Click to check out other cities. Source: Climate Central

Click to check out other cities. Source: Climate Central

Travails of the Modern Macro Tourist

My Sunday Washington Post Business Section column is out. This morning, we look at travels and travails of the macro...

My Sunday Washington Post Business Section column is out. This morning, we look at travels and travails of the macro...

San Diego County Fires Its High-Priced, Leveraged,...

Last August, we called out the San Diego County retirement fund for paying way too much in fees to Salient Partners, its outside...

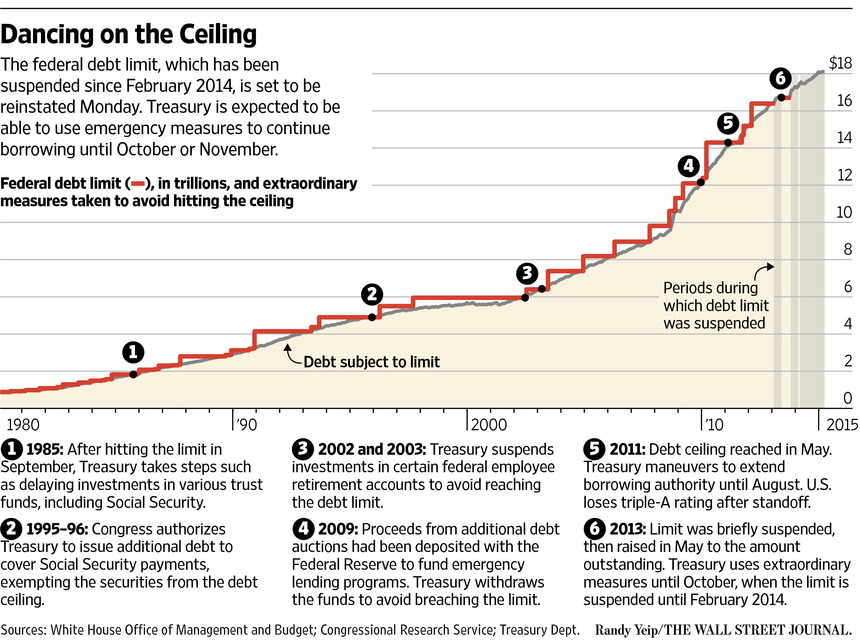

Here Comes the Debt Ceiling Debate

What China Can Learn from America’s Plunge Protection Team

A Plunge Protection Team for China’s Markets? China may do no better at propping up markets than the U.S. Bloomberg, July 13, 2015....

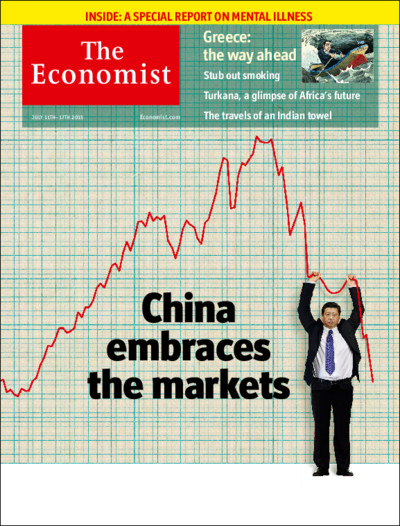

China “Embraces” the Markets

Fantastic cover from this week’s Economist; I think we have different definitions of “embrace” . . . ...

Fantastic cover from this week’s Economist; I think we have different definitions of “embrace” . . . ...

Gold Can’t Find a Bid

This was the week Greece inched closest to chaos, as a bank holiday and a technical default caused markets around the world to erupt in...

The Trouble with Macro

Markets around the world start the week bracing for trouble as Greece spirals further into crisis. Can the country avoid a full-blown...

Shifting the Goalposts in Seattle Minimum Wage Debate

@TBPInvictus here It’s been a few months since the first increase in the Seattle minimum wage (see here for the schedule of bump...

Are Mutual Fund Managers Skilled?

Jonathan Berk turns the efficient market hypothesis, which popularized the belief that mutual fund managers were “monkey...