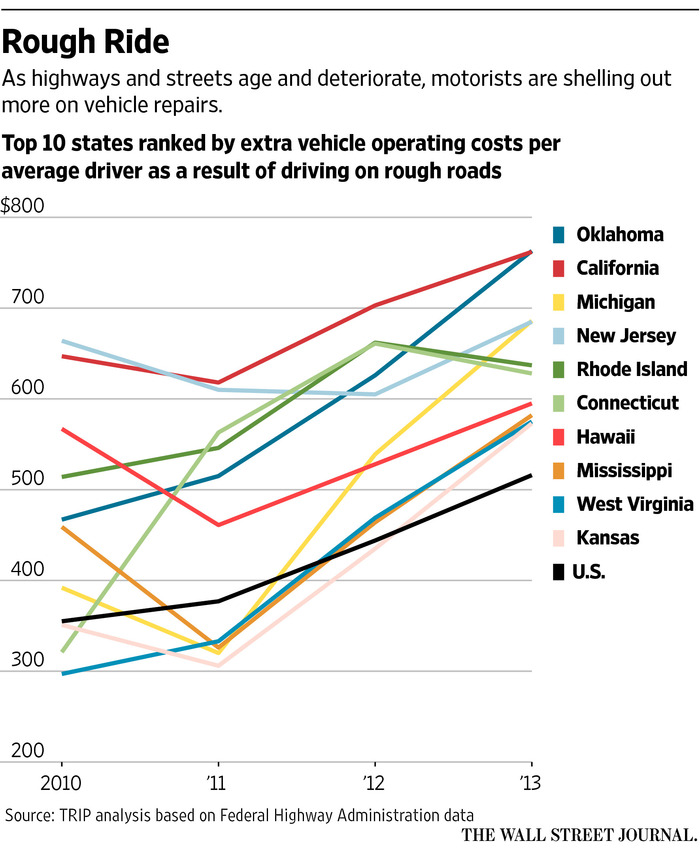

Source: WSJ

Source: WSJ

As Goes Apple, So Goes the Market?

With the stock markets down almost (OMG!) 5 percent from their all-time highs, lots of folks are looking for signs that the bull is...

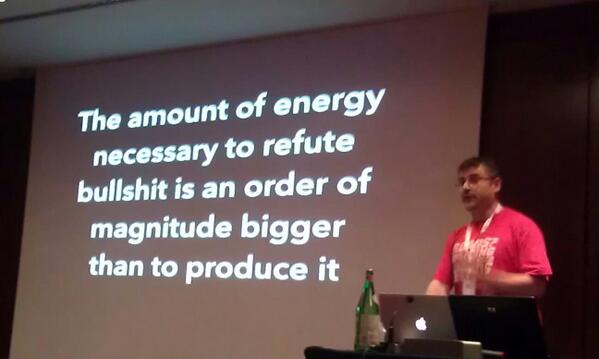

Farm-to-Table for Bad Information

@TBPInvictus I am reminded of the above law each and every day. And a law it is. Inviolable. No sooner had I posted the other day...

@TBPInvictus I am reminded of the above law each and every day. And a law it is. Inviolable. No sooner had I posted the other day...

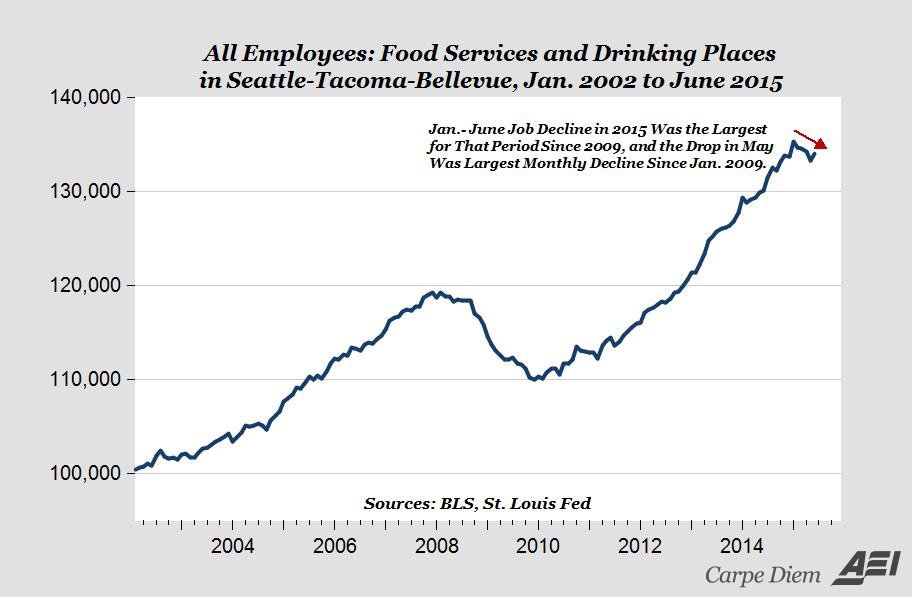

Fact Versus Fiction on Seattle Minimum Wage

@TBPInvictus “He who knows nothing is closer to the truth than he whose mind is full of falsehoods and errors.” –...

@TBPInvictus “He who knows nothing is closer to the truth than he whose mind is full of falsehoods and errors.” –...

Sorting Through Online Investment Noise

Hey, investment cranks: The Internet never forgets By Barry Ritholtz Washington Post, August 1, 2015 As Theodore Sturgeon...

How to sort through garbage online investment advice

My Sunday Washington Post Business Section column is out. This morning, we look at how the internet evolved as a source...

My Sunday Washington Post Business Section column is out. This morning, we look at how the internet evolved as a source...

Who Benefits from Bailouts?

I always find it amusing whenever someone expresses surprise that the financial bailouts for Greece haven’t benefitted Greek...