@TBPInvictus here. We have interesting experiments going on in the state of Kansas and the city of Seattle. Herewith a brief update on...

@TBPInvictus here. We have interesting experiments going on in the state of Kansas and the city of Seattle. Herewith a brief update on...

Read More

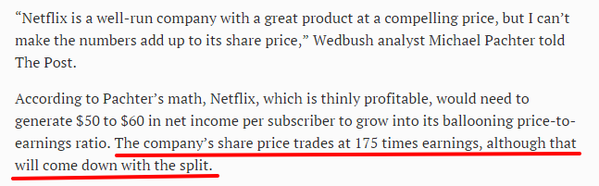

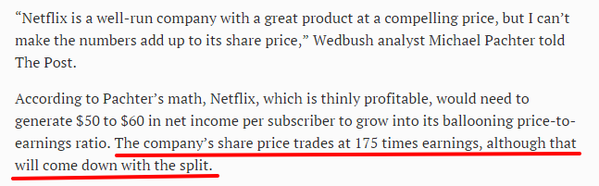

@TBPInvictus here: The New York Post ran a piece on Netflix (NFLX), written by Claire Atkinson, that was, to put it charitably,...

@TBPInvictus here: The New York Post ran a piece on Netflix (NFLX), written by Claire Atkinson, that was, to put it charitably,...

Read More

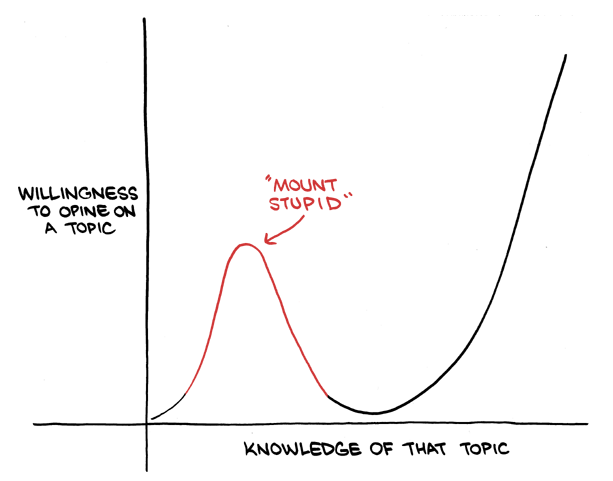

I interviewed Richard Thaler for MiB today. He is known as the father of Behavioral Economics. Parts of our conversation made me think...

I interviewed Richard Thaler for MiB today. He is known as the father of Behavioral Economics. Parts of our conversation made me think...

Read More

Every now and again, I disagree with an article written by someone I like and respect. On occasion, an author will crank out a column...

Read More

Richard Fuld, the former chief executive officer of Lehman Brothers, is the Shaggy of finance. On the cause of the financial crisis and...

Read More

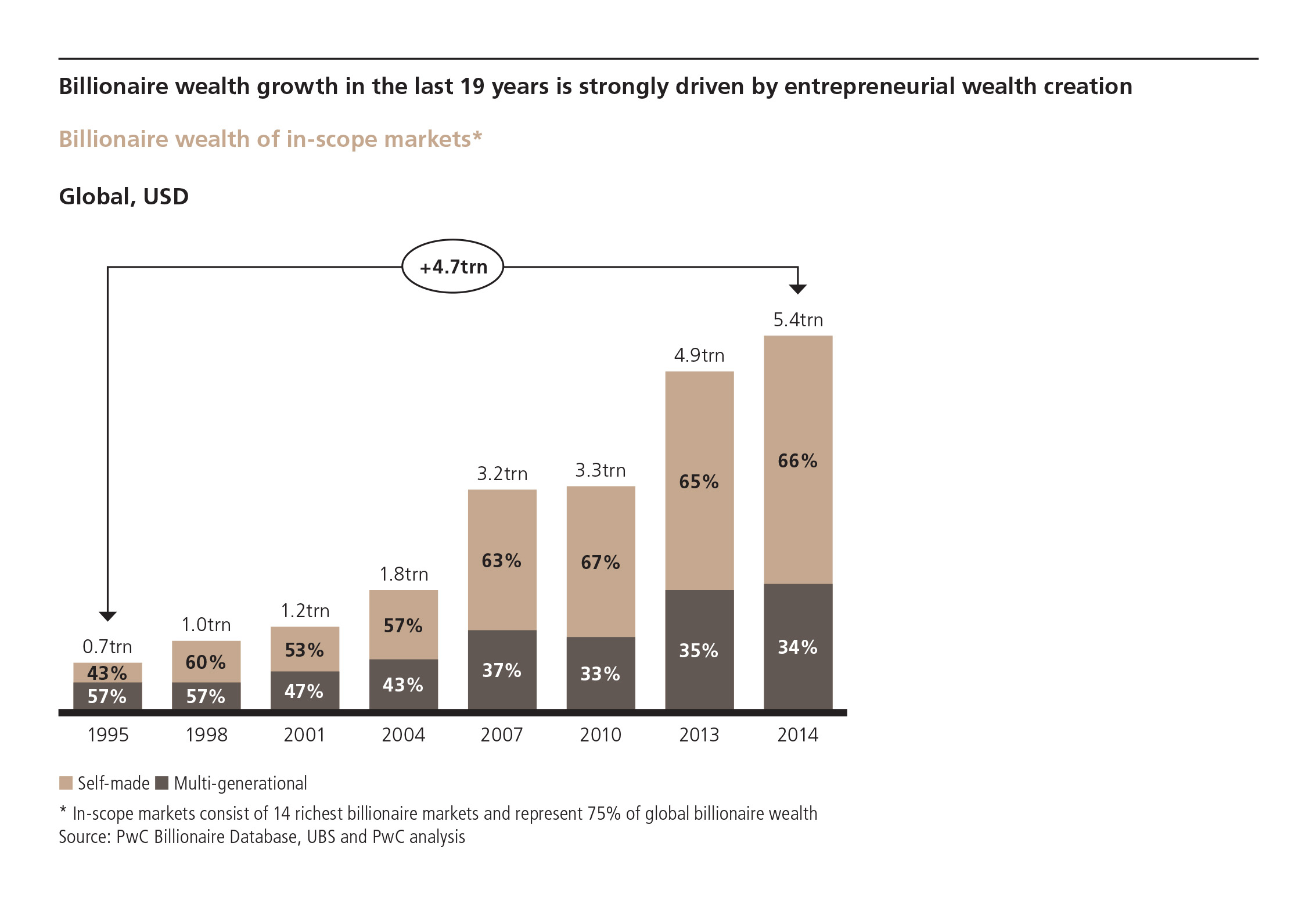

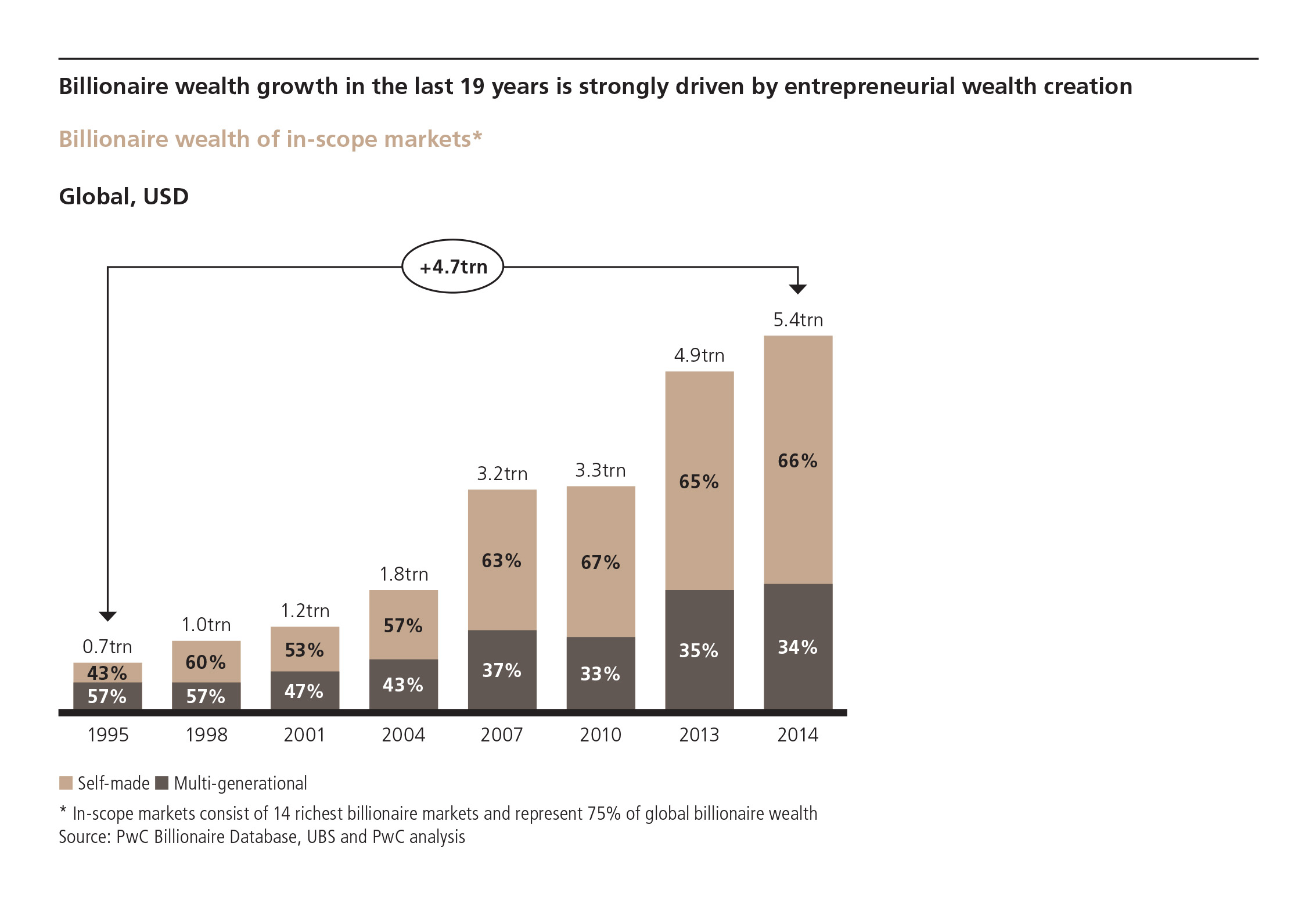

This has to be the strangest headline relative to the content I have seen in a very long time: Source: Wealth Management

This has to be the strangest headline relative to the content I have seen in a very long time: Source: Wealth Management

Read More

A Tax Deal That Fixes U.S. Roads? Democrats and Republicans might get what they want. Bloomberg, May 27, 2015 My wife...

Read More

In honor and reverence to one of my favorite comedic personalities, David Letterman, and the end of his talk show career here is my own...

Read More

The details are still being sorted out on the deadly Amtrak crash that killed at least six people earlier this week and injured 100s...

Read More

@TBPInvictus here. We have interesting experiments going on in the state of Kansas and the city of Seattle. Herewith a brief update on...

@TBPInvictus here. We have interesting experiments going on in the state of Kansas and the city of Seattle. Herewith a brief update on...

@TBPInvictus here. We have interesting experiments going on in the state of Kansas and the city of Seattle. Herewith a brief update on...

@TBPInvictus here. We have interesting experiments going on in the state of Kansas and the city of Seattle. Herewith a brief update on...