Pre-Crisis Financial Company CEO Compensation

Since CEO compensation is back in the news, I thought we might want to revisit this collection of excess via Bailout Nation: Pre-Crisis...

A Market Indicator That Predicts Nothing Its predictive value is minimal. Bloomberg, April 29, 2015 Every now...

A Market Indicator That Predicts Nothing Its predictive value is minimal. Bloomberg, April 29, 2015 Every now...

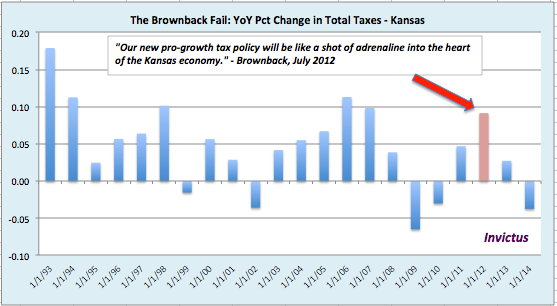

@TBPInvictus When pushing his tax cuts for Kansas in July 2012, Governor Sam Brownback wrote: “Our new pro-growth tax policy will be...

@TBPInvictus When pushing his tax cuts for Kansas in July 2012, Governor Sam Brownback wrote: “Our new pro-growth tax policy will be...

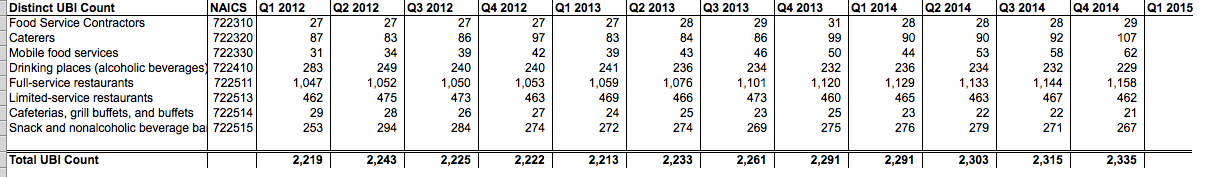

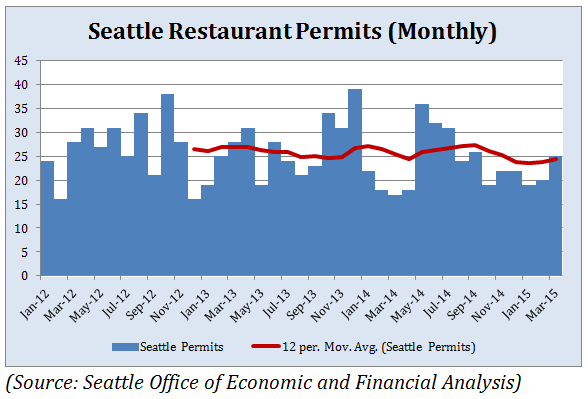

@TBPInvictus On Wednesday, I threw in my $0.02 about the controversy surrounding the increase in Seattle’s minimum wage. Unlike any...

@TBPInvictus On Wednesday, I threw in my $0.02 about the controversy surrounding the increase in Seattle’s minimum wage. Unlike any...

@TBPInvictus Barry wrote yesterday about how political bias can corrupt economic analysis. It’s something he and I discuss all the...

@TBPInvictus Barry wrote yesterday about how political bias can corrupt economic analysis. It’s something he and I discuss all the...

Get subscriber-only insights and news delivered by Barry every two weeks.