MiB: Bethany McLean on Pandemic Fails

This week, we speak with Bethany McLean, a writer for Vanity Fair and coauthor of The Smartest Guys in the Room. She was...

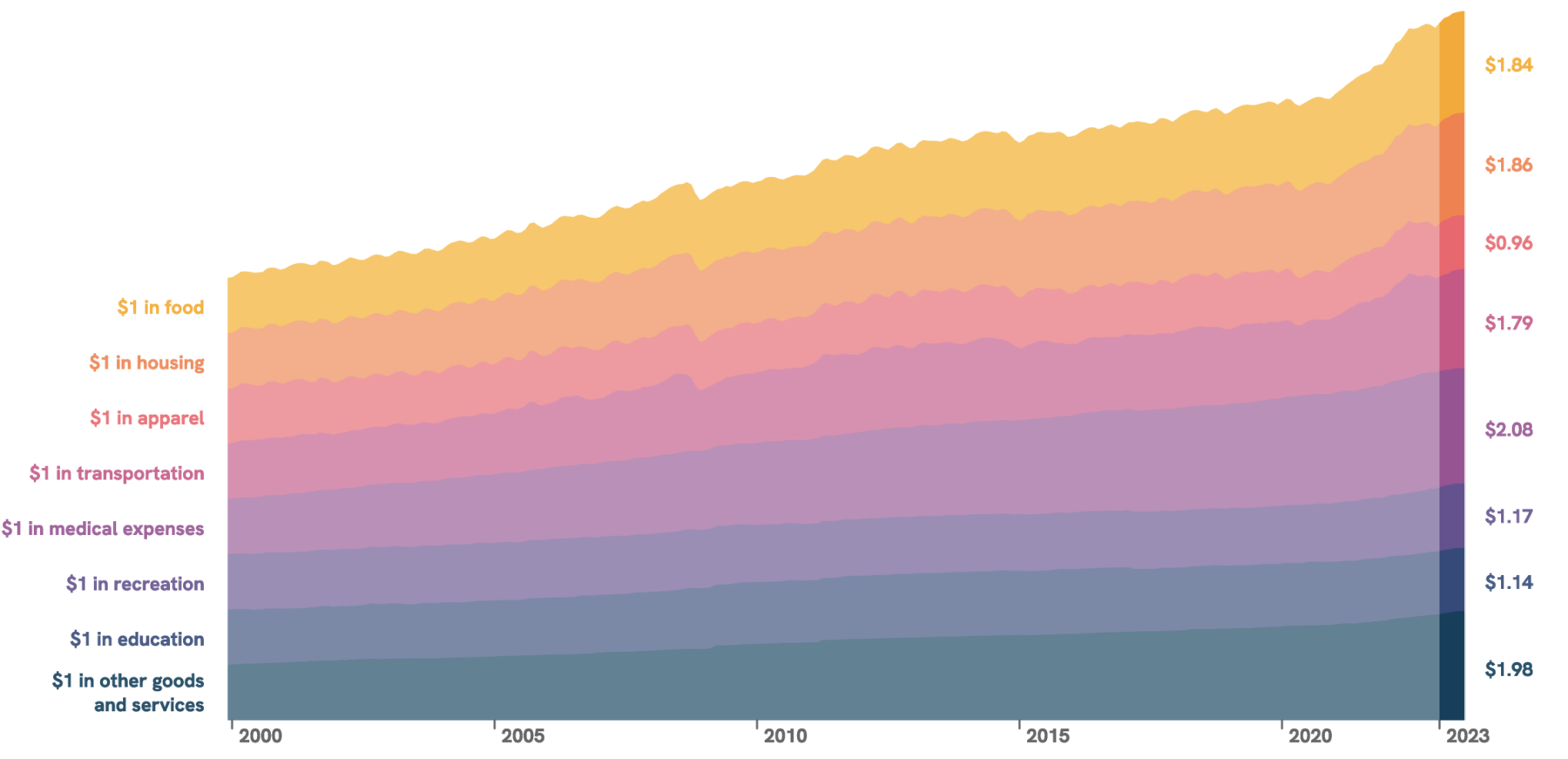

“I need the US Dollar to be a store of value between the time I make it until I spend it, invest it, pay my...

“I need the US Dollar to be a store of value between the time I make it until I spend it, invest it, pay my...

One of my favorite responsibilities as chief investment officer at Ritholtz Wealth Management is the quarterly conference call I do for...

One of my favorite responsibilities as chief investment officer at Ritholtz Wealth Management is the quarterly conference call I do for...

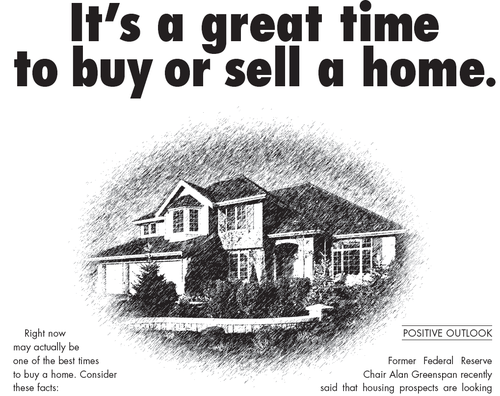

My buddy Jonathan Miller does not hesitate to call out the weasels who represent those who work in his industry: NAR Proves...

My buddy Jonathan Miller does not hesitate to call out the weasels who represent those who work in his industry: NAR Proves...

In August of 2022, I explained how Amazon became ordinary. Today I want to discuss how they have become bad. Since I first...

In August of 2022, I explained how Amazon became ordinary. Today I want to discuss how they have become bad. Since I first...

“If you want to read a moral condemnation of crypto theft, you can get that anywhere. You go to Michael Lewis for character...

“If you want to read a moral condemnation of crypto theft, you can get that anywhere. You go to Michael Lewis for character...

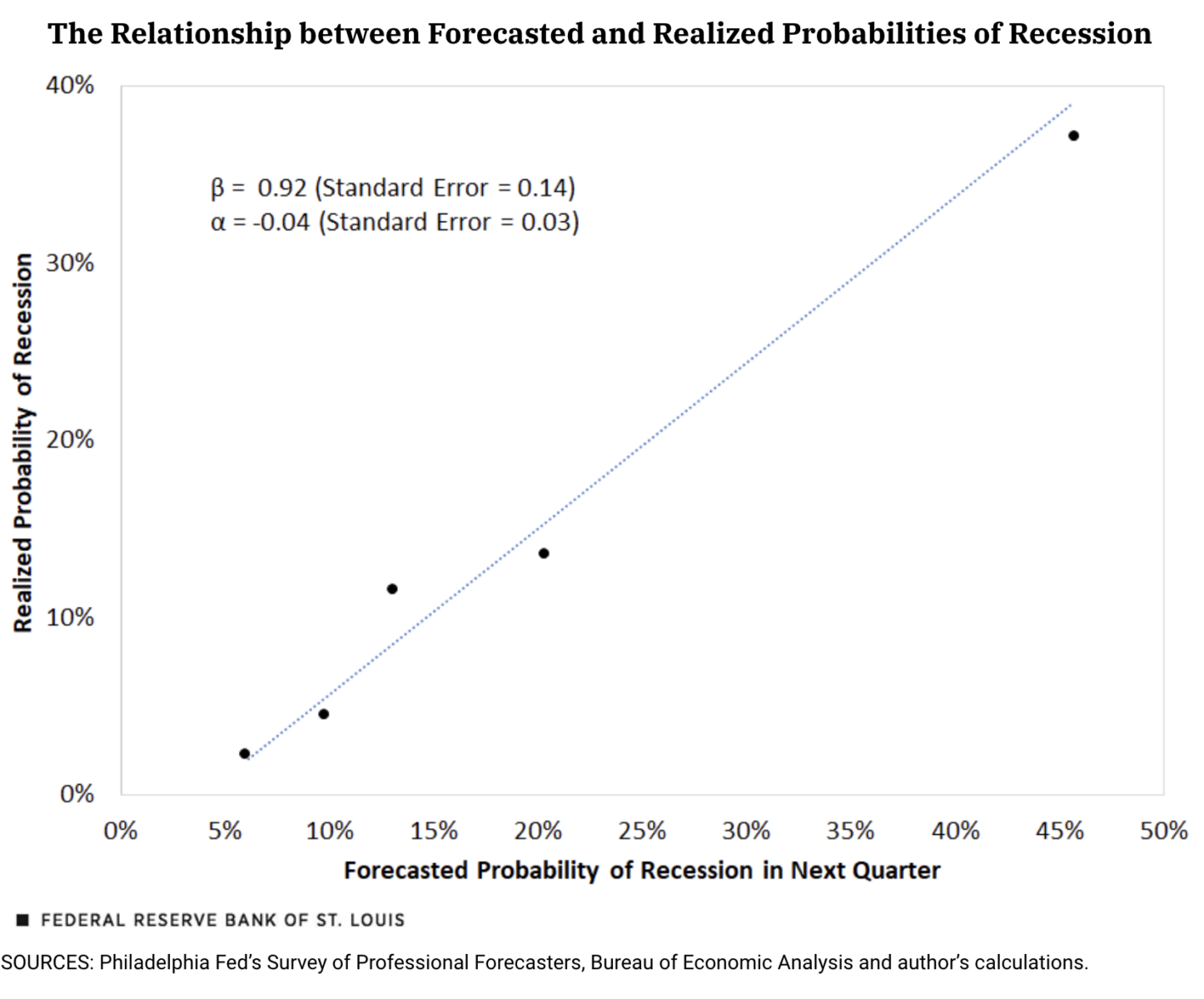

Before your week ends and you head out the door, I wanted to share a new paper from St. Louis Fed. The title: Can Economists...

Before your week ends and you head out the door, I wanted to share a new paper from St. Louis Fed. The title: Can Economists...

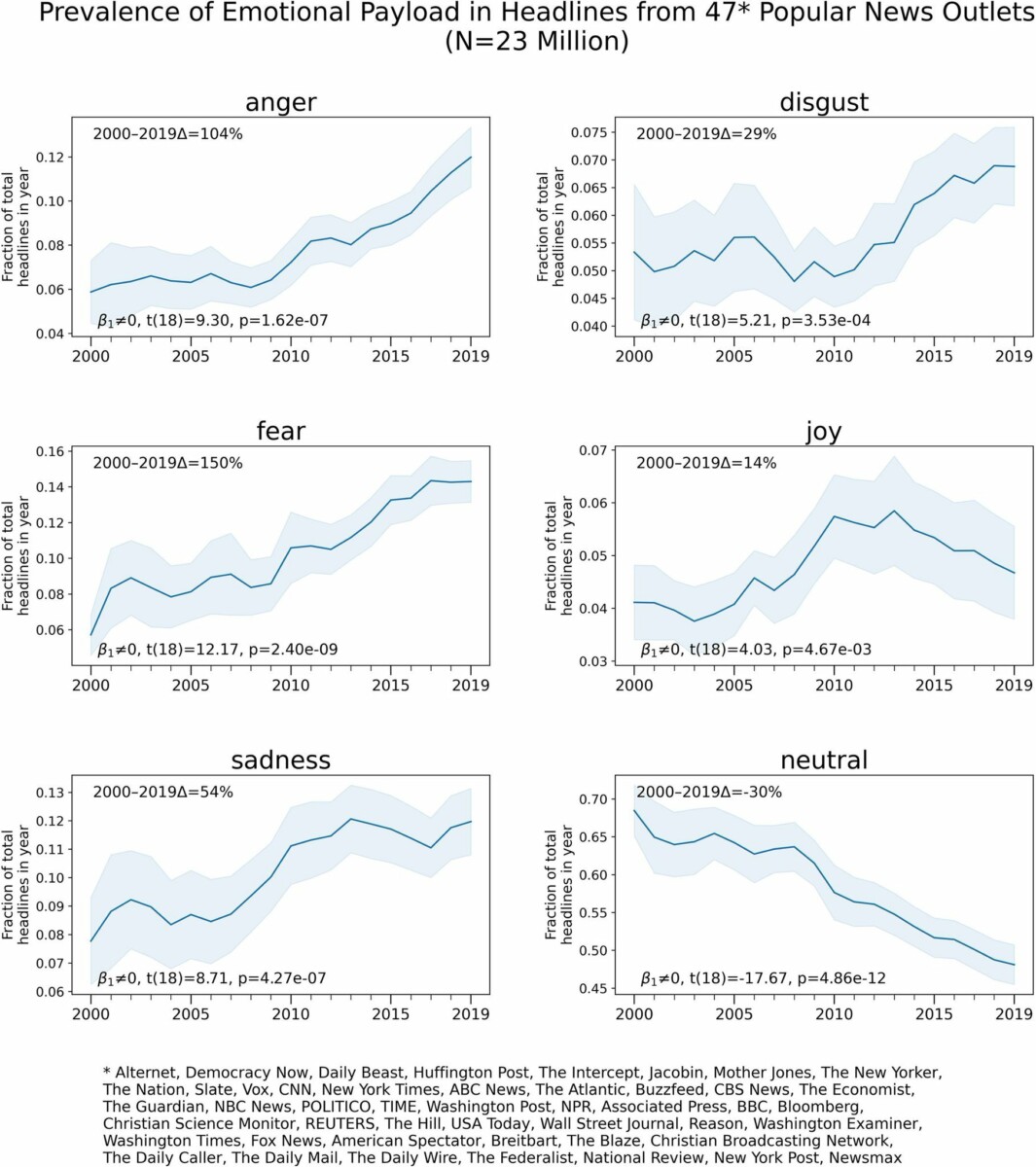

I have been watching various sentiment polls and Right/Wrong Track questionnaires with detached bemusement. Bemused because they...

I have been watching various sentiment polls and Right/Wrong Track questionnaires with detached bemusement. Bemused because they...

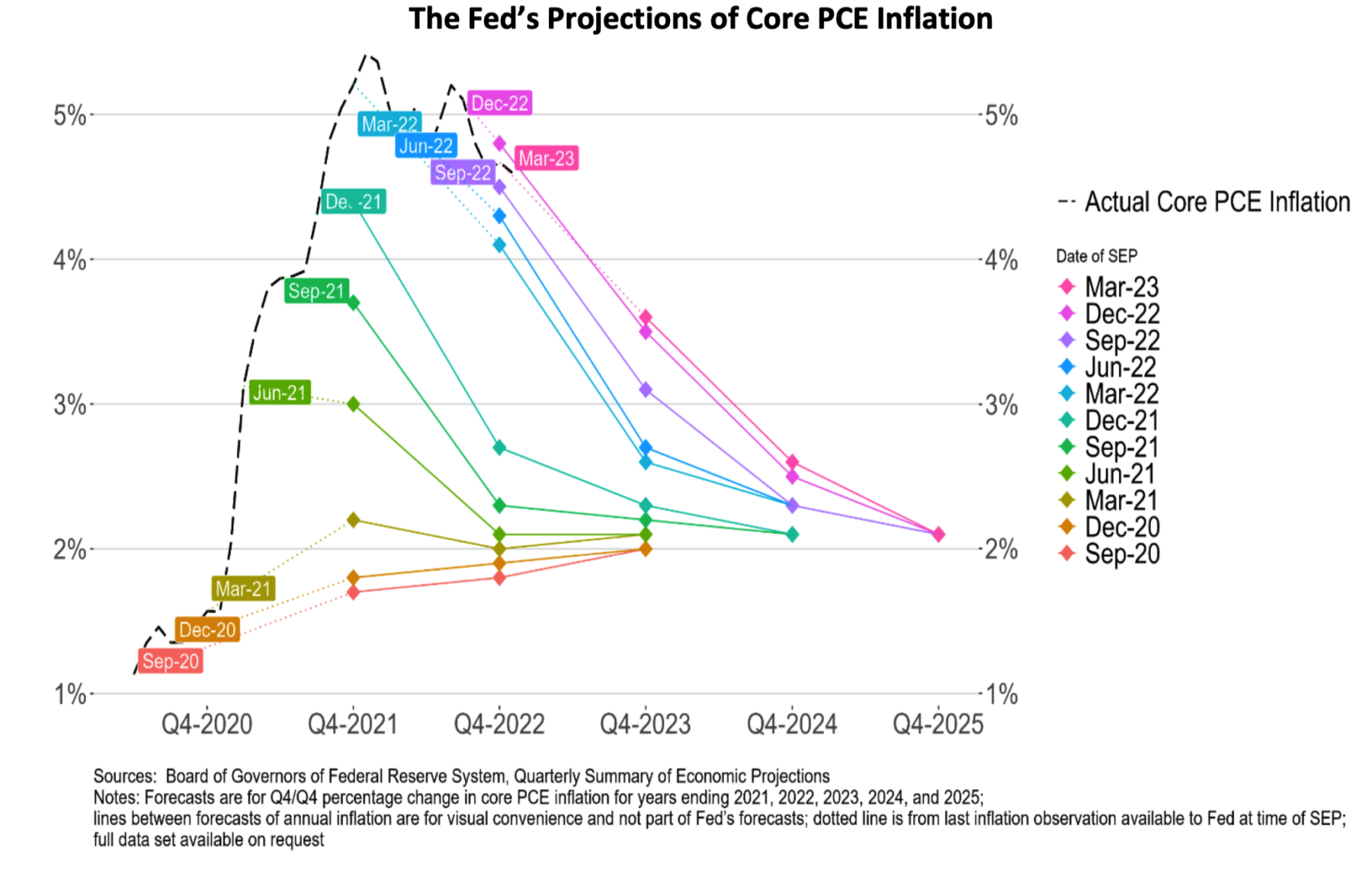

The September Federal Reserve meeting is behind us we still have November and December ahead of us. Markets are nervous expecting...

The September Federal Reserve meeting is behind us we still have November and December ahead of us. Markets are nervous expecting...

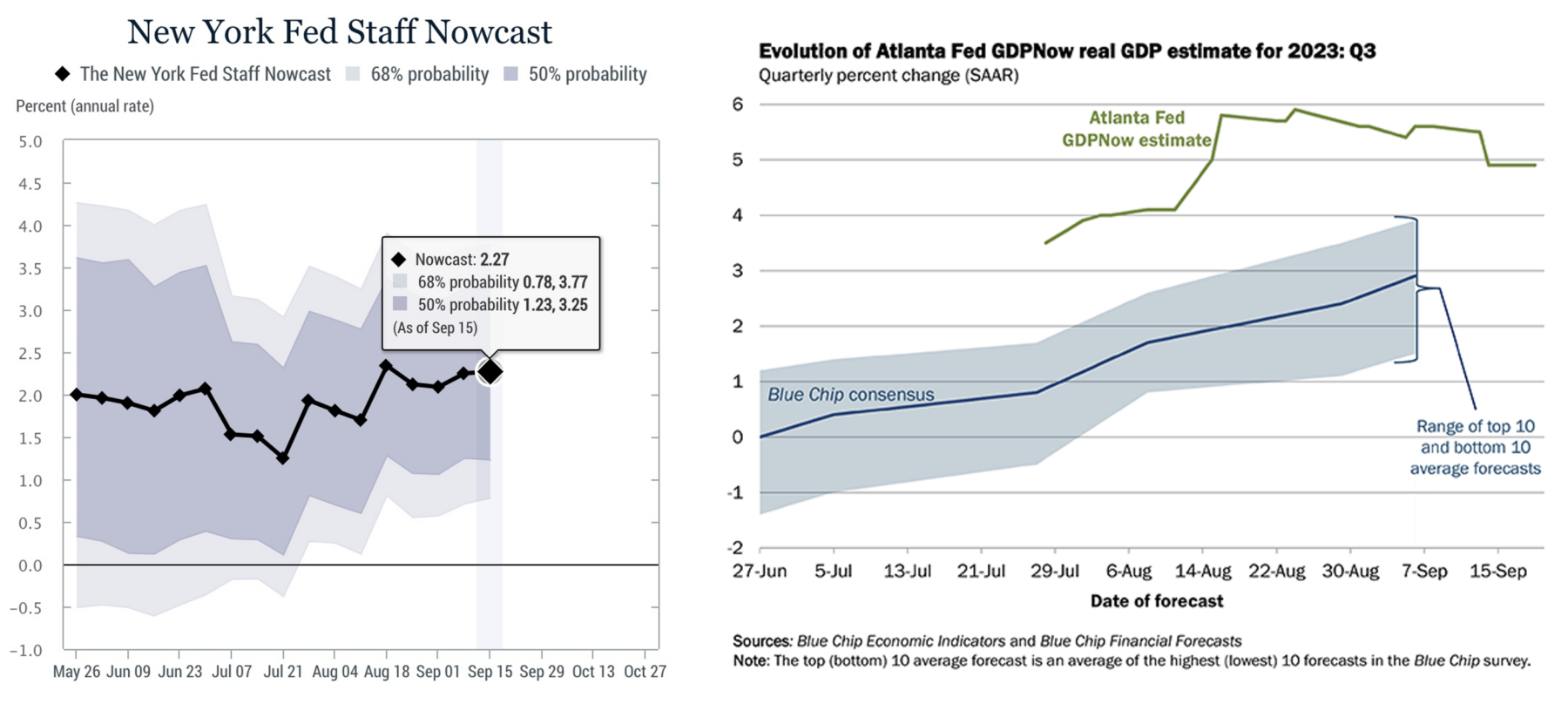

With 10 days left in the Third Quarter, it seems that lots of folks have been obsessing about the various GDP Now forecasts. The...

With 10 days left in the Third Quarter, it seems that lots of folks have been obsessing about the various GDP Now forecasts. The...

Get subscriber-only insights and news delivered by Barry every two weeks.