I am pleased to introduce to Big Picture readers someone I have known and admired for many years: Bruce Bartlett worked for Congressmen...

I am pleased to introduce to Big Picture readers someone I have known and admired for many years: Bruce Bartlett worked for Congressmen...

Read More

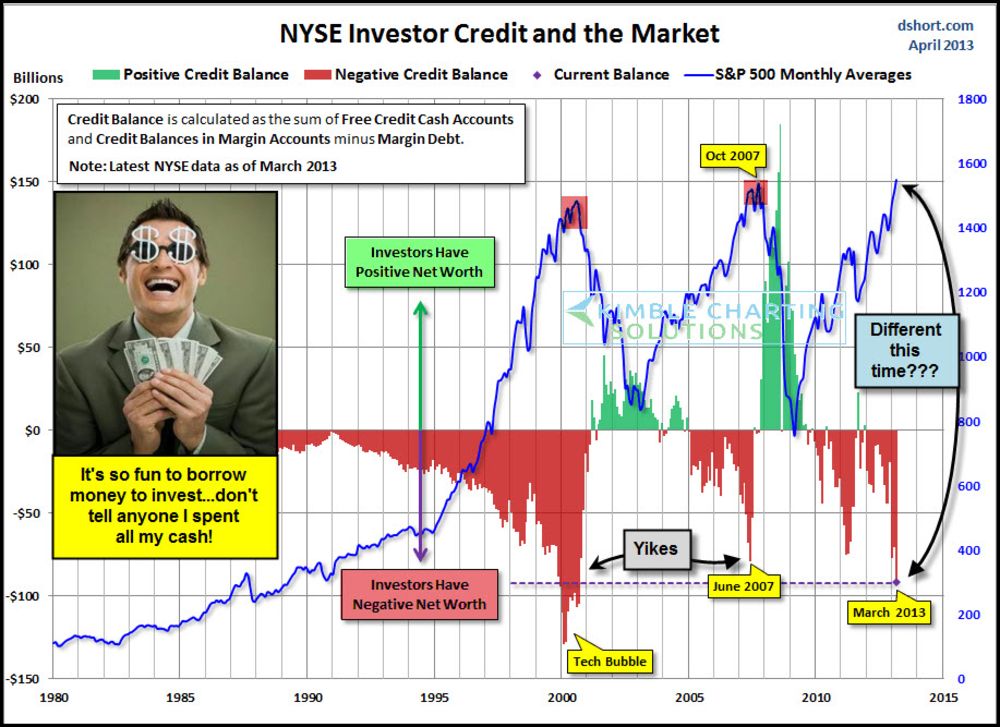

This video, based on this May 10, 2010 column, Why volatility means you should sell stocks, is now 5 years old. Rather than me comment on...

Read More

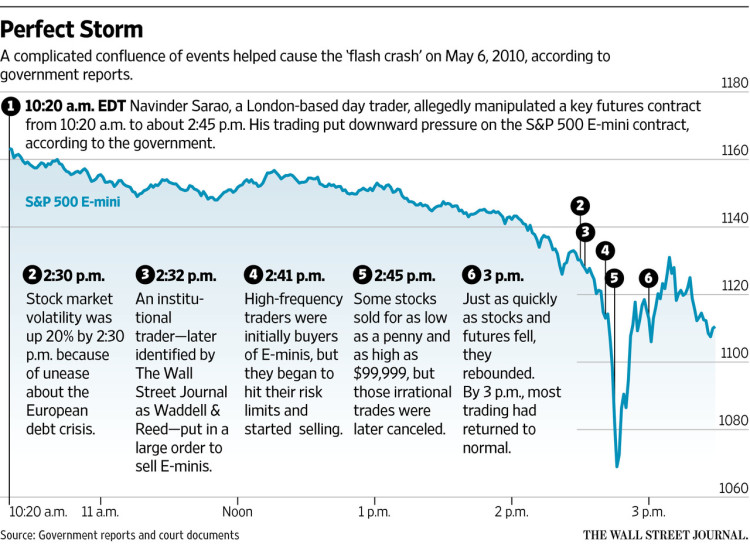

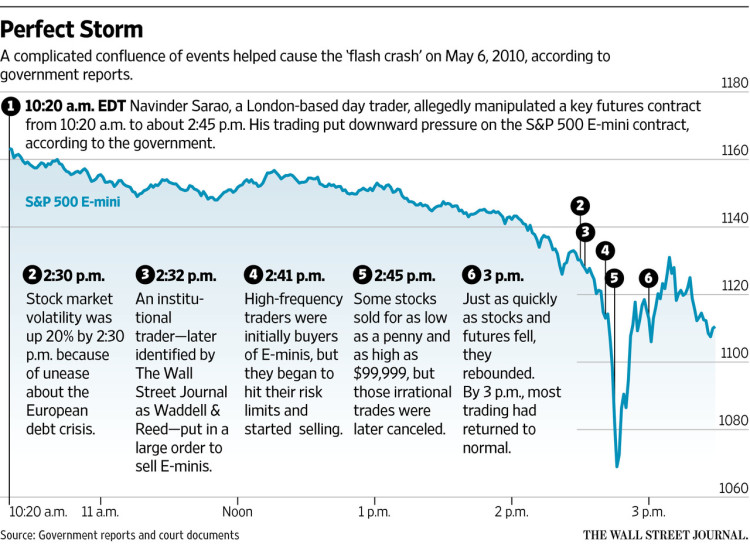

Great couple of graphics from the WSJ this AM. This is the simple version, a short explanatory overlaid on a graph: Perfect Storm...

Great couple of graphics from the WSJ this AM. This is the simple version, a short explanatory overlaid on a graph: Perfect Storm...

Read More

What makes this so good is how dead on accurate this collection of cliches have become: Click to create your own personal...

What makes this so good is how dead on accurate this collection of cliches have become: Click to create your own personal...

Read More

Nobody wants to watch the Discovery Channel. 2.9 million people viewed “Naked and Afraid.” But a hundred million paid for it....

Read More

Executive Pay Gluttony Maybe big institutional investors could make a difference. Bloomberg, April 30, 2015 ...

Executive Pay Gluttony Maybe big institutional investors could make a difference. Bloomberg, April 30, 2015 ...

Read More

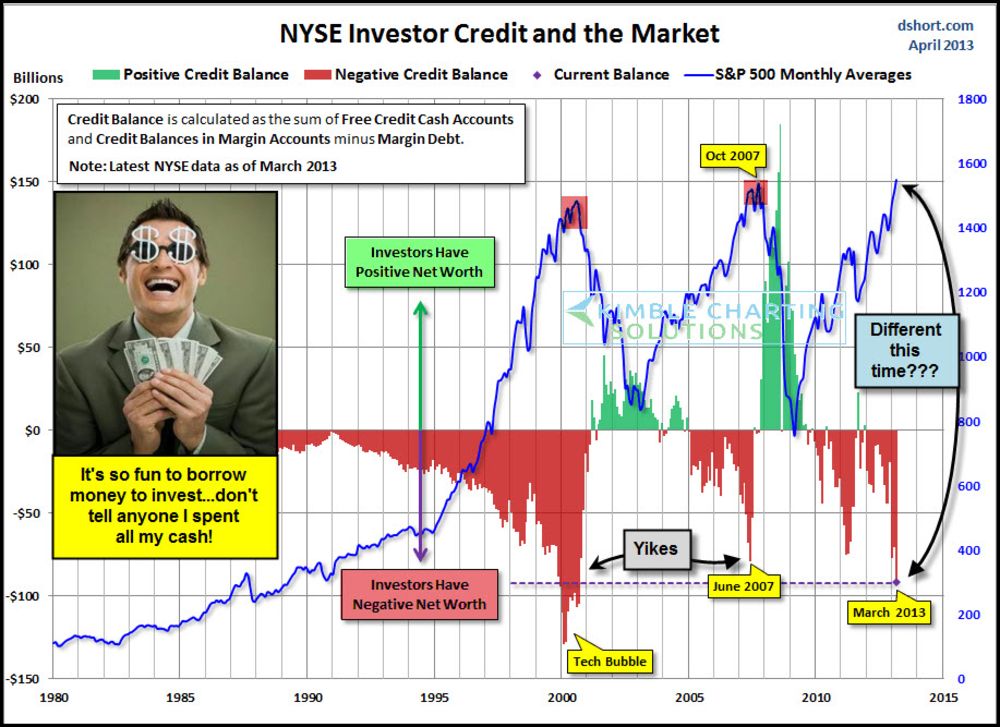

A Market Indicator That Predicts Nothing Its predictive value is minimal. Bloomberg, April 29, 2015 Every now and...

A Market Indicator That Predicts Nothing Its predictive value is minimal. Bloomberg, April 29, 2015 Every now and...

Read More

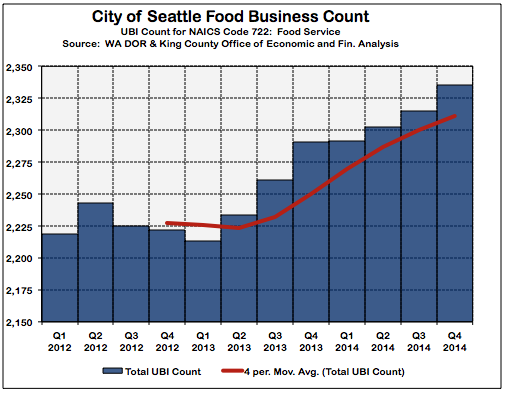

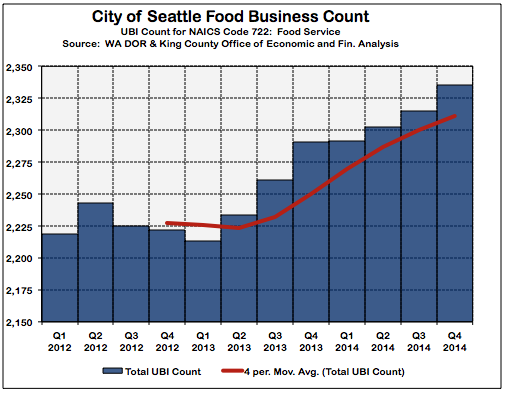

Barry here: I know Invictus personally for more than a decade. I also know he works at a shop that does not allow its staff to publish...

Barry here: I know Invictus personally for more than a decade. I also know he works at a shop that does not allow its staff to publish...

Read More

Since CEO compensation is back in the news, I thought we might want to revisit this collection of excess via Bailout Nation: Pre-Crisis...

Read More

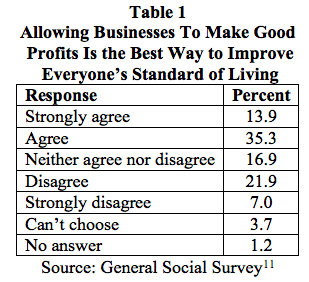

I am pleased to introduce to Big Picture readers someone I have known and admired for many years: Bruce Bartlett worked for Congressmen...

I am pleased to introduce to Big Picture readers someone I have known and admired for many years: Bruce Bartlett worked for Congressmen...

I am pleased to introduce to Big Picture readers someone I have known and admired for many years: Bruce Bartlett worked for Congressmen...

I am pleased to introduce to Big Picture readers someone I have known and admired for many years: Bruce Bartlett worked for Congressmen...