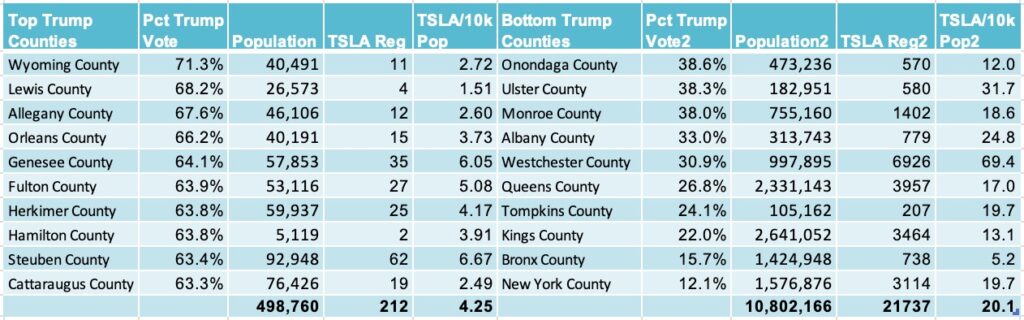

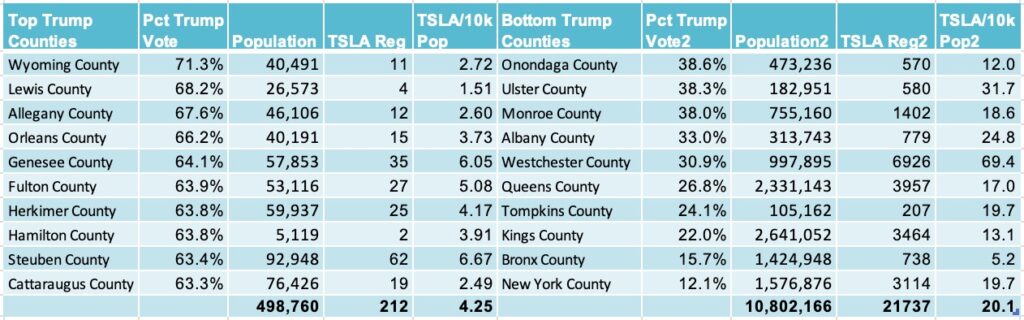

@TBPInvictus here: Back in December 2022, I hypothesized that Elon Musk’s antics and his newfound desire to own the...

@TBPInvictus here: Back in December 2022, I hypothesized that Elon Musk’s antics and his newfound desire to own the...

Read More

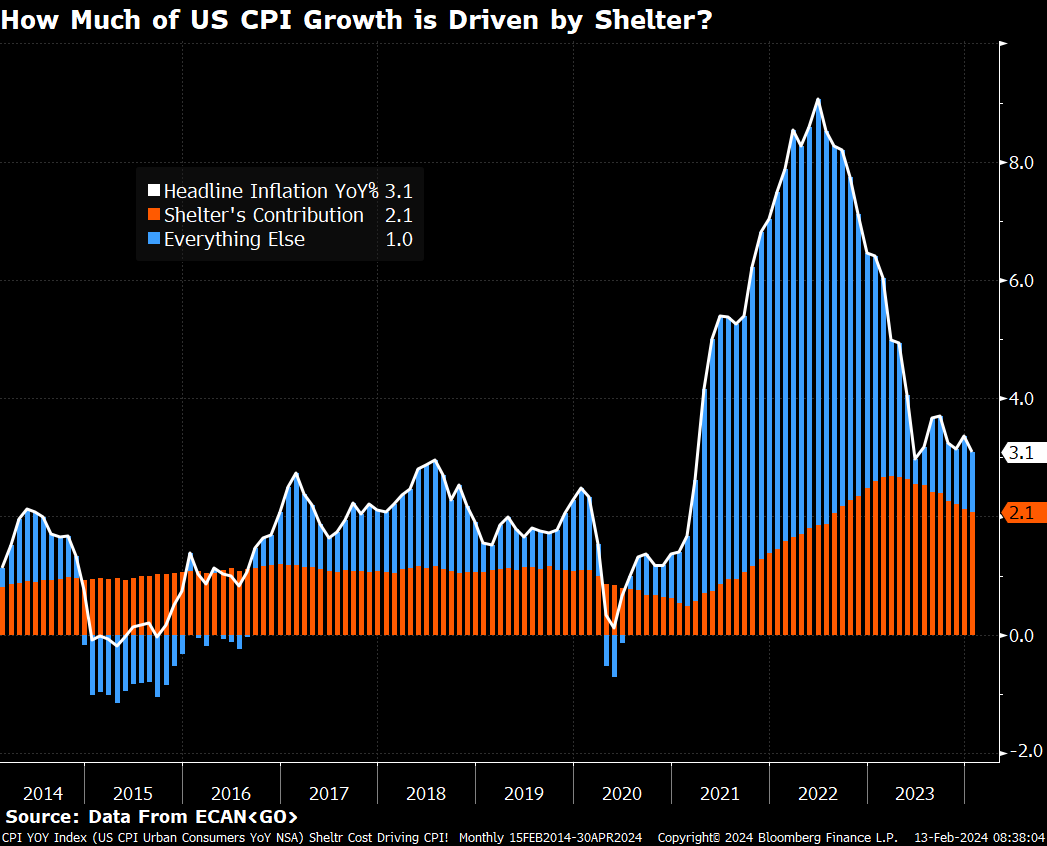

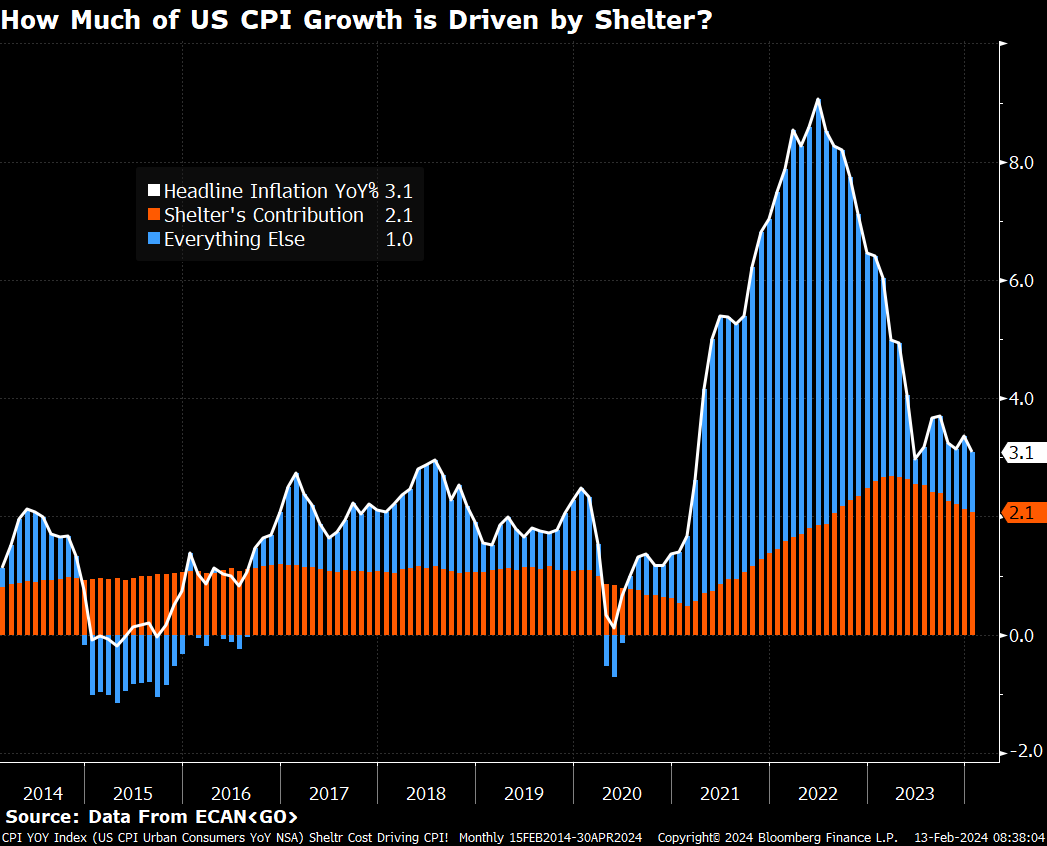

Last month, I mentioned that CPI inflation measures were based on lagging BLS measures of Owners’ Equivalent Rent...

Last month, I mentioned that CPI inflation measures were based on lagging BLS measures of Owners’ Equivalent Rent...

Read More

At the Money: Forecasting Recessions with Claudia Sahm (January 31, 2024 ) Investors don’t like recessions. But how...

Read More

Remember Squid Game? Written and directed by Hwang Dong-hyuk, “Squid Game” made its debut on Netflix on September 17, 2001. It...

Remember Squid Game? Written and directed by Hwang Dong-hyuk, “Squid Game” made its debut on Netflix on September 17, 2001. It...

Read More

Tyler Cowen and his colleague Alex Tabarrok write some interesting posts over at Marginal Revolution. Sometimes I agree with them,...

Tyler Cowen and his colleague Alex Tabarrok write some interesting posts over at Marginal Revolution. Sometimes I agree with them,...

Read More

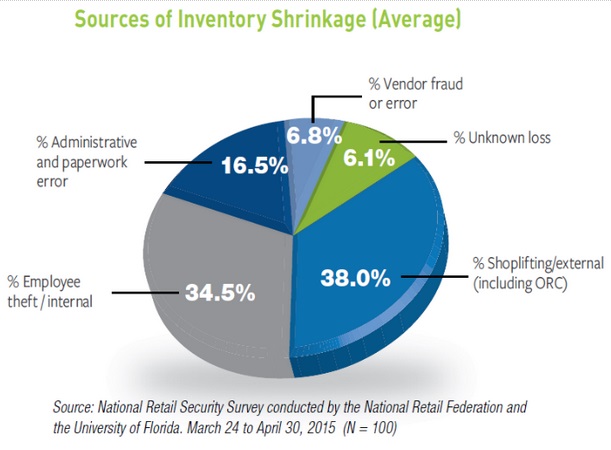

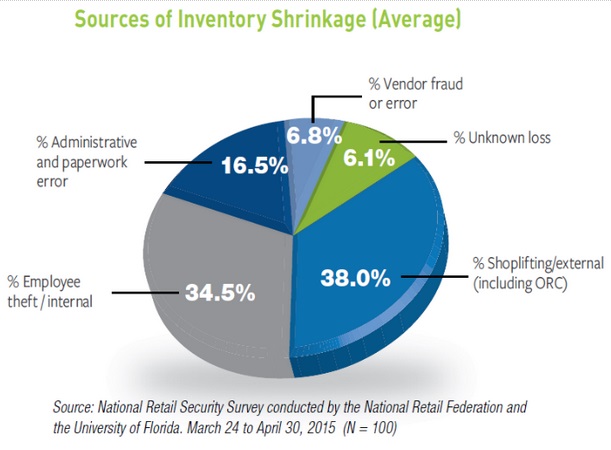

No, “nearly half” of $94.5 billion in retail inventory losses in 2021 was not “attributable to organized retail crime.”...

No, “nearly half” of $94.5 billion in retail inventory losses in 2021 was not “attributable to organized retail crime.”...

Read More

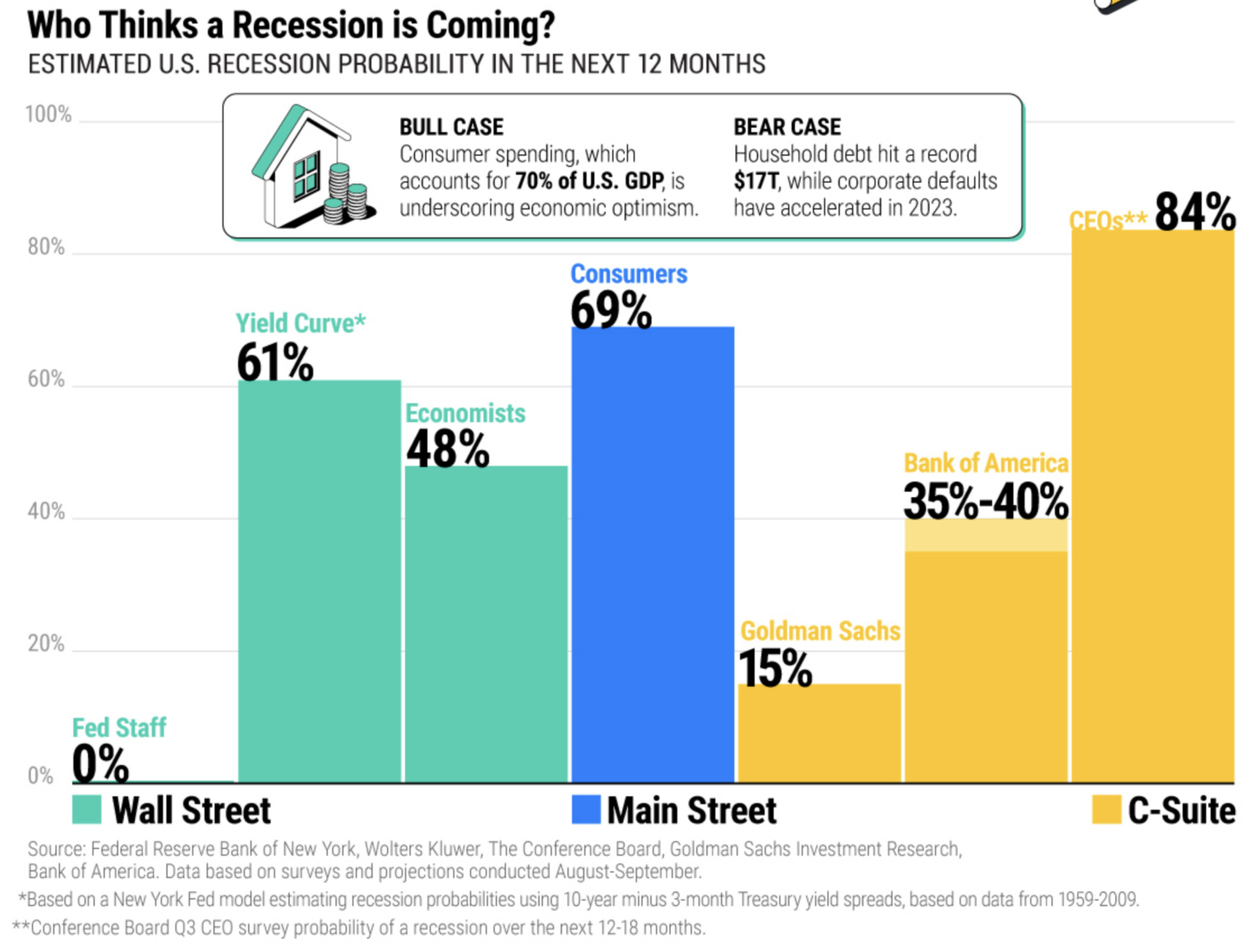

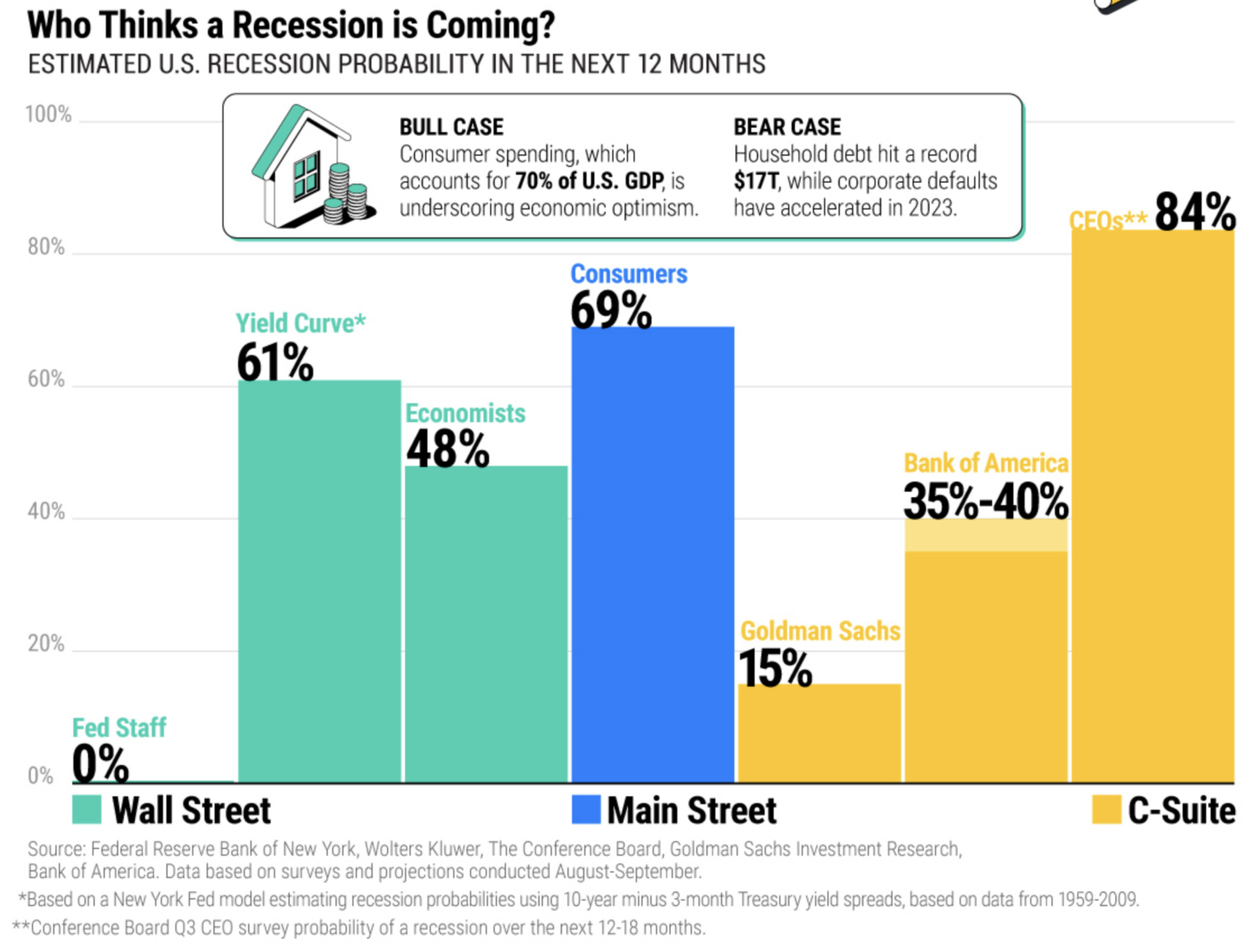

The chart above shows that 84% of CEOs are forecasting a recession over the next 12 months, 69% of Consumers saying the...

The chart above shows that 84% of CEOs are forecasting a recession over the next 12 months, 69% of Consumers saying the...

Read More

By now you surely know the story: In 2019, Elon Musk unveiled the Tesla Cyber truck, making all sorts of amazing promises....

By now you surely know the story: In 2019, Elon Musk unveiled the Tesla Cyber truck, making all sorts of amazing promises....

Read More

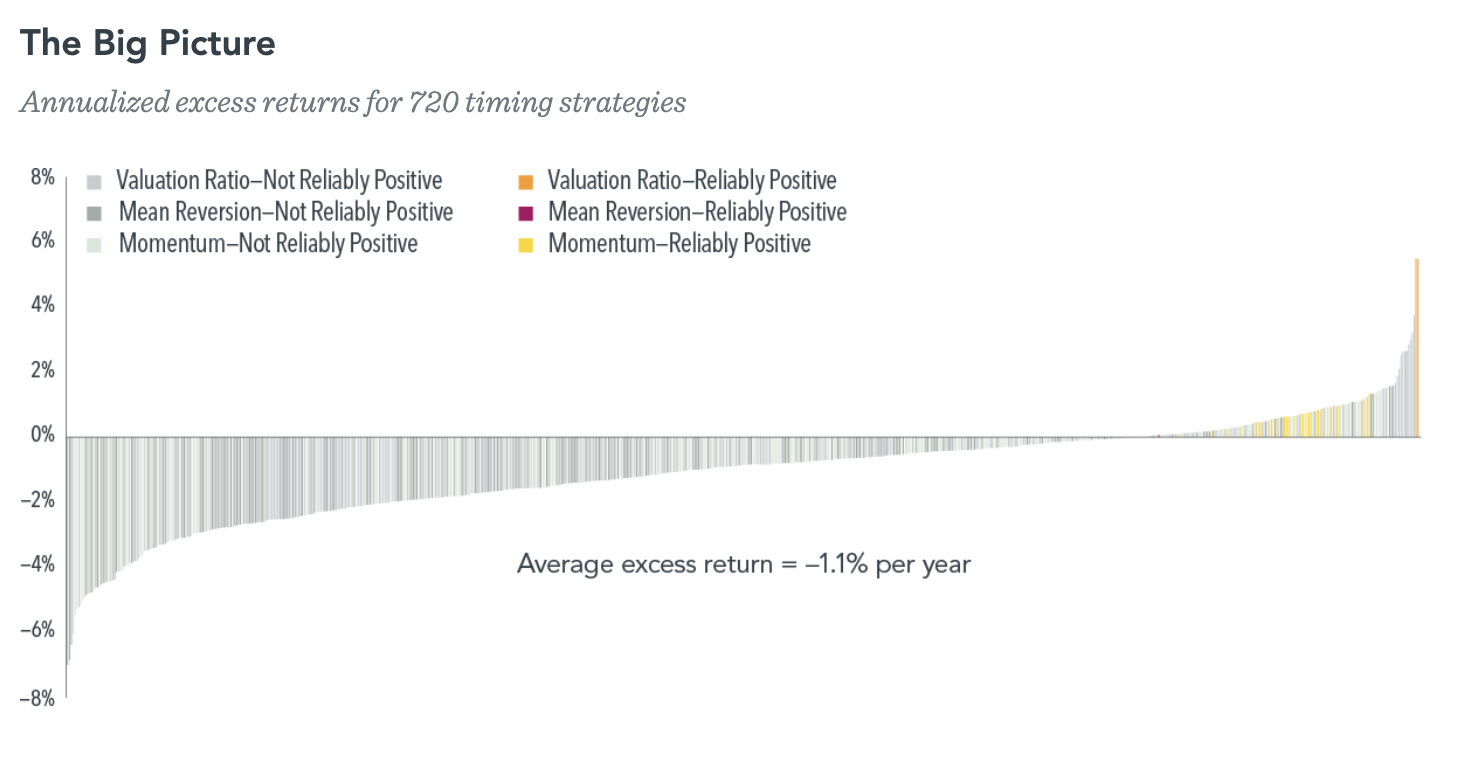

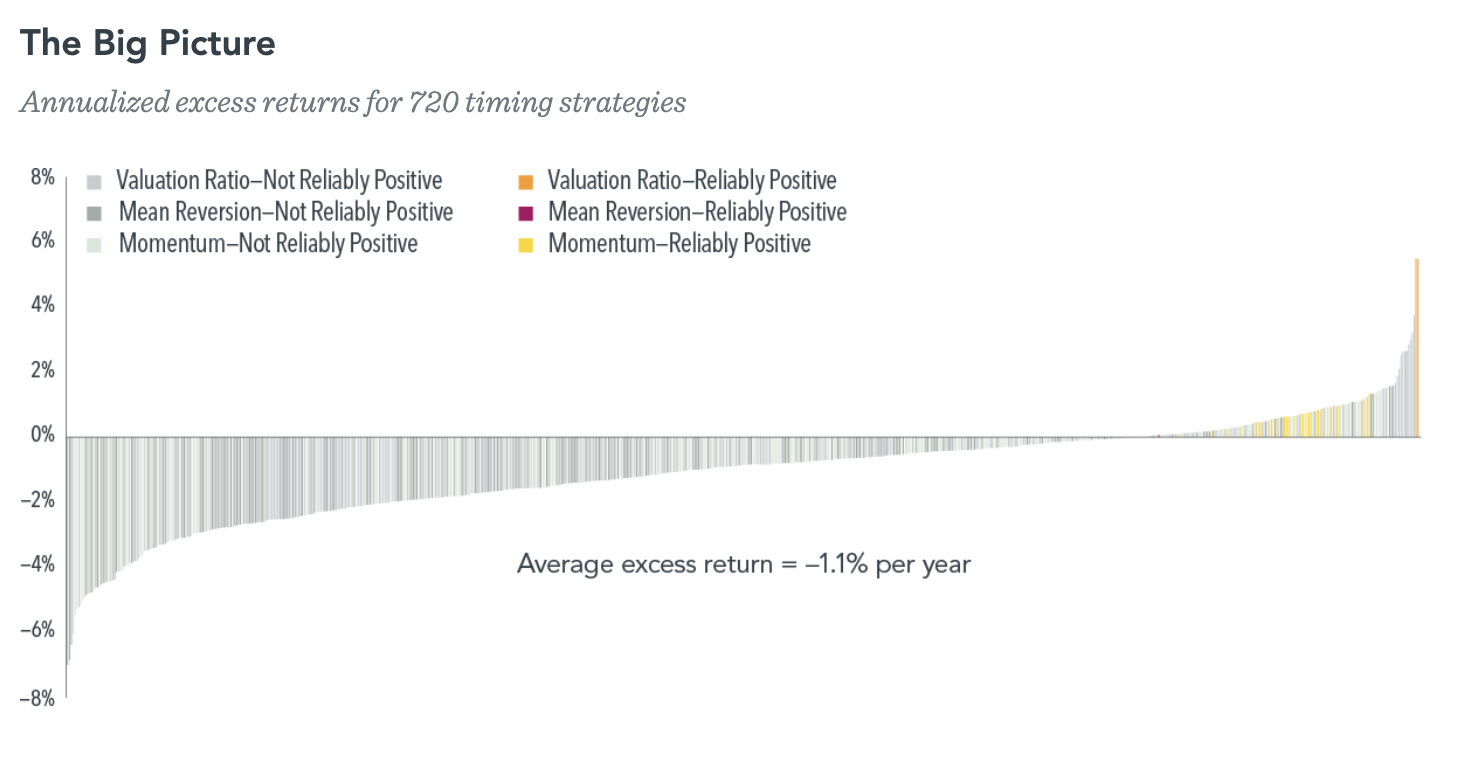

This weekend Jeff Sommer discussed a DFA research paper on market timing; both are well worth your time to read. The broad strokes...

This weekend Jeff Sommer discussed a DFA research paper on market timing; both are well worth your time to read. The broad strokes...

Read More

We spend way too much time trying to predict the future (especially this time of year). Rather than engage in futility, let’s...

We spend way too much time trying to predict the future (especially this time of year). Rather than engage in futility, let’s...

Read More

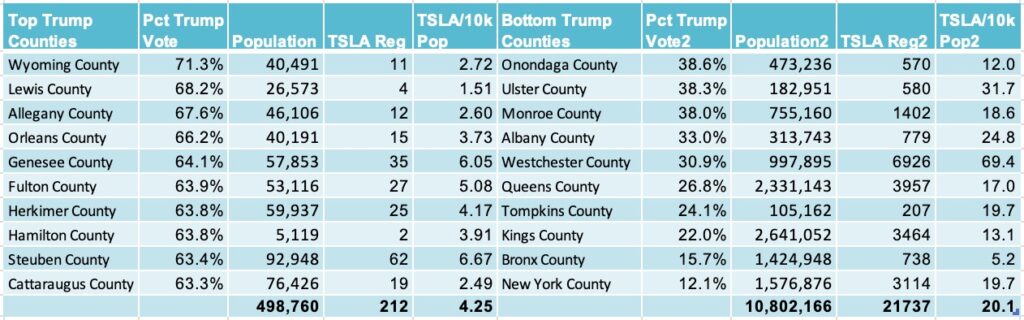

@TBPInvictus here: Back in December 2022, I hypothesized that Elon Musk’s antics and his newfound desire to own the...

@TBPInvictus here: Back in December 2022, I hypothesized that Elon Musk’s antics and his newfound desire to own the...

@TBPInvictus here: Back in December 2022, I hypothesized that Elon Musk’s antics and his newfound desire to own the...

@TBPInvictus here: Back in December 2022, I hypothesized that Elon Musk’s antics and his newfound desire to own the...