Most people don’t know that it is the editors, not the writers, who craft headlines. This should be common knowledge...

Most people don’t know that it is the editors, not the writers, who craft headlines. This should be common knowledge...

Read More

The public is responsible. There’s this fiction that no one knew about the Holocaust, that concentration...

The public is responsible. There’s this fiction that no one knew about the Holocaust, that concentration...

Read More

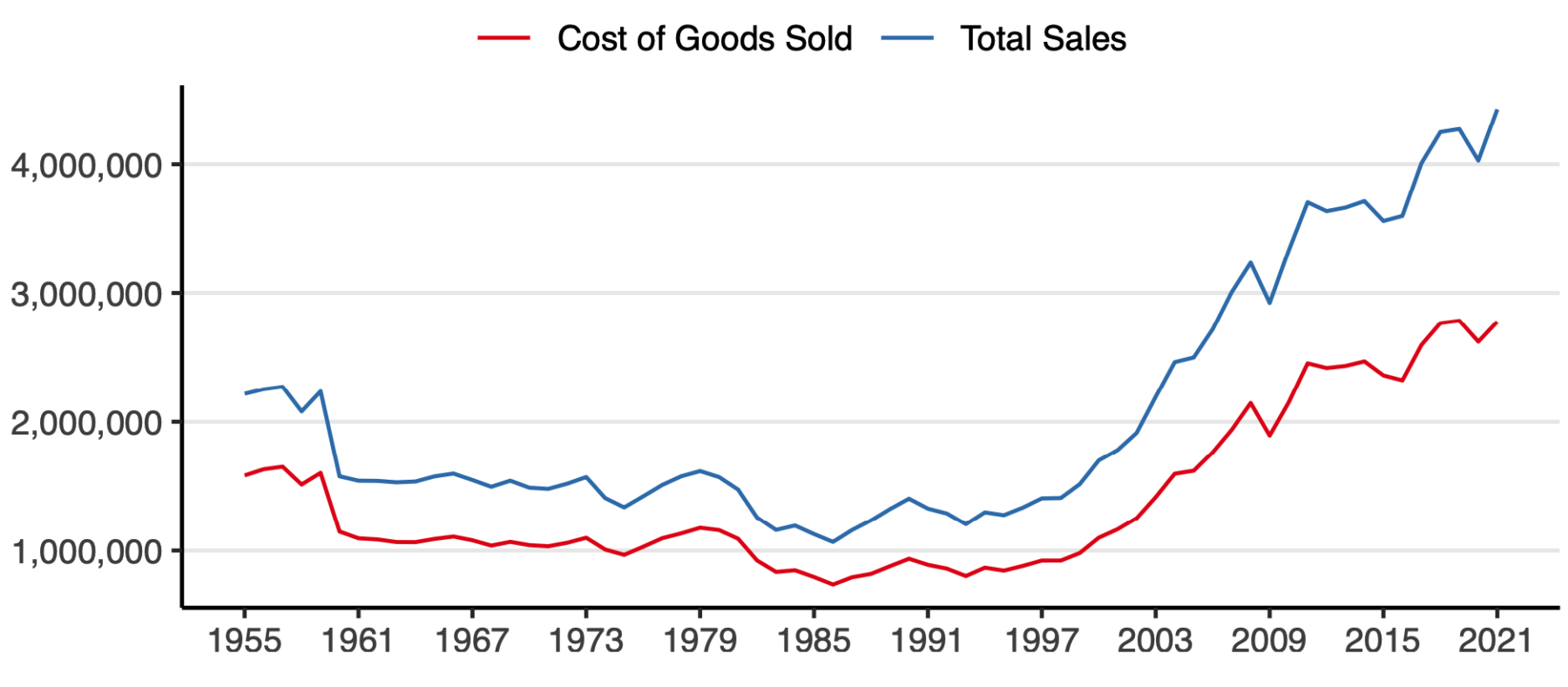

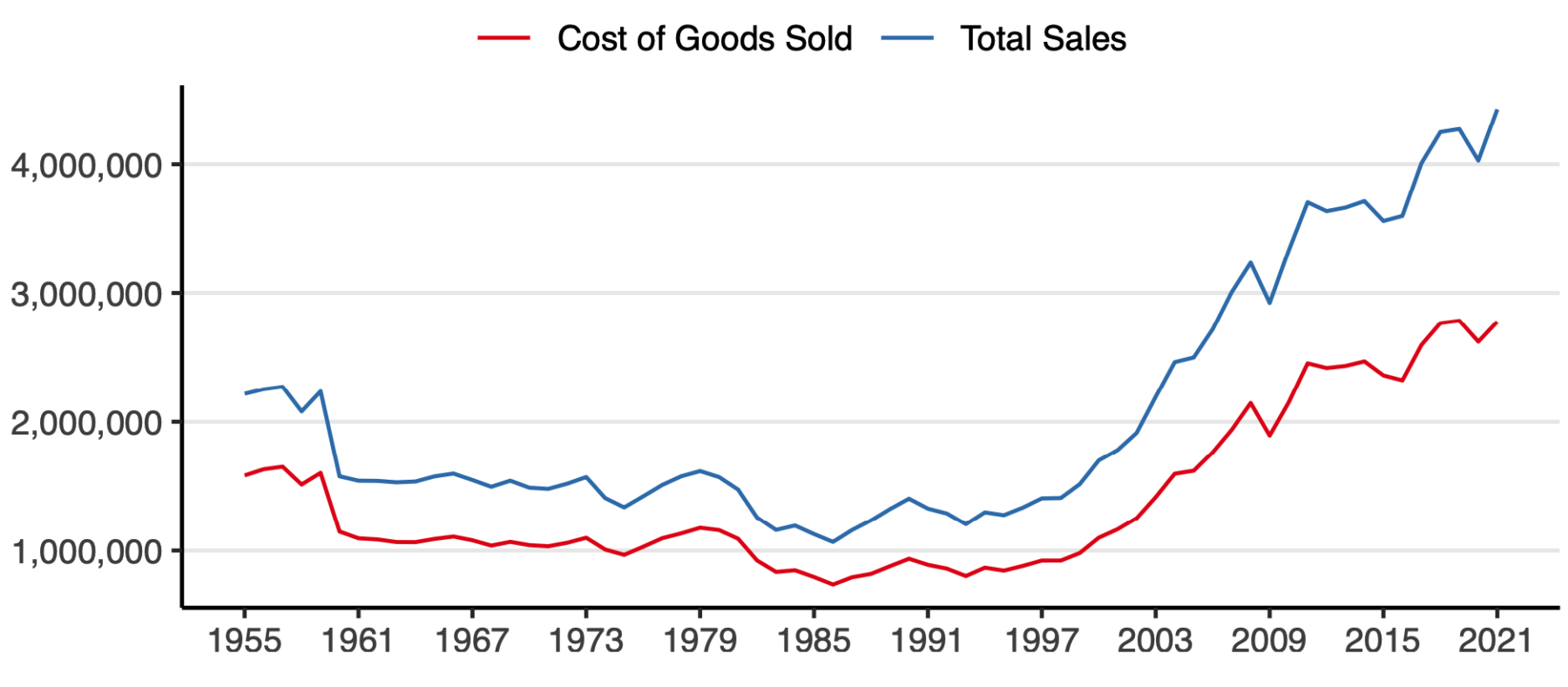

Over at Alphaville, Robin Wigglesworth looks at whether ‘Greedflation’ (aka price-gouging) meaningfully contributed to...

Over at Alphaville, Robin Wigglesworth looks at whether ‘Greedflation’ (aka price-gouging) meaningfully contributed to...

Read More

As promised, the full video of the Navigating Financial Disasters presentation from last month. In it, I tell the story of the...

Read More

I haven’t been paying much attention to the 2023 election cycle, other than getting annoyed at all the silly polls for next...

I haven’t been paying much attention to the 2023 election cycle, other than getting annoyed at all the silly polls for next...

Read More

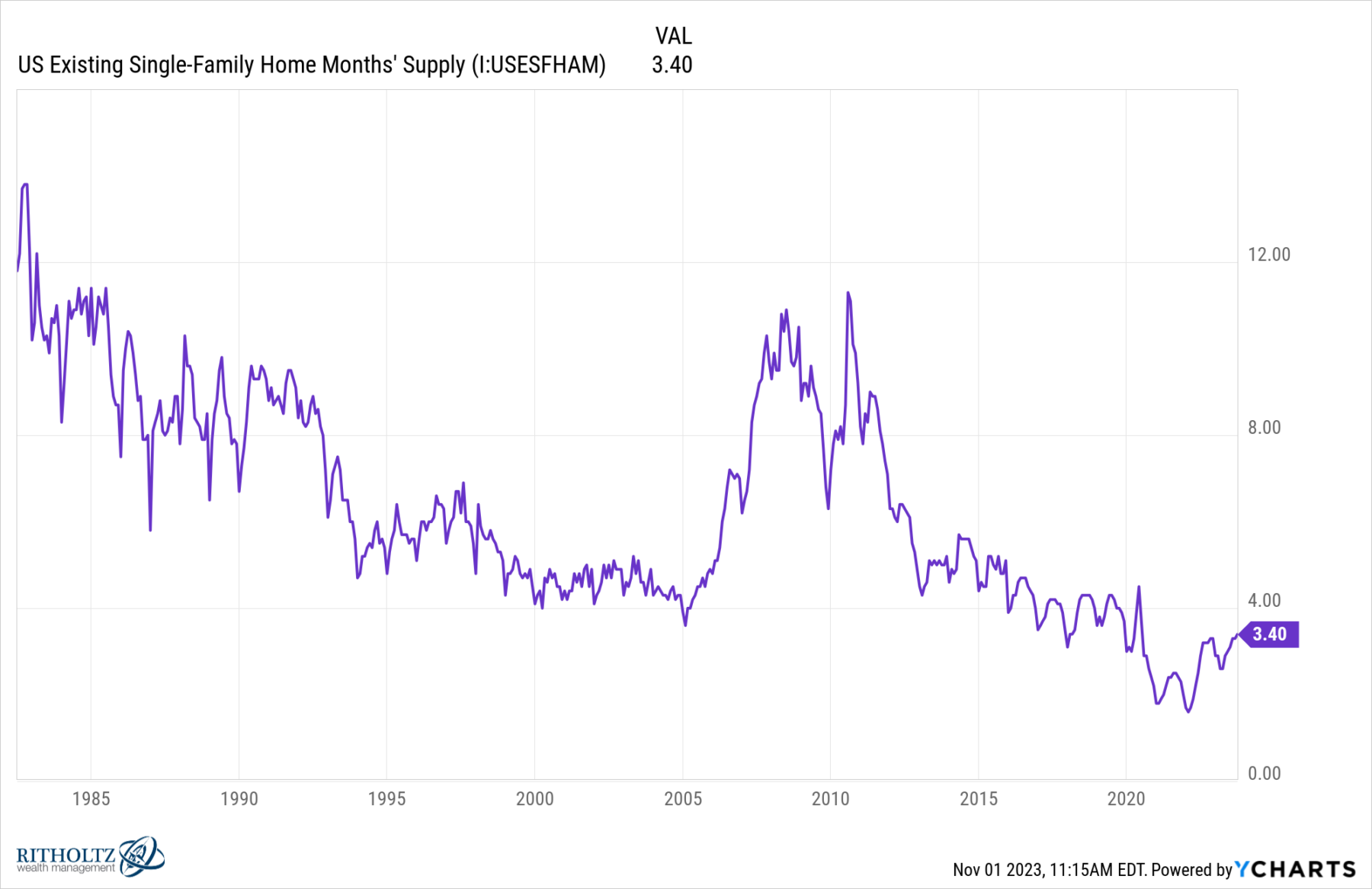

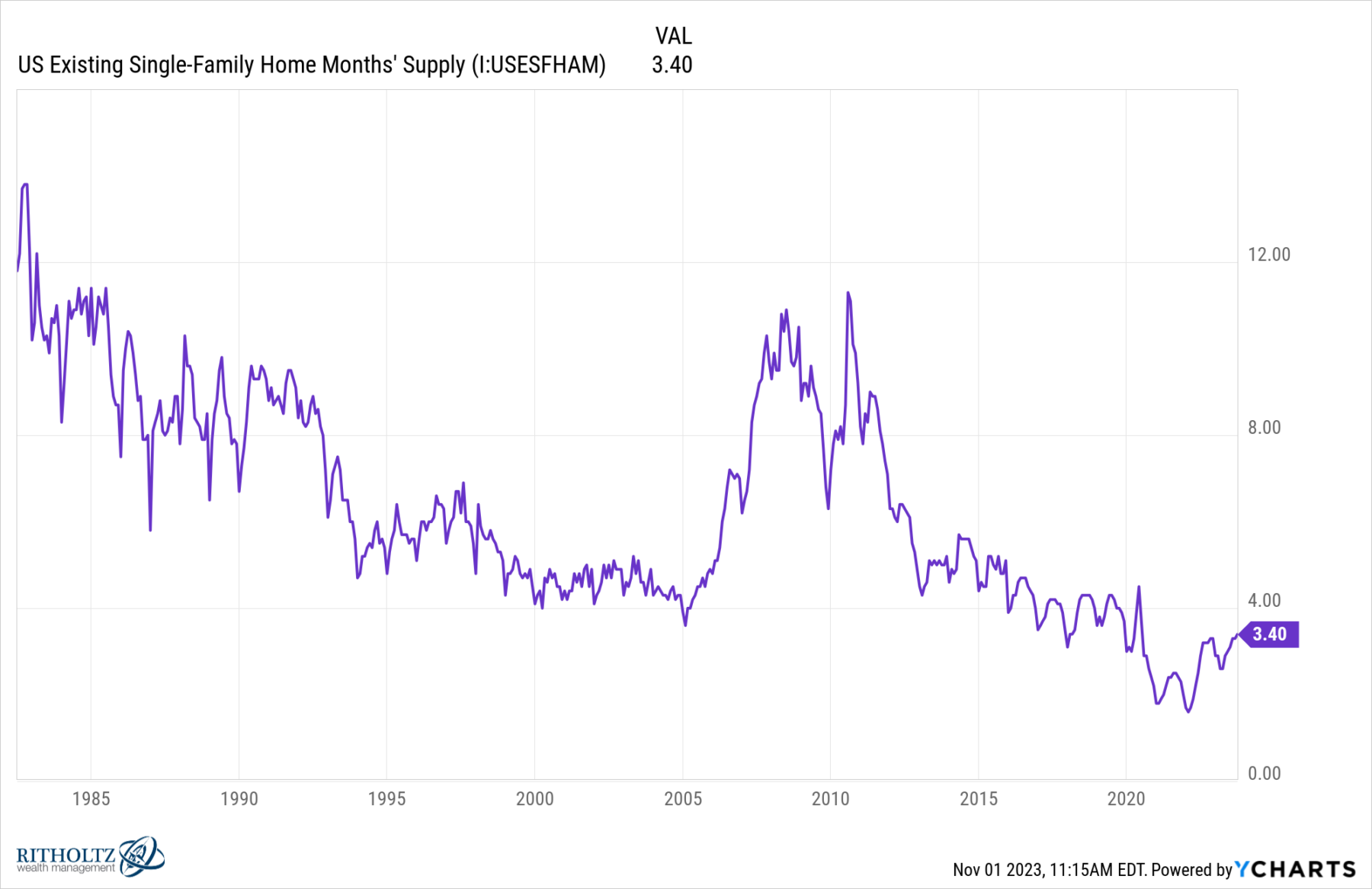

Everybody is waiting with bated breath for today’s 2:00 announcement about the rates, but let me spare you the suspense:...

Everybody is waiting with bated breath for today’s 2:00 announcement about the rates, but let me spare you the suspense:...

Read More

Earlier this year, I gave my first presentation since the pandemic began. I discussed all of the many ways we hurt ourselves...

Earlier this year, I gave my first presentation since the pandemic began. I discussed all of the many ways we hurt ourselves...

Read More

Last week, I mentioned the quarterly conference calls I do for clients of RWM, which led to a broad discussion of...

Last week, I mentioned the quarterly conference calls I do for clients of RWM, which led to a broad discussion of...

Read More

The transcript from this week’s, MiB: Bethany McLean on Pandemic Fails, is below. You can stream and download our full...

Read More

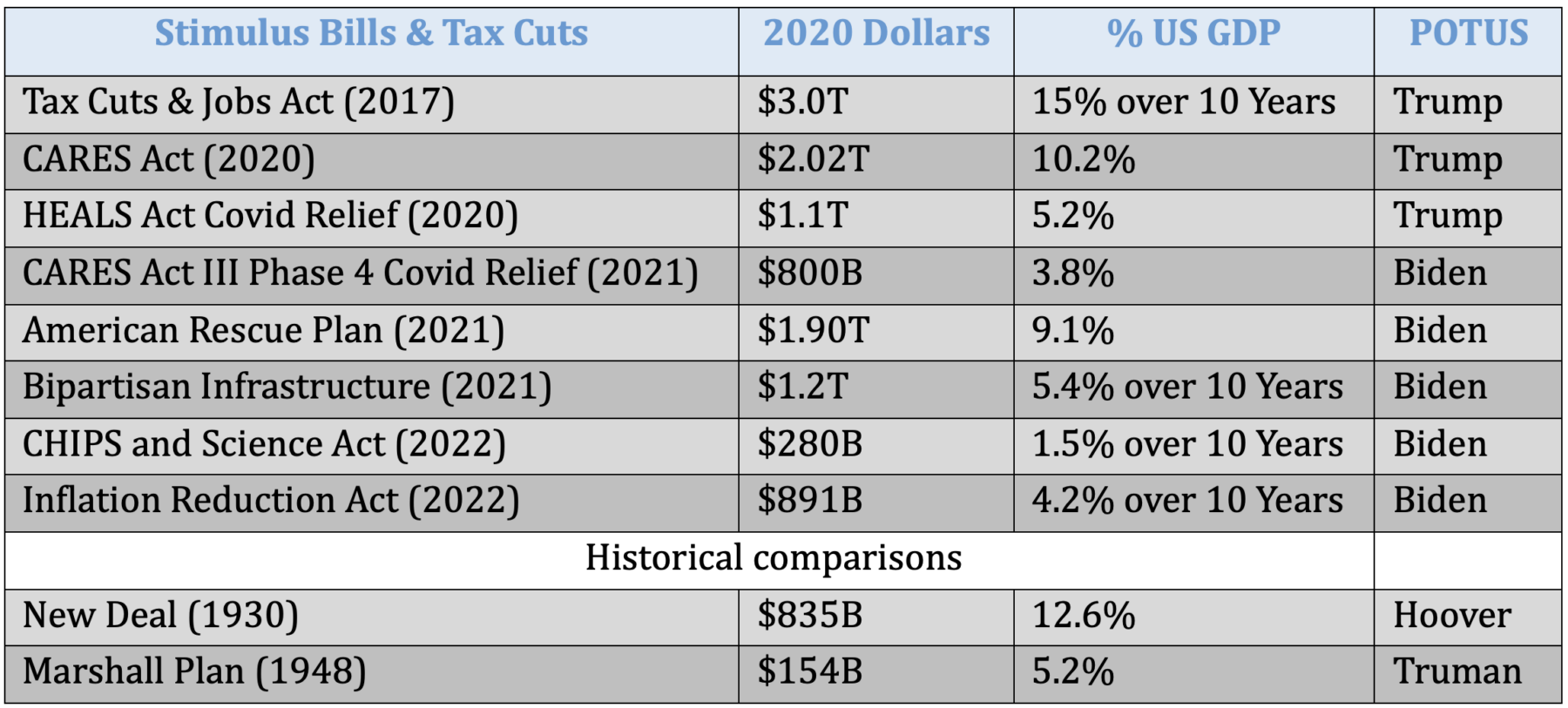

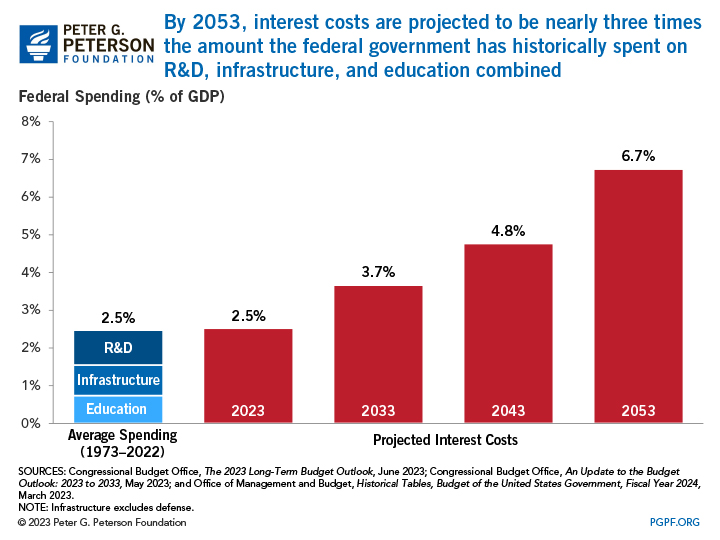

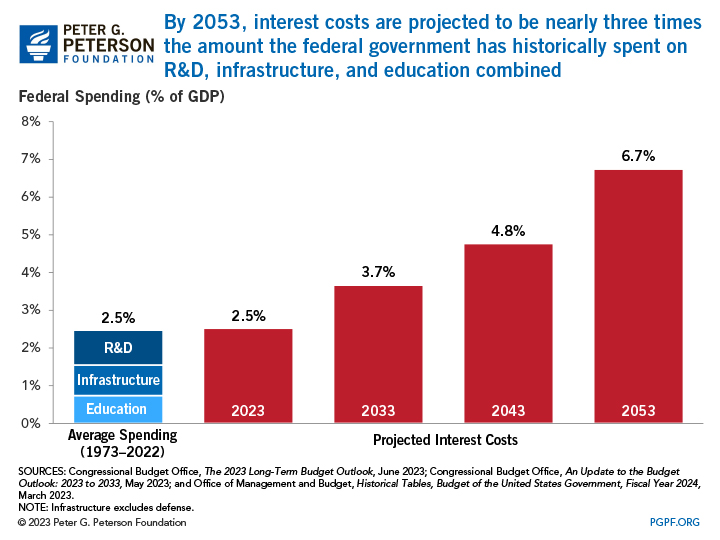

The chart in this morning’s reads shows what it is going to cost to fund the interest payments on the federal debt....

The chart in this morning’s reads shows what it is going to cost to fund the interest payments on the federal debt....

Read More

Most people don’t know that it is the editors, not the writers, who craft headlines. This should be common knowledge...

Most people don’t know that it is the editors, not the writers, who craft headlines. This should be common knowledge...

Most people don’t know that it is the editors, not the writers, who craft headlines. This should be common knowledge...

Most people don’t know that it is the editors, not the writers, who craft headlines. This should be common knowledge...