Who Benefits from Bailouts?

I always find it amusing whenever someone expresses surprise that the financial bailouts for Greece haven’t benefitted Greek...

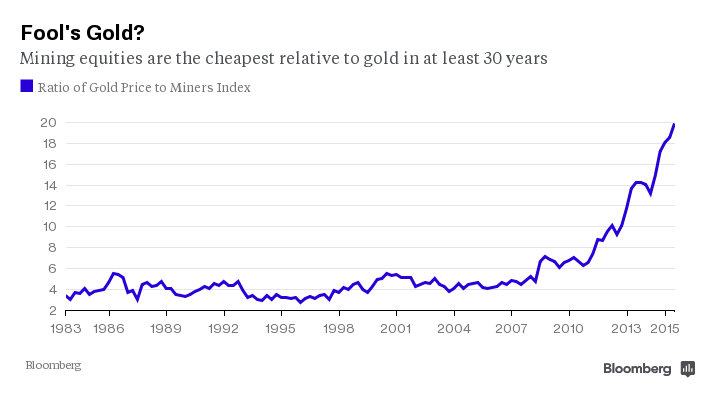

Let’s say this right up front: The SPDR Gold Shares Trust exchange-traded fund has killed the shares of the gold miners. For a few...

Let’s say this right up front: The SPDR Gold Shares Trust exchange-traded fund has killed the shares of the gold miners. For a few...

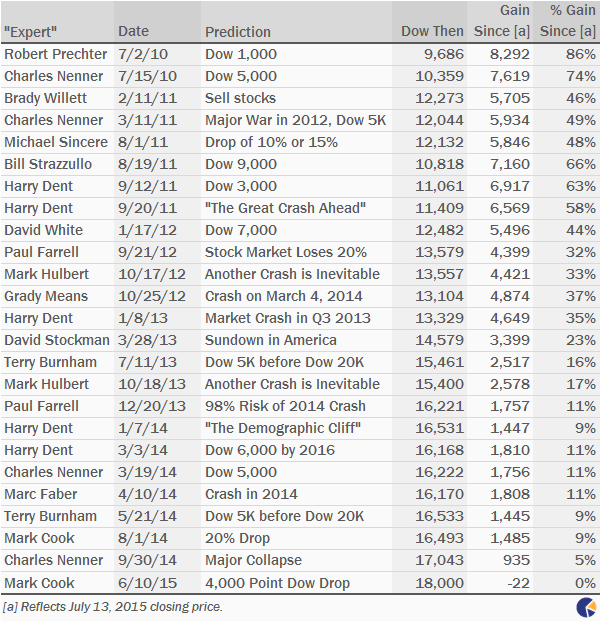

Earlier this summer, I tweeted a wonderful line from Brett Arends column, 25 things I wish I knew when I graduated from high school:...

Earlier this summer, I tweeted a wonderful line from Brett Arends column, 25 things I wish I knew when I graduated from high school:...

Get subscriber-only insights and news delivered by Barry every two weeks.