Gay Discrimination Is A Billion Dollar Self-Indulgence

By now, you have surely heard about Indiana’s so-called Religious Freedom Restoration Act and its potential for giving cover to those...

Governor Mike Pence is lying about the purpose of this law. The photo below, and who the governor invited to its being signed into law,...

Governor Mike Pence is lying about the purpose of this law. The photo below, and who the governor invited to its being signed into law,...

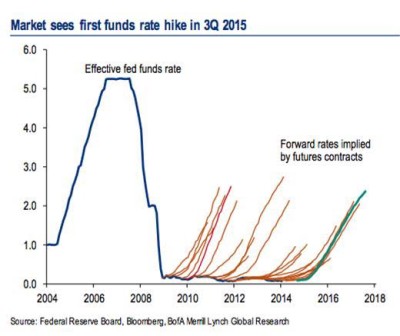

Source: BAML, Fiscal Times I have been fairly agnostic on several issues related to where interest rates are heading. It...

Source: BAML, Fiscal Times I have been fairly agnostic on several issues related to where interest rates are heading. It...

This week, the NBC/Wall Street Journal poll on presidential contenders for 2016 came out. It was the usual sort of thing: Favorable...

This week, the NBC/Wall Street Journal poll on presidential contenders for 2016 came out. It was the usual sort of thing: Favorable...

Equity markets started off this year by falling. They rallied in February, working their way back into the green. The Standard &...

Equity markets started off this year by falling. They rallied in February, working their way back into the green. The Standard &...

Get subscriber-only insights and news delivered by Barry every two weeks.