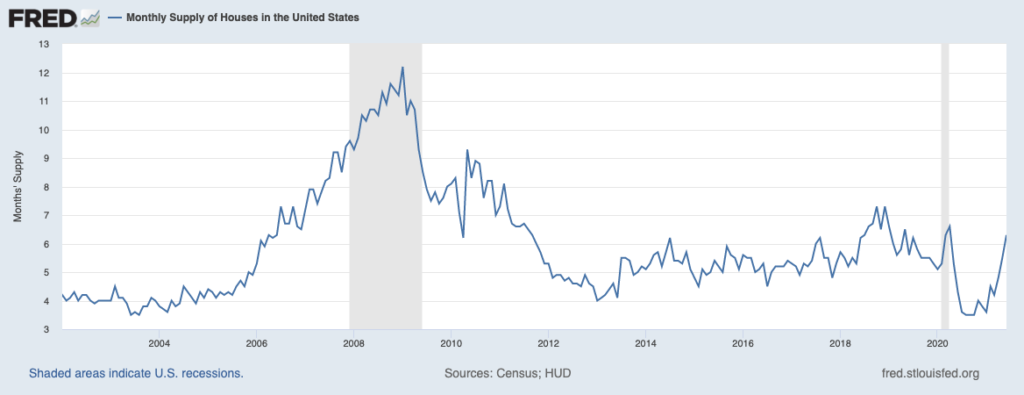

To hear an audio spoken word version of this post, click here. Why are there too few houses in general, and...

To hear an audio spoken word version of this post, click here. Why are there too few houses in general, and...

Read More

So, we were back in the office yesterday (officially) for the first time as a group in a year. We (unofficially) re-opened the...

So, we were back in the office yesterday (officially) for the first time as a group in a year. We (unofficially) re-opened the...

Read More

The Covid-19 pandemic has been “the Great Disruptor,” forcing people into reconsidering their living circumstances,...

Read More

The Land Report 100 Meb Faber’s ideafarm shares this amazing dive into the largest U.S. Real Estate transactions and owners.

The Land Report 100 Meb Faber’s ideafarm shares this amazing dive into the largest U.S. Real Estate transactions and owners.

The Land Report 100 Meb Faber’s ideafarm shares this amazing dive into the largest U.S. Real Estate transactions and owners.

The Land Report 100 Meb Faber’s ideafarm shares this amazing dive into the largest U.S. Real Estate transactions and owners.