One of the most important aspects of becoming a good investor is creating a model of the world around you. To do this, you must have good...

One of the most important aspects of becoming a good investor is creating a model of the world around you. To do this, you must have good...

Read More

Of all the cognitive errors in behavioral finance and human psychology, the one that creates the most confusion is the...

Of all the cognitive errors in behavioral finance and human psychology, the one that creates the most confusion is the...

Read More

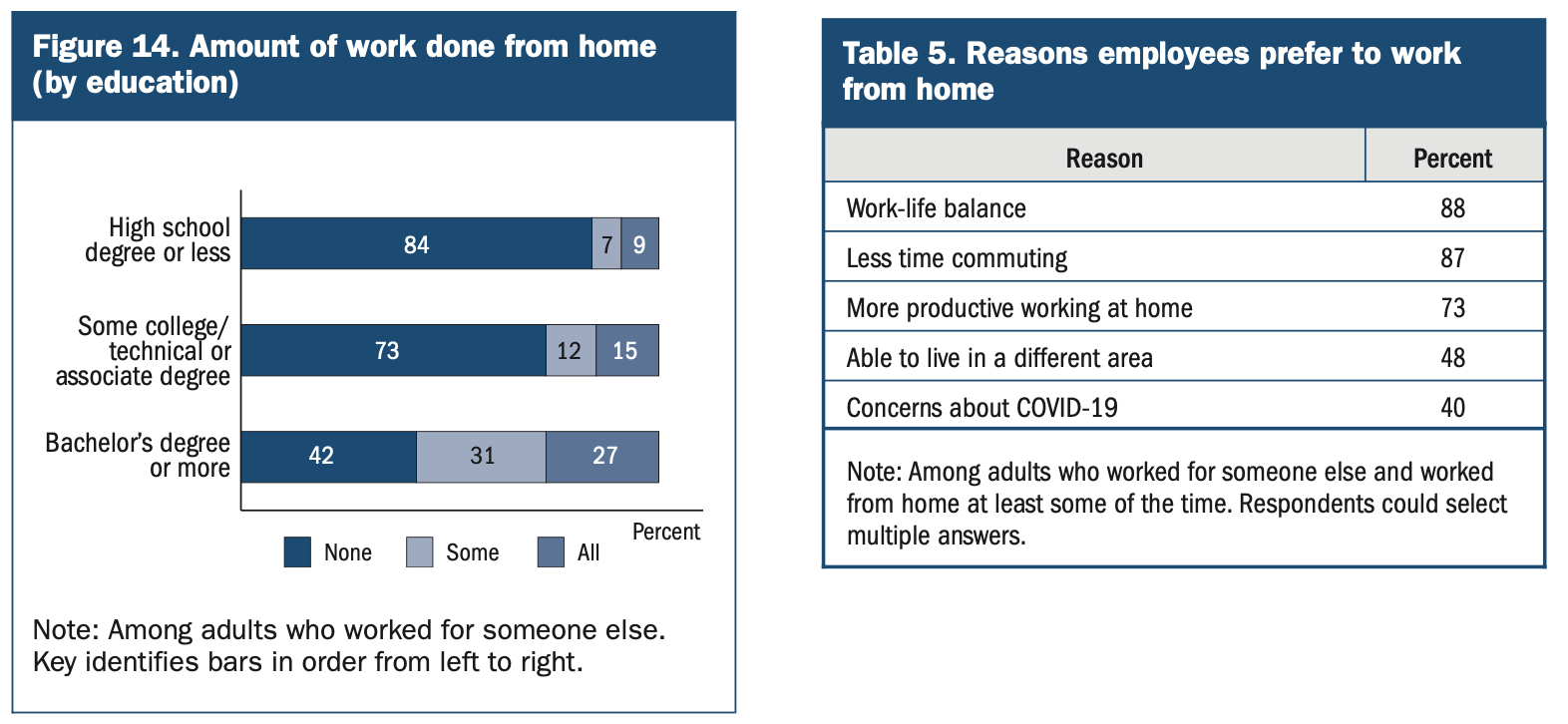

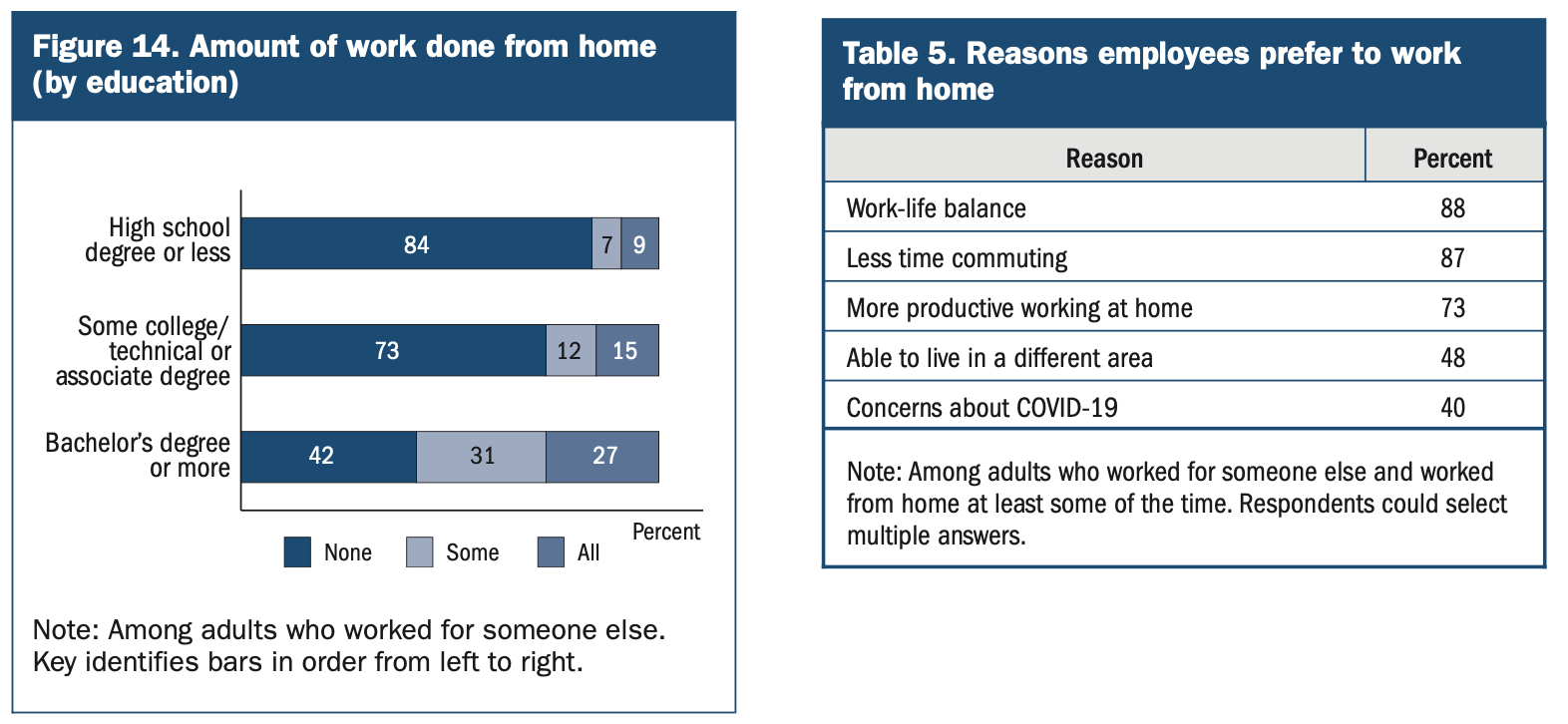

This week saw the release of the Fed’s big annual research report, Economic Well-Being of U.S. Households in 2022....

This week saw the release of the Fed’s big annual research report, Economic Well-Being of U.S. Households in 2022....

Read More

I have a new thesis I have been noodling around with: All of those Square credit card processing machines you use to pay for...

I have a new thesis I have been noodling around with: All of those Square credit card processing machines you use to pay for...

Read More

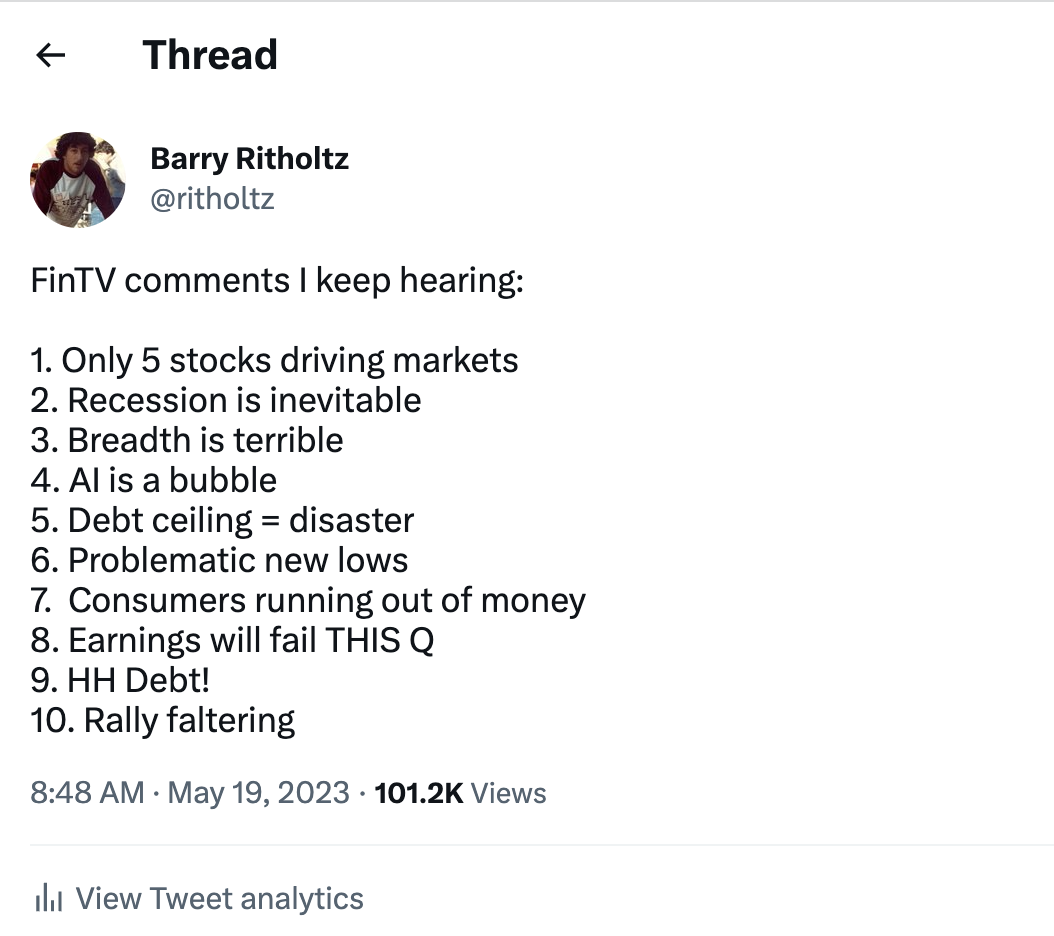

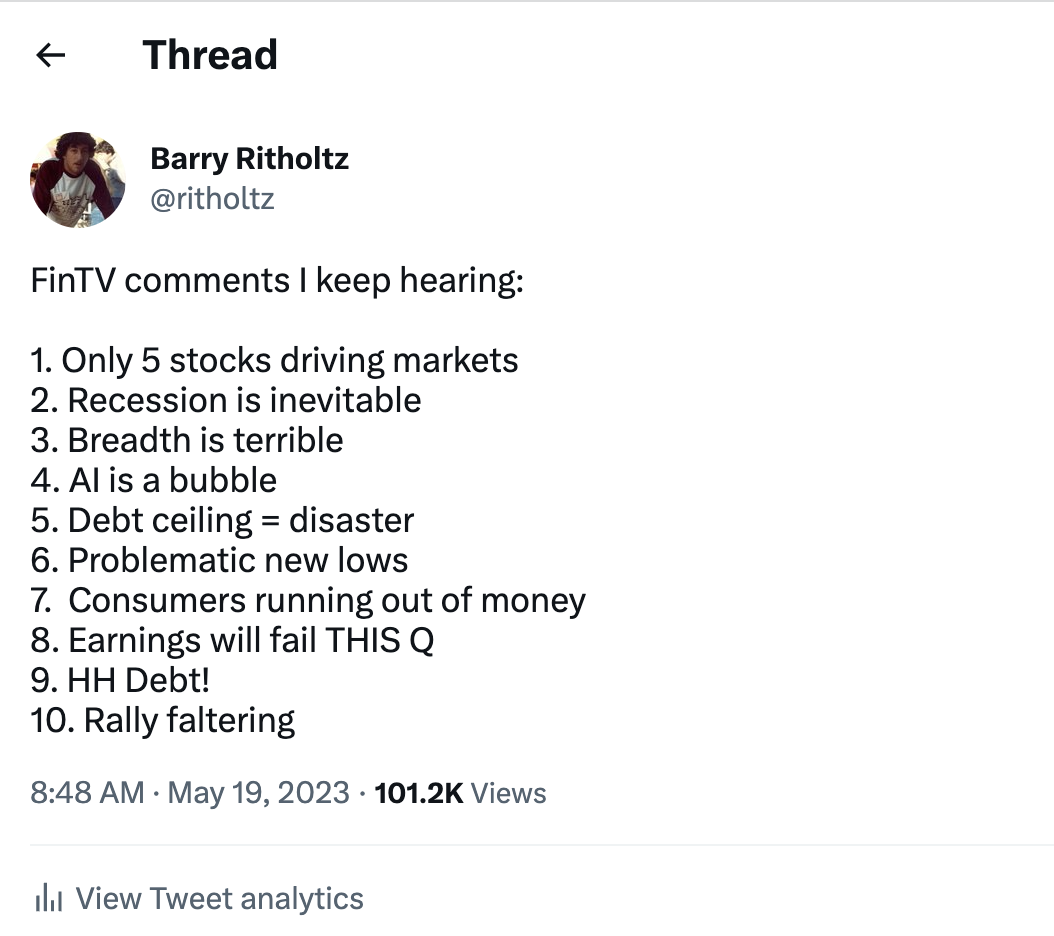

Let’s see if I can find something to counter and/or undercut each of these 10 items listed in this morning’s...

Let’s see if I can find something to counter and/or undercut each of these 10 items listed in this morning’s...

Read More

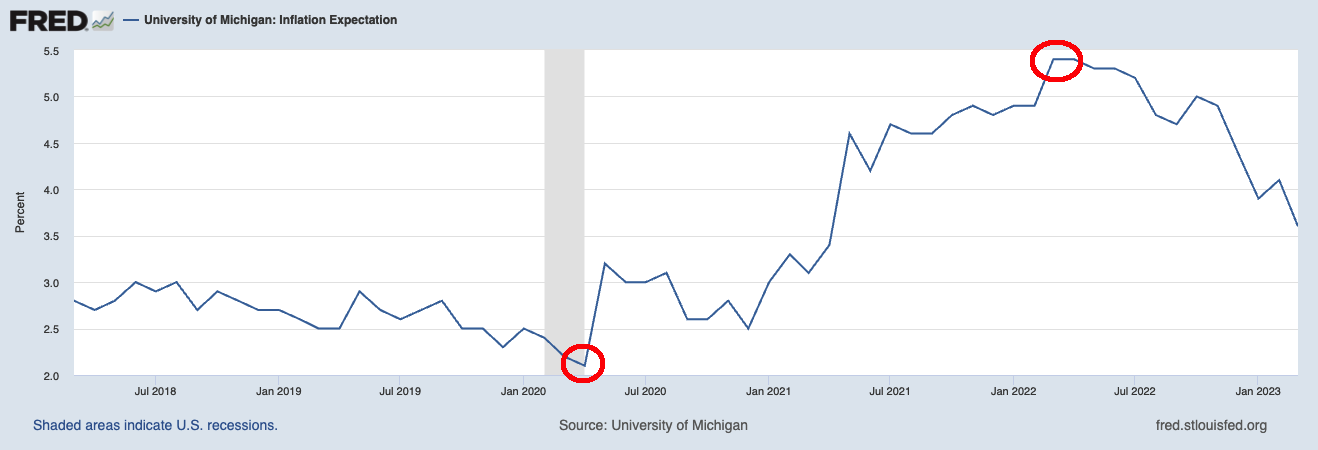

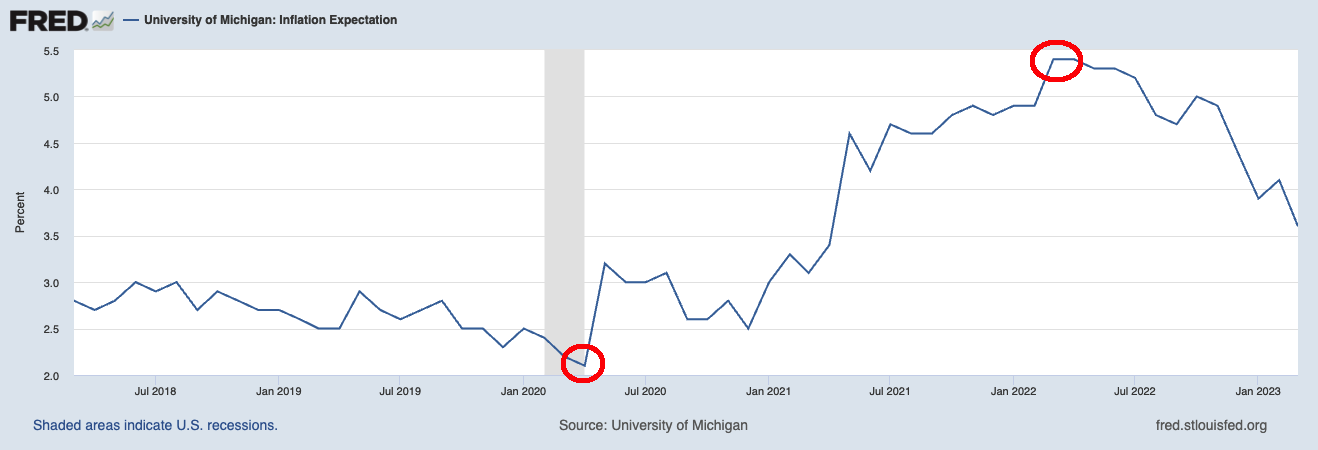

Jerome Powell and the Federal Reserve spend a lot of time worrying about Inflation Expectations. They shouldn’t. Generally,...

Jerome Powell and the Federal Reserve spend a lot of time worrying about Inflation Expectations. They shouldn’t. Generally,...

Read More

One of the core philosophical beliefs I hold dear is that the future is inherently unknown and unknowable. This tends to be true for the...

One of the core philosophical beliefs I hold dear is that the future is inherently unknown and unknowable. This tends to be true for the...

Read More

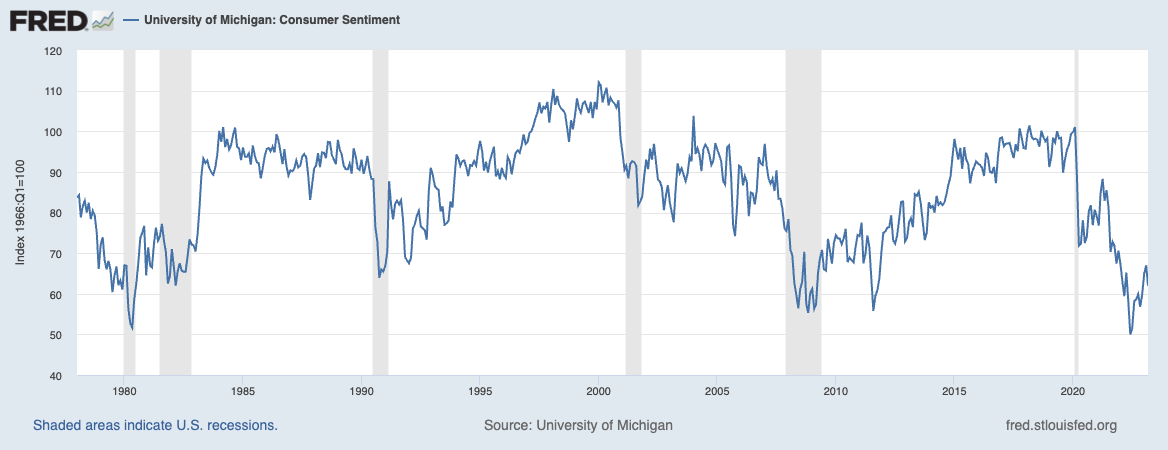

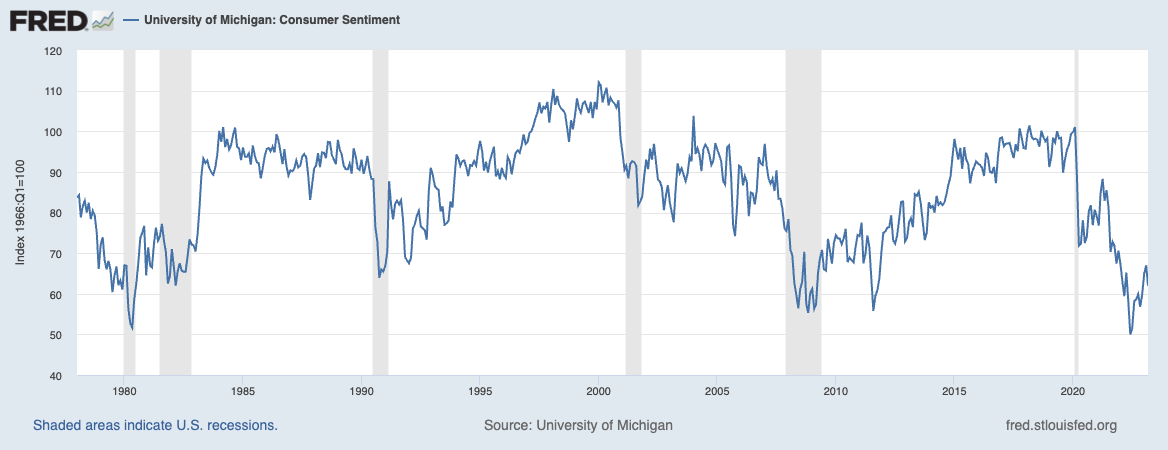

Source: FRED, May 8, 2023 There’s an old joke about a hypochondriac who is constantly complaining to his doctor about his...

Source: FRED, May 8, 2023 There’s an old joke about a hypochondriac who is constantly complaining to his doctor about his...

Read More

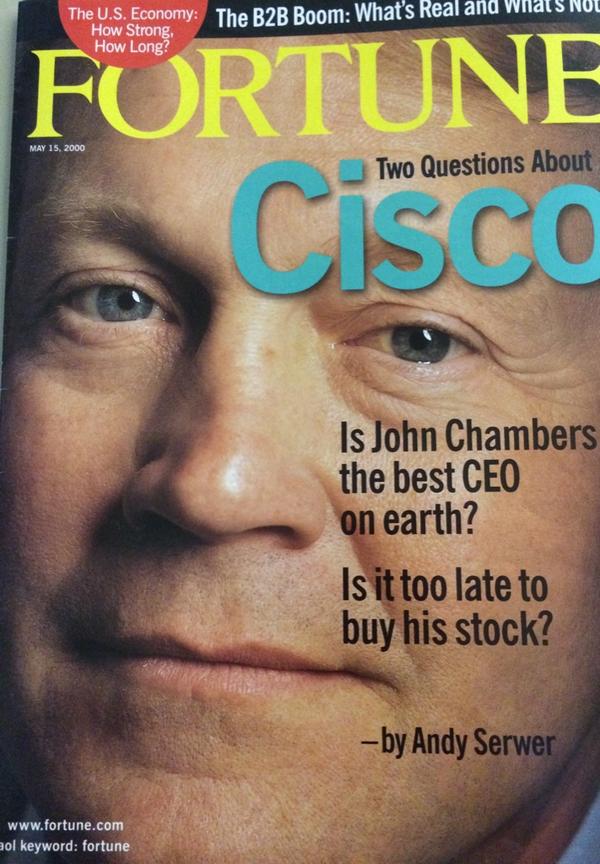

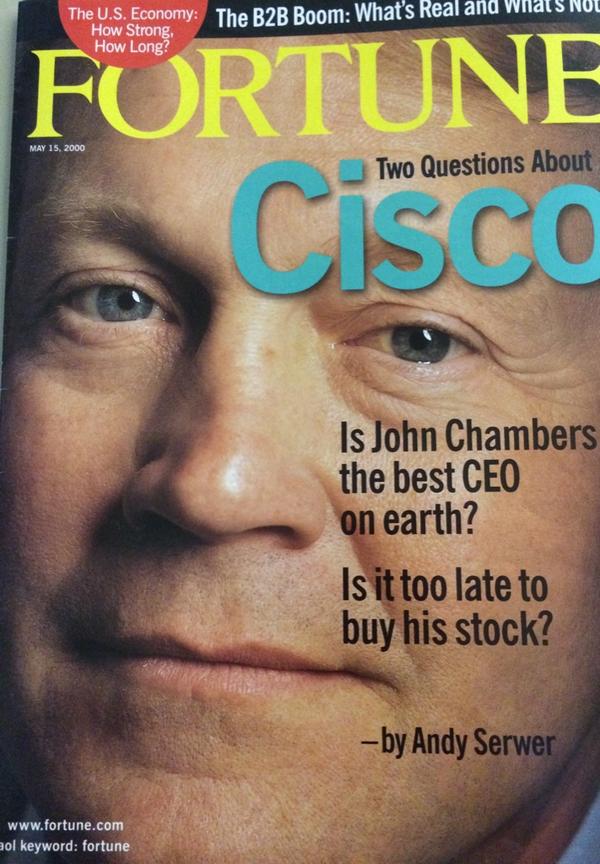

Imagine you had a device that allowed you to peer into the future. You enter a subject matter into this machine, requesting a...

Imagine you had a device that allowed you to peer into the future. You enter a subject matter into this machine, requesting a...

Read More

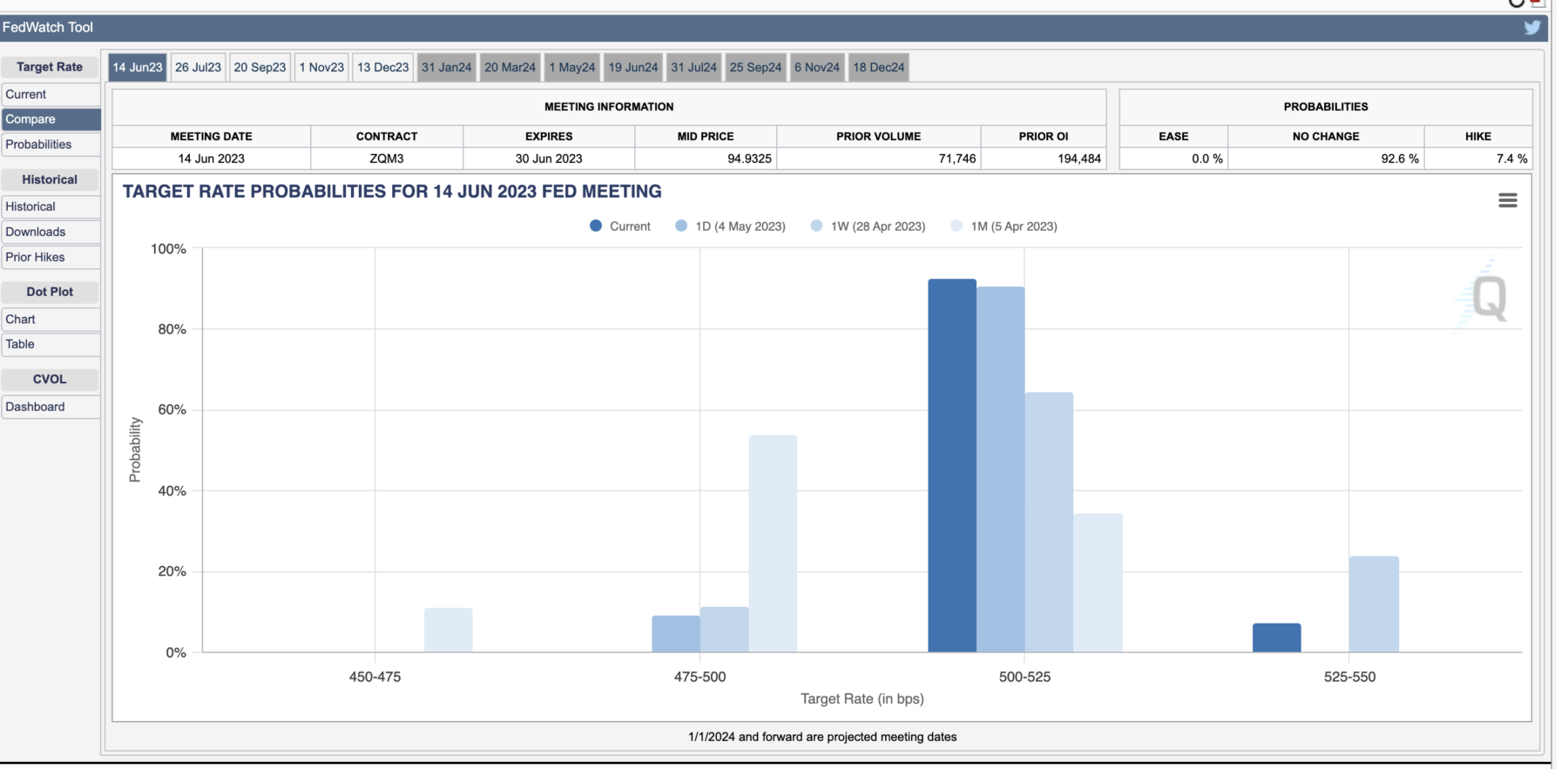

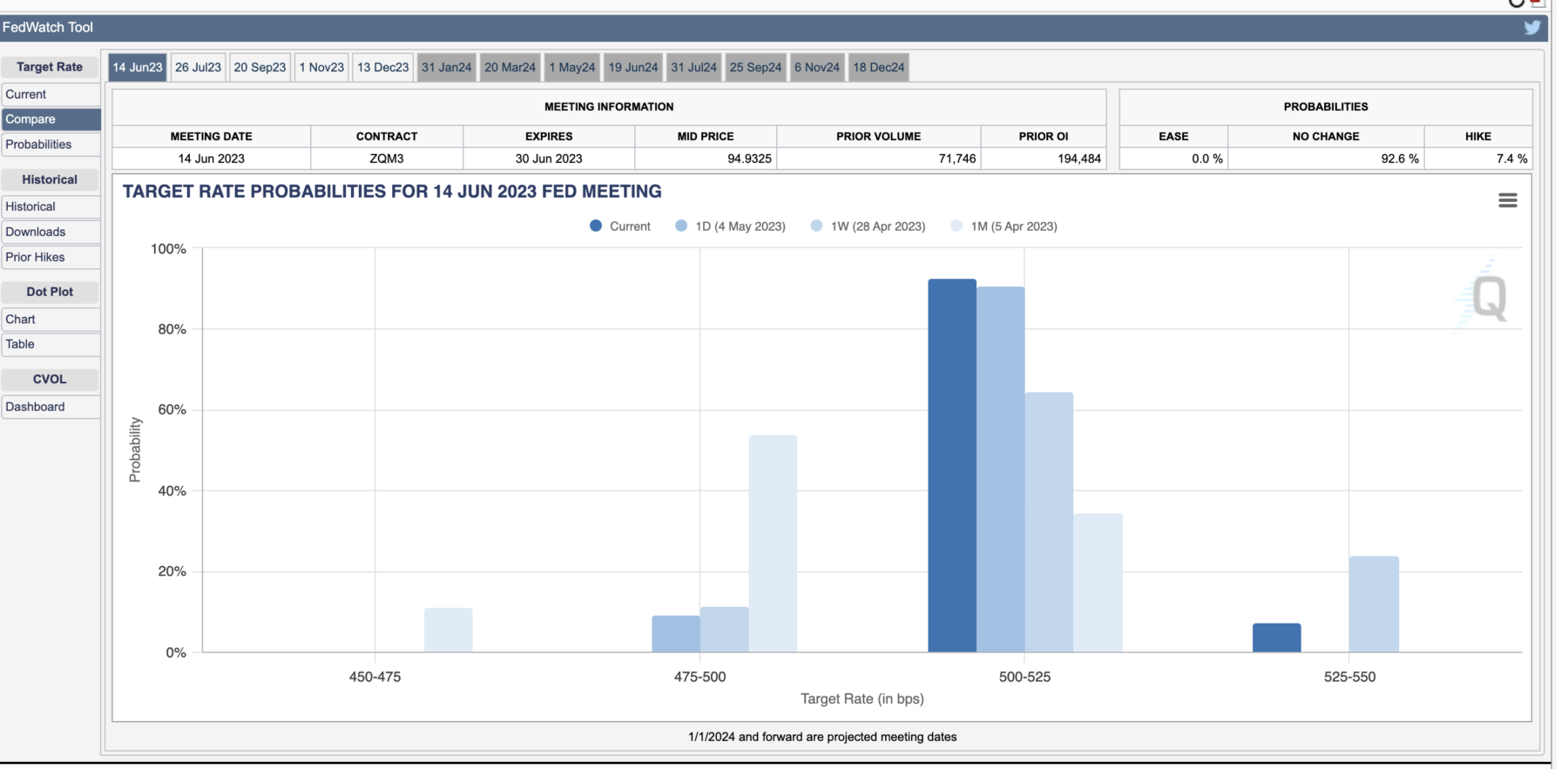

At least they told us what they were going to do. As much as critics of the Federal Reserve have been up in arms over the fastest...

At least they told us what they were going to do. As much as critics of the Federal Reserve have been up in arms over the fastest...

Read More

One of the most important aspects of becoming a good investor is creating a model of the world around you. To do this, you must have good...

One of the most important aspects of becoming a good investor is creating a model of the world around you. To do this, you must have good...

One of the most important aspects of becoming a good investor is creating a model of the world around you. To do this, you must have good...

One of the most important aspects of becoming a good investor is creating a model of the world around you. To do this, you must have good...